However, seeing as your 1099 MISC isn't subject to a self-employment tax withholding, you'll need to calculate and pay these on your own. Social Security and Medicare taxes will appear on a Schedule SE. You'll need to attach this to your return.

Full Answer

Do I have to pay Social Security tax on 1099 income?

Jun 01, 2019 · How do I pay social security and medicare taxes from my 1099 misc, income? When you receive a 1099-MISC for earned income, this is reported on Schedule C, where you …

What is the 1099 tax rate?

Nov 03, 2021 · The 1099 tax rate consists of two parts: 12.4% for social security tax and 2.9% for Medicare. The self-employment tax applies evenly to everyone, regardless of your income …

How to pay Social Security and Medicare taxes?

Dec 09, 2015 · How will this affect my taxes? Workers pay a 15.3% FICA tax, which is used to fund Social Security and Medicare. As an employee with a W-2, you pay 7.65%, and your employer …

Do I have to report 1099-nec on my taxes?

Apr 06, 2022 · Also known as FICA (Federal Income Insurance Contributions Act), self-employment taxes are how freelancers pay Social Security and Medicare taxes. . W-2 …

Do you pay Social Security and Medicare on 1099?

How do I pay Social Security taxes on a 1099?

How does a self-employed person pay into Social Security?

Do I have to pay FICA on 1099 income?

What is the tax rate for 1099 income 2021?

Do you pay Medicare tax on Social Security income?

How do independent contractors avoid paying taxes?

What taxes do I pay if self-employed?

Do self-employed pay Medicare tax?

How do independent contractors pay FICA?

How do you pay Medicare taxes?

What Do You Do With The 1099-Misc Form You received?

A 1099-MISC form is used to report amounts paid to non-employees (independent contractors and other businesses to whom payments are made). Non-empl...

Do You Have to Pay Social Security and Medicare Taxes on 1099 Income?

Yes. Every US taxpayer must pay Social Security and Medicare taxes on his or her income. For self-employed individuals, these taxes are called self...

How Do You Include 1099 Income on Your Tax Return?

How you report 1099-MISC income on your income tax return depends on the type of business you own. If you are a sole proprietor or single-member LL...

Why Aren't Taxes Taken Out of My 1099-Misc Income?

Employers are not required to withhold federal income taxes from non-employees, except in specific circumstances, such as backup withholding (discu...

Do You Have to Pay Self-Employment Taxes on 1099 Income If You Have Fica Taxes Withheld from Employment Income?

Yes, if you have 1099 income you are considered to be self-employed, and you will need to pay self-employment taxes (Social Security and Medicare t...

Why was Income Tax Withheld from Your 1099-Misc Income?

In most cases, no federal income taxes are withheld from non-employees. But there is one circumstance in which the IRS requires backup withholding:...

What If You Have Income but No 1099-Misc form? Do You Still Have to Pay Taxes on This Income?

All income must be reported to the IRS and taxes must be paid on all income. The payee may have forgotten to prepare and submit a 1099-MISC form fo...

What If I'm Not Self-Employed?

If you don't consider yourself self-employed, how you report this income on your personal tax return depends on where it is located on the 1099-MIS...

Why is there no tax withholding on 1099?

You may be wondering why there was no tax withholding on your 1099-NEC form. That's because the payer didn't withhold any taxes from your payments during the year. Employers are not required to withhold federal income taxes from non-employees, except in specific circumstances.

Do you report 1099 income on Schedule C?

If you are a sole proprietor or single-member LLC owner, you report 1099 income on Schedule C—Profit or Loss From Business. When you complete Schedule C, you report all business income and expenses.

What is the 1099-NEC used for?

