What is the Medicare deductible and how does it work?

How Does the Medicare Deductible Work? Your deductible is the amount of money you have to pay for your prescriptions and healthcare before Original Medicare, other insurance, or your prescription drug plan starts paying for your healthcare expenses.

What is the deductible for Medicare Part C and D?

Additionally, Part C and Part D have deductibles that will vary from year to year and plan to plan. Some are as low as $0, while others are a few hundred.

What is the Medicare Part a hospital deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What counts toward my Medicare Part B deductible?

Almost any item or service that Part B covers will count toward your deductible. For example, say you fall and break your arm. You go to the emergency room to get treatment. Part B would cover the cost of the care if you are treated as an outpatient, and Medicare Part A would cover any services receive if you are formally admitted as an inpatient.

When did Medicare deductions begin?

1966Medicare Taxes: The Basics Medicare HI taxes began in 1966, at a modest rate of 0.7%. Employers and employees were each responsible for paying 0.35%. Employees paid their share when their employers deducted it from their paychecks.

When Did Medicare Start Irmaa?

2003IRMAA was first enacted in 2003 as a provision of the Medicare Modernization Act. This provision applied only to high-income enrollees of Medicare Part B. In 2011, IRMAA was expanded under the Affordable Care Act to include high-income enrollees of Medicare Part D as well.

What is the deductible on Medicare 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the Medicare Part B deductible for the year 2022?

$233The 2022 Medicare deductible for Part B is $233. This reflects an increase of $30 from the deductible of $203 in 2021. Once the Part B deductible has been paid, Medicare generally pays 80% of the approved cost of care for services under Part B.

How do I avoid Medicare Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

How do I know if I have to pay Irmaa?

SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year that you start paying IRMAA. The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income.

What changes are coming to Medicare in 2021?

The Medicare Part B premium is $148.50 per month in 2021, an increase of $3.90 since 2020. The Part B deductible also increased by $5 to $203 in 2021. Medicare Advantage premiums are expected to drop by 11% this year, while beneficiaries now have access to more plan choices than in previous years.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Why did my Medicare deduction increase?

The Affordable Care Act expanded the Medicare payroll tax to include the Additional Medicare Tax. This new Medicare tax increase requires higher wage earners to pay an additional tax (0.9%) on earned income. All types of wages currently subject to the Medicare tax may also be subject to the Additional Medicare Tax.

What is the Medicare Plan G deductible for 2022?

$2,490$233 – the annual Part B deductible in 2022 is what you will pay for your Plan G deductible. However, Plan G does not have its own deductible separate from the Part B deductible. There is also a High Deductible Plan G which has a deductible of $2,490 in 2022.

How much will Medicare premiums increase in 2022?

$170.10 a monthMedicare premiums are rising sharply next year, cutting into the large Social Security cost-of-living increase. The basic monthly premium will jump 15.5 percent, or $21.60, from $148.50 to $170.10 a month.

What is the medical deductible for 2022?

$1,556 perIn 2022, the Medicare Part A deductible is $1,556 per benefit period, and the Medicare Part B deductible is $233 per year. Medicare Advantage deductibles, Part D drug plan deductibles and Medicare Supplement deductibles can vary. Learn more about 2022 Medicare deductibles and other Medicare costs.

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to p...

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of...

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

Key Takeaways

Parts A and B of Original Medicare have deductibles you must meet before Medicare will pay for healthcare.

What is the Medicare Deductible for 2022?

A deductible refers to the amount of money you must pay out of pocket for covered healthcare services before your health insurance plan starts to pay. A deductible can be based upon a calendar year, upon a plan year or — as is unique to Medicare Part A — upon a benefit period.

Does Original Medicare Have Deductibles?

Original Medicare is composed of Medicare Part A and Medicare Part B. Both parts of Original Medicare have deductibles you will have to pay out of pocket before your plan starts to pay for your healthcare.

Medicare Advantage (Part C) Deductibles

Medicare Advantage (Part C) is an alternative type of Medicare plan that is purchased through a private insurer. Not every Part C plan is available throughout the country. Your state, county and zip code will determine which plans are available for you to choose from in your area.

Medicare Part D Deductibles

Medicare Part D is prescription drug coverage. People are often surprised to learn that Part D is not included in Original Medicare. This is understandable since prescription medications are very often integral to health.

