Can you add a Medicare Supplement at any time?

One interesting feature of Medicare Supplement insurance plans is that you can apply for a plan anytime – you only need to be enrolled in Medicare Part A and Part B. However, a plan doesn't have to accept your application, unless you have guaranteed-issue rights.

What is the most common form of supplemental Medicare coverage?

Medigap Plan FThe most popular Medicare Supplement Insurance plan is Medigap Plan F, according to the most recent statistics from America's Health Insurance Plans (AHIP). Due to recent legislation affecting Medigap plans, however, Plan G is quickly becoming the most popular Medicare Supplement plan for new Medicare beneficiaries.Oct 6, 2021

Can a Medicare Supplement plan be purchased at any time of the year?

If you're in good health and comfortable answering medical questions, you can apply to change Medigap plans at any time of the year. Medicare Advantage plans and Medicare Part D prescription drug plans can only be changed during certain times of year, but Medicare supplements are different.Jan 26, 2021

How much is a Medicare Supplement premium?

Medicare Supplement Plans have premiums that cost anywhere from around $70/month to around $270/month. Typically, plans with higher monthly premiums will have lower deductibles. Plans with lower monthly premiums typically have higher deductibles.

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is the difference between a Medicare supplement and a Medicare Advantage Plan?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

What is the maximum out-of-pocket for Medicare Advantage?

The US government sets the standard Medicare Advantage maximum out-of-pocket limit every year. In 2019, this amount is $6,700, which is a common MOOP limit. However, you should note that some insurance companies use lower MOOP limits, while some plans may have higher limits.Oct 1, 2021

How long does it take to get Medicare Part B after?

Most Medicare provider number applications are taking up to 12 calendar days to process from the date we get your application. Some applications may take longer if they need to be assessed by the Department of Health. We assess your application to see if you're eligible to access Medicare benefits.Dec 10, 2021

Does Medicare coverage start the month you turn 65?

For most people, Medicare coverage starts the first day of the month you turn 65. Some people delay enrollment and remain on an employer plan. Others may take premium-free Part A and delay Part B. If someone is on Social Security Disability for 24 months, they qualify for Medicare.

What is the monthly premium for Plan G?

Medicare Plan G will cost between $199 and $473 per month in 2020, according to Medicare.gov. You'll see a range of prices for Medicare supplement policies since each insurance company uses a different pricing method for plans.Jan 24, 2022

How much is deducted from Social Security for Medicare?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.Nov 24, 2021

What Is A Medicare Supplement Plan?

Let’s start with a bit of background about Medicare Supplement (also called Medigap) plans.Private insurance companies offer Medicare Supplement pl...

Is A Medicare Supplement Plan Right For You?

Ultimately you are the best judge of the type of insurance that meets your personal needs and lifestyle. However, if one or more of the following c...

How Do I Shop For The Best Medicare Supplement Plan?

Each standardized Medicare Supplement plan helps cover a different range of certain Medicare costs. For example, some plans may cover 100% of the M...

Who regulates Medicare Supplement Insurance?

Medicare Supplement Insurance plans are tightly regulated by the Centers for Medicare and Medicaid Services (CMS), a government agency. CMS determines what each letter plan will cover, and it requires each insurance company to offer the plan as is, without modifications.

How long does a Supplement 1 plan cover?

The Supplement 1 plan covers 120 days of mental health hospitalization and the state-mandated benefits, plus the deductibles for Medicare Part A and Part B, co-insurances for services at a skilled nursing facility under Part A, and emergency medical costs when traveling outside of the U.S.

What is a Medigap plan?

Also called Medigap because it covers “gaps” in costs after Medicare Parts A and B pay their share. Medigap Plans C and F, which cover the Medicare Part B deductible, are being discontinued in 2020. Sign up for Medigap during Open Enrollment to lock in the best premium for your plan. Our Approach.

What is covered by Plan A?

Plan A also covers 100% of coinsurances or copayments for hospice care services, 100% of Medicare Part B coinsurances or copayments for medical outpatient services, and 100% of the cost of the first three pints of blood you are administered during a procedure.

How much does Medicare pay for a doctor's visit?

Here’s an example with numbers: if the doctor’s visit had a Medicare-approved cost of $100, Medicare would pay $80, your Medigap would pay $15, and you would only have to pay $5.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Does Cigna cover Part B?

