Did not receive 1095 B from Medicare?

Apr 20, 2019 · As a general rule, no. You shouldn’t have to fill out the 1095-B form. If you receive one, it should come to you pre-filled by Medicare or your Medicare Advantage provider. The 1095-B form is a tax document with proof of your coverage and should be stored with any of your other tax documents for the previous year.

Does Medicare issue 1095 B?

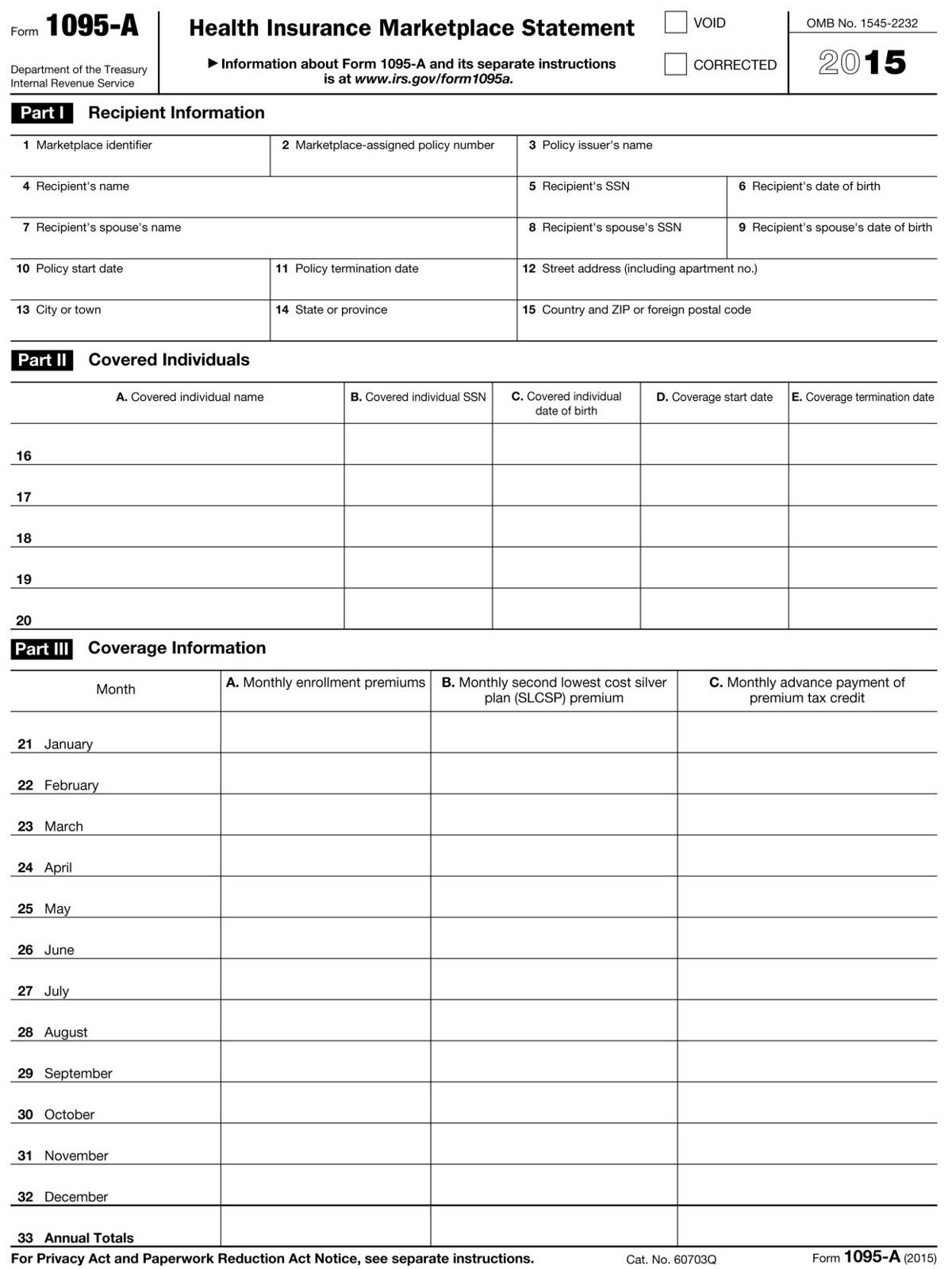

If anyone in your household had a Marketplace plan in 2021, you should get Form 1095-A, Health Insurance Marketplace® Statement, by mail no later than mid-February. It may be available in your HealthCare.gov account as soon as mid-January. IMPORTANT: You must have your 1095-A before you file. Don’t file your taxes until you have an accurate 1095-A.

Will I receive a 1095 from Medicare?

Jan 27, 2022 · January 27, 2022 If anyone in your household had a Marketplace plan in 2021, you'll need Form 1095-A, Health Insurance Marketplace® Statement, to file your federal taxes. You should get it in the mail by early February. Keep it with your important tax information, like W-2 forms and other records. What to do with Form 1095-A

Where can I get a copy of my 1095b form?

Mar 12, 2020 · March 12, 2020 If anyone in your household had Marketplace health insurance in 2019, you should have already received Form 1095-A, Health Insurance Marketplace® Statement, in the mail. Here are 5 important things to know about this form. Helpful tips about tax Form 1095-A: You should already have Form 1095-A.

