When should you enroll in Medicare Part D?

Nov 05, 2021 · Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. … Program expenditures were $102 billion, which accounted for 12% of Medicare spending. Through the Part D program, Medicare finances more than one-third of retail prescription medicine spending in the United States.

When did Medicare Part D become effective?

Medicare Part D plans have their origin in the Medicare Prescription Drug, Improvement, and Modernization Act which was passed on December 8, 2003. This law established a voluntary drug benefit for Medicare beneficiaries and created the new Medicare Part D program.

What are the rules of Medicare Part D?

President George W. Bush signed into law the Medicare Prescription Drug Improvement and Modernization Act of 2003, adding an optional prescription drug benefit known as Part D, which is provided only by private insurers. Until this time, about 25 percent of those receiving Medicare coverage did not have a prescription drug plan.

What year did Medicare Part D start?

Dec 08, 2003 · The Enactment of Medicare in 1965 The limited scope of the original Medicare benefits reflects the beating that President Harry Truman (D) took at the hands of the American Medical Association (AMA) after he introduced proposals for national health insurance between 1945 and 1948 and again after his election in 1948.

When did Medicare Part D become mandatory?

January 1, 2006In 2003 the Medicare Modernization Act created a drug benefit for seniors called Part D. The benefit went into effect on January 1, 2006.Aug 10, 2017

Who was president when Medicare Part D was enacted?

President George W. Bush signed into law the Medicare Prescription Drug Improvement and Modernization Act of 2003, adding an optional prescription drug benefit known as Part D, which is provided only by private insurers.

When did Medicare Part D Penalty start?

Paying for the Part D Late PenaltyDeadline for joining Part D without penaltyDate Part D coverage beginsLate penalty calculation for 2016March 2015January 20169 x 34 centsAugust 2014January 201616 x 34 centsNovember 2010January 201661 x 34 centsMay 2006January 2016115 x 34 cents1 more row

Why was Medicare Part D passed?

Medicare Part D, also called the Medicare prescription drug benefit, is an optional United States federal-government program to help Medicare beneficiaries pay for self-administered prescription drugs. Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006.

What problem did the Medicare Act of 1965 address?

On July 30, 1965, President Lyndon B. Johnson signed into law the Social Security Act Amendments, popularly known as the Medicare bill. It established Medicare, a health insurance program for the elderly, and Medicaid, a health insurance program for the poor.

Who sponsored the Medicare Modernization Act of 2003?

The bill was introduced in the House of Representatives early on June 25, 2003 as H.R. 1, sponsored by Speaker Dennis Hastert.

How can I avoid Medicare Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

How far back does the Medicare Part D Penalty go?

63 daysA person enrolled in a Medicare plan may owe a late enrollment penalty if they go without Part D or other creditable prescription drug coverage for any continuous period of 63 days or more after the end of their Initial Enrollment Period for Part D coverage.

Can I opt out of Medicare Part D?

To disenroll from a Medicare drug plan during Open Enrollment, you can do one of these: Call us at 1-800 MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Mail or fax a signed written notice to the plan telling them you want to disenroll.

Is Medicare Part D required by law?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

What is the max out of pocket for Medicare Part D?

3, out-of-pocket drug spending under Part D would be capped at $2,000, while under H.R. 19 and the Senate Finance bill, the cap would be set at $3,100 (both amounts exclude the value of the manufacturer price discount).Jul 23, 2021

Who has the cheapest Part D drug plan?

SilverScript Medicare Prescription Drug Plans Although costs vary by zip code, the average nationwide monthly premium cost of the SmartRX plan is only $7.08, making it the most affordable Medicare Part D plan on the market.

When was Medicare Part D established?

On December 8, 2003, President George W. Bush (R) signed the Medicare Prescription medicine, Improvement, and Modernization Act (P.L. 108–173), which authorizes Medicare coverage of outpatient prescription drugs as well as a host of other changes to the program.

What did seniors do before Medicare Part D?

Before the passage of Part D, seniors spent an average of $2,318 on out-of-pocket medicine costs. About 90 percent of Medicare-eligible seniors now have prescription medicine coverage. Enrollees in Part D pay an average of $30 a month in premiums.

Is Medicare Part D required by law?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription medicine Plan.

In what year was Part D for Medicare added and which President signed the bill into law?

President George W. Bush signed into law the Medicare Prescription medicine Improvement and Modernization Act of 2003, adding an optional prescription medicine benefit known as Part D, which is provided only by private insurers.

How did Medicare Part D get passed?

Part D was enacted as part of the Medicare Modernization Act of 2003 and went into effect on January 1, 2006. … Program expenditures were $102 billion, which accounted for 12% of Medicare spending. Through the Part D program, Medicare finances more than one-third of retail prescription medicine spending in the United States.

Can you opt out of Medicare Part D?

