How can the government decrease the cost of Medicare?

· Abstract The US Supreme Court’s ruling on the Affordable Care Act in 2012 allowed states to opt out of the health reform law’s Medicaid expansion. Since that ruling, fourteen governors have...

Why are millions on Medicaid at risk of losing coverage?

In our main analysis we found that a 1-percentage-point drop in the employment-to-population ratio would, on average, lead to a decrease in Medicare spending of 0.258 percent from 2009 to …

How much did Medicare spending increase in the 1990s?

Starting in 2012 (for hospital discharges after October 1, 2012), Medicare began reducing payments to hospitals with high numbers of preventable hospital readmissions. And starting in 2015, hospitals with a high rate of preventable hospital-acquired conditions were also subject to reduced payments under a provision of the ACA.

How much will Medicare spending increase between 2018 and 2028?

· Decrease Medicare benefits: No one wants to pay the same amount for less. As it stands, many people argue that Medicare does not cover enough. For example, Medicare does not cover the cost of corrective lenses, dentures, or hearing aids even though the most common things that happen as we age are changes in vision, dental health, and hearing. This already …

Why does enrollment in Medicaid typically increase during times of economic downturn?

Medicaid is a counter-cyclical program, meaning that more people become eligible and enroll during economic downturns; at the same time, states may face declines in revenues that make it difficult to fund the state share of funding for the program.

How has Medicare changed over the years?

Medicare has expanded several times since it was first signed into law in 1965. Today Medicare offers prescription drug plans and private Medicare Advantage plans to suit your needs and budget. Medicare costs rose for the 2021 plan year, but some additional coverage was also added.

Is Medicare underfunded?

Politicians promised you benefits, but never funded them.

What factors affect Medicaid?

Medicaid spending is driven by multiple factors, including the number and mix of enrollees, medical cost inflation, utilization, and state policy choices about benefits, provider payment rates, and other program factors.

Which president changed Medicare?

President George W. Bush signed into law the Medicare Prescription Drug Improvement and Modernization Act of 2003, adding an optional prescription drug benefit known as Part D, which is provided only by private insurers.

What is the history of Medicare and Medicaid?

On July 30, 1965, President Lyndon B. Johnson signed into law legislation that established the Medicare and Medicaid programs. For 50 years, these programs have been protecting the health and well-being of millions of American families, saving lives, and improving the economic security of our nation.

Why is Medicare running out money?

Medicare is not going bankrupt. It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses.

Is Medicare financially stable?

The Medicare Hospital Insurance (HI) Trust Fund, which pays for Medicare beneficiaries' hospital bills and other services, is projected to become insolvent in 2024 — less than three years away.

What happens when Medicare runs out in 2026?

The trust fund for Medicare Part A will be able to pay full benefits until 2026 before reserves will be depleted. That's the same year as predicted in 2020, according to a summary of the trustees 2021 report, which was released on Tuesday.

What are the disadvantages of Medicaid?

Disadvantages of Medicaid They will have a decreased financial ability to opt for elective treatments, and they may not be able to pay for top brand drugs or other medical aids. Another financial concern is that medical practices cannot charge a fee when Medicaid patients miss appointments.

Why did Florida not expand Medicaid?

However, the U.S. Supreme Court ruled in 2012 that the withholding of funds for existing Medicaid programs was unconstitutional. Medicaid expansion was left as an option for states, and Florida did not implement it. As of August 2020, Florida is one of 12 states that have not expanded Medicaid.

What are the pros and cons of Medicaid expansion?

List of Medicaid Expansion ProsNot every low-income individual actually qualifies for Medicaid. ... Expansion would support local economies. ... It offers people a level of financial protection. ... Medicaid expansion drops the uninsured rate. ... The cost of expansion is minimal for the states.More items...•

Why did Medicare spending slow down?

Great uncertainty remains over why Medicare spending growth slowed even prior to the recent recession, but several factors have contributed to its sustained slowdown in the years after the recession. 3 Recent work has found that as much as 62 percent of the slower-than-projected Medicare spending growth from 2009 onward can be explained by a number of policy changes, including elements of the Affordable Care Act (ACA), the Budget Control Act of 2011, and policy changes enacted by the Centers for Medicare and Medicaid Services (CMS). 4 These policy changes had the collective effect of lowering payments to insurance plans and providers through both direct cuts and adjustments to payment formulas. An open question is how much of the remaining non-policy-related slowdown in Medicare spending growth can be attributed to the recession and sluggish economic recovery from 2009 onward. 5

How would a prolonged economic downturn affect Medicare?

