Is Medicare funded by taxes?

Medicare is funded through a combination of taxes deposited into trust funds, beneficiary monthly premiums, and additional funds approved through Congress. According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion.

Where does FDIC insurance money come from?

The types of accounts the FDIC insures includes:

- Savings accounts

- Checking accounts

- Money market accounts

- Certificates of deposits (CDs)

- Cashier's checks

- Money orders

How does the federal government funds Medicaid?

The federal government guarantees matching funds to states for qualifying Medicaid expenditures; states are guaranteed at least $1 in federal funds for every $1 in state spending on the program.

Where does primary support for Medicare Part A come from?

This money comes from the Medicare Trust Funds. Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare.

Is Medicare funded by taxpayers?

Medicare is federally administered and covers older or disabled Americans, while Medicaid operates at the state level and covers low-income families and some single adults. Funding for Medicare is done through payroll taxes and premiums paid by recipients. Medicaid is funded by the federal government and each state.

Is Medicare subsidized by the federal government?

Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare.

Who funds Medicare in the US?

the U.S. TreasuryMedicare is funded through two trust funds held by the U.S. Treasury. Funding sources include premiums, payroll and self-employment taxes, trust fund interest, and money authorized by the government.

Where does the government get the money to fund Social Security and Medicare?

In 2020, $1.001 trillion (89.6 percent) of total Old-Age and Survivors Insurance and Disability Insurance income came from payroll taxes. The remainder was provided by interest earnings $76 billion (6.8 percent) and revenue from taxation of OASDI benefits $41 billion (3.6 percent).

What happens when Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.

Who controls Medicare premiums?

The State of California participates in a buy-in agreement with the Centers for Medicare and Medicaid Services (CMS), whereby Medi-Cal automatically pays Medicare Part B premiums for all Medi-Cal beneficiaries who have Medicare Part B entitlement as reported by Social Security Administration (SSA).

How much is Medicare in debt?

Medicare accounts for a significant portion of federal spending. In fiscal year 2020, the Medicare program cost $776 billion — about 12 percent of total federal government spending. Medicare was the second largest program in the federal budget last year, after Social Security.

Does Medicare run a deficit?

Last year, the Medicare Part A fund ran a deficit of $5.8 billion, and that excess of spending over revenue is expected to continue until it finally runs dry.

Why does Medicare cost so much?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

What president took money from the Social Security fund?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19647.STATEMENT BY THE PRESIDENT COMMENORATING THE 30TH ANNIVERSARY OF THE SIGNING OF THE SOCIAL SECURITY ACT -- AUGUST 15, 196515 more rows

Why is SS running out of money?

People believe the program will run out of money for many reasons, including: The Social Security trust funds going broke: It is true that the Social Security trust funds, where the money raised by Social Security taxes is invested in non-marketable securities, is projected to run out of funds by around 2034.

Which president messed up Social Security?

President Richard M. Nixon1.SPECIAL MESSAGE TO THE CONGRESS ON SOCIAL SECURITY -- SEPTEMBER 25, 19694.STATEMENT ABOUT APPROVAL OF THE WELFARE REFORM AND SOCIAL SECURITY BILL BY THE HOUSE COMMITTEE ON WAYS AND MEANS--MAY 18, 197119 more rows

How does Medicare get money?

Medicare gets money from two trust funds : the hospital insurance (HI) trust fund and the supplementary medical insurance (SMI) trust fund. The trust funds get money from payroll taxes, as allowed by the Federal Insurance Contributions Act (FICA) enacted in 1935.

How much is Medicare spending in 2019?

According to the Centers for Medicare and Medicaid Services, Medicare expenditures in 2019 totaled $796.2 billion. This article looks at the ways in which Medicare is funded. It also discusses changes in Medicare costs.

How much is the Medicare deductible for 2020?

A person enrolled in Part A will also pay an inpatient deductible before Medicare covers services. Most recently, the deductible increased from $1,408 in 2020 to $1,484 in 2021. The deductible covers the first 60 days of an inpatient hospital stay.

What is the best Medicare plan?