Warning. As of Jan. 1, 2020, Medicare Supplement plans sold to new Medicare recipients aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on Jan. 1, 2020. Medicare Supplement plans don't cover the costs ...

Does Medicare Supplement cover out of pocket costs?

As the cost of healthcare continues to increase, so do the out-of-pocket costs for services that are not covered by Original Medicare. Because it can be difficult to predict your exact health care needs and costs, Medicare Supplement plans are used to cover many of the services you may need.

Does Mutual of Omaha offer a discount?

Mutual of Omaha also offers a 7% discount if your spouse or domestic partner has applied for, or is applying for, coverage with Mutual of Omaha or an affiliate company. However, the company only offers three plans (F, G, and N).

How to choose a Medicare Supplement Plan?

Is a Medicare Supplement plan right for you? 1 You are enrolled in Medicare Part A and Part B and have many doctor visits or frequent hospitalizations. 2 You want the security of knowing you’ll have help with many of the medical expenses that Medicare Part A and Part B don’t completely cover. 3 You like the flexibility of being able to choose any doctor or hospital that accepts Medicare, possibly even when traveling throughout the United States 4 You divide your time between two homes in different regions of the United States and you want to be able to receive treatment from any doctor or health facility that accepts Medicare.

How does Medicare Supplement work?

When you buy a Medicare Supplement plan, you generally pay a premium to the insurance company for your coverage. Typically, as long as you continue to pay your premium and have Medicare Part A and Part B, your Medicare Supplement plan will be automatically renewed each year, although the premium amount may change.

Which states have different Medicare Supplement plans?

Massachusetts, Minnesota, and Wisconsin have different standardized Medicare Supplement plans than the 10 types offered elsewhere in the United States. Please note that all insurance companies won’t necessarily offer all the types of Medicare Supplement plans. When you buy a Medicare Supplement plan, you generally pay a premium to ...

Do you pay monthly premiums for Medicare Supplement?

Keep in mind that you do pay a monthly premium with a Medicare Supplement policy (and you still continue paying your Medicare Part B premium as well). Medicare Supplement plan premiums may vary by insurance company and among different plans. Generally speaking, the more coverage provided by the Medicare Supplement plan, the higher the premium.

Does Medicare Supplement cover deductible?

Each standardized Medicare Supplement plan helps cover a different range of certain Medicare costs. For example, some plans may cover 100% of the Medicare Part A deductible, some cover a portion of that deductible, and some plans don’t cover the deductible at all. Some plans may cover emergency medical care when you’re traveling ...

Is Medicare Supplement a good plan?

However, if one or more of the following circumstances is true for you, a Medicare Supplement plan may be a good choice. You are enrolled in Medicare Part A and Part B and have many doctor visits or frequent hospitalizations. You want the security of knowing you’ll have help with many of the medical expenses that Medicare Part A ...

Does Medicare Supplement Plan A include the same benefits?

For example, Medicare Supplement Plan A (not to be confused with Medicare Part A) includes the same benefits no matter where you buy this plan (however, some insurance companies might offer additional benefits). Massachusetts, Minnesota, and Wisconsin have different standardized Medicare Supplement plans than the 10 types offered elsewhere in ...

What is Medicare Supplement?

Medicare Supplement insurance plans are standardized in most states, meaning that plans of the same letter offered by different companies must cover the same basic benefits. However, pricing for the same plan may differ from company to company. Insurance companies use three ways to price Medicare Supplement insurance plans:

Is Medicare Supplement available to everyone?

Medicare Supplement insurance plans are not available to everyone. The first requirement is to be enrolled in Medicare Part A and Part B. When you become eligible for Medicare, you may have the choice to stay with Original Medicare (Part A and Part B) or go with a Medicare Advantage plan that covers your Medicare hospital and medical benefits (except for hospice care, which Part A still covers). Many Medicare Advantage plans also offer additional benefits, such as routine dental care. If you have Medicare Advantage, you can’t be sold a Medicare Supplement insurance plan.

Does Medicare Supplement cover out of pocket costs?

You may have heard that a Medicare Supplement (Medigap) insurance plan can help you pay for Original Medicare’s out-of-pocket costs, such as copayments, coinsurance and deductibles . Following the below steps may help you as shop for and enroll in a Medicare Supplement insurance plan.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

How to find a Medigap policy?

