When will Medicare run out of money?

Apr 22, 2019 · (Reuters) - Medicare’s hospital insurance fund will be depleted in 2026, as previously forecast, and Social Security program costs are likely to exceed total income in 2020 for the first time since...

When will Social Security and Medicare be exhausted?

Aug 31, 2021 · Medicare funds are expected to be exhausted in 2026, and Social Security will be unable to pay full benefits starting in 2034, according to a report released Tuesday by the programs' trustees, the...

What happens to Medicare if the trust fund is depleted?

Aug 31, 2021 · August 31, 2021 Getty Images The trust fund for Medicare Part A will be able to pay full benefits until 2026 before reserves will be depleted. That’s the same year as predicted in 2020, according...

Will Medicare go bankrupt after 2026?

Jun 11, 2018 · The Board of Trustees for Medicare just released its 2018 Annual Report with the chilling news that the Medicare Part A hospital trust fund is going to be depleted in 2026, three years earlier than originally predicted. Here’s some background on the situation and what led to this dire projection. Learn all about Medicare Part A benefits here.

Will Medicare ever go away?

Medicare is not going bankrupt. It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses.Dec 20, 2021

How long until Medicare runs out of money?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.Dec 30, 2021

What will happen to Medicare in 2026?

The trust fund for Medicare Part A will be able to pay full benefits until 2026 before reserves will be depleted. That's the same year as predicted in 2020, according to a summary of the trustees 2021 report, which was released on Tuesday.Aug 31, 2021

When Medicare runs out what happens?

Medicare will stop paying for your inpatient-related hospital costs (such as room and board) if you run out of days during your benefit period. To be eligible for a new benefit period, and additional days of inpatient coverage, you must remain out of the hospital or SNF for 60 days in a row.

How Long Will Social Security and Medicare last?

The combined OASI and DI Trust Fund reserves have a projected depletion date of 2034, a year earlier than in last year's report. After the depletion of reserves, continuing tax income would be sufficient to pay 78 percent of scheduled benefits in 2034, and 74 percent by 2095.

Should you carry your Medicare card with you at all times?

Keep your Medicare Advantage Card: If you're in a Medicare Advantage Plan (like an HMO or PPO), your Medicare Advantage Plan ID card is your main card for Medicare – you should still keep and use it whenever you need care. However, you also may be asked to show your new Medicare card, so you should carry this card too.

What is the problem we are facing with Medicare?

Financing care for future generations is perhaps the greatest challenge facing Medicare, due to sustained increases in health care costs, the aging of the U.S. population, and the declining ratio of workers to beneficiaries.Oct 1, 2008

What does Medicare a cover 2021?

Medicare Part A coverage for 2021 includes inpatient hospital stays, which may take place in: acute care hospitals. long-term care hospitals. inpatient rehabilitation facilities.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

What is Medicare Part A deductible for 2021?

Medicare Part A Premiums/Deductibles The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

The two funds

The Hospital Insurance Trust Fund (HI) is for Medicare Part A, covering costs for hospital care, some home health services, skilled nursing facilities, and hospice care. So HI = Medicare Part A.

The outflow is more than income

The problem in a nutshell: In 2017, expenditures were $710 billion while income was $705 billion.

Action is needed

The report suggests that “substantial steps” must be undertaken soon to address this challenge and ensure that HI is sufficiently funded. However, an article by PBS News Hour says the report “serves as a reminder of major issues left to languish while Washington plunges deeper into partisan strife.”

When will Medicare be exhausted?

Medicare Will Be Exhausted in 2026, Social Security in 2033. The government said Friday that Medicare's giant hospital trust will not be exhausted until 2026, two years later than projected last year, while the date that Social Security will exhaust its trust fund remained unchanged at 2033.

Why is Medicare funding so elusive?

A solution to the funding problems for Social Security and Medicare has proven elusive because of the political dangers posed by any agreement that would trim benefits for millions of Americans or raise taxes to cover the projected shortfalls.

What would Obama do to Medicare?

Obama's approach to Medicare savings would trim payments to drug companies, hospitals and other service providers. He has also proposed having a growing share of seniors pay higher premiums over time, based on their incomes. In addition, Obama would have wealthy taxpayers pay a higher Medicare payroll tax.

Why is Medicare improving?

The reasons given for the improved financial outlook for Medicare were an overall slowdown in the rate of increase in health-care spending, particularly on skilled nursing care, as well as lower projected costs for popular insurance plans available within the Medicare program.

What would happen if the Social Security Trust Fund was exhausted?

For Social Security, retirees would continue to receive about 75 percent of benefits once the Social Security trust fund was exhausted in 2033.

How much would the Cola cut in Social Security?

His proposed change in the COLA, once phased in, would mean a cut in Social Security benefits of nearly $1,000 a year for an average 85-year-old recipient of Social Security benefits.

Who said that Congress could decide to correct the shortfall in the disability program by moving tax revenue away from Social Security?

Charles Blauhous III , one of two public members of the trustees group, said that while Congress could decide to correct the shortfall in the disability program by moving tax revenue away from Social Security, that would only worsen the funding problems facing the Social Security retirement program.

When will Social Security be depleted?

En español | According to the 2020 annual report of the Social Security Board of Trustees, the surplus in the trust funds that disburse retirement, disability and other Social Security benefits will be depleted by 2035.

Will Social Security be around?