We may use a few terms in this piece that can be helpful to understand when selecting the best insurance plan: 1 Deductible: This is an annual amount that a person must spend out of pocket within a certain time period before an insurer starts to fund their treatments. 2 Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%. 3 Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

What is Medicare for adults?

Medicare is the federal healthcare program for adults aged over 65, adults with disabilities, and people with end stage renal disease. The program provides coverage for inpatient and outpatient services, and prescription drugs. Medicare gets money from two trust funds: the hospital insurance (HI) trust fund and the supplementary medical insurance ...

How much will Part D premiums be in 2021?

The adjusted monthly fee for 2021 ranges from $12.30 to a maximum of $77.10.

Why is it so hard to predict the future of Medicare?

According to the 2020 Medicare Trustees Report, it is difficult to predict future Medicare costs because of the uncertainty of changes and advances in technology and medicine. Each Medicare part has different costs, which help fund Medicare services.

What is Medicare funded by?

Medicare is funded by federal tax revenue, payroll tax revenue (the Medicare tax), and premiums paid by Medicare beneficiaries. The trust fund that pays for Medicare Part A is projected to run out of money in 2026 unless more tax revenue is raised.

When will Medicare run out of money?

The trust fund that pays for Medicare Part A is projected to run out of money in 2026 unless more tax revenue is raised. Medicare is a federally run health insurance program that serves seniors and people living with certain disabilities. There are four parts of Medicare, each of which covers different types of health care expenses.

How does Medicare Part B get paid?

Medicare Part B (outpatient insurance) is paid through the SMI Trust Fund. The fund gets money from the premiums paid by Medicare Part B and Part D beneficiaries, federal and state tax revenue, and interest on its investments.

What is the Medicare trust fund?

The fund primarily comprises revenue from the Medicare tax. It is also maintained through taxes on Social Security benefits, premiums paid by Medicare Part A beneficiaries who are not yet eligible for other federal retirement benefits, and interest on the trust fund’ s investments.

How much will Medicare pay in 2021?

All workers pay at least 1.45% of their incomes in Medicare taxes. In 2021, Medicare Part B recipients pay monthly premiums of between $148.50 to $504.90. Most people qualify for premium-free Part A, but those who don’t will have premiums worth up to $471.

How many people will be covered by Medicare in 2020?

The future of Medicare funding. As of July 2020, Medicare covers about 62.4 million people, but the number of beneficiaries is outpacing the number of people who pay into the program. This has created a funding gap.

How many parts does Medicare have?

There are four parts of Medicare, each of which covers different types of health care expenses. The source of funding for each part of Medicare is different. Technically, Medicare funding comes from the Medicare Trust Funds. Those are two separate funds — the Hospital Insurance (HI) Trust Fund and the Supplementary Medical Insurance (SMI) ...

How Is Medicare Funded?

Medicare is a Federal program that is managed by the Centers for Medicare & Medicaid Services (CMS). The funds for the program come from a few different sources, with the primary source being FICA payroll taxes. These taxes are in addition to the 6.2% Social Security tax or OASDI tax that you will see withheld from your paycheck.

Is Medicare Funded By State Or Federal?

Many people wonder whether Medicare is a state or federal program. Medicare is really funded by you, the taxpayer. It is a Federal program that is administered by the Federal government. There is little to no state involvement with the Medicare program. Medicare provides health care coverage for retirees and disabled persons who can qualify.

How Does Medicare Work For Those Who Are Self-Employed?

Medicare insurance plans work exactly the same for those who are self-employed. If you have enough work credits to qualify for Medicare, then you will be automatically enrolled in Part A coverage at age 65. There is one major difference that self-employed individuals need to be aware of.

Conclusion

Medicare funding is extremely important to provide coverage to those individuals who rely on this insurance system, so it is helpful that you have a good understanding of where this funding comes from. Medicare is a Federally administered program that is funded primarily through taxpayer dollars.

Frequently Asked Questions

The government provides very few subsidies for Medicare. The program is almost entirely funded through federal income taxes, employer payroll taxes, and premium payments. However, with its current funding, the program may begin to run out of money in the next 5-10 years. The current funding model may be forced to change to keep the program running.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

What percentage of Medicare is from the federal government?

