When does Medicare Part A or Part B start?

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65. (If your birthday is on the first of the month, coverage starts the month before you turn 65.) Part B (and Premium-Part A): Coverage starts based on the month you sign up: You can sign up for Part A any time after you turn 65.

What happens if I Miss my Medicare Part B initial enrollment window?

For Medicare Part B, you have from January 1 through March 31 to enroll. Coverage doesn’t begin until July. What happens if you miss your initial enrollment window? If you delay Medicare Part B enrollment, then you’ll have to wait to enroll when the general enrollment period starts.

Do I need Medicare Part B right away?

Some people don’t need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special conditions. And some people choose not to enroll in Medicare Part B, because they don’t want to pay for medical coverage they feel they don’t need.

How do I get information about Medicare Part B?

Medicare Part B For more information on Medicare, please call the number below to speak with a healthcare specialist: 1-800-810-1437 TTY 711 If you are about to turn 65 and need information regarding the various portions of Medicare, then you’ve come to the right place.

Can you add Medicare Part B at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

Does Medicare Part B have to start on the first of the month?

Part B (Medical Insurance) Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

What is the special enrollment period for Medicare Part B?

What is the Medicare Part B special enrollment period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse's current job. You usually have 8 months from when employment ends to enroll in Part B.

What day of the month does Medicare take effect?

Your Medicare coverage generally starts on the first day of your birthday month. If your birthday falls on the first day of the month, your Medicare coverage starts the first day of the previous month. If you qualify for Medicare because of a disability or illness, in most cases your IEP is also seven months.

Does Medicare start on your birthday or the month of your birthday?

Your first chance to sign up (Initial Enrollment Period) It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

How do I add Part B to my Medicare online?

To do this, you can complete form CMS-40B (Application for Enrollment in Medicare – Part B [Medical Insurance]) and CMS-L564 (Request for Employment Information) online.

Is Medicare Part B coverage retroactive?

Social Security also offers you Part B coverage retroactively if you want it—while making it clear that, if you accept, you must pay backdated Part B premiums for the time period in question, which can amount to hundreds or even thousands of dollars.

What is the Part B late enrollment penalty?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

What is the best time to apply for Medicare?

A: The best time to enroll is during the open enrollment window around your 65th birthday – preferably in the three months before the month you turn 65, so that you'll have Medicare coverage by the time you turn 65.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How do I change my Medicare Part B effective date?

If changing your initial month of Part B coverage is possible in your case, you'll likely need to submit a new form CMS-40B (https://www.cms.gov/cms40b-application-enrollment-part-b) along with any required documentation. You should probably first contact Social Security to see what options are available to you.

Understanding What Medicare Part B Offers

First, let’s take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications:...

Medicare Part B Enrollment Options and Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed...

The Cost of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium. For the most part, the premium for Medicare Part B is $134 per month. You also pay $204...

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment (known as a premium) for its services, some people may find it difficult to pay for the monthly...

Medicare Part B Special Circumstances and Updates

Some people don’t need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special condi...

Benefits of Medicare Part B

Medicare Part B covers a variety of routine healthcare visits and treatments. If you can afford the premiums, then you may want to take advantage o...

What is the Medicare Part B special enrollment period (SEP)?

The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 month...

Do I qualify for the Medicare Part B special enrollment period?

You qualify for the Part B SEP if: you are eligible for Medicare because of your age or because you collect disability benefits. (People who have E...

How do I use the Part B SEP?

To use this SEP you should call the Social Security Administration at 1-800-772-1213 and request two forms: the Part B enrollment request form (CMS...

What if an employer gives me money to buy my own health plan?

A note about individual coverage: you’ll qualify for an SEP if you delayed Part B because you had employer-sponsored coverage through a group healt...

