When Can I Get Medicare Supplement Plan G? Most people sign up for Plan G during their Open Enrollment, the 6 month after you enroll in Medicare Part B. If you currently have a Medicare Supplement plan, you can apply to switch carriers or plan letters any time of the year.

Full Answer

When can I sign up for Medicare Part G?

Most people sign up for Plan G during their Open Enrollment, the 6 month after you enroll in Medicare Part B. If you currently have a Medicare Supplement plan, you can apply to switch carriers or plan letters any time of the year.

Does Medigap Plan G Pay Part B?

With Medigap Plan G, you will be responsible for the Part B deductible but you will have no excess charges. What Does Medicare Plan G pay for? Plan G pays for your hospital deductible and all copays and coinsurance under Medicare. Does Medicare Plan G cover dental? No, Medicare and Medigap plans do not cover routine dental care.

Who is eligible for Medicare Plan G?

Everyone is eligible for Medicare Plan G, also known as Medigap Plan G, during the Medigap Open Enrollment Period. After the open enrollment period, a plan may cost more, or an insurer may deny it, depending on a person’s health.

When do I get my Medicare Part A and Part B?

We’ll mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts. You get Part A automatically. If you want Part B, you need to sign up for it. If you don’t sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

Does Medicare Plan G pay for everything?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

What is the 2021 deductible for Medicare Plan G?

Effective January 1, 2021, the annual deductible amount for these three plans is $2,370. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Is Medicare Part G expensive?

Annual premiums for Medicare Plan G typically cost between $1,500 and $2,000. Some insurance companies offer extra perks and benefits for vision and dental care with Medicare Plan G.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

Is Plan G guaranteed issue in 2021?

First of all, Plan G is not offered as a “guaranteed issue” (no health questions) option in situations where someone is losing group coverage or Medicare Advantage plan coverage.

Does Medicare Plan G have a maximum out-of-pocket?

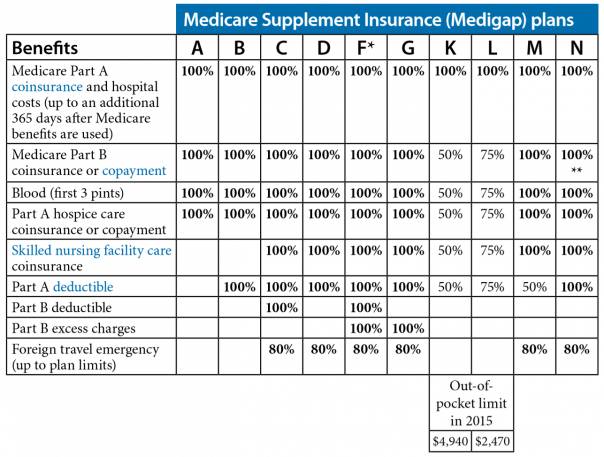

Similarly, Plan G has no out-of-pocket limit to protect you from spending too much on covered health care in a year. If you are interested in an out-of-pocket limit, consider Plan K or Plan L. Plan G is most similar in coverage to Plan F.

What is the annual deductible for Plan G?

Medicare Plan G, also called Medigap Plan G, is an increasingly popular Supplement for several reasons. First, Plan G covers each of the gaps in Medicare except for the annual Part B deductible. This deductible is only $233 in 2022.

What is 2022 Part G deductible?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Is Plan G better than Plan C?

What's the Difference Between Plan C vs. Plan G? If you don't want to enroll in Plan C for one reason or another, then Plan G is the best alternative. The only difference between Plan C and Plan G is coverage for your Part B Deductible.

Does Plan G cover prescriptions?

Medicare Supplement plans, including Plan G, do not cover the cost of prescription medications. To tap into this coverage, you'll need to add a Medicare Part D prescription drug policy to your Original Medicare plan.

What is the deductible for Plan G for 2020?

With a standard Supplement Plan G, you're covered immediately and are responsible only for the $233 Part B deductible, plus your monthly premium. With a high-deductible Plan G, your coverage begins once you pay your $2,490 deductible, which then covers all future out-of-pocket costs.

How much does AARP Medicare Supplement Plan G cost?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan G (1)$173Plan K$70Plan L$136Plan N$1676 more rows•Jan 24, 2022

What is the average cost of Plan G?

There is no set premium for Plan G as plans can range from $100 to $200. Your monthly premium will depend on your location and zip code, your gende...

What is the Plan G deductible in 2022?

$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separ...

What is the difference between Plan N and Plan G?

The biggest difference between these two is your out-of-pocket costs. With Plan N you will be responsible for the Part B deductible, $20 copay for...

What Does Medicare Plan G pay for?

Plan G pays for your hospital deductible and all copayments and coinsurance under Medicare. For example, this would include the hospice care coinsu...

Does Medicare Plan G cover dental?

No, since Medicare does not cover routine dental care, a Medigap policy will not either. However, medically necessary dental services can be covere...

