What is a Medicare fee schedule?

· The Centers for Medicare & Medicaid Services (CMS) announced today that CMS’ aggressive corrective actions led to an estimated $20.72 billion reduction of Medicare Fee-for-Service (FFS) improper payments over seven years.

How does Original Medicare work?

· The CMS Medicare FFS schedule: Level I April 1, 2010 through December 31, 2010. Level II January 1, 2011 through December 31, 2011. Fully compliant on January 1, 2012. For further information on CMS' Medicare FFS 5010/D.0 Implementation activities go to HIPAA Eligibility Transaction System (HETS) Help (270/271) and, Medicare Fee-for-Service ...

What was the purpose of the Medicare Act of 1965?

· Issued by: Centers for Medicare & Medicaid Services (CMS) Issue Date: August 10, 2020. For updates regarding Medicare Fee-For-Service (FFS) medical review during the 2019-Novel Coronavirus (COVID-19) Public Health Emergency (PHE), please visit: https://www.cms.gov/files/document/provider-burden-relief-faqs.pdf (PDF)

When should I submit my Medicare physician fee schedule claim?

· Issue Date: August 10, 2020. Medicare only pays for items and services when the provider’s medical record documentation indicates that all coverage and coding requirements were met. The Medicare documentation requirements appear in various locations and on separate websites causing burden to providers who must navigate the various websites to find …

What year did Medicare start charging premiums?

1966President Johnson signs the Medicare bill into law on July 30 as part of the Social Security Amendments of 1965. 1966: When Medicare services actually begin on July 1, more than 19 million Americans age 65 and older enroll in the program.

When did fee-for-service start in the US?

Title XVIII and Title XIX of the Social Security Act established the Medicare and Medicaid programs in 1965. This was a significant legislative health reform initiative designed to provide a safety net for retirees, certain low-income individuals and the medically underserved.

What is original Medicare fee-for-service?

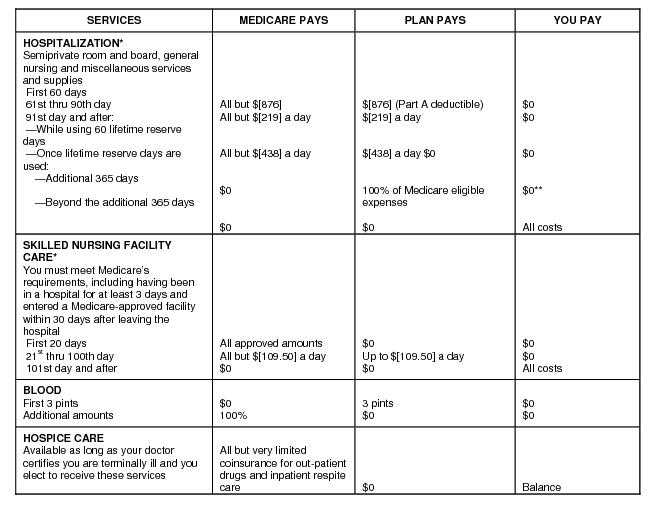

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or Medigap.

When was CMS implemented?

On July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving lives, and improving the economic security of our nation.

What is wrong with fee-for-service?

Economists argue that fee-for-service is inefficient and incentivizes providers to do more (tests, procedures, visits) than necessary to increase revenue. The model rewards the most expensive interventions, at the cost of preventive care, behavioral health services and disease management.

Is FFS the same as PPO?

Fee-for-Service (FFS) Plans with a Preferred Provider Organization (PPO) An FFS option that allows you to see medical providers who reduce their charges to the plan; you pay less money out-of-pocket when you use a PPO provider. When you visit a PPO you usually won't have to file claims or paperwork.

What is Medicare fee-for-service vs managed care?

Under the FFS model, the state pays providers directly for each covered service received by a Medicaid beneficiary. Under managed care, the state pays a fee to a managed care plan for each person enrolled in the plan.

Where do the fees for service rendered come from?

Fee for service (FFS) is the most traditional payment model of healthcare. In this model, the healthcare providers and physicians are reimbursed based on the number of services they provide or their procedures. Payments in an FFS model are not bundled.

What is the difference between the Medicare approved amount for a service and the actual charge?

If you use a nonparticipating provider, they can charge you the difference between their normal service charges and the Medicare-approved amount. This cost is called an “excess charge” and can only be up to an additional 15 percent of the Medicare-approved amount.