As with the younger working population, a prolonged economic downturn would be expected to affect health spending by Medicare beneficiaries if two conditions were met. First, beneficiaries must have some “skin in the medical costs game”—for example, they must face some cost sharing. Second, they must have some financial exposure to macroeconomic conditions, such as being involved in the labor force or owning property. As we discuss below, these conditions likely were met for many Medicare beneficiaries during and immediately after the recession.

Was the recession the primary driver of the slowdown in Medicare spending?

First, these results provide further support for the argument that the recession was not the primary driver of the slowdown in Medicare spending. 31 For example, Chapin White and coauthors identify policy-related causes for nearly two-thirds of the difference between projected and actual Medicare spending in 2014. 4

When were the Medicare spending coefficients negative?

As expected, the coefficients were negative after the 2009 fall in the employment-to-population ratio but near zero before 2009. This pattern rules out any pre-recession trends in regional spending that were correlated with the regional impacts of the recession. 26

What is the data in Appendix 1?

The data contain Parts A and B spending per enrollee; total enrollment; and an average risk-adjustment score for Part B enrollees, which accounts for differences in health. Online Appendix 1 and Appendix Exhibit 1 include information on how spending in our sample tracks Medicare spending from CMS’s National Health Expenditure Accounts (NHEA). 22

Is Medicare a shock to the economy?

While Medicare beneficiaries are less likely than younger workers to be exposed to the effects of macroeconomic conditions, they are not entirely shielded from sudden shocks to the economy. This was particularly true in the most recent downturn. For example, many seniors suffered major reductions in their net worth following the stock market crash of 2008 and the housing crash of 2007–10. These shocks to net worth had a larger impact than those in other recent recessions.

Does Medicare have cost sharing?

Combining these facts, we estimate that upward of half of traditional Medicare beneficiaries do make economically meaningful copayments and that the share of beneficiaries making meaningful copayments has been growing in recent years. 10 CMS has not substantially changed Medicare’s cost-sharing requirements, unlike the growing number of private employers that have migrated to high-deductible insurance plans. However, existing Medicare cost-sharing requirements are large enough that beneficiaries who suffer a negative financial shock might cut health spending.

Why did Medicare enrollment drop?

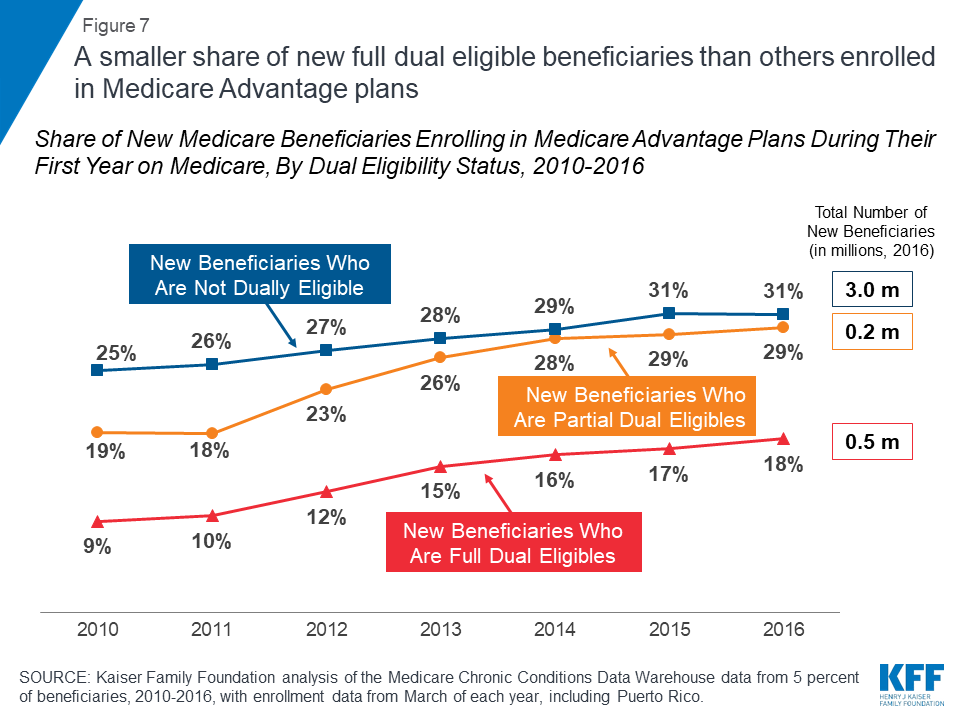

When the ACA was enacted, there were expectations that Medicare Advantage enrollment would drop because the payment cuts would trigger benefit reductions and premium increases that would drive enrollees away from Medicare Advantage plans.