Does Plan G cover prescriptions?

Plan G will cover the coinsurance on any Part B medications. These are typically drugs that are administered in a clinical setting, such as chemoth...

Which is better, Medicare Plan F vs G?

We get asked this question all the time, and the answer is that in many states Plan G is a better value. However, Plan F technically covers more th...

What is Medicare Plan G?

Medicare Plan G is a Medigap Supplement Insurance plan to help pay expenses from Medicare Part A and Part B. It is also called Medigap Plan G. A person is eligible to enroll during the Open Enrollment Period. However, if they delay enrolling in Medicare Plan G until after the Open Enrollment Period, the insurer may deny them a policy.

Who is eligible for Medicare?

People who are 65 years of age or older are eligible for Medicare coverage. Some people who are younger and have a disability are also eligible. In this article, learn about Medicare Plan G, who is eligible, coverage, costs, and enrollment.

How much is the annual deductible for Medicare?

The annual deductible for the high-deductible plan is $2,370. Not every state offers a high-deductible plan. A person pays the premiums for Medicare Plan G to the private insurance company where they buy the policy. They pay the premiums for Medicare Part A and B to Medicare.

What is Part B excess?

foreign travel, 80% of expenses up to the plan limit. Part B excess charges are costs over the amount Medicare approves for a procedure or service. In some states, a doctor can bill 15% more than Medicare allows for a medical service, and Medicare Plan G pays the extra amount.

When does Medigap open enrollment end?

Everyone is eligible for all Medigap policies during the Medigap Open Enrollment Period, which starts in the month when a person turns 65 years of age and ends after 6 months. To qualify, the individual must also have enrolled in Medicare Part B.

Which states do not have to offer Medicare?

They do not offer all plans in all states and do not have to provide Medicare Plan G. Wisconsin, Minnesota, and Massachusetts standardize their Medigap plans in different ways.

Does Medicare cover travel expenses?

Medicare Part A and Part B do not cover medical expenses if a person is traveling outside of the U.S. However, Medicare Plan G will cover foreign travel expenses up to the plan limit. People should check the limit in their individual policy.

What is the Medicare Supplement Plan G?

Medicare Supplement Plan G covers most of the out-of-pocket costs that Original Medicare leaves you open to, with one exception. With Plan G, you will need to pay your Medicare Part B deductible. The Part B deductible for 2021 is $203. In their initial research phase, many people compare Plan G to Plan F, which covers the Part B deductible.

What is a G plan?

This means that Plan G will be the plan with the most comprehensive coverage available to you. Additionally, you will have the option to sign up for a High Deductible Plan G. If you currently have a Plan F and are considering switching, we can help you evaluate your options.

Does Medicare pay your portion?

It is easy for you to use the coverage, and most people never see any paperwork. Once Medicare approves your claim, they will pay their portion and notify your provider of what they owe. The company must then pay the amount due per Medicare’s instructions.

Is Plan G more cost effective than Plan F?

Because of this, many people find that even after they pay their deductible, Plan G is still the more cost-effective option. Keep in mind: if you become eligible for Medicare in 2020 or later, you will not be able to get Plan F.

Does Medicare Supplement have a doctor network?

The benefits of a Plan G will be the same regardless of the company you select. Doctor’s Network – Medicare Supplement insurance companies don’t have their own doctor’s networks. Their plans are only supplements to your primary Medicare Parts A & B coverage.

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

When to buy Medigap policy?

Buy a policy when you're first eligible. The best time to buy a Medigap policy is during your 6-month Medigap Open Enrollment Period. You generally will get better prices and more choices among policies. During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first ...

What is a select Medicare policy?

Medicare Select. A type of Medigap policy that may require you to use hospitals and, in some cases, doctors within its network to be eligible for full benefits. . If you buy a Medicare SELECT policy, you have rights to change your mind within 12 months and switch to a standard Medigap policy.

How long does it take for a pre-existing condition to be covered by Medicare?

Coverage for the pre-existing condition can be excluded if the condition was treated or diagnosed within 6 months before the coverage starts under the Medigap policy. After this 6-month period, the Medigap policy will cover the condition that was excluded. When you get Medicare-covered services, Original Medicare.

Can Medigap refuse to cover out-of-pocket costs?

A health problem you had before the date that new health coverage starts. . In some cases, the Medigap insurance company can refuse to cover your. out-of-pocket costs. Health or prescription drug costs that you must pay on your own because they aren’t covered by Medicare or other insurance.

Can you get Medicare if you are 65?

Some states provide these rights to all people with Medicare under 65. Other states provide these rights only to people eligible for Medicare because of disability or only to people with ESRD. Check with your State Insurance Department about what rights you might have under state law.

Can you charge more for a Medigap policy?

Charge you more for a Medigap policy. In some cases, an insurance company must sell you a Medigap policy, even if you have health problems. You're guaranteed the right to buy a Medigap policy: When you're in your Medigap open enrollment period. If you have a guaranteed issue right.