What did the Medicare Act of 1965 do?

On July 30, 1965, President Lyndon B. Johnson signed the Medicare and Medicaid Act, also known as the Social Security Amendments of 1965, into law. It established Medicare, a health insurance program for the elderly, and Medicaid, a health insurance program for people with limited income.

When did Medicare start and why?

The Medicare program was signed into law in 1965 to provide health coverage and increased financial security for older Americans who were not well served in an insurance market characterized by employment-linked group coverage.

When did Medicare Advantage begin?

2003President Bill Clinton signed Medicare+Choice into law in 1997. The name changed to Medicare Advantage in 2003. Advantage plans automatically cover essential Part A and Part B benefits, except hospice services. Insurance companies offer six different approaches to Medicare Advantage plans.

What is the Medicare FFS rate for 2021?

The 2021 Medicare FFS estimated improper payment rate (claims processed July 1, 2019 to June 30, 2020) is 6.26% ̶ an historic low. This is the fifth consecutive year the Medicare FFS improper payment rate has been below the 10% threshold for compliance established in the Payment Integrity Information Act of 2019. Due to CMS corrective actions, the agency saw key successes in the following areas:

How much did the CMS decrease in improper payments in 2021?

Inpatient Rehabilitation Facility claims had a $1.81 billion decrease in estimated improper payments from 2018 to 2021. This is the result of years of sustained effort from CMS, which included clarifying policy to reduce provider burden and educating providers through the Targeted Probe and Educate program. CMS uses the Targeted Probe and Educate program to provide one-on-one help to providers, focusing on those who have high denial rates or unusual billing practices, to reduce claim errors and denials.

How much was the DME reduction in 2020?

Durable Medical Equipment (DME) claims saw a $388 million reduction in estimated improper payments since 2020 due to a nationwide expansion of prior authorization of certain DME items as well as the Targeted Probe and Educate program.

What is the Part D improper payment rate for 2021?

The FY 2021 projected Part D improper payment rate is 1.58%. The slight increase is likely due to year-over-year variability.

The Medicare FFS Approach

The purpose of this message is to clearly communicate the approach that Medicare Fee-For-Service (FFS) is taking to ensure compliance with the Health Insurance Portability and Accountability Act's (HIPAA's) new versions of the Accredited Standards Committee (ASC) X12 and the National Council for Prescription Drug Programs (NCPDP) Electronic Data Interchange (EDI) transactions..

CMS HETSHelp site

The CMS HETSHelp site provides information specific to the HIPAA Eligibility Transaction System (HETS) for 270/271 Medicare eligibility transactions. Please visit the HETSHelp site at: http://www.cms.hhs.gov/HETSHelp/ for details about the changes being made to HETS to support the X12 5010 standard.

When was the ADR limit updated?

December 21, 2018 - The CMS has posted an updated version of the Institutional-Provider-Facilities-ADR-Limits document ( /Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Recovery-Audit-Program/Resources ). This update changes the ADR “cycle” limit, from zero (0) to one (1), for those providers who, under the previous methodology would have an ADR “cycle” limit of zero (0), even though their “annual” ADR limit was greater than zero (e.g. 1, 2, 3, or 4).

Does CMS require RAC to review claims?

At CMS discretion, CMS may require the RAC to review claims, based on these referrals. These CMS-Required RAC reviews are conducted outside of the established ADR limits.

What is Medicare doing to streamline access to requirements?

CMS is collaborating with ongoing industry efforts to streamline workflow access to coverage requirements, starting with developing a prototype Medicare Fee for Service (FFS) Documentation Requirement Lookup Service.

How will this benefit providers?

Providers will be able to discover Medicare FFS prior authorization and documentation requirements:

The Vision

CMS is participating in two workgroups to promote development of standards that will support the Medicare FFS Documentation Requirement Lookup Service. One workgroup is a private sector initiative hosted by Health Level Seven International (HL7), the Da Vinci project.

How can other health plans get involved?

CMS currently requires Medicare Advantage (MA) organizations to communicate their MA coverage and documentation guidelines to providers and, as appropriate, to enrollees. MA plans usually communicate these guidelines on separate websites causing burden to providers who must navigate various websites to find coverage and prior authorization rules.

Reference Implementation

For IT developers who are interested, the first release of the Coverage Requirements Discovery (CRD) Reference Implementation (RI) Version 0.9 can be found on GitHub: https://github.com/HL7-DaVinci/CRD/releases/tag/v0.9

When is the Medicare Physician Fee Schedule 2020?

