There is a single model notice for dismissals at the initial determination level (organization determinations/coverage determinations) and separate model notices for dismissals of Part C and Part D level 1 appeals. The Part C model notices can be found at https://www.cms.gov/Medicare/Appeals-and-Grievances/MMCAG/Notices-and-Forms

Full Answer

What does it mean to withdraw from Medicare After retirement?

Withdraw from Medicare. When a physician or non-physician practitioner retires, surrenders his or her license for any reason, or chooses to no longer participate in the Medicare program, he/she should voluntarily withdraw from the Medicare program. Withdrawing from Medicare is considered a change, and should be reported within 90 days.

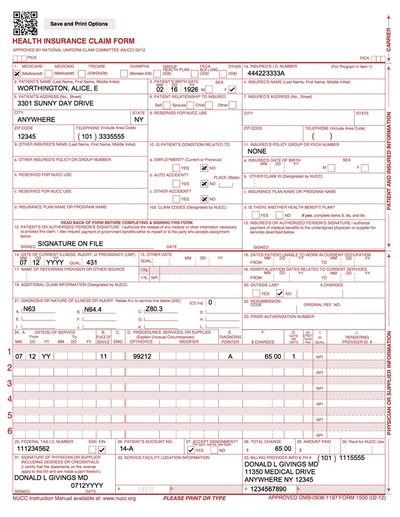

Where can I find the Medicare reimbursement form?

The Medicare reimbursement form, also known as the “Patient’s Request for Medical Payment,” is available in both English and Spanish on the Medicare website. How to Get Reimbursed From Medicare To get reimbursement, you must send in a completed claim form and an itemized bill that supports your claim.

How do I drop Part B of my Medicare plan?

To drop Part B (or Part A if you have to pay a premium for it), you usually need to send your request in writing and include your signature. Contact Social Security. If you recently got a welcome packet saying you automatically got Medicare Part A and Part B, follow the instructions in your welcome packet, and send your Medicare card back.

How does out of network care work for Medicare Part D?

If you obtain out of network care, you may have to pay for it up-front and then submit a claim to your insurance company. The process for doing this varies depending on your insurance company and plan. Part D is prescription drug coverage provided by private insurance companies.

What is the Form 1099-SA?

A 1099-SA is a U.S. tax form that reports distributions made from a health savings account (HSA), Archer medical savings account (Archer MSA), or Medicare Advantage medical savings account (MA MSA). Its purpose is to show you (and the Internal Revenue Service) how much money you spent from your account.

How do I find my 1099-SA form?

For the most recent version, go to IRS.gov/Form1099SA. Online fillable forms. Due to the very low volume of paper Forms 1099-SA and 5498-SA received and processed by the IRS each year, these forms have been converted to an online fillable format.

What is form 5498-SA used for?

Form 5498-SA reports your annual contributions to these tax-free accounts that you use to pay for medical expenses. Contributions to similar accounts, such as Archer Medical Savings Accounts and Medicare Advantage MSAs will also warrant a Form 5498-SA. This form must be mailed to participants and the IRS by May 31.

What is Box 2 on form 5498-SA?

Note: Box 2 on Form 5498-SA will include all amounts contributed during 2021, even if you elected to apply a portion of those contributions to the 2020 tax year. Therefore, in completing your tax return, you should refer to your Form W-2 to identify the amount of pre-tax contributions made during 2021.

What is the difference between 5498-SA and 1099-SA?

The IRS Form 1099-SA is used for reporting HSA distributions; the IRS Form 5498-SA is used for reporting contributions. If you did not have contributions during the year, then you will not see the IRS Form 5498-SA.

Is 1099-SA the same as SSA-1099?

You'll get Form 1099-SA if you paid for medical or other expenses from your HSA or MSA during the tax year. Don't confuse the 1099-SA with the SSA-1099 which reports Social Security benefits.

Where do I put form 5498 on my taxes?

Form 5498 is for informational purposes only. You are not required to file it with your tax return. This form is not posted until May because you can contribute to an IRA for the previous year through mid-April. This means you will have finished your taxes before you receive this form.

Do I have to report 5498-SA on my tax return?

The 5498-SA tax form is used to report contributions to a health savings account (HSA). It is for informational purposes and is not required to file a tax return.

Does form 5498-SA need to be reported on 1040?

Am I required to report information contained in Form 5498-SA on my federal tax return? No. Report all contributions (employee, employer, and other third-party contributions) to your Fidelity HSA on IRS Form 8889, “Health Savings Accounts (HSAs),” and file it with your IRS Form 1040.

Is form 5498 the same as 1099 R?

Relation to other forms With regards to IRAs, Form 1099-R is used for reporting distributions from an IRA while Form 5498 is used for reporting contributions to an IRA. Income earned (such as interest and dividends) through an IRA is not reported on either Form 1099-R or Form 5498.

Why does my 5498-SA not match my W-2?

If the contributions on your W-2 don't match your Form 5498-SA, you likely made after-tax contributions or contributions between January 1 and tax day for the previous tax year.

What is a 1095 C form used for?

Form 1095-C provides information about the health coverage offered by your employer and, in some cases, about whether you enrolled in this coverage. Use Form 1095-C to help determine your eligibility for the premium tax credit.