That does not mean Social Security will no longer be around ; it means the system will exhaust its cash reserves and will be able to pay out only what it takes in year-to-year in Social Security taxes. If this comes to pass, Social Security would be able to pay about 79 percent of the benefits to which retired and disabled workers are entitled.

Does Medicare pay FICA taxes?

FICA and SECA taxes also generate a revenue stream for Medicare, which flows into the trust fund that finances Medicare Part A (hospitalization coverage). As detailed in the 2019 Medicare trustees report, that fund is under much the same pressure as the Social Security trust funds due to demographic trends and rising costs.

Why did Medicare repeal the Independent Payment Advisory Board?

Policymakers also repealed the Independent Payment Advisory Board, which was projected to help slow Medicare’s cost growth. And the Administration has failed to address excessive Medicare Advantage payments due to insurance company assessments of their beneficiaries that make them appear less healthy than they are.

What will Medicare be in 2040?

Total Medicare spending is projected to grow from 3.7 percent of gross domestic product (GDP) today to 5.9 percent in 2040. Medicare has been the leader in reforming the health care payment system to improve efficiency and has outperformed private health insurance in holding down the growth of health costs.

How much is Medicare payroll tax?

This means that Congress could close the projected funding gap by raising the Medicare payroll tax — now 1.45 percent each for employers and employees — to about 1.9 percent, or by enacting an equivalent mix of program cuts and tax increases.

Why does Medicare pay the benefits owed?

Trustees’ reports have been projecting impending insolvency for over four decades, but Medicare has always paid the benefits owed because Presidents and Congresses have taken steps to keep spending and resources in balance in the near term.

Will Medicare run out of money in 2026?

This shortfall will need to be closed through raising revenues, slowing the growth in costs, or most likely both. But the Medicare hospital insurance program will not run out of all financial resources and cease to operate after 2026, as the “bankruptcy” term may suggest.

Is Medicare a major change?

In contrast to Social Security, which has had no major changes in law since 1983, the rapid evolution of the health care system has required frequent adjustments to Medicare, a pattern that is certain to continue.

Is Medicare going bankrupt?

Medicare Is Not “Bankrupt”. Claims by some policymakers that the Medicare program is nearing “bankruptcy” are highly misleading. Although Medicare faces financing challenges, the program is not on the verge of bankruptcy or ceasing to operate. Such charges represent misunderstanding (or misrepresentation) of Medicare’s finances.

When will Medicare run out of money?

In April, Medicare's trustees reported that the Part A trust fund, which pays for hospital and other inpatient care, would start to run out of money in 2026. That is the same as the projection in 2019. But the trustees cautioned at the time that their projections did not include the impact of COVID-19 on the trust fund.

Where does Medicare funding come from?

The funding largely comes from a 1.45% payroll tax paid by employees and employers. Funding is shrinking for Medicare's Part A trust fund, which pays for hospitalization and in-patient care. The funding largely comes from a 1.45% payroll tax paid by employees and employers. Everyone involved even tangentially in health care today is consumed by ...

How much money was given to hospitals in the Cares Act?

At least $60 billion of the funding provided as part of the CARES Act to help hospitals weather the pandemic came not from the general treasury, but from the Trust Fund itself. That money in " accelerated and advance payments " is supposed to be paid back, via a reduction in future payments.

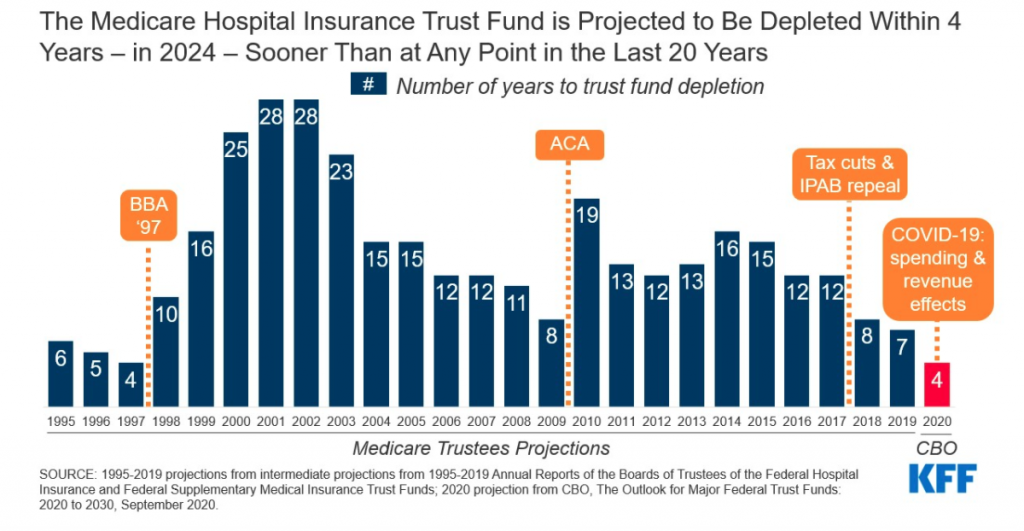

When will the Part A fund be unable to pay its bills?

The Committee for a Responsible Federal Budget, a nonpartisan group of budget experts focused on fiscal policy, estimates that the pandemic will cause the Part A trust fund to be unable to pay all of its bills starting in late 2023 or early 2024.

Is Medicare Part B insolvent?

(Medicare Part B, which pays physicians and other outpatient costs, is funded by beneficiary premiums and general tax funding, so it cannot technically become insolvent.)