Medicare Premiums, Deductibles, and Copays Change for 2018

| Yearly Income | Monthly Premium |

| single, $85,000–$107,000 | $187.50 |

| married, $170,001–$214,000 | $187.50 |

| single, $107,001–$133,500 | $267.90 |

| married, $214,001–$267,000 | $267.90 |

Full Answer

What is the Medicare Part a hospital deductible for 2018?

Nov 17, 2017 · About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017.

How can I deduct my Medicare premiums on my taxes?

9 rows ·

What are the 2018 Medicare Part A and Part B premiums?

How much is the Medicare Part B deductible?

Nov 17, 2017 · Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A annual inpatient hospital deductible that …

Where do you deduct Medicare premiums on your tax return?

Can I deduct Medicare premiums on Schedule C?

What is the Medicare Part B deductible 2018?

Are Medicare premiums deducted from Social Security tax deductible?

Are Medicare premiums tax-deductible for retirees?

Can I deduct Medicare premiums as a business expense?

Are health insurance premiums tax-deductible in 2018?

What is the Medicare deductible for 2019 Part B?

What is the cost of Medicare Part D for 2018?

Deductibles for prescription drug plans increased, from $292 in 2018 to $308 in 2019. Medicare sets limits on the annual deductible for Part D plans. In 2019, the limit is $415 and in 2022, the limit increases to $435.Dec 30, 2021

How much does Social Security deduct for Medicare?

What is the maximum Part D deductible for 2018?

The maximum Part D deductible for 2018 is $405 per year (though some plans waive the deductible). Also, if your adjusted gross income is over $85,000 (or $170,000 for a couple), you will pay a monthly adjustment amount to Medicare in addition to your monthly premium, as follows:

How much does Medicare cost a month?

If you first enroll in Medicare Part B during 2018, or you are not collecting Social Security benefits, your premium will be $134 per month.

How much does Medicare pay for a spouse?

Most people don't pay a monthly premium for Medicare Part A (hospital insurance). But if you have to pay for Part A because you or your spouse don't have a long enough work history, you'll pay between $232 (for 30-39 work credits) and $422 (for fewer than 30 work credits). In 2018, you'll also pay a $1,340 deductible for each benefit period in ...

How much is deductible for hospital days 61-90?

Hospital days 61-90: $335 coinsurance per day of each benefit period.

Is there a subsidy for Part D?

There are subsidies available to pay for Part D for those with low income (called Extra Help). See Nolo's article on Extra Help for Part D for eligibility numbers for 2018.

How much of your medical expenses can you deduct on your taxes?

As of 2019, out-of-pocket medical expenses that exceed 10 percent of your gross income could be tax-deductible.

How many parts are there in Medicare?

There are four parts to the Medicare program:

What percentage of retirement income goes to healthcare?

According to a 2019 report by Fidelity, about 15% of a retiree’s annual expenses could go to healthcare-related expenses including Medicare premiums, deductibles, and copayments. If you’re on Medicare and looking for ways to minimize your tax burden, here’s what you need to know about Medicare premiums and income tax.

Can you itemize a $20,000 hospital bill?

preventive care. home modifications necessary to keep you safe. Keep in mind that only the expenses you pay out-of-pocket count toward the itemized deductions. In other words, if you have a $20,000 hospital bill, and Medicare pays all but $1,500 of it, only the $1,500 you pay for your care can be itemized on your return, not the entire $20,000 bill.

Do you pay Medicare premiums based on your work history?

Medicare premiums for Part A are based on your work history; most people qualify for premium-free Part A. Everyone generally pays the base Part B premium, even if you enroll in a Medicare Advantage plan, although some low-income individuals qualify for additional help with Medicare premiums for Part B. Those with higher incomes may pay ...

Can you deduct Medicare premiums on a fixed income?

County Select... Summary: If you itemize deductions, you may be able to deduct healthcare costs such as Medicare premiums. If you’re on a fixed income, every dollar counts—including money spent on health care and Medicare premiums.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much is the Part B premium for 91?

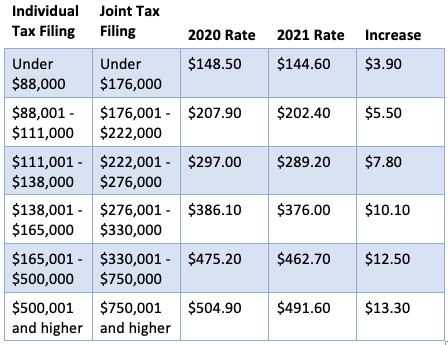

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover prescription drugs?

Option al benefits for prescription drugs available to all people with Medicare for an additional charge. This coverage is offered by insurance companies and other private companies approved by Medicare.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare B?

Medicare B — This is supplemental insurance, and you can include it.

Is Medicare a medical expense?

The payroll tax for Medicare is never a medical exp ense.

What is a tax deduction for Medicare?

What is a tax deduction? If you meet certain conditions set by the Internal Revenue Service (IRS), you may be able to get a tax deduction for your Medicare Advantage premiums. According to the IRS, you subtract your tax deductions from your income before you calculate the amount of tax you owe. The more deductions you have, ...

How many premiums do you pay for Medicare Advantage?

If you have a Medicare Advantage plan you could be paying two premiums: Your Medicare Part B premium and an additional premium charged by the private insurance company that administers your plan. The Medicare Advantage premium amount varies from plan to plan.

How much of your medical expenses can you deduct on your taxes?

Generally, you may be able to deduct only the amount of your medical and dental expenses that is more than 7.5% of your adjusted gross income. The IRS defines adjusted gross income (AGI) as gross income minus adjustments to income.

What is adjusted gross income?

The IRS defines adjusted gross income (AGI) as gross income minus adjustments to income. You can refer to your past income tax return to get a quick estimate of your AGI.

Can you take a standard deduction for Medicare?

When you are paying your taxes to the Internal Revenue Service (IRS), you might have a choice to take a standard deduction or itemize your tax deductions. In order to get a tax deduction for your Medicare Advantage premium (or Medicare Part B premium) you must itemize your tax deductions.

Does Medicare Advantage cover hospice?

If you have Original Medicare (Part A and Part B), you may have an option to get your Medicare benefits in another way – through a Medicare Advantage plan, offered by a Medicare-approved private insurance company. Medicare Advantage must cover everything Original Medicare covers, except for hospice care, which is still covered by Original Medicare ...

Can you deduct itemized deductions?

According to the IRS, you may not be able to deduct all your itemized deductions if your adjusted gross income is more than a certain amount. Check the IRS website or talk to a tax preparer for details.