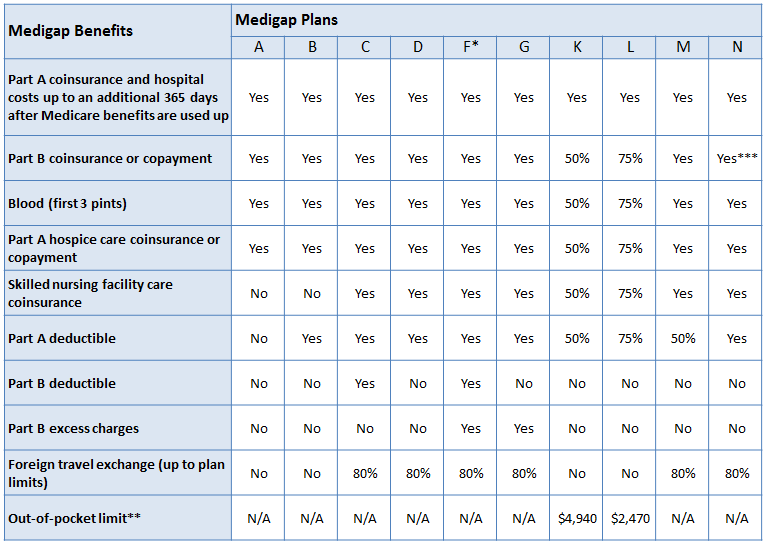

Medicare Supplement Plan Deductible Coverage

Medicare Supplement Insurance is also known as Medigap. Medigap is supplemental insurance sold by private insurers. It is designed to fill in the cost “gaps” for people who have Original Medicare.

Do You Have to Pay a Deductible with Medicare?

You’ve probably heard the one about death and taxes. If you have Original Medicare, you can add deductibles to that list.

How much does Medicare cover if you have met your deductible?

If you already met your deductible, you’d only have to pay for 20% of the $80. This works out to $16. Medicare would then cover the final $64 for the care.

What happens when you reach your Part A or Part B deductible?

What happens when you reach your Part A or Part B deductible? Typically, you’ll pay a 20% coinsurance once you reach your Part B deductible. This coinsurance gets attached to every item or service Part B covers for the rest of the calendar year.

What is the Medicare Part B deductible for 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject ...

How much is Medicare Part B 2020?

The Medicare Part B deductible for 2020 is $198 in 2020. This deductible will reset each year, and the dollar amount may be subject to change. Every year you’re an enrollee in Part B, you have to pay a certain amount out of pocket before Medicare will provide you with coverage for additional costs.

How much is a broken arm deductible?

If you stayed in the hospital as a result of your broken arm, these expenses would go toward your Part A deductible amount of $1,408. Part A and Part B have their own deductibles that reset each year, and these are standard costs for each beneficiary that has Original Medicare. Additionally, Part C and Part D have deductibles ...

Does Medicare Advantage have coinsurance?

They can offer coverage for some of the expenses you’ll have as a Medicare beneficiary like deductibles and coinsurance. An alternative to Original Medicare, a Medicare Advantage, or Medicare Part C, plan will offer the same benefits as Original Medicare, but most MA plans include additional coverage.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Big hike in Medicare Part B premiums

Although the 2022 increase is substantial, most beneficiaries won’t see the full amount in their checks because Medicare Part B premiums are deducted directly from most Social Security retirement payments.

Credit for work

In order to get Social Security retirement benefits, you must have earned 40 work credits , or the equivalent of 10 years. Each credit is three months of qualifying work a year. To qualify, you need to make a minimum amount of money per quarter. In 2021, the minimum was $1,470 per quarter. In 2022, the minimum will be $1,510.

Subtraction for work

Social Security retirement benefits are generally designed for those who have stopped working. If you are earning money and collecting Social Security retirement benefits before you reach full retirement age, the SSA may withhold $1 in benefits for every $2 in earnings that exceed the threshold.

Taxes

Social Security is paid for by a 6.2 percent tax on employees, which is matched by a 6.2 percent tax from employers. (The self-employed pay a 12.4 percent combined tax.) The tax rate hasn’t changed. The amount of income that’s subject to that tax, however, has also increased in line with the COLA.