The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970. Looking forward, such revenues are projected to continue funding a major share of the Medicare program.

What percentage of Medicare is home health?

Medicare is a major player in our nation's health system and is the bedrock of care for millions of Americans. The program pays for about one-fifth of all healthcare spending in the United States, including 32 percent of all prescription drug costs and 39 percent of home health spending in the United States — which includes in-home care by skilled nurses to support recovery and self-sufficiency in the wake of illness or injury. 4

How much of Medicare was financed by payroll taxes in 1970?

In 1970, payroll taxes financed 65 percent of Medicare spending.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

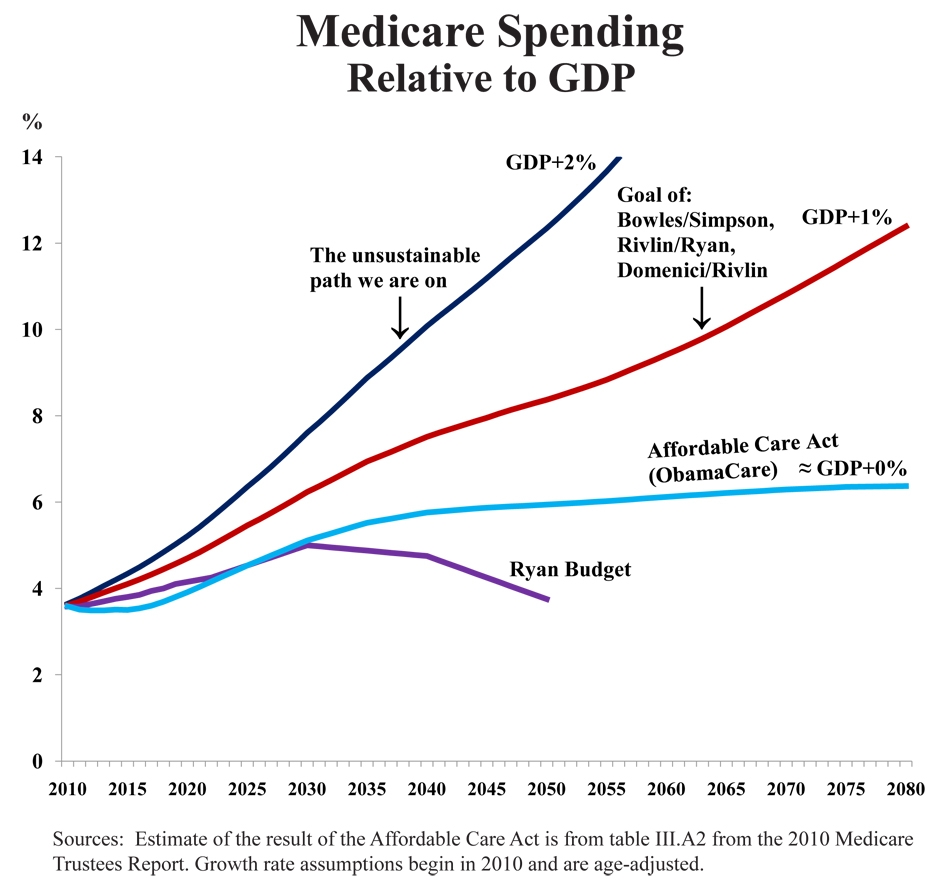

What percentage of GDP will Medicare be in 2049?

In fact, Medicare spending is projected to rise from 3.0 percent of GDP in 2019 to 6.1 percent of GDP by 2049. That increase in spending is largely due to the retirement of the baby boomers (those born between 1944 and 1964), longer life expectancies, and healthcare costs that are growing faster than the economy.

What Is Medicare?

The U.S. government created Medicare to offer health care insurance for retired Americans. Until the Affordable Care Act went into effect, many citizens could only receive health insurance through their employers.

How Is Medicare Funded?

According to the Henry J. Kaiser Family Foundation (KFF), spending on Medicare accounted for 15 percent of the federal budget in 2015. The KFF further reveals that Medicare funding comes from three primary sources:

Will Medicare Funding Run Out?

