What is the best supplement for Medicare?

Decide which plan you want. Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need. See benefits of each plan. Step 2.

What are the top 5 Medicare supplement plans?

Mar 24, 2022 · Plan F. Plan F is the most extensive Medicare Supplement Insurance plan available. It covers everything the other plans cover, in addition to 100% of Medicare Part B excess charges. Plan F also covers 80% of medical emergency expenses when you …

Are Medicare supplement plans worth it?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover. Find a Medigap policy. Find and compare drug plans, health plans, and Medigap policies. When can I buy Medigap? Get the facts about the specific times when you can sign up for a Medigap policy.

How to pick the best Medicare supplement plan?

Visit Medicare.gov/supplements-other-insurance/how-to-compare-medigap-policies to view this information online. Standardized Medigap policies aren’t required to cover long-term. care (like care in a nursing home), vision or dental care, hearing. aids, eyeglasses, and private-duty nursing.

What is the most basic Medicare Supplement plan?

There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold).Sep 25, 2021

What states have the cheapest Medicare Supplement plans?

The chart below shows the average monthly premium for Medicare Supplement Insurance Plan G for each state in 2018. Wisconsin, Hawaii and Iowa had the plans with the lowest average monthly premiums, around $102 per month.Feb 15, 2022

Can Medicare Supplement plans be purchased any time of the year?

If you're in good health and comfortable answering medical questions, you can apply to change Medigap plans at any time of the year. Medicare Advantage plans and Medicare Part D prescription drug plans can only be changed during certain times of year, but Medicare supplements are different.Jan 26, 2021

How much does AARP Medicare Supplement Plan G cost?

In states with this pricing structure, the average monthly cost for the AARP Medigap Plan G is $124 per month for someone who is 65 years old. At age 75, the average monthly premium is $199, and it's $209 for those aged 85.Jan 24, 2022

What is the least expensive Medigap plan?

Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves against major medical expenses, a high-deductible plan is another way to have low-cost coverage.Mar 16, 2022

Are all Plan G Medicare supplements the same?

Because all Medicare Supplement Plan G policies provide the exact same coverage or benefits. This is what people mean when they say these plans are “standardized.” That said, not all Plan G policies cost the same. Insurance companies are free to charge what they want for them, and so they do.Nov 11, 2020

Can you be denied a Medicare supplement plan?

Within that time, companies must sell you a Medigap policy at the best available rate, no matter what health issues you have. You cannot be denied coverage.

Can I change Medicare supplement plans anytime?

You can change your Medicare Supplement Plan anytime, just be aware that you might have to answer medical questions if your outside your Open Enrollment Period.

Can I change Medicare supplement plans without underwriting?

During your Medigap Open Enrollment Period, you can sign up for or change Medigap plans without going through medical underwriting. This means that insurance companies cannot deny you coverage or charge you more for a policy based on your health or pre-existing conditions.Nov 22, 2021

Are there copays with Plan G?

Plan G covers nearly all out-of-pocket costs for services and treatment once you pay the Medicare Part B $233 deductible. This means you pay no copays or coinsurance. If you don't need that level of coverage, though, you might want a plan with less coverage.

What is the deductible for Plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Does UnitedHealthcare Plan G have a deductible?

The standard version of Plan G has no deductible, which means your Plan G coverage will begin with the very first dollar spent on covered care. The high-deductible version features a deductible of $2,370 (in 2021) that must be met before the plan coverage kicks in.Sep 21, 2021

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

What is the name of the insurance company that offers Medicare Supplement Plans?

Blue Cross Blue Shield. BlueCross Blue Shield (known as Anthem in some states, as well as BCBS) is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don't have to worry about sorting through health insurance information that doesn't apply to you.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

How to find Medicare premiums with United Medicare Advisors?

When it comes to finding plans and premiums with United Medicare Advisors, they provide a simple online form where you enter contact information such as your name, phone number, and email address. This same information is required by almost all Medicare Supplement Plan sites.

How much is the BCBS discount?

