Full Answer

What is the current tax rate for Social Security and Medicare?

Different rates apply for these taxes. Social Security and Medicare Withholding Rates. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What is the Medicare tax rate in 2021?

The Medicare tax rate in 2021 is 2.9%. That amount is split evenly between employers and employees, with each side paying 1.45% respectively. The Medicare tax rate has gradually increased over the years since debuting at 0.7% (0.35% for both employer and employee) in 1966.

What is the additional Medicare tax withholding rate?

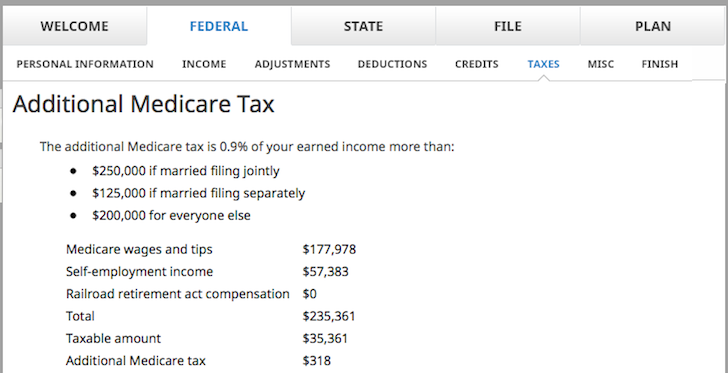

Additional Medicare Tax Withholding Rate. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual's wages paid in excess of $200,000 in a calendar year, without regard to filing status. An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess...

When does an employer have to start withholding Medicare tax?

An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee and continue to withhold it each pay period until the end of the calendar year. There's no employer match for Additional Medicare Tax.

When did Medicare tax go up?

Since 2013, you'll pay a 3.8% Medicare tax rate on your net investment income when the total amount exceeds the income thresholds. The tax, known as the Net Investment Income tax, will go into the government's General Fund and not into Medicare. Most people only pay the 2.9% flat tax rate.

Why did my Medicare tax withholding increase?

The Affordable Care Act expanded the Medicare payroll tax to include the Additional Medicare Tax. This new Medicare tax increase requires higher wage earners to pay an additional tax ( 0.9% ) on earned income. All types of wages currently subject to the Medicare tax may also be subject to the Additional Medicare Tax.

How much Medicare tax has been deducted from his current pay?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What is the Medicare surtax rate for 2021?

0.9 percentThe tax rate for the Additional Medicare Tax is 0.9 percent. That means you'll pay 2.35 percent if you receive employment wages. Self-employed taxpayers will pay 3.8 percent.

Did Medicare withholding go up for 2022?

2022 updates For 2022, an employee will pay: 6.2% Social Security tax on the first $147,000 of wages (6.2% of $147,000 makes the maximum tax $9,114), plus. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a separate return), plus.

What is the Medicare withholding rate for 2022?

For 2022, the FICA tax rate for employers is 7.65% — 6.2% for Social Security and 1.45% for Medicare (the same as in 2021).

What is the Medicare tax limit for 2020?

The Social Security tax rate remains at 6.2 percent. The resulting maximum Social Security tax for 2020 is $8,537.40. There is no limit on the amount of earnings subject to Medicare (hospital insurance) tax.

Are payroll taxes changing in 2021?

For 2021, Social Security payroll tax increased by $5,100 to $142,800 — increasing from $137,700 in 2020. In addition, a new W-4 is required for employees hired on or after January 1, 2021, and current employees who wish to change their withholding statuses.

Who pays additional Medicare tax 2021?

An employer must withhold Additional Medicare Tax from wages it pays to an individual in excess of $200,000 in a calendar year, without regard to the individual's filing status or wages paid by another employer.

Does the 3.8 Medicare surtax apply to capital gains?

What Types of Income Are Subject to the Medicare Surtax? Income sources like interest, dividends, capital gains, rental income, royalties, and even some other passive investment income will be counted.

Who pays the 3.8 Medicare tax?

The tax applies only to people with relatively high incomes. If you're single, you must pay the tax only if your adjusted gross income (AGI) is over $200,000. Married taxpayers filing jointly must have an AGI over $250,000 to be subject to the tax.