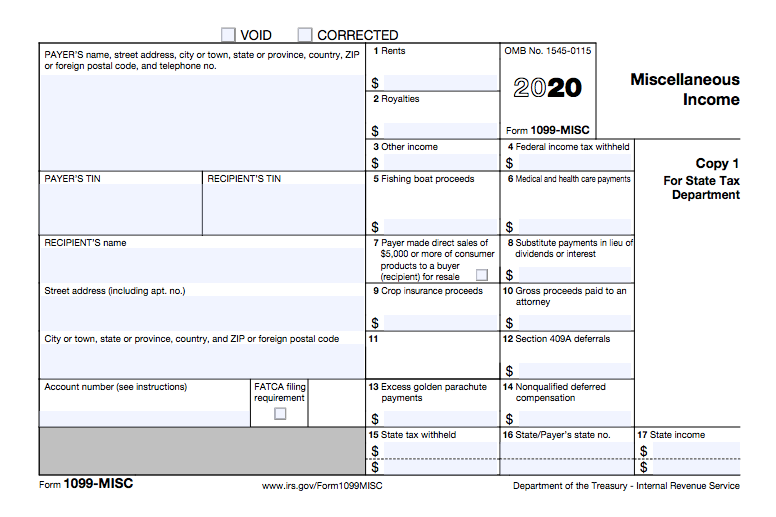

For 2020 taxes and beyond, Form 1099-NEC now must be used to report payments to non-employees, including independent contractors. Form 1099-MISC is now bused to report other types of payments.

When do non-employees get 1099?

Payers are required to give a 1099-NEC form to non-employees only when the total income during the year was $600 or more.

Do self employed people pay taxes?

Every U.S. taxpayer must pay Social Security and Medicare taxes on his or her income. For self-employed individuals, these taxes are called self-employment taxes. Self -employment taxes are calculated on the individual's federal income tax return based on the net income from the business, including 1099 income.#N##N#

What is self employment tax?

For self-employed individuals, these taxes are called self-employment taxes. Self-employment taxes are calculated on the individual's federal income tax return based on the net income from the business, including 1099 income. .

Do employers have to withhold taxes from non-employees?

That's because the payer didn't withhold any taxes from your payments during the year. Employers are not required to withhold federal income taxes from non-employees, except in specific circumstances. Employers also do not withhold Social Security and Medicare taxes from non- employees. . .

Final Thoughts On How To 1099 Someone

This task is a headache, there is no doubt about it. However, it’s a requirement and you need to get together with your accountant ahead of time to work out the details so they can help you make the process as painless as possible.They aren’t the only ones who can assist.

Keep An Eye On Your Business Income

W-2 employees have it easy when it comes to tracking their yearly income. Their employer does that on their behalf. On the other hand, independent contractors need to record your business income or earnings in as much detail as possible so you can easily calculate your net income and determine your taxes.

What Do You Do With Irs Nec Received

A 1099 NEC Form used to report amounts paid to non-employees which includes independent contractors, freelancers etc. Non-employees receive a Form each year at the same time as employees receive W-2 Forms. Taxpayers send this Form at the end of January every year.

How To Calculate Adjusted Gross Income For Tax Purposes

Lea Uradu, J.D. is graduate of the University of Maryland School of Law, a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, Tax Writer, and Founder of L.A.W. Tax Resolution Services.

Filing The 1099 Tax Return

Besides paying quarterly estimates, it is all taxpayers’ responsibility to file a tax return by April 15th of the following year. If you miss the deadline, you’ll be subject to the 1099 late filing penalty rate.

What To Do With The 1099

A 1099-NEC form is used to report amounts paid to non-employees . Non-employees receive a form each year at the same time as employees receive W-2 formsthat is, at the end of Januaryso the information can be included in the recipient’s income tax return.

What Is The Difference Between 1099 And W

Forms 1099 and W-2 are two separate tax forms for two types of workers. Independent contractors use a 1099 form, and employees use a W-2.

How much is Medicare tax?

Taxes for Medicare are currently set at 2.9 percent of your income . If you receive wages from an employer, this is split 50/50, and each of you pays 1.45 percent of the total tax. If you are self-employed, you must pay the full amount yourself. [3]

How much is Social Security tax?

