When can I enroll in a Medicare Supplement Plan? When newly eligible for Medicare, you enter a seven-month Initial Enrollment Period (IEP) which begins three months before your 65th birthday and ends three months after the month of your birthday.

What is the initial enrollment period for Medicare?

You can sign up for Medicare only at certain times. You can enroll during your seven-month initial enrollment period, which starts on the first day of the month three months before the month you turn 65 and lasts through the three months after ...

When is the Medicare supplement open enrollment period (OEP)?

“Medicare OEP” could refer to the Medicare Advantage Open Enrollment Period. This is a new, different enrollment period that takes place every year from January 1 to March 31. It is very important to understand the differences between these two enrollment periods and how they affect your Medicare coverage.

Is there open enrollment for Medicare supplements?

Medicare open enrollment lasts from October 15 to December 7 each year ... Medicare Part D and Medicare Supplement insurance, so it’s your job to educate and help them determine which coverage combination best addresses their needs.

What is annual enrollment period?

LOS ANGELES, Feb. 8, 2022 /PRNewswire/ -- Heal, the pioneer of in-home care delivery, today announces the company experienced exponential growth following completion of its shift to a value-based primary care model for seniors, which leverages its tech-enabled in-home platform to deliver superior health outcomes.

Can a Medicare supplement plan be purchased at any time of the year?

Generally, there is no type of Medicare plan that you can get “any time.” All Medicare coverage, including Medicare Supplement (Medigap) plans, is subject to enrollment periods. Other types of Medicare plans, like Medicare Advantage and Medicare Part D prescription drug plans, have open enrollment periods every year.

At what age does the open enrollment period typically begin for Medicare supplement coverage?

65 or olderI'm 65 or older. Your Medigap open enrollment period begins when you enroll in Part B and can't be changed or repeated. In most cases, it makes sense to enroll in Part B when you're first eligible, because you might otherwise have to pay a Part B late enrollment penalty.

What are the 3 Medicare enrollment periods?

When you turn 65, you have a seven month window to enroll in Medicare. This includes three months before the month you turn 65, your birth month, and three months after the month you turn 65.

What does open enrollment mean for Medicare Supplements?

Medicare Supplement Open Enrollment is a one-time window during which you can enroll in any Medicare Supplement policy. You will not have to answer any medical questions. The Medicare Supplement insurance companies cannot turn you down during your personal Medigap Open Enrollment Period.

Can you switch Medicare Supplement plans anytime?

As a Medicare beneficiary, you can change supplements at any time. As a result, there's no guarantee an application will be accepted if switched outside the designated Open Enrollment Period. An application may be “medically underwritten”.

What is the Medicare premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Who is the largest Medicare Advantage provider?

AARP/UnitedHealthcareAARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

Which of the following is a qualifying life event for a Medicare Advantage Special Enrollment period?

You qualify for a Special Enrollment Period if you've had certain life events, including losing health coverage, moving, getting married, having a baby, or adopting a child, or if your household income is below a certain amount.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

Do Medicare Supplement plans cover pre-existing conditions?

The pre-existing condition waiting period “ This means that you may have to pay all your own out-of-pocket costs for your pre-existing condition for up to six months. After the waiting period, the Medicare Supplement insurance plan may cover Medicare out-of-pocket costs relating to the pre-existing condition.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What is 2022 Part G deductible?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

How long does Medicare initial enrollment last?

Your Initial Enrollment period lasts for seven months : It begins three months before you turn 65.

How long does Medicare last?

It includes your birth month. It extends for another three months after your birth month. If you are under 65 and qualify for Medicare due to dis ability, the 7-month period is based around your 25th month of disability benefits.

What happens if you don't sign up for Medicare?

If you don't sign up during your Initial Enrollment Period and if you aren't eligible for a Special Enrollment Period , the next time you can enroll in Medicare is during the Medicare General Enrollment Period.

When is the best time to enroll in Medicare Supplement?

If you have Original Medicare and would like to enroll in a Medicare Supplement Insurance plan (also called Medigap), the best time to sign up is during your six-month Medigap Open Enrollment Period .

How long does it take to switch back to Medicare?

If you sign up for a Medicare Advantage plan during your Initial Enrollment Period, you can change to another Medicare Advantage plan or switch back to Original Medicare within the first 3 months that you have Medicare.