There is also a household discount of 5% if more than one household member is enrolled in a BCBS Medicare Supplement Plan. That discount is lower than many other insurers, who typically offer anywhere from 7% to 15% off, and sometimes that applies even if no one else is currently enrolled with you.

How long has Aetna been around?

Aetna. Aetna has been around for a LONG time: over 160 years, as a matter of fact. And, as the insurer most often quoted during our process of finding Medicare Supplement Plans, Aetna is an obvious company to consider for your coverage needs.

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

What is Medicare Supplement?

Medicare Supplement insurance plans are standardized in most states, meaning that plans of the same letter offered by different companies must cover the same basic benefits. However, pricing for the same plan may differ from company to company. Insurance companies use three ways to price Medicare Supplement insurance plans:

Is Medicare Supplement available to everyone?

Medicare Supplement insurance plans are not available to everyone. The first requirement is to be enrolled in Medicare Part A and Part B. When you become eligible for Medicare, you may have the choice to stay with Original Medicare (Part A and Part B) or go with a Medicare Advantage plan that covers your Medicare hospital and medical benefits (except for hospice care, which Part A still covers). Many Medicare Advantage plans also offer additional benefits, such as routine dental care. If you have Medicare Advantage, you can’t be sold a Medicare Supplement insurance plan.

Does Medicare Supplement cover out of pocket costs?

You may have heard that a Medicare Supplement (Medigap) insurance plan can help you pay for Original Medicare’s out-of-pocket costs, such as copayments, coinsurance and deductibles . Following the below steps may help you as shop for and enroll in a Medicare Supplement insurance plan.

How to choose a Medicare Supplement Plan?

Is a Medicare Supplement plan right for you? 1 You are enrolled in Medicare Part A and Part B and have many doctor visits or frequent hospitalizations. 2 You want the security of knowing you’ll have help with many of the medical expenses that Medicare Part A and Part B don’t completely cover. 3 You like the flexibility of being able to choose any doctor or hospital that accepts Medicare, possibly even when traveling throughout the United States 4 You divide your time between two homes in different regions of the United States and you want to be able to receive treatment from any doctor or health facility that accepts Medicare.

How does Medicare Supplement work?

When you buy a Medicare Supplement plan, you generally pay a premium to the insurance company for your coverage. Typically, as long as you continue to pay your premium and have Medicare Part A and Part B, your Medicare Supplement plan will be automatically renewed each year, although the premium amount may change.

Which states have different Medicare Supplement plans?

Massachusetts, Minnesota, and Wisconsin have different standardized Medicare Supplement plans than the 10 types offered elsewhere in the United States. Please note that all insurance companies won’t necessarily offer all the types of Medicare Supplement plans. When you buy a Medicare Supplement plan, you generally pay a premium to ...

Do you pay monthly premiums for Medicare Supplement?

Keep in mind that you do pay a monthly premium with a Medicare Supplement policy (and you still continue paying your Medicare Part B premium as well). Medicare Supplement plan premiums may vary by insurance company and among different plans. Generally speaking, the more coverage provided by the Medicare Supplement plan, the higher the premium.

Does Medicare Supplement cover deductible?

Each standardized Medicare Supplement plan helps cover a different range of certain Medicare costs. For example, some plans may cover 100% of the Medicare Part A deductible, some cover a portion of that deductible, and some plans don’t cover the deductible at all. Some plans may cover emergency medical care when you’re traveling ...

Is Medicare Supplement a good plan?

However, if one or more of the following circumstances is true for you, a Medicare Supplement plan may be a good choice. You are enrolled in Medicare Part A and Part B and have many doctor visits or frequent hospitalizations. You want the security of knowing you’ll have help with many of the medical expenses that Medicare Part A ...

Does Medicare Supplement Plan A include the same benefits?

For example, Medicare Supplement Plan A (not to be confused with Medicare Part A) includes the same benefits no matter where you buy this plan (however, some insurance companies might offer additional benefits). Massachusetts, Minnesota, and Wisconsin have different standardized Medicare Supplement plans than the 10 types offered elsewhere in ...