How is the Medicare surcharge calculated?

Additional taxes withheld by their employer can also be reported on the IRS Form 8859. In Tax Clarity, for a married couple filing jointly (MFJ) with earned income of $252,000, the Medicare surtax would be based on the $250,000 threshold. As such, $2,000 multiplied by 0.9% would equate to an $18 surcharge.

Is the Medicare tax mandatory?

Generally, if you are employed in the United States, you must pay the Medicare tax regardless of your or your employer’s citizenship or residency s...

Are tips subject to Additional Medicare Tax?

If tips combined with other wages exceed the $200,000 threshold, they are subject to the additional Medicare tax.

Is there a wage base limit for Medicare tax?

The wage base limit is the maximum wage that’s subject to the tax for that year. There is no wage base limit for Medicare tax. All your covered wag...

What is Medicare tax?

The standard Medicare tax applies to all earned income, with no minimum income limit.

How much Medicare tax do you pay?

An employee will pay 1.45% standard Medicare tax, plus the 0.9% additional Medicare tax, for a total of 2.35% of their income.

What is the threshold for Medicare 2020?

The 2020 tax year thresholds are as follows: Status. Tax threshold. single , head of household, or a qualifying widow (er) $200,000. married tax filers, filing jointly.

How much is Medicare for married couples?

The limit is $250,000 for married couples. This article explains the Medicare standard tax and the Medicare additional tax. It also looks at who pays the additional tax, how the IRS calculates it, and how the government uses the money.

Which Act expanded Medicare Part B preventive services?

The Affordable Care Act also expanded Medicare Part B preventive services to include:

How much do employers contribute to payroll taxes?

Employers contribute 1.45% for each employee, based on the employee’s monthly earnings. An employer must also deduct payroll taxes of 1.45% from their employees’ monthly earnings.

Does Medicare tax help with prescriptions?

The additional Medicare tax helps also helps lower the cost of Medicare Advantage plans and prescription medications.

What is the additional Medicare tax?

The Additional Medicare Tax is an extra 0.9 percent tax on top of the standard tax payment for Medicare. The additional tax has been in place since 2013 as a part of the Affordable Care Act and applies to taxpayers who earn over a set income threshold.

How much tax do you pay on Medicare?

For example, if you’re a single tax filer with an employment income of $250,000, you’d pay the standard 1.45 percent on $200,000 of your income, and then 2.35 percent on the remaining $50,000. So, in this example, you’d pay $4,075 in Medicare taxes for the year.

How is Medicare tax calculated?

How is the Additional Medicare Tax calculated? Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

What are the benefits of the Affordable Care Act?

Notably, the Affordable Care Act provided some additional benefits to Medicare enrollees, including: lower premiums for Medicare Advantage (Part C) plans. lower prescription drug costs. closure of the Part D benefit gap, or “ donut hole ”.

What happens when you file Medicare taxes?

In some cases, you might owe more, and in other cases, you might have paid too much. Any payment owed or refund adjustment needed will be added to your overall required payment or refund amount.

How much Medicare do self employed people pay in 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

Do you have to pay taxes on Medicare?

While everyone pays some taxes toward Medicare, you’ll only pay the additional tax if you’re at or above the income limits. If you earn less than those limits, you won’t be required to pay any additional tax. If your income is right around the limit, you might be able to avoid the tax by using allowed pre-tax deductions, such as:

What is the Medicare tax rate?

The Medicare tax rate is 1.45%. But the Federal Insurance Contributions Act tax combines two rates. FICA taxes include both the Social Security Administration tax rate of 6.2% and the Medicare tax rate.

What percentage of income goes to Medicare?

The percentage of income that goes to your Medicare tax is 1.45%. Your employer will then match the rate you pay. But if you’re self-employed, you’ll pay the full 2.9%.

What is the Social Security Tax Rate?

The Social Security tax rate is a percentage of your payroll that goes towards funding the program. In 2021, this rate is 6.20%. Anyone self-employed will need to pay double. Although, with proper deductions, you may pay half of that.

What is the wage limit for Medicare?

Currently, no wage limit for Medicare tax exists; 1.45% is applied to all covered wages.

What is the Medicare surtax?