A. You can quit Part D during the annual open enrollment period (which is for enrolling and disenrolling) that runs from October 15 to December 7.

When did Part D become mandatory?

Medicare did not cover outpatient prescription drugs until January 1, 2006, when it implemented the Medicare Part D prescription medicine benefit, authorized by Congress under the “Medicare Prescription medicine, Improvement, and Modernization Act of 2003.” [1] This Act is generally known as the “MMA.”

What is Medicare Part D?

Medicare prescription drug coverage (Part D) helps you pay for both brand-name and generic drugs. Medicare drug plans are offered by insurance companies and other private companies approved by Medicare.

Who is responsible for Medicare Part D?

The Centers for Medicare and Medicaid Services (CMS) or Medicare is responsible for the administration of the Medicare Part D prescription drug program. Private insurance carriers actually implement the various Medicare Part D plans across the country under the direction of CMS. Top.

Does Medicare cover prescription drugs?

In general, Medicare Part D prescription drug plans provide insurance coverage for your prescription drugs - just like other types of insurance. Your Medicare prescription drug coverage can be provided by a "stand-alone" Medicare Part D plan (only prescription coverage) or a Medicare Advantage plan that includes prescription coverage ...

Does Medicare have a deductible?

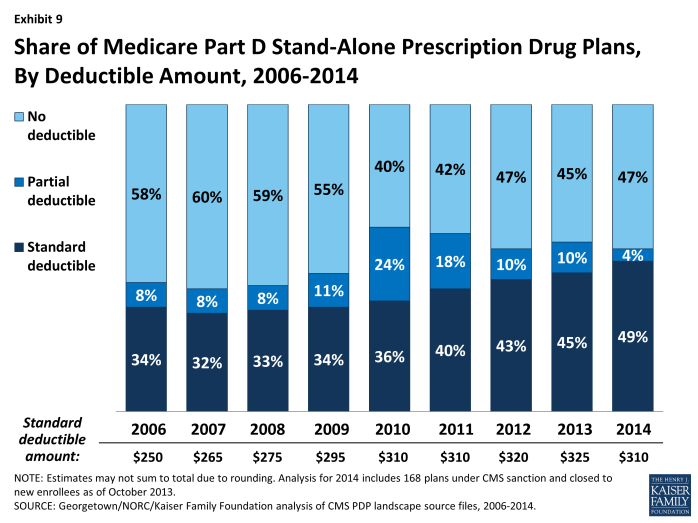

Some Medicare Part D or Medicare Advantage plans have an initial deductible where you pay 100% of your pre scription costs before your Part D prescription drug coverage or benefits begin.

What is Medicare Part D?

Medicare Part D Prescription Drug benefit. The Medicare Prescription Drug Improvement and Modernization Act of 2003 (MMA) made the biggest changes to the Medicare in the program in 38 years. Under the MMA, private health plans approved by Medicare became known as Medicare Advantage Plans.

When did Medicare expand?

Over the years, Congress has made changes to Medicare: More people have become eligible. For example, in 1972 , Medicare was expanded to cover the disabled, people with end-stage renal disease (ESRD) requiring dialysis or kidney transplant, and people 65 or older that select Medicare coverage.

How long has Medicare and Medicaid been around?

Medicare & Medicaid: keeping us healthy for 50 years. On July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving lives, and improving the economic security ...

When was the Children's Health Insurance Program created?

The Children’s Health Insurance Program (CHIP) was created in 1997 to give health insurance and preventive care to nearly 11 million, or 1 in 7, uninsured American children. Many of these children came from uninsured working families that earned too much to be eligible for Medicaid.

What is the Affordable Care Act?

The 2010 Affordable Care Act (ACA) brought the Health Insurance Marketplace, a single place where consumers can apply for and enroll in private health insurance plans. It also made new ways for us to design and test how to pay for and deliver health care.

When did Medicare start?

But it wasn’t until after 1966 – after legislation was signed by President Lyndon B Johnson in 1965 – that Americans started receiving Medicare health coverage when Medicare’s hospital and medical insurance benefits first took effect. Harry Truman and his wife, Bess, were the first two Medicare beneficiaries.

How much was Medicare in 1965?

In 1965, the budget for Medicare was around $10 billion. In 1966, Medicare’s coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B. Nineteen million individuals signed up for Medicare during its first year. The ’70s.

How much will Medicare be spent in 2028?

Medicare spending projections fluctuate with time, but as of 2018, Medicare spending was expected to account for 18 percent of total federal spending by 2028, up from 15 percent in 2017. And the Medicare Part A trust fund was expected to be depleted by 2026.

What is the Patient Protection and Affordable Care Act?

The Patient Protection and Affordable Care Act of 2010 includes a long list of reform provisions intended to contain Medicare costs while increasing revenue, improving and streamlining its delivery systems, and even increasing services to the program.