Many people worry that Medicare funding will run out. However, in its current status, Medicare will be able to fund Part A health care expenses for beneficiaries through 2028. Additionally, the program can adjust for inflation and increase deductions to fund the program well into the 2030 decade.

How Can You Protect Your Financial Future?

Whether you’re enrolling in a Medicare program now or planning to in the future, you can take advantage of supplemental health insurance to make sure that your health care costs remain covered. Americans have plenty of options to protect themselves against health care crises.

What are the sources of Social Security?

Another source of funding for the program comes from: 1 Income taxes on Social Security benefits 2 Premiums associated with Part A 3 Interest accrued on trust fund investments

What is benchmark amount for Medicare?

Benchmark amounts vary depending on the region. Benchmark amounts can range from 95% to 115% of Medicare costs. If bids come in higher than benchmark amounts, the enrollees must pay the cost difference in a monthly premium. If bids are lower than benchmark amounts, Medicare and the health plan provide a rebate to enrollees after splitting ...

What are the sources of revenue for Advantage Plans?

Three sources of revenue for Advantage plans include general revenues, Medicare premiums, and payroll taxes. The government sets a pre-determined amount every year to private insurers for each Advantage member. These funds come from both the H.I. and the SMI trust funds.

What is supplementary medical insurance?

The supplementary medical insurance trust fund is what’s responsible for funding Part B, as well as operating the Medicare program itself. Part B helps to cover beneficiaries’ doctors’ visits, routine labs, and preventative care.

Will Medicare stop paying hospital bills?

Of course, this isn’t saying Medicare will halt payments on hospital benefits; more likely, Congress will raise the national debt. Medicare already borrows most of the money it needs to pay for the program. The Medicare program’s spending came to over $600 billion, 15% of the federal budget.

Does Medicare Supplement pay for premiums?

Many times, seniors who are retired may have their premiums paid by their former employers. The federal government doesn’t contribute financially to Medigap premiums.

Why is Medicare important?

Medicare is a vital program for millions of Americans, many of whom wouldn't be able to afford to pay their healthcare costs without it. Ensuring stable funding for the long run is crucial in order to continuing meeting this need and keeping Medicare financially strong for decades to come.

How many Americans are covered by Medicare?

Tens of millions of Americans participate in Medicare coverage, and many more expect to take advantage of the program in the future. In order to ensure its continuing viability, it's important to understand where Medicare gets its money.

What is Medicare Supplemental Medical Insurance Trust Fund?

To some extent, the Medicare Supplemental Medical Insurance Trust Funds provide protection against future shortfalls. Yet because those funds are supported not by payroll taxes but rather from general revenue, the role of the SMI Trust Funds is different from the HI Trust Fund or the Social Security Trust Fund.

How much does Medicare pay for self employed?

Self-employed workers pay the full 2.9% themselves. Unlike with Social Security, which imposes a wage base limit above which Social Security payroll taxes are no longer owed, Medicare charges its payroll tax on an unlimited amount of earned income.

What is the key variable for Medicare?

The key variable for Medicare is the pace at which healthcare costs rise. Recent slowdowns in the growth rate for medical costs have given the program greater long-term viability. Yet in the past, changes in costs have been cyclical in nature.

When will Medicare run out of money?

One concern about Medicare Part A is that the Medicare Hospital Insurance Trust Fund is expected to run out of money in 2030.

Is Medicare going to run out of money in 2030?

One concern about Medicare Part A is that the Medicare Hospital Insurance Trust Fund is expected to run out of money in 2030. A rising number of baby boomers is ramping up the need for healthcare spending from Medicare, and a smaller number of workers means fewer people are coming with money to pay for baby boomers' needs.

What percentage of Medicare is spending?