When does Medicare open enrollment end?

The Medicare Advantage Open Enrollment Period starts January 1 and ends March 31 every year. During this period, you can switch Medicare Advantage plans or leave a Medicare Advantage plan and return to Original Medicare.

Is Medicare Part D still open?

Yes, the fall Medicare Open Enrollment Period for Medicare Advantage plans and Medicare prescription drug coverage is still open. You have until December 7, 2020 to drop, switch or enroll in a Medicare Advantage or Medicare Part D prescription drug plan for the 2021 plan year.

What is Medicare Supplement Open Enrollment Period?

What is Medicare Supplement Open Enrollment? Medicare Supplement Open Enrollment Period is a once in a lifetime window that allows you to enroll in any Medigap plan without answering health questions.

What happens if you miss your Medigap open enrollment period?

When you miss your Medigap Open Enrollment Period and are denied coverage, there are alternative options. If you have a serious health condition that causes a Medigap carrier not to accept you, you should be able to enroll in a Medicare Advantage plan.

Why do people delay enrolling in Medicare Supplement?

For some; they choose to delay enrolling in Part B due to still working and having creditable coverage with their employer. When they do retire and enroll in Part B, they will initiate their Medicare Supplement Open Enrollment Period.

How long does Medicare open enrollment last?

Applying outside your open enrollment window can result in higher premiums, as well as restrict your coverage options. This window only lasts for six months for each new beneficiary, unless you delay enrollment into Part B due to having other creditable coverage.

Do you have to be 65 to get a Medigap plan?

Many states are not required to offer all supplement plans to those under 65. Most states only offer Plan A to those under 65. If they wait to enroll in a Medigap plan when they turn 65 during their second Medigap OEP, they’ll be able to choose from all the programs available to them in their state.

Does timing affect Medigap coverage?

Timing can affect how much you pay for coverage; how easy coverage is to obtain, and it can significantly determine the options available to you. The Megiap OEP is the only time you’ll ever get that allows you to enroll in any Medigap letter plan. You’ll be able to avoid having to answer any health questions.

Which states have open enrollment?

Some states have unique open enrollment rules, like Connecticut and California. In California, they have a birthday rule that allows you to enroll days surrounding your birthday without answering health questions. In Connecticut, they have a year-round open enrollment window for all beneficiaries.

How long is the Medicare Supplement open enrollment period?

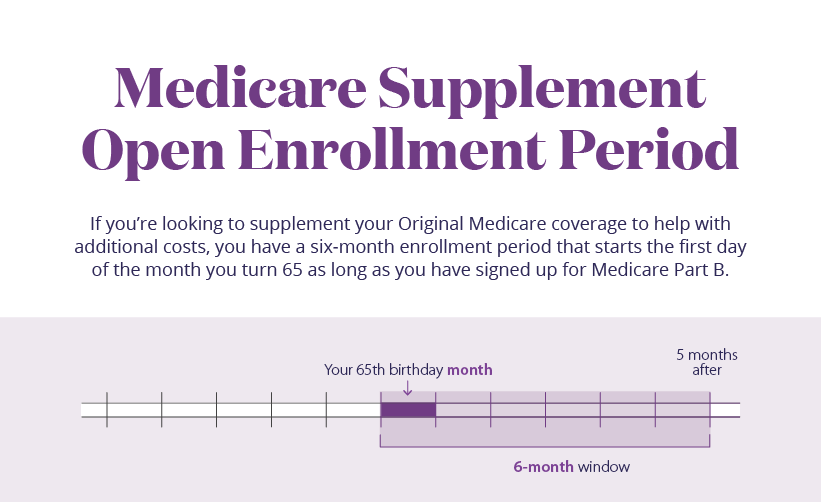

Medicare Supplement Open Enrollment Period. If you’re looking to supplement your Original Medicare coverage to help with additional costs, you have a six-month enrollment period that starts the first day of the month you turn 65 as long as you have signed up for Medicare Part B. This includes a 6-month window.

What is Medicare enrollment period?

Let's unpack what you need to know about Medicare enrollment periods. An enrollment period is a window of time when you can make changes to your insurance plan. It's actually multiple periods because different circumstances call for different ways to enroll. Let's take a look at the different times to enroll. The initial enrollment period.

What is Medicare star rating?