When does Medigap coverage start?

Ask for your policy to become effective when you want coverage to start. Generally, Medigap policies begin the first of the month after you apply. If, for any reason, the insurance company won't give you the effective date for the month you want, call your State Insurance Department.

How to fill out a medical application?

Tips for filling out your application 1 Fill out the application carefully and completely, including medical questions. The answers you give will determine your eligibility for open enrollment or guaranteed issue rights (also called "Medigap protections"). 2 If your insurance agent fills out the application, check to make sure it's correct. 3 Remember that the insurance company can't ask you any questions about your family history or require you to take a genetic test. 4 If you buy a Medigap policy during your#N#Medigap Open Enrollment Period#N#A one-time only, 6-month period when federal law allows you to buy any Medigap policy you want that's sold in your state. It starts in the first month that you're covered under Part B and you're age 65 or older. During this period, you can't be denied a Medigap policy or charged more due to past or present health problems. Some states may have additional open enrollment rights under state law.#N#, the insurance company can’t use any medical answers you give to deny you a Medigap policy or change the price. 5 If you provide evidence that you're entitled to a guaranteed issue right, the insurance company can't use any medical answers you give to deny you a Medigap policy or change the price.

How long is the open enrollment period for Medigap?

Medigap Open Enrollment Period. A one-time only, 6-month period when federal law allows you to buy any Medigap policy you want that's sold in your state. It starts in the first month that you're covered under Part B and you're age 65 or older.

How to pay for insurance?

How to pay for your policy. It's best to pay by check, money order, or bank draft. Make it payable to the insurance company, not the agent. If buying from an agent, get a receipt with the insurance company's name, address, and phone number for your records. Some companies may offer electronic funds transfer.

Can you be denied a Medigap policy?

During this period, you can't be denied a Medigap policy or charged more due to past or present health problems. Some states may have additional open enrollment rights under state law. , the insurance company can’t use any medical answers you give to deny you a Medigap policy or change the price.