Currently, Social Security taxes amount to 12.4 percent of your income. If you work with an employer, this amount is split 50/50 (you pay 6.2 percent, and your employer pays the other 6.2 percent). If you are self-employed, you need to calculate 12.4 percent of your income and pay this amount yourself. [2]

Do you pay FICA taxes if you are self employed?

If you earn wages from an employer, these are called Federal Insurance Contributions Act (FICA) taxes, and they are split 50/50 between the two of you. If you are self-employed, according to the Self-Employment Contributions Act (SECA), you must pay the full amount of these taxes yourself. When completing your yearly income taxes, you will need ...

Do you pay taxes on self employment if you make $45,000?

If you earned $45,000 from wages and $35,000 from self-employment, your employer will take out Social Security taxes on your wages. You will need to pay the taxes on your self-employment income. All of your wages and income will be subject to SS taxes because they total less than $127,200.

Does SS take out if you have $50,000?

If you have $100,000 from wages and $50,000 from self-employment income, your employer will take out Social Security taxes on your wages. However, only the first $27,200 of your self-employment income will be subject to SECA SS taxes. This is because your wages ($100,000) plus a portion of your self-employment income ($27,200) ...

Is Social Security split 50/50?

It is not split 50/50. Pay both FICA and SECA Social Security taxes, if necessary. If you have both wages from an employer and income from self-employment, Social Security taxes are paid on your wages first, but only if your total income is more than $127,200.

Do you have to pay income tax on 1099?

One thing you’ll notice on your 1099-NEC forms is that your clients don’t withhold income tax from your payments like they do for their employees. This does not mean, however, that you can wait until you prepare your tax return to pay 100% of the income tax you owe. Instead, you may have an obligation to make up to four estimated tax payments to the IRS during the year.

When do you have to file 1099 NEC?

In most circumstances, your clients are required to issue Form 1099-NEC when they pay you $600 or more in any year. As a self-employed person, you're required to report your self-employment income if the amount you receive from all sources totals $400 or more. The process of filing your taxes with Form 1099-NEC is a little different ...

The differences between a W-2 and 1099

First, it’s important to distinguish between a 1099-MISC and a W-2 . Organizations may employ two types of workers — employees and independent contractors. Form 1099-MISC is the tax form you receive from a company you contract with, and Form W-2 is the tax form you receive as an employee.

How will this affect my taxes?

Workers pay a 15.3% FICA tax, which is used to fund Social Security and Medicare. As an employee with a W-2, you pay 7.65%, and your employer pays the other 7.65%.

If I have both types of income, how do I pay taxes on my 1099?

Partnerships, S Corporations, and sole-proprietorships are referred to as “pass-through entities” because business income is passed through to the individual’s personal tax return. The new tax law provides a deduction on income generated through these businesses.

Earn, Learn, and Save

Whether you’re a business owner, a freelancer, an employee or a combination of both, understanding how income payments are categorized can save you from making costly mistakes this tax season.

How your Taskrabbit income is taxed

You must pay taxes on your TaskRabbit Earnings. By January the 31st, TaskRabbit files all of their contractors' and taskers' earnings to the IRS. You can therefore expect to receive a Form 1099-K or 1099-NEC at the beginning of the year.

Breakdown of TaskRabbit 1099 Forms

If you've made income as a tasker last year, you'll receive a 1099 tax form, and a copy of the form is sent to the Internal Revenue Service aka. the IRS. The 1099 form you've received, is for you to keep in your financial records and documents your taxable income. When tax season comes, you're going to fall in one of three categories.

How to find your transaction history

Regardless if you've received your 1099 tax form or not, you can download your transaction history over the last year through the app.