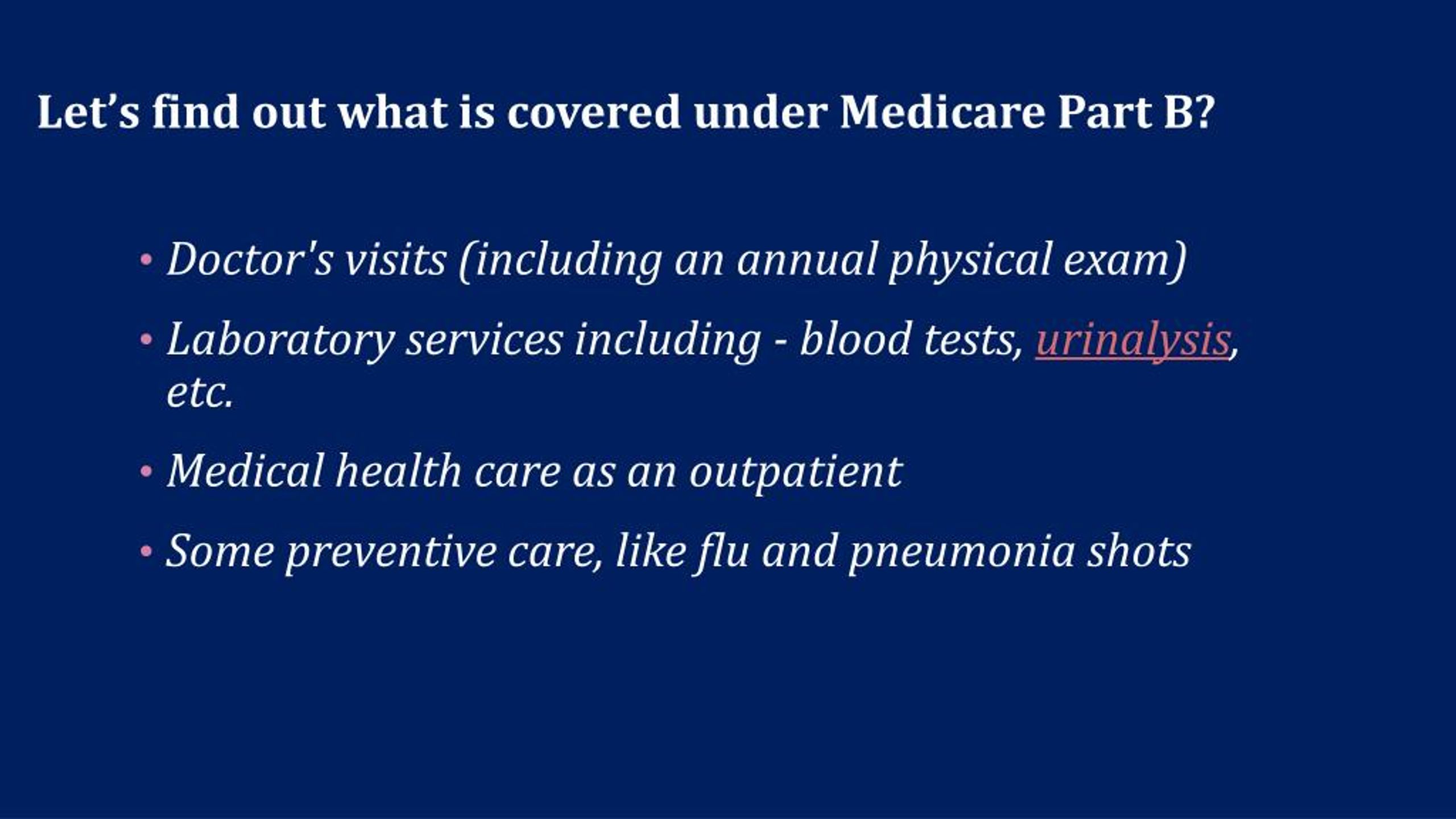

What is covered by Medicare Part B?

In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

How long do you have to be in Medicare to get Medicare Part B?

You have a seven-month initial period to enroll in Medicare Part B. The seven months include the three months prior to your 65th birthday, the month containing your 65th birthday and the three months that follow your birthday month. If you turn 65 on March 8, then you have from December 1 to June 30 to enroll in Medicare Part B.

Why don't people enroll in Medicare Part B?

And some people choose not to enroll in Medicare Part B, because they don’t want to pay for medical coverage they feel they don’t need. There are a variety of reasons why you might hesitate to pay for medical insurance. Likewise, you may be concerned about how the new healthcare laws affect Medicare Part B coverage.

How much does Medicare pay if you make less than $500,000?

Individuals who earn more than $163,000 but less than $500,000 per year will pay $462.70 in Medicare Part B premiums per month. If you earn $500,000 per year or more, your Medicare Part B premium will be $491.60 per month. These amounts reflect individual incomes only.

How much is Medicare Part B in 2021?

That premium changes each year, usually increasing. In 2021, the Part B premium is $148.50 a month. You’ll also have an annual deductible of $203 in 2021 (an increase from the $198 deductible in 2020).

What is the number to call for Medicare?

1-800-810-1437 TTY 711. If you are about to turn 65 and need information regarding the various portions of Medicare, then you’ve come to the right place. We know how overwhelming all of the information regarding Medicare can be. And we want to help you choose a plan that meets your individual needs.

How much does a person make on Part B?

If you earn more than $109,000 and up to $136,000 per year as an individual, then you’ll pay $289.20 per month for Part B premiums. If you earn more than $136,000 and up to $163,000 for the year as a single person, you’ll pay $376.00 per month for Part B premiums.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

Why does Part A end?

There are special rules for when premium-free Part A ends for people with ESRD. Premium Part A and Part B coverage can be voluntarily terminated because premium payments are required. Premium Part A and Part B coverage ends due to: Voluntary disenrollment request (coverage ends prospectively); Failure to pay premiums;

If You Have A Disability

If youve been receiving either Social Security disability benefits or railroad retirement board disability benefits for at least 24 consecutive months, youre eligible to enroll in Medicare at any time, no matter your age.

Primary And Secondary Payers

Your Medicare and private insurance benefits are coordinated, which means they work together. Typically, a primary payer will pay insurance claims first and a secondary payer will only kick in for costs not covered by the primary payer.

Penalty Fees For Late Enrollment

Medicare charges penalty fees for those who do not enroll in their Initial Enrollment Period, or they do not qualify for an exception due to employer insurance or other coverage.