Do you get a 1095 form if you are on Medicare?

For the entire year, your insurance provider will not send a 1095 form. Retirees that are age 65 and older, and who are on Medicare, may receive instructions from Medicare about how to report their health insurance coverage.

When should I receive my 1095 form?

When should I expect my 1095-B?

Can I get my 1095-B form online?

Did not receive 1095-A?

How do I know if I have a 1095-A?

If your form didn't come by mail or you can't find it, check your online Marketplace account.Mar 7, 2019

Do you need 1095 to file taxes 2021?

Do I need a 1095-B to file my taxes 2021?

Is 1095-B required to file taxes 2020?

How do I get my 1095-B from Medicare?

Why did I get a 1095-B instead of 1095-A?

Where do I put 1095-B on my taxes?

Please keep a copy of form 1095-B with your tax records for future reference. If you have any questions about your 1095-B form, please contact the issuer of the form.

How to Find Your 1095-A Online

Note: Your 1095-A may be available in your HealthCare.gov account as early as mid-January, or as late as February 1. If you’re already logged in, s...

What’S on Form 1095-A and Why You Need It

1. Your 1095-A contains information about Marketplace plans any member of your household had in 2017, including: 1. Premiums paid 2. Premium tax cr...

How to Check Form 1095-A For Accuracy & What to Do If It's Wrong

1. Carefully read the instructions on the back. 2. Make sure it’s accurate. If anything about your coverage or household is wrong, contact the Mark...

Use The Information from Your 1095-A to “Reconcile”

Once you have an accurate 1095-A and second lowest cost Silver plan premium, you’re ready to fill out Form 8962, Premium Tax Credit.See a step-by-s...

How to get a 1095A?

Helpful tips about tax Form 1095-A: 1 You should already have Form 1095-A. It comes from the Marketplace, not the IRS. If your form didn’t come by mail or you can’t find it, check your online Marketplace account before contacting the Marketplace Call Center. 2 Store it in a safe space with other important tax information, like W-2 forms. This way, you can easily find it when you sit down to file. 3 Before doing anything with the form, make sure it’s accurate. Check basic coverage and household member information, and confirm the premium for your second lowest cost Silver plan (SLCSP). Contact the Marketplace Call Center to report any errors. 4 If you request a new, updated form, it’s important that you don’t file until we send you the correct version. If you already filed, you may need to file an amended return using the information from your new 1095-A. 5 You’ll use the information from your 1095-A to “reconcile” your premium tax credit. To do this, you’ll compare the amount of premium tax credit you used in advance during the year against the premium tax credit you actually qualify for based on your final income for the year. Any difference will affect your refund or tax owed. See a step-by-step guide to “reconciling” your premium tax credit.

Where does the 1095-A come from?

Helpful tips about tax Form 1095-A: You should already have Form 1095-A. It comes from the Marketplace , not the IRS. If your form didn’t come by mail or you can’t find it, check your online Marketplace account before contacting the Marketplace Call Center. Store it in a safe space with other important tax information, like W-2 forms.

When is the 1095-A deadline?

The annual deadline for the Marketplace to provide Form 1095-A is January 31. The deadline for insurers, other coverage providers and certain employers to provide Forms 1095-B and 1095-C to individuals is January 31.

What is a 1095-A form?

The forms are: Form 1095-A, Health Insurance Marketplace Statement. The Health Insurance Marketplace (Marketplace) sends this form to individuals who enrolled in coverage there, with information about the coverage, who was covered, and when. Form 1095-B, Health Coverage. Health insurance providers (for example, ...

Can you hand deliver health insurance forms?

The Marketplace, health coverage providers and applicable large employers will mail (or hand deliver) these forms to you or provide them electronic ally to you , if you have consented to electronic delivery.

What is a 1095?

Many people wonder, “what is a 1095?” Here’s a summary of the form series. With the passing of the Affordable Care Act, three new tax forms came into the scene: Form 1095 A, B, and C. These tax forms were used to report your healthcare coverage during a tax year. But, in 2019, the healthcare penalty went away.

1095 tax form

If you’re not sure or have more questions about the health insurance information you need for your tax return, continue reading for more details.

Where to go for more help with 1095 and other tax forms

If you need more guidance on Form 1095 or other healthcare tax topics, we can help. For guidance on understanding tax guidance related to healthcare or otherwise, call 1-800-HRBLOCK or visit a local H&R Block office.

When will 1095-B be sent out?

The latest extension, detailed in IRS Notice 2020-76, gives insurers and employers until March 2, 2021, to distribute Forms 1095-B and 1095-C to plan members and employees. Forms 1095-A (from the exchanges) for 2020 coverage still had to be sent to enrollees by February 1, 2021.

When will the IRS issue 1095-B?

The latest extension, detailed in IRS Notice 2020-76, gives insurers and employers until March 2, 2021, to distribute Forms 1095-B and 1095-C to plan members and employees.

What is a 1095-A?

Form 1095-A is your proof that you had health insurance coverage during the year , and it’s also used to reconcile your premium subsidy on your tax return, using Form 8962 (details below).

Is Form 8962 required for 2020?

The information on Form 1095-A is used to complete Form 8962 (again, Form 8962 is not required for 2020 if you would have had to repay some or all of the premium tax credit; not filing it for 2020 will not affect subsidy eligibility in future years).