How did the ACA reduce Medicare costs?

Cost savings through Medicare Advantage. The ACA gradually reduced costs by restructuring payments to Medicare Advantage, based on the fact that the government was spending more money per enrollee for Medicare Advantage than for Original Medicare. But implementing the cuts has been a bit of an uphill battle.

When was Medicare Part D created?

When Medicare Part D was created in 2003, part of the legislation specifically forbid the government from negotiating drug prices with manufacturers, and that has continued to be the case. There has been considerable debate about changing this rule, but it has met with continued pushback from the pharmaceutical lobby.

Is there a donut hole in Medicare?

Technically, this means that there is no longer a donut hole, but it’s important to understand that the donut hole concept is still relevant: It plays a role in determining how your out-of-pocket costs are counted and who actually pays for your drugs (you, your health plan, the drug manufacturer, or the Medicare program).

What percentage of Medicare donut holes are paid?

The issue was addressed immediately by the ACA, which began phasing in coverage adjustments to ensure that enrollees will pay only 25 percent of “donut hole” expenses by 2020, compared to 100 percent in 2010 and before.

How many Medicare Advantage plans will be available in 2021?

For 2021, there are 21 Medicare Advantage and/or Part D plans with five stars. CMS noted that more than three-quarters of all Medicare beneficiaries enrolled in Medicare Advantage plans with integrated Part D prescription coverage would be in plans with at least four stars as of 2021.

Is Medicare Advantage free?

Medicare Advantage takes the place of Medicare A and B. For most seniors, Medicare A is free, but Medicare B has a premium of $148.50/month for most beneficiaries in 2021; it’s important to understand that Medicare Advantage enrollees have to pay their Medicare Part B premium in addition to whatever premium they owe for the Medicare Advantage plan, so a zero-premium plan would mean that the person just has to pay the Part B premium.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

Why is Medicare spending so slow?

Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care and reduce costs, including accountable care organizations (ACOs), medical homes, bundled payments, and value-based purchasing initiatives. The BCA lowered Medicare spending through sequestration that reduced payments to providers and plans by 2 percent beginning in 2013.

What is excess health care cost?

Over the next 30 years, CBO projects that “excess” health care cost growth—defined as the extent to which the growth of health care costs per beneficiary, adjusted for demographic changes, exceeds the per person growth of potential GDP (the maximum sustainable output of the economy)—will account for half of the increase in spending on the nation’s major health care programs (Medicare, Medicaid, and subsidies for ACA Marketplace coverage), and the aging of the population will account for the other half.

What is the average annual growth rate for Medicare?

Average annual growth in total Medicare spending is projected to be higher between 2018 and 2028 than between 2010 and 2018 (7.9 percent versus 4.4 percent) (Figure 4).

Will Medicare spending increase in the future?

While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicare’s actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care prices.

Is Medicare spending comparable to private health insurance?

Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Has Medicare spending been reduced?

There has been a notable reduction in the growth of Medicare spending in recent years, compared to prior decades, both overall and per beneficiary.

How much did Medicare spend in 2016?

In 2016, people on Original Medicare (Part A and Part B) spent 12% of their income on health care. People with five or more chronic conditions spent as much as 14%, significantly higher than those with none at 8%, showing their increased need for medical care. 9.

When will Medicare become insolvent?

Near the peak of unemployment in 2020, David J. Shulkin, MD, ninth secretary of the Department of Veterans Affairs, projected Medicare could become insolvent by 2022 if pandemic conditions persisted. 10

What is the CMS?

As the number of chronic medical conditions goes up, the Centers for Medicare and Medicaid Services (CMS) reports higher utilization of medical resources, including emergency room visits, home health visits, inpatient hospitalizations, hospital readmissions, and post-acute care services like rehabilitation and physical therapy .

How long do people on Medicare live?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average , 84.2 years. A women who turned 65 on the same date could expect to live, on average, 86.7 years.