This final rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after Jan. 1, 2020.

When will Medicare change to MPFS?

On December 27, the Consolidated Appropriations Act, 2021 modified the Calendar Year (CY) 2021 Medicare Physician Fee Schedule (MPFS):

What is the MPFS conversion factor for 2021?

CMS has recalculated the MPFS payment rates and conversion factor to reflect these changes. The revised MPFS conversion factor for CY 2021 is 34.8931. The revised payment rates are available in the Downloads section of the CY 2021 Physician Fee Schedule final rule (CMS-1734-F) webpage.

When will CMS issue a correction notice for 2021?

On January 19, 2021, CMS issued a correction notice to the Calendar Year 2021 PFS Final Rule published on December 28, 2020, and a subsequent correcting amendment on February 16, 2021. On March 18, 2021, CMS issued an additional correction notice to the Calendar Year 2021 PFS Final Rule. These notices can be viewed at the following link:

When will Medicare start charging for PFS 2022?

The CY 2022 Medicare Physician Fee Schedule Proposed Rule with comment period was placed on display at the Federal Register on July 13, 2021. This proposed rule updates payment policies, payment rates, and other provisions for services furnished under the Medicare Physician Fee Schedule (PFS) on or after January 1, 2022.

When will CMS accept comments on the proposed rule?

CMS will accept comments on the proposed rule until September 13, 2021, and will respond to comments in a final rule. The proposed rule can be downloaded from the Federal Register at: ...

Does CMS process claims?

CMS is ready to process claims correctly and on time. You don’t need to wait to submit your claims.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

Is PFFS the same as Medicare?

PFFS plans aren’t the same as. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). or Medigap.

Does Medicare Advantage cover prescription drugs?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. to get coverage.

When was the ADR limit updated?

December 21, 2018 - The CMS has posted an updated version of the Institutional-Provider-Facilities-ADR-Limits document ( /Research-Statistics-Data-and-Systems/Monitoring-Programs/Medicare-FFS-Compliance-Programs/Recovery-Audit-Program/Resources ). This update changes the ADR “cycle” limit, from zero (0) to one (1), for those providers who, under the previous methodology would have an ADR “cycle” limit of zero (0), even though their “annual” ADR limit was greater than zero (e.g. 1, 2, 3, or 4).

Does CMS require RAC to review claims?

At CMS discretion, CMS may require the RAC to review claims, based on these referrals. These CMS-Required RAC reviews are conducted outside of the established ADR limits.

When did the Hospital Acquired Condition Reduction Program start?

The Hospital Acquired Condition Reduction Program initiated in 2014.

What is the CMS program?

The Centers for Medicare and Medicaid Services (CMS) initiated three important programs — mandated by the Affordable Care Act — that reward hospitals based on the quality of care provided to patients. They are: The Hospital Value Based Purchasing Program initiated in 2012;

What happens if a hospital is over the quality adjusted target price?

If the hospital was over the quality-adjusted target price, they would owe CMS the difference. With this mandate, the acute care hospital was at risk; however, there was a provision for “financial arrangements” with other care providing stakeholders that were part of the care continuum. Those stakeholders that entered into financial arrangements had the potential of either sharing in the gain or loss, respectively, according to the retrospective reconciliation.

What happens if health care organizations are unable to achieve value in the provision of cardiovascular care?

Those health care organizations who are unable to achieve value in the provision of cardiovascular care will find their programs unsustainable as the health care organizations that “get it” may dominate their markets and become the provider of choice for health care consumers and payers.

What is the perverse incentive of fee for service?

The “perverse incentive” with fee-for-service means the more health care services provided, the more that can be billed. The problem resulting was that this reimbursement incentivizes care to be provided if no evidence supports the care as being medically necessary. Quality and patient-reported outcomes are not tied to the cost of care to determine whether this provides patient value. Reimbursement depends on the quantity of care rather than the quality of care.

What is the challenge of controlling the costs of medical care?

The inability to control the costs of medical care is a challenge that threatens the sustainability of the U.S. health care system. Cardiovascular disease imposes one of the highest cost burdens of any disease category.

Why are providers incentivized?

Providers are incentivized to help patients improve their health, reduce the incidence and effects of chronic disease, and live healthier lives. The “value” comes from measuring outcomes against the cost.