What Is The Initial Enrollment Period For Part C

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans.

Enrolling In Original Medicare

If youre already receiving Social Security or Railroad Retirement Board benefits and youre a U.S. resident, the federal government automatically enrolls you in both Medicare Part A and Medicare Part B at age 65.

Your First Chance To Sign Up

Generally, when you turn 65. This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65.

When Do I Sign Up For Medicare Advantage

Before you sign up for Medicare Advantage, make sure you weigh the pros and cons of Medicare Advantage vs. Medicare Supplements. If you choose to sign up for Medicare Advantage, you can do so during your IEP.

When do you have to take Part B?

You have to take Part B once your or your spouse’s employment ends. Medicare becomes your primary insurer once you stop working, even if you’re still covered by the employer-based plan or COBRA. If you don’t enroll in Part B, your insurer will “claw back” the amount it paid for your care when it finds out.

How long can you delay Part B?

You can delay your Part B effective date up to three months if you enroll while you still have employer-sponsored coverage or within one month after that coverage ends. Otherwise, your Part B coverage will begin the month after you enroll.

What is a Part B SEP?

The Part B SEP allows beneficiaries to delay enrollment if they have health coverage through their own or a spouse’s current employer. SEP eligibility depends on three factors. Beneficiaries must submit two forms to get approval for the SEP. Coverage an employer helps you buy on your own won’t qualify you for this SEP.

What is a SEP for Medicare?

What is the Medicare Part B Special Enrollment Period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isn’t through a current job – such as COBRA benefits, ...

What Is The Medicare Open Enrollment Period

The Medicare Annual Enrollment Period can feel like a chaotic time for many of those on Medicare. Many worry that they may enroll into the wrong plan or not realize the changes happening to their current plan. Its all too easy to misunderstand the rules or forget to check whether a certain doctor is in the network.

Deferring Enrollment Before It Starts

If you want to defer your enrollment, you will have to contact the Social Security Administration to make sure that you arent enrolled in Medicare. This should be a straightforward process, but make sure that you do it as soon as you can, so you dont pay any premiums and then have to cancel later.

How Do I Prepare For My Medigap Open Enrollment Period

When you start the Medicare journey as a future Medicare beneficiary, many try and research everything themselves.

How To Enroll In And Change Medicare Plans

Once youve signed up for Medicare, youll have several options for changing certain aspects of your health coverage. Heres an outline:

How Does Medicare Open Enrollment Work

Medicare consists of a few key parts. Original Medicare refers to Part A and Part B, the basic parts of Medicare that cover hospital care and outpatient care. There is also Medicare Part D, prescription drug coverage, and Part C, which allows you to receive Medicare benefits through a private insurance company.

C: Medicare Advantage Plans

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system.

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date.

Long term care & life insurance combination

CareChoice One and CareChoice Select are whole life insurance policies with long term care riders. Click above to learn more.

Find a Financial Professional

Get information and advice from a MassMutual financial professional near you.

Create Your Account

An online account makes it easier to do more in less time. With an online account you can:

What is Medicare for 65?

Medicare, the government-sponsored health insurance program for those age 65 and older is the primary source of most retirees' health coverage. For that group, Medicare covers over 60 percent of medical expenses, compared to less than 20 percent that private insurance covers. Most people are automatically enrolled at age 65 in Medicare's hospital insurance component, also called Medicare Part A. It comes at no cost as long as you or your spouse paid Medicare taxes during your working years.

What percentage of medical expenses does Medicare cover?

For that group, Medicare covers over 60 percent of medical expenses, compared to less than 20 percent that private insurance covers. Most people are automatically enrolled at age 65 in Medicare's hospital insurance component, also called Medicare Part A.

When does Medicare Part B start?

Find out if you should get Part B based on your situation. General Medicare Enrollment Period: If you miss your Initial Enrollment Period, you can sign up during Medicare’s General Enrollment Period (January 1–March 31), and your coverage will start July 1.

When should I join Medicare Advantage?

When to join a Medicare Advantage Plan or Medicare Prescription Drug Plan. The best time to join a Medicare health or drug plan is when you first get Medicare. Signing up when you’re first eligible can help you avoid paying a lifetime Part D late enrollment penalty. If you miss your first chance, generally you have to wait ...

How to get Medicare if you are not collecting Social Security?

If you’re not already collecting Social Security benefits before your Initial Enrollment Period starts, you’ll need to sign up for Medicare online or contact Social Security. To get the most from your Medicare and avoid the Part B late enrollment penalty, complete your Medicare enrollment application during your Initial Enrollment Period.

When can I switch my Medicare plan?

If you miss your first chance, generally you have to wait until fall for Medicare’s annual Open Enrollment Period (October 15–December 7) to join a plan. During this time each year, you can also drop or switch your plan coverage. It’s important to understand when you can enroll in Medicare and be confident in your choices.

Can I sign up for Medicare during a SEP?

Special Enrollment Period: Once your Initial Enrollment Period ends, you may have the chance to sign up for Medicare during a Special Enrollment Period (SEP). You can sign up for Part A and or Part B during an SEP if you have special circumstances.