Full Answer

How many Medicare Advantage plans are there 2022?

3,834 Medicare Advantage plansTotal Number of Plans. In total, 3,834 Medicare Advantage plans are available nationwide for individual enrollment in 2022 – an 8 percent increase (284 more plans) from 2021 and the largest number of plans available in more than a decade (Figure 2; Appendix Table 1).

Will Medicare Advantage plans increase in 2022?

The income brackets for high-income premium adjustments for Medicare Part B and D start at $91,000 for a single person, and the high-income surcharges for Part D and Part B increased for 2022. Medicare Advantage enrollment is expected to continue to increase to a projected 29.5 million.

What is the Medicare Advantage premium for 2022?

How much does Medicare Advantage cost per month? In 2022, the average monthly premium for Medicare Advantage plans is $62.66 per month.

Can you add Medicare Advantage plans at any time?

You can change Medicare Advantage plans anytime during your Initial Enrollment Period. If you qualify for Medicare by age, your Initial Enrollment Period starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65.

Who is the largest Medicare Advantage provider?

AARP/UnitedHealthcareAARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What changes are coming to Medicare in 2022?

Changes to Medicare in 2022 include a historic rise in premiums, as well as expanded access to mental health services through telehealth and more affordable options for insulin through prescription drug plans. The average cost of Medicare Advantage plans dropped while access to plans grew.

What is the monthly cost for Medicare Part D 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

How much is AARP Medicare Advantage plan?

About 7 out of 10 of AARP's Medicare Advantage plans offer $0 premiums. Of AARP plans that have a premium, the monthly consolidated premium (including Part C and Part D) ranges from $9 to $112.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

When can I switch to Medicare Advantage?

Anyone can change their Medicare Advantage Plan during their Initial Enrollment Period, Open Enrollment or Medicare Advantage Open Enrollment. Open Enrollment occurs every year from October 15 to December 7. Medicare Advantage Open Enrollment lasts from January 1 through March 31 each year.

Can you change Medicare Advantage plans every year?

You can make changes to your plan at any time during the Medicare Advantage open enrollment period from January 1 through March 31 every year. This is also the Medicare general enrollment period. The changes you make will take effect on the first day of the month following the month you make a change.