How long will a 65 year old live on Medicare?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average, until 84.0. A women who turned 65 on the same date could expect to live, on average, until 86.5.

What is the source of Medicare HI?

The money collected in taxes and in premiums makes up the bulk of the Medicare HI trust fund. Other sources of funding include income taxes paid on Social Security benefits and interest earned on trust fund investments.

What is the source of Medicare trust funds?

The money collected in taxes and in premiums make up the bulk of the Medicare Trust Fund. Other sources of funding include income taxes paid on Social Security benefits and interest earned on trust fund investments.

How much is Medicare spending?

In 2012, Medicare’s aggregate spending reached $557 billion, and it is expected to nearly double in just 10 years, reaching over a trillion dollars by 2023. [4] Medicare spending accounted for 3.67 percent of the entire economy, measured as gross domestic product (GDP), in 2011. It will be an estimated 5.8 percent of GDP in 2030, according to the Medicare Actuary’s full alternative scenario, which uses the most realistic assumptions. By 2080, under the same assumptions, Medicare spending will account for 9.97 percent of the entire economy. [5]

How to solve Medicare's cost problem?

A Better Policy. To solve Medicare’s cost problem, Congress and the Administration should embark on both short-term and long-term reforms. In the near term, Congress and the President should: enact a modest and temporary Part A premium to cover the cash deficits in the Federal Hospital Insurance (HI) Trust Fund; gradually raise beneficiaries’ Part B and D premiums by 10 percent over the next five years; expand “means testing” provisions of current law; require an estimated 9 percent of the Medicare population to pay a larger share of their Medicare costs; and add a 10 percent copayment to Medicare home health care—which currently has no co-payment at all, despite its rapid growth.

How many baby boomers are eligible for medicare?

There are roughly 77 million baby boomers—who will be eligible for Medicare at the rate of 10,000 per day over the next 19 years. [14] .

Is Medicare a fiscal danger?

As a matter of law, Congress recognizes that the continual draw down of general taxpayer revenues to cover Medicare’s growing expenses is a fiscal danger signal and enacted a Medicare funding “warning.” In the Medicare Modernization Act of 2003, Congress specified that if general revenues account for 45 percent of total Medicare funding, the Medicare trustees are to issue an official warning to that effect, and the President must submit remedial legislation to address the problem within 15 days of his budget submission to Congress. For its part, Congress is legally required to consider this remedial legislation expeditiously. Over the period 2007 to 2011, the Medicare trustees have issued these official warnings but, as the trustees themselves have reported, “elected officials have not enacted legislation responding to these funding warnings.” [13]

What percentage of taxes will be paid in 2086?

Should such taxes in the future maintain their historical average level of the last 50 years relative to the national economy, then, based on the intermediate projections, SMI [Parts B and D] general revenue financing in 2086 would represent about 26 percent of total income taxes under current law and substantially more than that if Congress were to modify the physician payment system and the productivity adjustments to non-physician price updates. [12]

What is short term financial inadequacy?

Short-Term Financial Inadequacy. Medicare’s financial health is often measured by the balance of the HI trust fund, which is funded by the Medicare payroll tax and pays for Medicare Part A benefits. Many Americans, fixated by media reports focused on the precarious solvency of the HI trust fund, should not be misled.

What percentage of the economy is Medicare?

Medicare spending accounted for 3.67 percent of the entire economy, measured as gross domestic product (GDP), in 2011. It will be an estimated 5.8 percent of GDP in 2030, according to the Medicare Actuary’s full alternative scenario, which uses the most realistic assumptions.

How long has the national health spending been declining?

After years of increases, the rate of increase in national health spending has been declining since 2002. Since 2002, when the rate of increase in national spending was 9.5% over the prior year, the annual spending increases have declined to less than half that amount — 3.9% in 2010 — an amount similar to the 3.8% in 2009 (Figure 3). CMS indicates that these recent rates are lower than in any other years during the 51-year history of the National Health Expenditure Accounts record-keeping. 3 CMS attributes the moderation to an “extraordinarily slow growth in the use and intensity of services.” The recession in the US economy, which officially lasted from December 2007 through June 2009, had an impact on utilization of services as people were reluctant to spend money on medical care, including those who lost their jobs and thus their insurance and those who were cautious about, or could not afford, their insurance’s cost sharing. According to CMS, the slowdown in health spending from this recession occurred more quickly than in earlier recessions where the effects were typically lagged, with the largest declines in annual % increases apparent in 2008 (+4.7%), 2009 (+3.8%), and 2010 (+3.9%). An example of the effect of the economy on medical service utilization — physician office visits by privately insured patients — can be seen at http://healthreform.kff.org/notes-on-health-insurance-and-reform/2011/november/the-economy-and-medical-care.aspx. 4

How much of the population spent on health care in 2009?