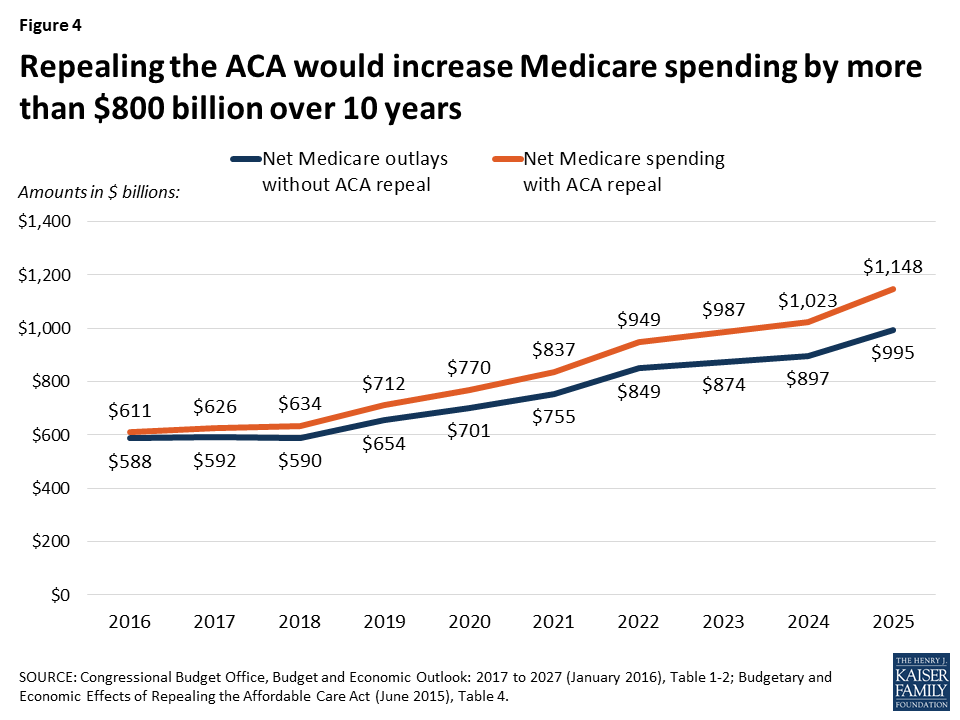

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How is Medicare Part D funded?

Part D is financed by general revenues (71 percent), beneficiary premiums (17 percent), and state payments for beneficiaries dually eligible for Medicare and Medicaid (12 percent). Higher-income enrollees pay a larger share of the cost of Part D coverage, as they do for Part B.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

How is Medicare's solvency measured?

The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases.

How much of the federal government is funding Medicaid expansion?

The federal government provided additional funds to states undergoing Medicaid expansion, paying 100 percent of Medicaid expansion costs through 2016 and 90 percent of those costs through 2020. All states, whether or not they participate in Medicaid expansion, continue to receive federal funding from these three sources:

How much does Medicaid pay for health care?

According to the American Hospital Association, hospitals are paid only 87 cents for every dollar spent by the hospital to treat people on Medicaid. 2

What is the GOP's plan for 2020?

Healthy Adult Opportunity. The GOP aims to decrease how much federal money is spent on Medicaid. The 2020 Fiscal Year budget 6 proposed cutting Medicaid by $1.5 trillion over the next decade but the budget failed to pass.

When did the FMAP increase?

The Affordable Care Act increased the enhanced FMAP for states from October 1, 2015 through September 30, 2019. It did so by 23 percentage points but did not allow any state to exceed 100%. For Fiscal Year 2020, the enhanced matching rates will be lower.

How much does the federal government match for Medicaid?

For every $1 a state pays for Medicaid, the federal government matches it at least 100%, i.e., dollar for dollar. The more generous a state is in covering people, the more generous the federal government is required to be. There is no defined cap, and federal expenditures increase based on a state's needs.

Which states have 50% FMAP?

Alaska, California, Colorado, Connecticut, Maryland, Massachusetts, Minnesota, New Hampshire, New Jersey, New York, North Dakota, Virginia, Washington, and Wyoming are the only states to have an FMAP of 50% for Fiscal Year 2020 (October 1, 2019 through September 30, 2020). All other states receive a higher percentage of Medicaid funds from ...

Who is excluded from Medicaid expansion?

Specifically, adults on Medicaid expansion or adults less than 65 years old without disabilities or long-term care placement needs would be affected. Pregnant women and low-income parents would be excluded. States could require asset tests for these individuals, propose work requirements, and/or require cost-sharing.