How many people will have Medicare in 2021?

As of 2021, 63.1 million Americans had coverage through Medicare. Medicare spending is expected to account for 18% of total federal spending by 2028. Medicare per-capita spending grew at a slower pace between 2010 and 2017. Discussion about a national health insurance system for Americans goes all the way back to the days ...

What was Truman's plan for Medicare?

The plan Truman envisioned would provide health coverage to individuals, paying for such typical expenses as doctor visits, hospital visits, ...

When did Medicare expand home health?

When Congress passed the Omnibus Reconciliation Act of 1980 , it expanded home health services. The bill also brought Medigap – or Medicare supplement insurance – under federal oversight. In 1982, hospice services for the terminally ill were added to a growing list of Medicare benefits.

How much does Medicare pay for Part D?

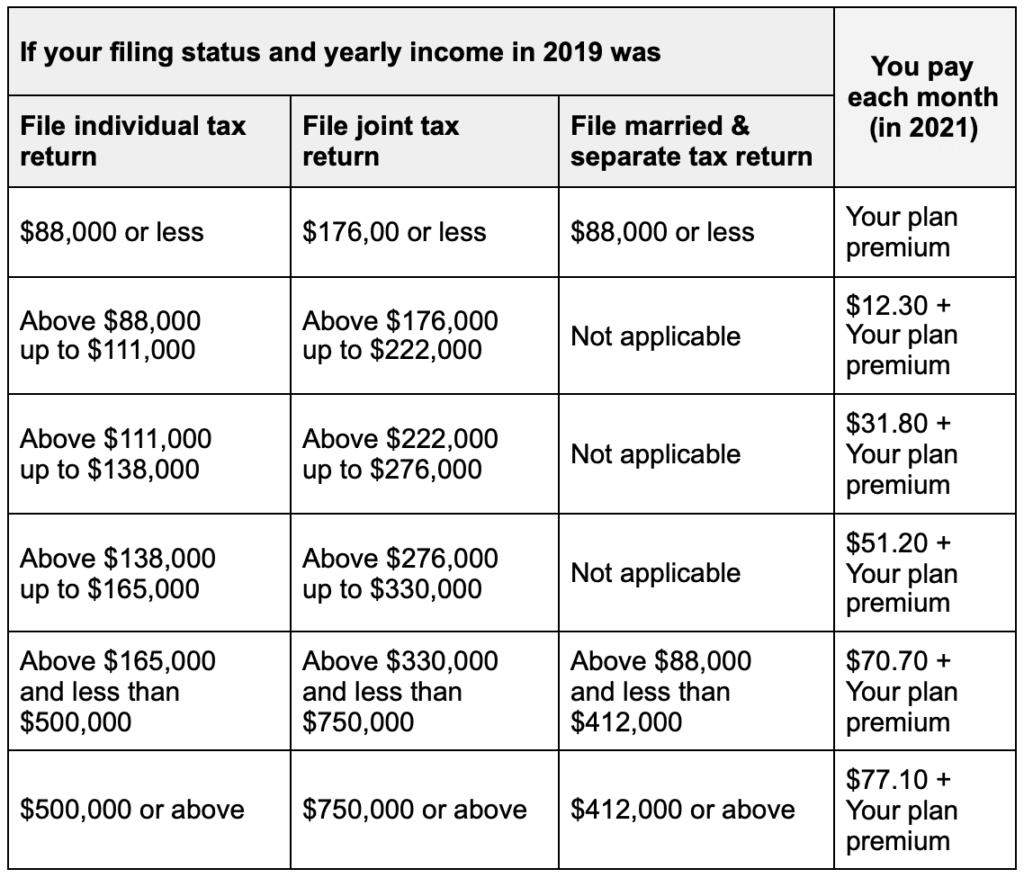

The standard Part D benefits would have an estimated initial premium of $35 per month and a $250 annual deductible. Medicare would pay 75 percent of annual expenses between $250 and $2,250 for approved prescription drugs, nothing for expenses between $2,250 and $5,100, and 95 percent of expenses above $5,100.

When did Medicare start paying the $30 enrollment fee?

The voluntary interim program would begin in mid-2004. Medicare would pay the $30 enrollment fee and provide a $600 credit for those beneficiaries with a household income below 135 percent of poverty (in 2003, $12,123 for an individual and $16,362 for a couple) who do not qualify for Medicaid or have other coverage.

How many Medicare beneficiaries will have private prescription coverage?

At that time, more than 40 million beneficiaries will have the following options: (1) they may keep any private prescription drug coverage they currently have; (2) they may enroll in a new, freestanding prescription drug plan; or (3) they may obtain drug coverage by enrolling in a Medicare managed care plan.

What was the Task Force on Prescription Drugs?

