What is Medicare conditional billing?

• A conditional payment is a payment that Medicare makes. for services where another payer may be responsible. This. conditional payment is made so that the Medicare beneficiary won't have to use their own money to pay the bill.

When would Medicare make a conditional payment to a beneficiary?

MSP provisions allow conditional payments in certain situations when the primary payer has not paid or is not expected to pay within 120 days after receipt of the claim for specific items and/or services. Medicare makes these payments “on condition” that it will be reimbursed if it is shown another payer is primary.

How do I request a Medicare conditional payment?

You can obtain the current conditional payment amount and copies of CPLs from the BCRC or from the Medicare Secondary Payer Recovery Portal (MSPRP). To obtain conditional payment information from the BCRC, call 1-855-798-2627.

When should MSPQ be completed?

every 90 daysAs a Part A institutional provider rendering recurring outpatient services, the MSP questionnaire should be completed prior to the initial visit and verified every 90 days.

What is a conditional claim?

Conditional (or “contingent”) claim limitations recite a step or function that is only performed upon the satisfaction of some condition. In a method claim, a conditional limitation might follow the structure, “if A, then B,” reciting that the step B is performed if the condition A occurs.

What letter sent to the beneficiary provides an interim estimate of conditional payments to date?

The CPL explains how to dispute any unrelated claims and includes the BCRC's best estimate, as of the date the letter is issued, of the amount Medicare should be reimbursed (i.e., the interim total conditional payment amount).

What is Medicare Secondary Payer recovery process?

Note: The Medicare Secondary Payer Recovery Portal (MSPRP) is a web-based tool designed to assist in the resolution of Liability Insurance, No-Fault Insurance, and Workers' Compensation Medicare recovery cases.

What is a CMS Lien?

A Medicare lien results when Medicare makes a “conditional payment” for healthcare, even though a liability claim is in process that could eventually result in payment for the same care, as is the case with many asbestos-related illnesses.

Do Medicare benefits have to be repaid?

The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later. You're responsible for making sure Medicare gets repaid from the settlement, judgment, award, or other payment.

Why must the MSPQ be completed?

The MSPQ was initiated by the Center for Medicare and Medicaid Services (CMS) to emphasize the requirements that providers must investigate all options to identify whether traditional Medicare is the primary or secondary payer in each individual case.

How often is the MSPQ completed on a single encounter specific hospital account?

Billing for Part A inpatient or outpatient hospital services requires the MSPQ to be completed for every date of service, unless it is for recurring outpatient services. See Publication 100-05, Chapter 3, Section 20.1.

When would a biller most likely submit a claim to secondary insurance?

If a claim has a remaining balance after the primary insurance has paid, you will want to submit the claim to the secondary insurance, if one applies.

When do hospitals report Medicare beneficiaries?

If the beneficiary is a dependent under his/her spouse's group health insurance and the spouse retired prior to the beneficiary's Medicare Part A entitlement date, hospitals report the beneficiary's Medicare entitlement date as his/her retirement date.

What is secondary payer?

Medicare is the Secondary Payer when Beneficiaries are: 1 Treated for a work-related injury or illness. Medicare may pay conditionally for services received for a work-related illness or injury in cases where payment from the state workers’ compensation (WC) insurance is not expected within 120 days. This conditional payment is subject to recovery by Medicare after a WC settlement has been reached. If WC denies a claim or a portion of a claim, the claim can be filed with Medicare for consideration of payment. 2 Treated for an illness or injury caused by an accident, and liability and/or no-fault insurance will cover the medical expenses as the primary payer. 3 Covered under their own employer’s or a spouse’s employer’s group health plan (GHP). 4 Disabled with coverage under a large group health plan (LGHP). 5 Afflicted with permanent kidney failure (End-Stage Renal Disease) and are within the 30-month coordination period. See ESRD link in the Related Links section below for more information. Note: For more information on when Medicare is the Secondary Payer, click the Medicare Secondary Payer link in the Related Links section below.

Does Medicare pay for black lung?

Federal Black Lung Benefits - Medicare does not pay for services covered under the Federal Black Lung Program. However, if a Medicare-eligible patient has an illness or injury not related to black lung, the patient may submit a claim to Medicare. For further information, contact the Federal Black Lung Program at 1-800-638-7072.

Does Medicare pay for the same services as the VA?