Self-employment tax

When you're a tasker, uber driver, or DoorDasher, you're a part of the emerging gig economy. You are essentially self-employed and play by different rules than regular W2 employees. As self-employed, the IRS sees you as a business and an employee, meaning you'll have to pay both parties federal taxes total of 15.3%.

Write-offs you can take

All of the business expenses you come across can be fully or partially deducted from your income before you pay taxes. It's a big advantage and you should use it to your best ability. Since you are an independent contractor at the end of the day, you are literally paying yourself first, and pay the IRS, whatever is left!

Filing your taxes

When you understand what we've just covered, filing taxes as a contractor is not that hard. At first, you are going to need a couple of tax forms. To be exact, you'll need Schedule C, Schedule SE, your Form 1099

Final words

Filing taxes may seem intimidating at first. But once you understand the basics and use the tools available to you, it's not that hard. The good thing is that once you understand the 1099 TaskRabbit taxes, is that you can use the same method to file all of your 1099 forms yourself, no matter if it's Uber, Lyft, DoorDash, Postmates or anything else.

Is a 1099 contractor self employed?

If you’re a 1099 contractor, then you’re self-employed. As a 1099 contractor, you’re typically responsible for quarterly and annual taxes. The easiest way to lower your taxes is to track your mileage and expenses using an app like Everlance.

How to calculate quarterly taxes?

Here is how to calculate your quarterly taxes: 1. Calculate your adjusted gross income from self-employment for the year. 2. Use the IRS’s Form 1040-ES as a worksheet to determine your estimated taxes.

What is self employed tax?

As a self-employed individual, you are generally responsible for estimated quarterly tax payments and an annual return. You are responsible for federal and state (if applicable) taxes on your adjusted gross income. So the more tax deductions you can find, the more money you’ll keep in your pocket.

What is the tax rate for self employment?

The self-employment tax rate is 15.3% (12.4% for Social Security tax and 2.9% for Medicare). The self-employment tax applies to your adjusted gross income. If you are a high earner, a 0.9% additional Medicare tax may also apply.

When are quarterly taxes due?

While the annual return is due on Tax Day (April 15th), quarterly tax payments are due every quarter. Make sure to pay estimated taxes on time. The four estimated tax payments are usually due each year on the 15th of April, June, September, and January.

Do independent contractors pay taxes?

Nevertheless, independent contractors are usually responsible for paying the Self-Employment Tax and income tax. With that in mind, it’s best practice to save about 25–30% of your self-employed income to pay for taxes. (If you’re looking to automate this, check out Tax Vault!)

Taxes You'll Pay For As A Fiverr Freelancer

Remember, as a self-employed freelancer, you are solely responsible for reporting all of your income and paying all of the taxes you'll owe. Since Fiverr doesn't withhold any money from your earnings or what you are paid, you'll report and pay taxes on all of the income you make. Let's quickly review all of the taxes you will be responsible for.

1099s You'll Receive As A Fiverr Contractor

There are two forms you'll generally have to deal with as a Fiverr independent contractor. Businesses are required to send out these forms by January 31. We'll review the two forms. 1099-NEC and 1099-K, and their requirements here.

The Low-Down On Quarterly Estimated Taxes

Most employees don't have to worry or care about withholding and the underpayment of income taxes. The employer practically will handle all of that. As a freelance contractor with 1099 income, you need to listen closely. If you'll owe more than $1,000 in taxes at the end of the year, the IRS requires you to pay quarterly taxes.

Tax Deductions Available to Fiverr Freelancers

As a business owner, one of the luxuries you can take advantage of is business deductions to avoid paying taxes. Keeping track of your receipts for taxes is a surefire way to pay less money to Uncle Sam when you file your tax return.

It's Time To File Your Taxes (Fiverr International LTD 2021)

The end of the year is a great time to take care of personal and business taxes. If you’re an independent contractor (1099) with Fiverr, then it's your responsibility to report all income and expenses on Schedule C as well as pay quarterly estimated taxes throughout the year.