Is Medicare funded by taxes?

Medicare is funded through a combination of taxes deposited into trust funds, beneficiary monthly premiums, and additional funds approved through Congress. According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion.

Where does FDIC insurance money come from?

The types of accounts the FDIC insures includes:

- Savings accounts

- Checking accounts

- Money market accounts

- Certificates of deposits (CDs)

- Cashier's checks

- Money orders

How does the federal government funds Medicaid?

The federal government guarantees matching funds to states for qualifying Medicaid expenditures; states are guaranteed at least $1 in federal funds for every $1 in state spending on the program.

Where does primary support for Medicare Part A come from?

This money comes from the Medicare Trust Funds. Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare.

How does Medicare get money?

Medicare gets money from two trust funds : the hospital insurance (HI) trust fund and the supplementary medical insurance (SMI) trust fund. The trust funds get money from payroll taxes, as allowed by the Federal Insurance Contributions Act (FICA) enacted in 1935.

How much did Medicare spend in 2019?

According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion.

How much is the Medicare deductible for 2020?

A person enrolled in Part A will also pay an inpatient deductible before Medicare covers services. Most recently, the deductible increased from $1,408 in 2020 to $1,484 in 2021. The deductible covers the first 60 days of an inpatient hospital stay.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is Medicare for adults?

Medicare is the federal healthcare program for adults aged over 65, adults with disabilities, and people with end stage renal disease. The program provides coverage for inpatient and outpatient services, and prescription drugs. Medicare gets money from two trust funds: the hospital insurance (HI) trust fund and the supplementary medical insurance ...

What is a copayment for Medicare?

Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

Why is it so hard to predict the future of Medicare?

According to the 2020 Medicare Trustees Report, it is difficult to predict future Medicare costs because of the uncertainty of changes and advances in technology and medicine. Each Medicare part has different costs, which help fund Medicare services.

How does Medicare get its funding?

Medicare funding comes from two trust funds, which are funded by tax revenue and premiums paid by Medicare beneficiaries

Where does Medicare money come from?

Technically, Medicare funding comes from the Medicare Trust Funds. Those are two separate funds — the Hospital Insurance (HI) Trust Fund and the Supplementary Medical Insurance (SMI) Trust Fund — which each pay for different parts of the Medicare program. Money in those two funds can only go toward paying for Medicare.

What is the Medicare tax?

Some of these payroll taxes go toward paying your personal income taxes and some go toward FICA taxes. The Federal Insurance Contributions Act (FICA) requires all U.S. employers and employees to pay income taxes to help fund the federal insurance programs of Social Security and Medicare.

What is the Medicare trust fund?

The fund primarily comprises revenue from the Medicare tax. It is also maintained through taxes on Social Security benefits, premiums paid by Medicare Part A beneficiaries who are not yet eligible for other federal retirement benefits, and interest on the trust fund’ s investments.

How is Medicare Part A paid?

Medicare Part A (hospital insurance) is paid through the HI Trust Fund. The fund primarily comprises revenue from the Medicare tax. It is also maintained through taxes on Social Security benefits, premiums paid by Medicare Part A beneficiaries who are not yet eligible for other federal retirement benefits, and interest on the trust fund’s investments.

What is the surtax for Medicare?

If you have a high income, you may have to pay a surtax (an extra tax) called the Additional Medicare Tax. The surtax is 0.9% of your income and when you start paying it depends on your income and filing status. The table below has the thresholds for the Additional Medicare Tax in 2021.

How many people will be covered by Medicare in 2020?

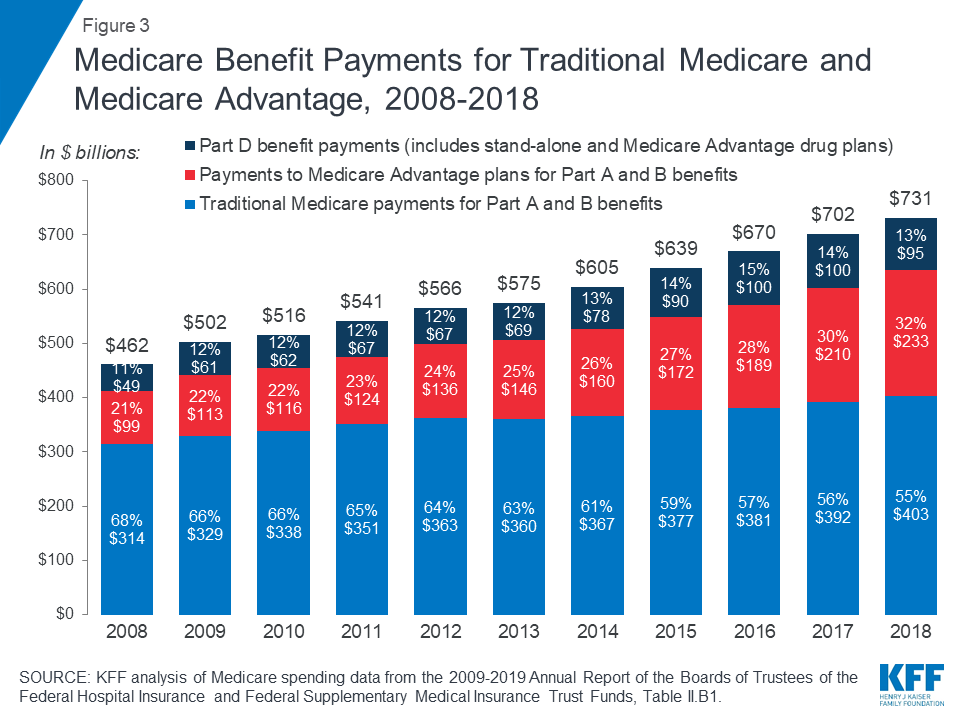

The future of Medicare funding. As of July 2020, Medicare covers about 62.4 million people, but the number of beneficiaries is outpacing the number of people who pay into the program. This has created a funding gap.