Veteran’s Administration (VA) Benefits - Medicare does not pay for the same services covered by VA benefits.

Is Medicare a primary or secondary payer?

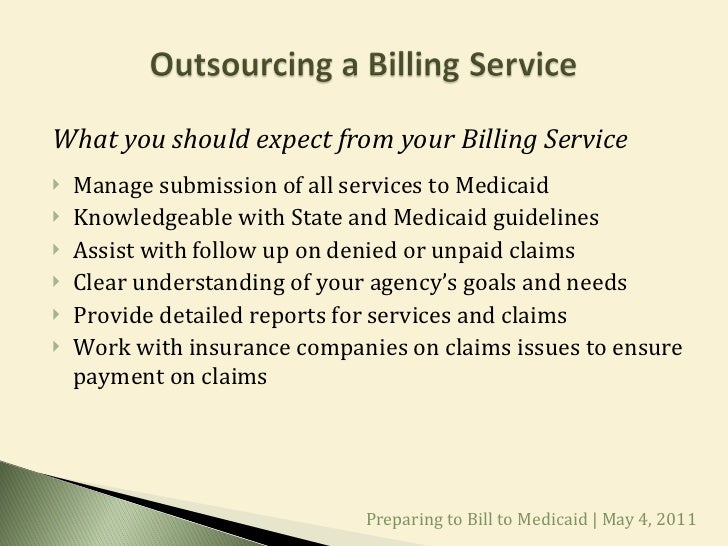

Providers must determine if Medicare is the primary or secondary payer; therefore, the beneficiary must be queried about other possible coverage that may be primary to Medicare. Failure to maintain a system of identifying other payers is viewed as a violation of the provider agreement with Medicare.

Why is Medicare considered a conditional payment?

Medicare may make a conditional payment when there is evidence that payment has not been made or cannot reasonably be expected to be made promptly by workers’ compensation, liability insurance (including self-insurance), or no-fault insurance. These payments are referred to as conditional payments because the money must be repaid to Medicare ...

What is prompt payment for Medicare?

These payments are referred to as conditional payments because the money must be repaid to Medicare when a settlement, judgment, award, or other payment is secured. Prompt or promptly means: Liability insurance (including self-insurance) Payment within 120 days after the earlier of the following: Date a general liability claim is filed ...

How long does it take to get Medicare after a car accident?

No-fault and workers' compensation. Payment within 120 days after receipt of the claim. After the 120-day period, you may bill Medicare conditionally. Note: If an injury resulted from an automobile accident and/or there is an indication ...

What is a health care provider?

Tell your doctor and other. health care provider. A person or organization that's licensed to give health care. Doctors, nurses, and hospitals are examples of health care providers. about any changes in your insurance or coverage when you get care.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is conditional payment information?

Conditional Payment Information. Once the BCRC is aware of the existence of a case, the BCRC begins identifying payments that Medicare has made conditionally that are related to the case. The BCRC will issue a conditional payment letter with detailed claim information to the beneficiary.

What is a demand letter for Medicare?

This letter includes: 1) a summary of conditional payments made by Medicare; 2) the total demand amount; 3) information on applicable waiver and administrative appeal rights. For additional information about the demand process and repaying Medicare, please click the Reimbursing Medicare link.

Does BCRC issue a recovery letter?

This letter does not provide a final conditional payment amount; Medicare might make additional conditional payments while the beneficiary's claim is pending. The BCRC does not issue a formal recovery demand letter until there is a settlement, judgment, award, or other payment.

Is Medicare a lien or a recovery claim?

Please note that CMS’ Medicare Secondary Payer (MSP) recovery claim (under its direct right of recovery as well as its subrogation right) has sometimes been referred to as a Medicare “lien”, but the proper term is Medicare or MSP “recovery claim.”.

Can Medicare pay conditionally?

If the item or service is reimbursable under Medicare rules, Medicare may pay conditionally, subject to later recovery if there is a subsequent settlement, judgment, award, or other payment. In situations such as this, the beneficiary may choose to hire an attorney to help them recover damages.

Does Medicare require a copy of recovery correspondence?

Note: If Medicare is pursuing recovery from the insurer/workers’ compensation entity, the beneficiary and his attorney or other representative will receive a copy of recovery correspondence sent to the insurer/workers’ compensation entity. The beneficiary does not need to take any action on this correspondence.