The Medicare Star Ratings is an independent ratings system that allows consumers to evaluate plan performance on a number of factors. The Centers for Medicare and Medicaid Services created these star ratings for consumers. Learn more about Special Enrollment Periods.

How long does it take to enroll in Medicare?

Let's take a look at the different times to enroll. The initial enrollment period. When you turn 65, you have a seven month window to enroll in Medicare. This includes three months before the month you turn 65, your birth month, and three months after the month you turn 65.

When is the best time to buy Medicare Supplement?

If you’re looking to supplement your Original Medicare coverage to help with additional costs, the best time to buy a Medicare Supplement plan is during the six-month enrollment period that starts the first day of the month you turn 65 — as long as you have signed up for Medicare Part B.

What is the phone number for a spouse to sign up for Medicare?

Health insurance information (type and dates of coverage). If you are applying for a spouse or signing up for Medicare by phone (1-800-772-1213) or in person at the Social Security office, you may need to submit additional information.

Can you change your insurance plan outside of the enrollment period?

This period allows you to change plans outside of the annual enrollment period. It's usually based on a life event. For example, if you move outside your plan's area, or leave a job and lose your coverage, you may qualify to change or enroll in a new plan.

What is Medicare Supplemental Insurance?

Medicare supplemental insurance, or Medigap, is an insurance product that is provided by private insurance companies to help cover things that Original Medicare benefits does not , such as deductibles, copayments, or coinsurance.

Is Medicare for seniors?

Medicare is relied upon by millions of Americans, including seniors 65 years of age or older and individuals under the age of 65 with certain disabilities. Medicare coverage is a vital part of health and wellness for many individuals, as it includes coverage for healthcare expenses for a wide range of care. The Medicare program serves ...

What is Empire State's EPIC program?

New York’s EPIC program is an additional resource that helps many eligible Medicare beneficiaries cover their out-of-pocket prescription drug costs.

What is the show me state?

The Show Me State offers a helpful Medigap Shopping Guide, programs to help Medicare beneficiaries with their out-of-pocket costs, and the state features a unique Medigap enrollment guaranteed issue period .

How long is the Medigap Plan A guaranteed issue period?

And each year, carriers must designate a one-month guaranteed-issue period (outside of Open Enrollment), during which any applicant will be accepted into Medigap Plan A. Medicare Savings Programs (MSPs) – Main has state-specific guidelines for Medicare Savings programs related to income limits.

How long is the Medigap Open Enrollment Period?

Medigap OEP. Medigap Open Enrollment Period. 6 months, starting the month you’re 65 or older and enrolled in Medicare Part B. Can vary, but usually begins the first day of the month after you apply.

What is the Low Income Assistance Program?

Low Income Assistance Program — The Extra Help/Low Income Subsidy can help pay your Medicare Part D premiums, deductibles and copays. Old Age Pension Health and Medical Care Program (OAP) — If you make too much to qualify for Health First Colorado and receive Old Age Pension, you may be eligible for OAP.

How long does it take to get ALS on Medicare?

Amytrophic Lateral Sclerosis (ALS or Lou Gehrig's disease) If you have ALS, there's no 24 month waiting period. You'll be automatically enrolled in Original Medicare the same month your Social Security disability benefits begin. You may also choose to enroll in a Medicare Advantage or Prescription Drug plan.

What is SEP in Medicare?

SEP. Special Enrollment Period for the Working Aged and Working Disabled. For Original Medicare Part A and Part B: 8 months, following the month you retire or lose creditable coverage; For Medicare Part C and Part D: 63 days after the loss of employer healthcare coverage. Coverage start date varies.

What is a select Medicare policy?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. . If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. .

Can you charge more for a Medigap policy?

Charge you more for a Medigap policy. In some cases, an insurance company must sell you a Medigap policy, even if you have health problems. You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period. If you have a guaranteed issue right.

Can Medigap refuse to cover out-of-pocket costs?

A health problem you had before the date that new health coverage starts. . In some cases, the Medigap insurance company can refuse to cover your. out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance.

Can you shorten the waiting period for a pre-existing condition?

It's possible to avoid or shorten waiting periods for a. pre-existing condition. A health problem you had before the date that new health coverage starts. if you buy a Medigap policy during your Medigap open enrollment period to replace ".