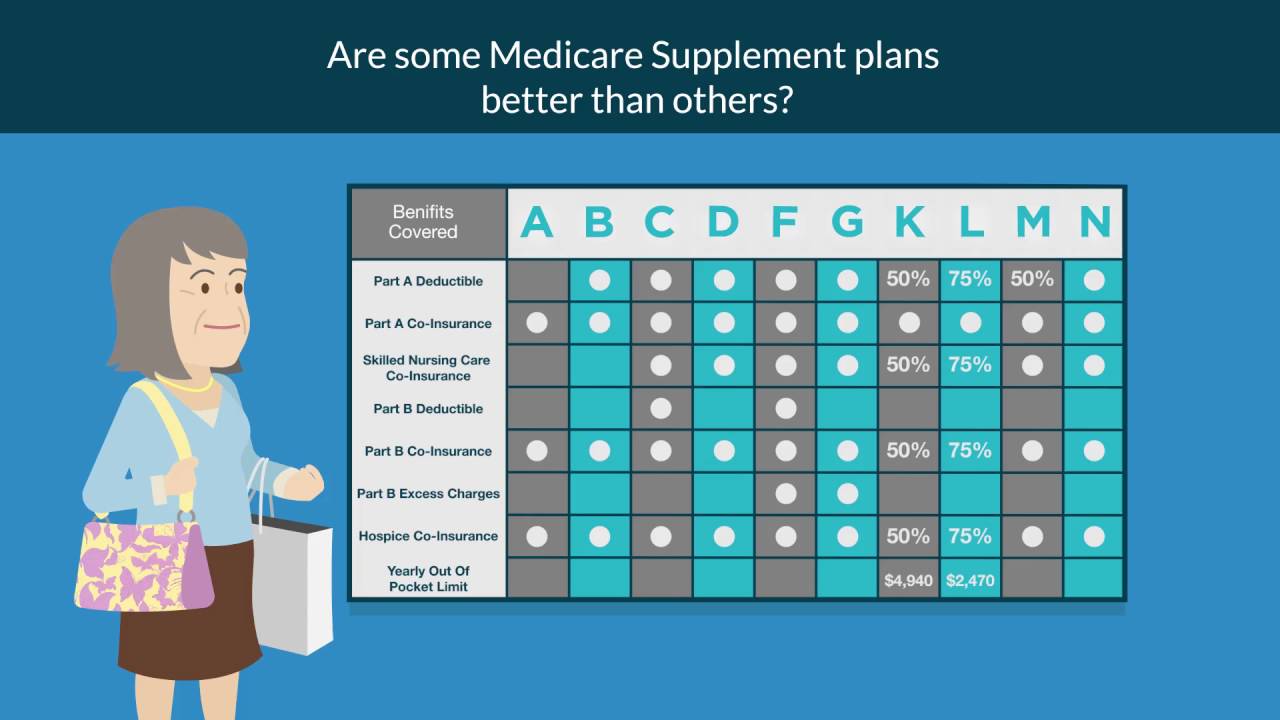

What are the different Medicare Supplement plans?

Different Medicare Supplement insurance plans cover different benefits, sometimes at different percentages. In most states up to 10 Medicare Supplement insurance plans, labeled A, B, C*, D, F*, G, K, L, M, and N, are available. Medicare Supplement insurance Plan A (not to be confused with Medicare Part A) is the most basic and fully covers four categories: 1 100% of hospital coinsurance up to 365 days after Medicare benefits are used 2 100% of Medicare Part B coinsurance or copayment 3 100% of first 3 pints of blood 4 100% of hospice care coinsurance

How much is Medicare Supplement 2020?

According to eHealth research, the average Medicare Supplement premium in 2020 was $157 per month. This research was limited to the plans included in this report, which were limited to a specific period of time.**. Private health insurance companies can price (or “rate“) their Medicare Supplement ...

What is issue age rated?

Issue-age-rated (also called “entry-age-rated“) For an “entry-age-rated” policy, the premium is based on your age when you first buy the Medicare Supplement insurance policy. The premium is lower for people who are younger and don’t go up as you get older.

What is community rated insurance?

Community-rated (also called “no-age-rated“) For a “no-age-rated” pricing plan, the same premium is generally charged to everyone regardless of age or gender. This means that someone who is 65 would pay the same monthly premium as someone who is 95.

What are out of pocket costs for Medicare?

These out-of-pocket costs could include copayments, coinsurance, and deductibles, among other costs. In most states, insurance companies that offer Medicare Supplement insurance plans must sell “standardized“ policies, meaning that each policy offers the same benefits, regardless of which insurance company sells it.

What is an attained age rated policy?

Attained-age-rated. For an “attained-age-rated” policy, the premium is based on your current age and goes up as you get older. This means that the premium for someone who is 75 will be higher than for someone who is 65, regardless of the age when they each bought a policy.

Does Medicare Supplement cover the same premium?

However, the Medicare Supplement insurance premium for the same policy may differ widely depending on the insurance company. Medicare Supplement insurance plan pricing can be affected by the benefits your plan covers, and when you buy the plan. If you buy the plan during your Medicare Supplement Open Enrollment Period, ...

How to find a Medigap policy?

Do any of the following: 1 Use our site to find a Medigap policy. 2 Call your State Health Insurance Assistance Program (SHIP). Ask if they have a "Medigap rate comparison shopping guide" for your state. SHIPs can give you free help choosing a policy. 3 Call your State Insurance Department . Ask if they keep a record of complaints against insurance companies that can be shared with you. Consider any complaints against the insurance company when deciding which Medigap policy is right for you. 4 Look online for information about the insurance companies. 5 Talk to someone you trust, like:#N#A family member#N#Your insurance agent#N#A friend who has a Medigap policy from the same Medigap insurance company 6 Call the insurance companies.

What is covered benefits and excluded services?

Covered benefits and excluded services are defined in the health insurance plan's coverage documents. you need and want while considering your current and future health care needs. You might not be able to switch policies later. Select which type of Medigap plan (A-N) ...