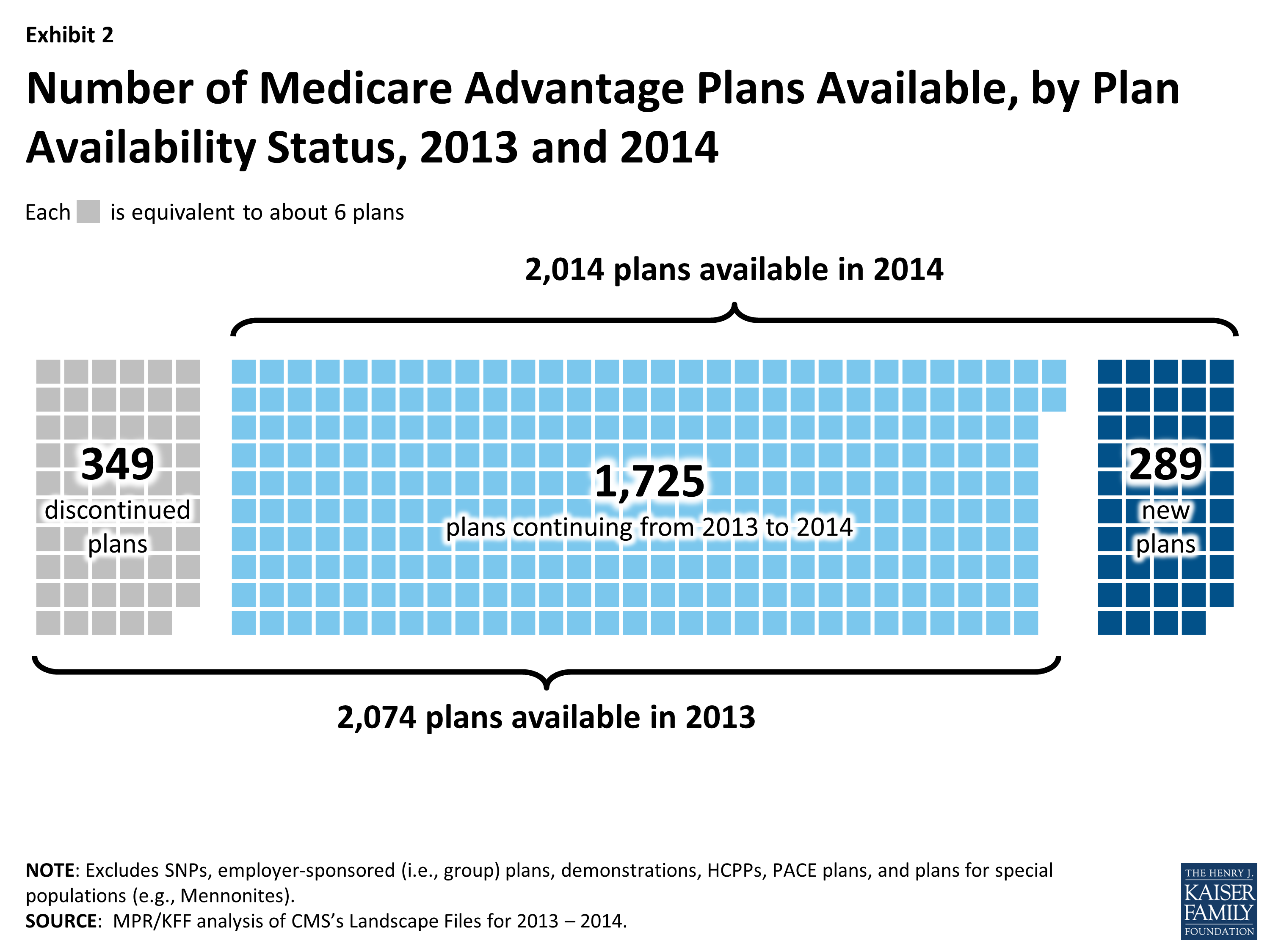

Change in Overall Plan Availability in 2014

- In total, there will be 2014 Medicare Advantage plans nationwide available for individual enrollment in 2014 (Exhibit 1). In aggregate, 60 fewer plans will be available in 2014 than in 2013, a relatively small change that reflects offsets of plan expansion and contraction (discussed belo…

2014 Plan Choices and Geographic Variation

- In 2014, as in recent years, virtually all Medicare beneficiaries will have access to a Medicare Advantage plan as an alternative to traditional Medicare (Exhibit 3). Nationwide 99 percent of all beneficiaries (100 percent in metro areas and 98 percent in non-metro areas) have one or more Medicare Advantage choices, and most have a wide range of plans available to them. The larges…

Availability by Level of Traditional Medicare Spending

- Historically, beneficiaries in counties with the highest per capita spending for traditional Medicare (top quartile) have had more Medicare Advantage plans available to them than have beneficiaries in lower cost counties (Table A1). In 2012, the first year of Medicare Advantage payment reform under the ACA (See Box on Recent Legislative and Regulatory Changes), the number of plans av…

Market Dynamics and Turnover

- While many organizations offer Medicare Advantage plans, a few – particularly Humana, United Healthcare, and the Blue Cross and Blue Shield (BCBS) affiliates – have particularly large geographic spread and these organizations historically account for a disproportionate share of enrollment. In 2014, 44 percent of available plans are being offered by one of these three firms o…

Premiums and Benefits in 2014

- Premiums, benefits, cost sharing requirements and provider networks are important plan characteristics for beneficiaries to consider when choosing among Medicare Advantage plans, because of the potential effect on beneficiaries’ out-of-pocket costs and their access to preferred health care providers. This analysis focuses on national trends in premiums, out-of-pocket spen…

Limits on Out-Of-Pocket Spending

- The traditional fee-for-service Medicare program does not include a limit on out-of-pocket spending for services covered under Parts A and B, which is one reason most beneficiaries have supplemental coverage to limit their financial liability. When HMOs were first offered under the risk contracting program in the mid-1980s, they covered most of Medicare’s cost sharing require…

Prescription Drug Coverage

- Prior to 2006, traditional Medicare did not offer an outpatient prescription drug benefit, and Medicare Advantage plans were an important source of prescription drug coverage for people on Medicare. Many plans offered some coverage for prescription drugs, which they often financed in part with the net difference between Medicare Advantage payments for Part A and B benefits an…

Discussion

- In 2014, Medicare beneficiaries will continue to be able to choose from among many Medicare Advantage plans, offered by many firms, in virtually all parts of the country. HMOs continue to be more numerous than other plan types, but the availability of local PPOs is growing. Regional PPOs also remain available to many Medicare beneficiaries, although a relatively small number of firm…

I. Overview

II. History of Private Plans in The Medicare Program

- The private plan option has been available in Medicare for over 30 years; it has grown considerably over that period from representing a small part of the program to accounting for nearly 30 percent of all enrollment today.2 Medicare Advantage (MA) is the name of the current program that allows beneficiaries to enroll in private health plans, rathe...

III. The Impact of The Affordable Care Act on The Medicare Advantage Program

- Prior to the enactment of the Affordable Care Act, concerns were raised about how the transition of MA plan payments to the FFS-based rates provided for in the Affordable Care Act would affect plan participation, enrollment, premiums and benefits. With the enactment, some predicted that the reduction in higher MA payments would cause a significant number of MA plans to withdra…

IV. Looking Forward to 2015

- Our goal is to continue improving the MA program while keeping costs down, reducing fraud and abuse, and fostering competition. As discussed earlier, the changes that are underway under the Affordable Care Act reduce higher payments to MA plans, by transitioning to FFS-based payment rates; and provide incentives for quality improvements by basing part of the MA payment on pla…

v. Conclusion

- In order to make good on the original rationale for including private plans in Medicare, the Medicare Advantage program needs to continue improving quality, while lowering costs. The early experience following the enactment of the Affordable Care Act indicates that the MA program is moving in the right direction – beneficiaries have a robust choice of plans, costs are coming do…