What is EOB in medical billing?

Your EOB is a window into your medical billing history. Review it carefully to make sure you actually received the service being billed, that the amount your doctor received and your share are correct, and that your diagnosis and procedure are correctly listed and coded.

What is EOB in healthcare?

Updated on July 19, 2020. An explanation of benefits (EOB) is a form or document provided to you by your insurance company after you had a healthcare service for which a claim was submitted to your insurance plan. Your EOB gives you information about how an insurance claim from a health provider (such as a doctor or hospital) ...

What is deductible in health insurance?

The deductible is the dollar amount that you must pay out of pocket before your health insurance begins paying for covered medical expenses. When you purchase an individual plan on the health insurance marketplace, and sometimes even if you’re choosing a plan offered by your employer, you will need to choose a deductible amount for your plan.

How much is deductible for annual check up?

The deductible might be anywhere from $500 to $1,500 if you’re an individual, or $1,000 to $3,000 if you’re a family. In general, plans with higher deductibles have lower premiums and vice versa.

What is a high deductible health plan?

High-deductible health plan (HDHP) An HDHP is a health plan with a deductible of $1,400 or more for individuals or over $2,800 for families. Employer-sponsored health insurance might not offer an HDHP, but it can be purchased on the Obamacare health insurance marketplace.

What does higher deductible mean?

Higher deductibles typically mean lower health insurance premiums and vice versa. Deductibles are a form of cost sharing; the insurers splits the cost of care with you. Your deductible resets every year, even if your expenses exceeded it the previous year. Your deductible is the amount you pay for health care out of pocket before your health ...

How much does a health insurance plan pay out of pocket?

You pay $500 out of pocket to the provider. Because you met the deductible, your health insurance plan begins to cover the costs. The remaining $5,000 is covered by insurance, but you may still be required to pay a percentage of the costs, depending on if your plan has copays or coinsurance.

What happens if you have a $500 deductible?

Let’s say you have a health insurance plan with a $500 deductible. A major medical event results in a $5,500 bill for an expense that is covered in your plan. Your health insurance will help in paying for these costs, but only after you’ve met that deductible. This is what happens next: You pay $500 out of pocket to the provider.

Can you choose your deductible when buying health insurance?

When buying an insurance policy, you’ll be able to choose your deductible amount. Many people only look at the insurance premiums when comparing health plans. But this monthly price only represents one of the expenses that contributes to how much you'll spend on health care in a given month.

How long does it take for Medicare to process a claim?

Medicare claims to providers take about 30 days to process. The provider usually gets direct payment from Medicare. What is the Medicare Reimbursement fee schedule? The fee schedule is a list of how Medicare is going to pay doctors. The list goes over Medicare’s fee maximums for doctors, ambulance, and more.

Can you get a surprise bill from a doctor?

However, occasionally you may receive a surprise bill from a doctor that was involved in your inpatient treatment. If this happens, contact the doctor and find out if they accept Medicare assignment and if and when they plan to submit the claim to Medicare.

Does Medicare cover out of network doctors?

Coverage for out-of-network doctors depends on your Medicare Advantage plan. Many HMO plans do not cover non-emergency out-of-network care, while PPO plans might. If you obtain out of network care, you may have to pay for it up-front and then submit a claim to your insurance company.

Do participating doctors accept Medicare?

Most healthcare doctors are “participating providers” that accept Medicare assignment. They have agreed to accept Medicare’s rates as full payment for their services. If you see a participating doctor, they handle Medicare billing, and you don’t have to file any claim forms.

Do you have to pay for Medicare up front?

But in a few situations, you may have to pay for your care up-front and file a claim asking Medicare to reimburse you. The claims process is simple, but you will need an itemized receipt from your provider.

Do you have to ask for reimbursement from Medicare?

If you are in a Medicare Advantage plan, you will never have to ask for reimbursement from Medicare. Medicare pays Advantage companies to handle the claims. In some cases, you may need to ask the company to reimburse you. If you see a doctor in your plan’s network, your doctor will handle the claims process.

Does Medicare cover nursing home care?

Your doctors will usually bill Medicare, which covers most Part A services at 100% after you’ve met your deductible.