How Is Medicare Funded?

These taxes are in addition to the 6.2% Social Security tax or OASDI tax that you will see withheld from your paycheck. So, in a nutshell, Medicare is funded by taxpayers.

Where does Medicare money come from?

You probably already know that many people qualify for Medicare Part A at no cost, so where does the money come from? Medicare receives funding primarily through taxes collected from your paycheck, although there are a few other ways that Medicare gets money. Knowing how Medicare and each part of it are funded can help you understand the overall Medicare system and how it can work for you. Let’s dive into the details of Medicare funding and how that it affects you and your personal financial situation.

What Is The “Medicare Tax”?

The so-called “Medicare Tax” is part of the tax collected by the Federal Insurance Contributions Act, or FICA tax. This tax requires 1.45% of your income to be withheld from your gross pay. Your employer must also pay 1.45% tax on your gross pay. These taxes are placed into the SMI and HI trust funds to provide dollars for the Medicare health plans offered to those who qualify.

How does Medicare Part B work?

It also covers preventive care like vaccines and routine screening. Part B is funded through the money that is put into the Medicare Medical Insurance Trust Fund. In addition, Part B receives dollars from premium payments. Since Part B is not free, the program is funded partially through Part B premiums paid by the insured. These dollars, along with interest on the trust funds, help pay for Medicare Part B. In some cases, Congress may even authorize special funds to be used for Part B funding.

How does Medicare work for self employed?

Medicare insurance plans work exactly the same for those who are self-employed. If you have enough work credits to qualify for Medicare, then you will be automatically enrolled in Part A coverage at age 65. There is one major difference that self-employed individuals need to be aware of. Instead of paying the 1.45% FICA tax that your employer also matches, you will be required to pay the full 2.9% Medicare tax. Your eligibility to enroll in the Medicare insurance program later in life will depend on whether you have contributed to the system during your working years.

What is the Medicare tax rate for 2021?

The Medicare tax rate in 2021 is 1.45%. Unlike the Social Security tax, there is no income cap for collection of the Medicare tax. You will pay this tax on every dollar that you earn. In addition, your employer also pays 1.45% of your income as their portion of the tax. The money collected from these taxes goes into two separate trust funds. The Medicare Hospital Insurance Trust Fund and the Supplemental Medical Insurance Trust Fund. In addition to these trust funds, Medicare also receives some additional funding from a few other sources. Let’s dive into each part for a deeper look

When was Medicare established?

Medicare was established in 1965 and signed into law by President Lyndon B. Johnson. The program was designed to provide health care coverage for retirees who no longer worked. Since most health insurance could only be purchased through employer provided group plans, retirees had no access to attainable health care options. That, of course, changed with the passage of the Affordable Care Act. However, millions of Americans still turn to Medicare for their health coverage.

How does Medicare get its money?

Medicare gets revenue from a relatively wide variety of sources, but three major ones stand out. First, the program collects payroll taxes from working Americans. Those payroll taxes made up 38% of all Medicare revenue in 2014, making it the second biggest provider of funding for the healthcare program.

When will Medicare run out of money?

One concern about Medicare Part A is that the Medicare Hospital Insurance Trust Fund is expected to run out of money in 2030.

How much payroll tax does Medicare collect?

For instance, Medicare collects payroll taxes in the amount of 1.45% from employees and a matching 1.45% from employers. Self-employed workers pay the full 2.9% themselves. Unlike with Social Security, which imposes a wage base limit above which Social Security payroll taxes are no longer owed, Medicare charges its payroll tax on an unlimited amount of earned income.

Why is Medicare important?

Medicare is a vital program for millions of Americans, many of whom wouldn't be able to afford to pay their healthcare costs without it. Ensuring stable funding for the long run is crucial in order to continuing meeting this need and keeping Medicare financially strong for decades to come.

How much does Medicare pay for self employed?

Self-employed workers pay the full 2.9% themselves. Unlike with Social Security, which imposes a wage base limit above which Social Security payroll taxes are no longer owed, Medicare charges its payroll tax on an unlimited amount of earned income.

What is Medicare Part A?

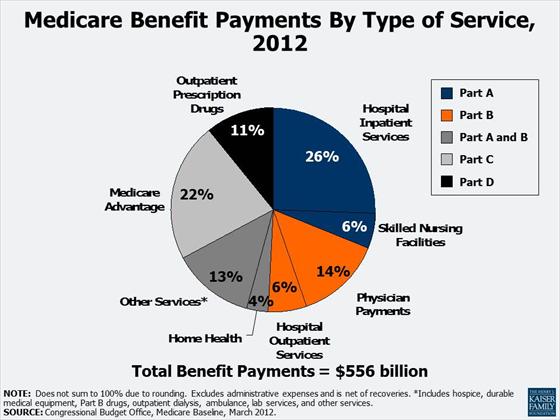

All of those payroll taxes go toward funding Medicare Part A, which is the part of the program that provides coverage for hospital stays and other inpatient medical needs. Part A gets about 87% of its funding for its $261 billion budget from Part A payroll tax withholding. Most of the remainder came from interest on the Medicare Hospital Insurance Trust Fund, which holds accumulated payroll taxes from past years that weren't necessary in order to pay current-year benefits.

What is the key variable for Medicare?

The key variable for Medicare is the pace at which healthcare costs rise. Recent slowdowns in the growth rate for medical costs have given the program greater long-term viability. Yet in the past, changes in costs have been cyclical in nature.