Department of Health, Education and Welfare (HEW; later renamed Health and Human Services) and the White House.

How much did Medicare cut in 1997?

Nonetheless, reducing the budget deficit remained a high political priority, and two years later, the Balanced Budget Act of 1997 (Balanced Budget Act) cut projected Medicare spending by $115 billion over five years and by $385 billion over ten years (Etheredge 1998; Oberlander 2003, 177–83).

How long have seniors waited for Medicare?

Seniors have waited 38 years for this prescription drug benefit to be added to the Medicare program. Today they are just moments away from the drug coverage they desperately need and deserve” (Pear and Hulse 2003). In fact, for many Medicare beneficiaries, the benefits of the new law are not so immediate or valuable.

How much money would the federal government save on medicaid?

The states would be required to pass back to the federal government $88 billion of the estimated $115 billion they would save on Medicaid drug coverage. It prohibited beneficiaries who enrolled in Part D from buying supplemental benefits to insure against prescription drug expenses not covered by the program.

When did Medicare Part D pass?

Why Medicare Part D Passed. The MMA (Medical Prescription Drug, Improvement and Modernization Act) became law back in the year 2003 (Matthews, 2006). Through the act, Medicare part D drugs were also created and implemented from the 1 st of January in the year 2006. This was done for the purpose of providing drugs coverage to elderly people ...

Who was involved in the Medicare Act of 1965?

The various stakeholders involved in the Medicare act of 1965 and the subsequent Medicare part D act in the year 2003 were the Republicans and Democrats at the House of Congress and Senate, the American Medical Association (AMA), various Senate Committees like the Ways & Means Committee and Policymakers (Zwillich, 2006).

How much did Medicare cost in 2001?

The cost of $6.5 billion as at the year 2001 compared to the $700 million incurred back in the year 1992 brought the quick attention of the country’s policymakers (Zwillich, 2006). This was mainly because Medicare was found to be paying two to ten times the value charged by manufacturers for these prescription drugs (Matthews, 2006).

How many prescription drugs are covered by Medicare?

These actions have in turn increased the number of prescription drugs which fall under Medicare and are physician dispensed to around 454 drugs.

What did the trustees of the 2003 Medicare report predict?

The trustees of the 2003 Medicare report projected that spending would increase more than the government’s earnings. The Republicans who already had this information suppressed it before it could be released to the public and exerted unwarranted influence on fellow Republicans to have the law passed (Krugman, 2006).

Why was Medicare Part D not in the best interest of the citizens?

This is mainly because the passage of Medicare part D was not in the best interest of the citizens as it came at a time when there was a looming economic deficit and the exact deficit figures were suppressed by those in power, the Republicans, and the public missed the information (Zwillich, 2006).

When was the Kerr Mills program enacted?

The AMA, on the other hand, proposed that the Kerr-Mills program that had been enacted back in the year 1960 should be expanded through the use of state-based and means-tested programs of understandable benefits (Matthews, 2006).

When did Medicare start covering precription drugs?

Medicare began covering the cost of some of the precription drugs that are taken at home on January 1, 2006. Known as the Medicare Part D Benefit (Part D), this benefit is administered through private insurance companies that offer Medicare approved prescription plans (PDPs) and through Medicare Advantage managed care plans that include a Part D drug benefit (MA-PDs). Part D replaced the coverage formerly provided by Medigap plans, Medicare drug discount cards and many managed care plans. (Matthews, 2006)

What was the impact of Part D on the Republican Party?

In addition to a massive political gain to the Republican Party in the next election, the passage of Part D yielded tremendous financial rewards to several of its key proponents.

What is the most fiscally irresponsible piece of legislation since the 1960s?

Part D has been called many things since its passage, but I believe the most accurate description is that of Comptroller General David Walker, who called it “the most fiscally irresponsible piece of legislation since the 1960s.” In 2003, the Bush administration was projecting the largest deficit in American history. The July 2003 mid-session Congressional budget review projected the fiscal year 2004 deficit would be $475 billion. With an election looming the next year, Bush and the Republican Party decided to gain the votes of America’s seniors by giving them a new program that appeared to be designed to pay for their prescription drugs. (Bartlett, 2009)

Is the 55% discount for Medicare Part D closing?

It was not until the passage of the Affordable Care Act (ACA) in 2010 that some these issues were finally addressed. A 55% discount was negotiated for Medicare Part D recipients with the pharmaceutical providers that includes most medications. The infamous “donut hole” where recipients are required to pay high prices for medications until huge annual deductibles are reached is being closed and will be gone by 2020. (The ACA and Medicare, 2015). In the meantime, the “Extra Help” program was implemented as part of the ACA to provide financial assistance for those Medicare recipients making less than $13,000 a year, and provides up to $4,000 of help anually in purchasing medications. (Extra Help, 2015)

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.