Do any of the following: 1 Use our site to find a Medigap policy. 2 Call your State Health Insurance Assistance Program (SHIP). Ask if they have a "Medigap rate comparison shopping guide" for your state. SHIPs can give you free help choosing a policy. 3 Call your State Insurance Department . Ask if they keep a record of complaints against insurance companies that can be shared with you. Consider any complaints against the insurance company when deciding which Medigap policy is right for you. 4 Look online for information about the insurance companies. 5 Talk to someone you trust, like:#N#A family member#N#Your insurance agent#N#A friend who has a Medigap policy from the same Medigap insurance company 6 Call the insurance companies.

What is covered benefits and excluded services?

Covered benefits and excluded services are defined in the health insurance plan's coverage documents. you need and want while considering your current and future health care needs. You might not be able to switch policies later. Select which type of Medigap plan (A-N) ...

What is Medicare Supplement Insurance?

Medicare Supplement Insurance is a type of supplemental medical insurance for seniors that is sold by private insurance companies to help cover some costs after Original Medicare (Medicare Parts A and B). These costs are mainly out-of-pocket expenses such as copayments and coinsurance for covered Medicare services.

How to contact HealthMarkets about Medicare Supplement?

Call a HealthMarkets licensed agent anytime at (800) 488-7621, or meet with a licensed agent near you.

How long is the open enrollment period for Medigap?

Your OEP lasts for 6 months. It starts on the first day of the month you’re 65 or older and enrolled in Medicare Part B. For example, if you turn 65 and enroll in Medicare Part B in May, then May 1 through October 31 would be the best time to enroll. 4

How long do you have to wait to buy Medicare Supplement?

You can buy Medicare Supplement Insurance if you have a pre-existing condition, but the insurance company could make you wait for up to 6 months before providing coverage related to your condition.

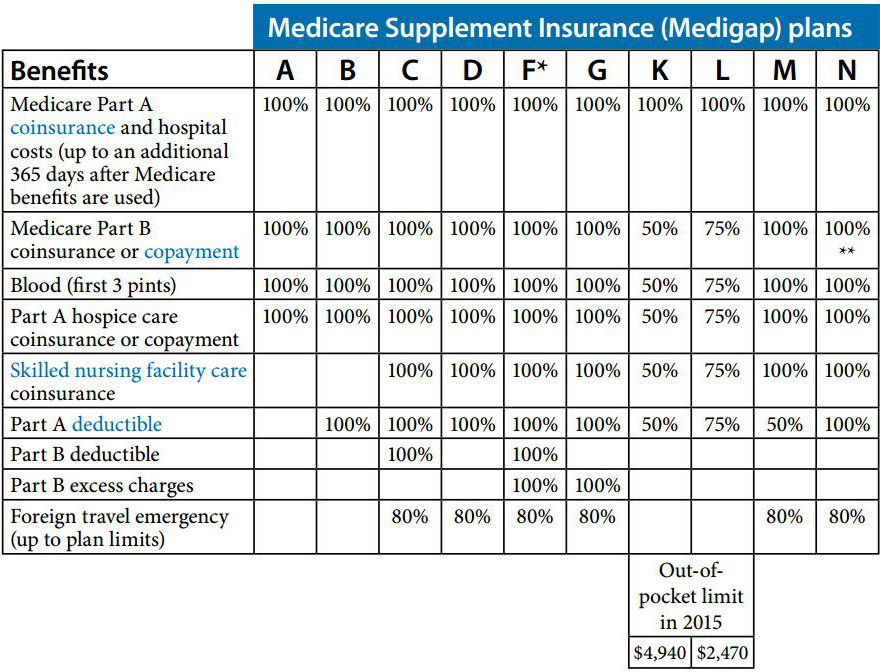

What percentage of Medigap benefits are covered?

As shown in the chart below, some Medigap plans provide no coverage for certain benefits, while other benefits are covered at either 50 percent, 75 percent, 80 percent, or 100 percent. 2.

When is the best time to enroll in Medicare?

It starts on the first day of the month you’re 65 or older and enrolled in Medicare Part B. For example, if you turn 65 and enroll in Medicare Part B in May, then May 1 through October 31 would be the best time to enroll. 4. If you choose to delay enrollment in Medicare Part B and you don’t buy a Medigap plan when you’re first eligible, ...

How long can you wait to get medical insurance?

If you had at least 6 continuous months (with no break in coverage for more than 63 days ) of prior creditable coverage, the insurance company is not allowed to make you wait before covering your pre-existing condition (s).