A small share of people accounts for a significant share of expenses in any year. In 2009, almost half of all health care spending was used to treat just 5% of the population, which included individuals with health expenses at or above $17,402 (Figure 5). 9 Under a quarter of health spending (21.8%) went towards the treatment of the 1% of the population who had total health expenses above $51,951 in 2009. Because the onset of disease is unpredictable and can require intensive technology and time to treat, the distribution of health spending is highly concentrated.

How does the population affect health care?

The U.S. population is getting older and disease prevalence has changed. Other factors also influence spending growth. The U.S. population is aging (CBO estimates that the number of people age 65 or older will increase by about one-third between 2012 and 2022), and because older people have more health problems and use more health care than younger people, population aging will have a small but persistent impact on cost growth in the years to come. 23 Increases in disease prevalence, particularly chronic diseases such as diabetes, asthma, and heart disease, coupled with the growing ability of the health system to treat the chronically ill, contribute to the high and growing levels of health spending. Rising obesity levels are another factor which may be influencing cost growth, but other trends, such as lower levels of smoking and alcohol consumption, may have a moderating effect. 24 A small share of the population accounts for a high proportion of costs (see Figure 5). Developments in medicine and medical technology enable people who otherwise might have died to live longer, though perhaps with chronic conditions such as cancer or HIV/AIDS which require ongoing medical care.

Why do countries spend more on health care?

21 Nations can spend more because the health care community continues to learn more every day about human health and health care conditions and , with that knowledge, is constantly expanding the inventory of health care products, techniques, and services that are available to address those conditions. Health care experts point to the development and diffusion of medical technology as primary factors in explaining the persistent difference between health spending and overall economic growth, with some arguing that new medical technology may account for about one-half or more of real long-term spending growth. 22

Does Medicaid cover disability?

Public programs provide health insurance coverage to people who are considered too poor to afford the full cost of coverage on their own. Medicaid also covers many children and individuals with disabilities who may not be able to afford or find private coverage to meet their needs. Eligibility for these programs is generally restricted to people in families with incomes at or below specific poverty levels (although it varied by state, as of January 2012 the median eligibility threshold at which children qualified for Medicaid or CHIP was 250% of poverty; Medicaid coverage for parents was much lower than for children, with the median eligibility threshold for working parents at 63% of poverty and for jobless parents at 37% of poverty). 18 The cost of health insurance, however, has risen substantially faster than the increase in FPL over time (Figure 20). For people whose income just exceeds the eligibility standards for public coverage, the share of family income required to pay for private health insurance increases substantially (see example at http://www.kff.org/insurance/snapshot/chcm021507oth.cfm ). Lower and moderate income families will receive assistance in 2014 under the ACA with the implementation of new tax credits that will be available to help them pay for private health insurance.

How does health care affect income?

A recent study found that although a median-income family of four’s monthly income increased by $1,910 from 1999 to 2009, this gain was offset to a great extent by increased spending on health care ($820, or 43% of the income growth), including health insurance premiums, out-of-pocket health spending, and taxes devoted to health care (not adjusted for inflation). 16 Ongoing research into measures of poverty has found that health care costs are a significant expenditure for families and individuals. Recent analysis by the Census Bureau found that of the various types of expenses that could be used in the development of a new supplemental measure of poverty, out-of-pocket medical costs has the largest effect, potentially increasing the rate of those in poverty from 12.7% to 16.0% in 2010, a difference of about 10 million people, with the greatest impact for those age 65 and older. 17 Research continues on the supplemental poverty measure, including an adjustment for the medical expenses of the uninsured.

How much has the health insurance premium increased since 2000?

Whereas premium increases have been between 3 and 13% per year since 2000, inflation and changes in workers’ earnings are typically in the 2 to 4% range. This usually means that workers have to spend more of their income each year on health care to maintain coverage.

How much did the CMS decrease in improper payments in 2021?