The Affordable Care Act enforces high wage earners to pay an extra Medicare payroll tax, or Medicare surtax, of 0.9% on earned income. All U.S. employees have to pay the Medicare tax.No matter the citizenship or residency status, each individual must pay this tax. Single filers with an income of at least $200,000 will need to pay the additional Medicare tax.

How much income do you need to file Medicare?

Single filers with an income of at least $200,000 will need to pay the additional Medicare tax. Married individuals who file separately will pay an extra tax if income is $125,000 or more. But if married and filing jointly, you’ll be subject to a fee when combined income is $250,000 or more.

How to calculate Social Security and Medicare tax?

You can calculate your Social Security and Medicare tax by taking your gross income and multiplying it by 7.65%. This is the amount of your company’s Social Security and Medicare tax matching contribution.

How Is Medicare Tax Calculated?

The Medicare tax rate is determined by the IRS and is subject to change. To calculate the Medicare tax, multiply your earnings by 0.0145. So if your biweekly pay is $2,000, your Medicare tax will be $29 (2,000 x 0.0145 = 29).

What is the Medicare tax rate for 2021?

The Medicare tax rate in 2021 is 2.9%. That amount is split evenly between employers and employees, with each side paying 1.45% respectively. The Medicare tax rate has gradually increased over the years since debuting at 0.7% (0.35% for both employer and employee) in 1966.

Is there a limit on Medicare taxes?

Unlike Social Security taxes, there is no limit on how much of your income is subject to Medicare taxes. The Medicare tax rate applies to all earned income and taxable wages, and there is no minimum income required to be subject to Medicare taxes.

Do you pay Medicare tax if you are on a tax return?

If your income is reported for tax filing purposes, then you will typically pay the Medicare tax.

Does Medicare tax apply to employers?

Only employees pay the additional 0.9%. The Additional Medicare Tax does not apply to employers.

Who does not pay Medicare taxes?

Anyone over the age of 65 who has no earned income does not pay Medicare taxes.

Is Medicare taxed separately from Social Security?

Some may confuse Medicare taxes with Social Security taxes. Both types of taxes are lumped under the FICA tax ( Federal Insurance Contributions Act) but remain separate from each other. The Medicare tax helps pay for the Medicare Hospital Insurance fund, while the Social Security tax funds Old Age, Survivors and Disability Insurance, more commonly called Social Security benefits. The current Social Security tax rate is 12.4% with employers and employees each paying 6.2%.

What is the tax rate for Medicare?

Depending on the amount of a person’s total taxable wages, the combined amount of his or her Medicare and Social Security tax rate would range anywhere between 7.65 percent (6.2 percent + 1.45 percent) to 8.55 percent (6.2 percent + 1.45 percent + 0.9 percent) on Medicare wages that are over $200,000 per year. The combined employer tax rate remains at 7.65 percent.

What is the Medicare tax rate for 200,000?

For the purpose of withholding, covered wages that are over $200,000 per year are taxed at a total rate of 2.35 percent (1.45 percent + 0.9 percent), regardless of a taxpayer’s filing status. The amount of the additional Medicare tax is not matched by an individual’s employer.

What was the maximum Social Security tax in 2015?

This increase meant that the maximum Social Security tax that is payable by an employee in 2015 will be $7,347.00 – which is an increase of $93.00 from the 2014 maximum tax of $7,254.00. Employers will match the employee’s tax.

Is there a maximum amount of Medicare contributions for 2015?

Therefore, there is no maximum employee or employer contribution amount for Medicare tax for 2015. All covered wages will be subject to Medicare tax at a rate of 1.45 percent. Employers will match the employee’s tax.

Is Medicare tax paid in excess of threshold?

All wages that are currently subject to the Medicare Tax are subject to the Additional Medicare Tax, if they are paid in excess of the applicable threshold for an individual’s filing status. Also, all Railroad Retirement Tax Act compensation that is currently subject to Medicare Tax is also subject to the Additional Medicare Tax if it is paid in excess to the applicable threshold for an individual’s filing status.

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is the FICA 751?

Topic No. 751 Social Security and Medicare Withholding Rates. Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare taxes. Different rates apply for these taxes.

Is there a wage base limit for Medicare?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.