Inpatient Rehabilitation Facility claims had a $1.81 billion decrease in estimated improper payments from 2018 to 2021. This is the result of years of sustained effort from CMS, which included clarifying policy to reduce provider burden and educating providers through the Targeted Probe and Educate program. CMS uses the Targeted Probe and Educate program to provide one-on-one help to providers, focusing on those who have high denial rates or unusual billing practices, to reduce claim errors and denials.

How much was the DME reduction in 2020?

Durable Medical Equipment (DME) claims saw a $388 million reduction in estimated improper payments since 2020 due to a nationwide expansion of prior authorization of certain DME items as well as the Targeted Probe and Educate program.

What is the Medicare FFS rate for 2021?

The 2021 Medicare FFS estimated improper payment rate (claims processed July 1, 2019 to June 30, 2020) is 6.26% ̶ an historic low. This is the fifth consecutive year the Medicare FFS improper payment rate has been below the 10% threshold for compliance established in the Payment Integrity Information Act of 2019. Due to CMS corrective actions, the agency saw key successes in the following areas:

What is the Part D improper payment rate for 2021?

The FY 2021 projected Part D improper payment rate is 1.58%. The slight increase is likely due to year-over-year variability.

How many appropriations bills were there in 2012?

The actual appropriations bills for Fiscal Year 2012 included four continuing resolutions and three full-year appropriations bills enacted in November and December 2011, in accordance with the United States budget process.

When was the 2012 budget?

The 2012 United States federal budget was the budget to fund government operations for the fiscal year 2012, which lasted from October 1, 2011 through September 30, 2012. The original spending request was issued by President Barack Obama in February 2011. That April, the Republican-held House ...

When did the Senate pass the second continuing resolution?

This led to the Senate passing a pair of continuing resolutions on September 26: one lasting until October 4, 2011 to give the then-out-of-session House of Representatives time to consider the second resolution, which funded the government through the first seven weeks of the 2012 fiscal year, until November 18, 2011.

When was the Budget Control Act passed?

On August 1, the Budget Control Act of 2011 passed the House 269–161, with 66 Republicans and 95 Democrats voting against the bill. On August 2, it passed in the Senate 74–26, and was signed into law by President Obama the same day.

What was the debt limit in 2011?

On July 31, 2011, President Obama and the leadership of both legislative chambers reached a deal on the debt limit legislation. The deal guaranteed $2.4 trillion in immediate and eventual debt limit increases. It mandated $917 billion in spending cuts over ten years, of which $21 billion would be included in the FY2012 budget. It would then give Congress a choice between either accepting the recommendation of a Joint Select Committee on Deficit Reduction which would cut the deficit by $1.2–1.5 trillion through spending cuts and/or revenue increases, or accepting automatic budget cuts to national security funding (including defense spending) and to Medicare, which would start in the FY2013 budget. Congress would also be required to vote on a Balanced Budget Amendment. On August 1, the Budget Control Act of 2011 passed the House 269–161, with 66 Republicans and 95 Democrats voting against the bill. On August 2, it passed in the Senate 74–26, and was signed into law by President Obama the same day. August 2 was also the date estimated by the Department of the Treasury that the borrowing authority of the US would be exhausted.

How many Republicans opposed the Balanced Budget Amendment?

After being altered to again require passage of a Balanced Budget Amendment before the second stage of debt limit increases, it passed the House 218–210, with 22 Republicans opposing the bill. It was defeated in the Senate two hours later by a vote of 59–41, as the Democratic plan was prepared to be taken up there.

What was the deal that was reached in July 2011?

Negotiations throughout July 2011 eventually reached a deal to pass the Budget Control Act , which resolved the United States debt-ceiling crisis in return for significant budget cuts over the following ten years. Pictured is a July 13 negotiation session involving President Barack Obama and Congressional leaders Eric Cantor, Nancy Pelosi, John Boehner, Harry Reid, and Mitch McConnell.

Summary

- Medicare, the federal health insurance program for nearly 60 million people ages 65 and over and younger people with permanent disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical and projected Medicare spending data published in the 2018 annual repor…

Health

- In 2017, Medicare spending accounted for 15 percent of the federal budget (Figure 1). Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2016, 29 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physician services.

Cost

- In 2017, Medicare benefit payments totaled $702 billion, up from $425 billion in 2007 (Figure 2). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased from 47 percent to 42 percent, sp…

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency...

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future increases in spending under Part B and …

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…