What is the current tax rate for Social Security and Medicare?

Mar 15, 2022 · Social Security and Medicare Withholding Rates. The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or ...

What is the Social Security tax base for 2018?

Nov 27, 2017 · The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion (OASDI) is 6.20% on earnings up to the applicable taxable maximum amount (see below). The Medicare portion (HI) is 1.45% on all earnings. Also, as of January 2013, individuals with earned income of more than

How much Medicare tax do I have to pay in 2018?

These rates are current for 2017. Costs for 2018 have not yet been released for Medicare Part A. Medicare Part B In 2018. Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you.

What is Medicare Part A in 2018?

Oct 16, 2017 · For 2018, an employee will pay: a. 6.2% Social Security tax on the first $128,700 of wages (maximum tax is $7,960.80 [6.2% of $128,400]), plus. b. 1.45% Medicare tax on the first $200,000 of wages ($250,000 for joint returns; $125,000 for married taxpayers filing a …

What is the Medicare tax rate for 2018?

1.45%Note: The 7.65% tax rate is the combined rate for Social Security and Medicare. The Social Security portion is 6.20% on earnings up to the applicable taxable-maximum amount. The Medicare portion is 1.45% on all earnings.

What is the SS and Medicare tax rates?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.Mar 15, 2022

What was the SS Max in 2018?

$128,400Maximum Taxable Earnings Each YearYearAmount2016$118,5002017$127,2002018$128,4002019$132,9004 more rows

How much of my Social Security is taxable for 2018?

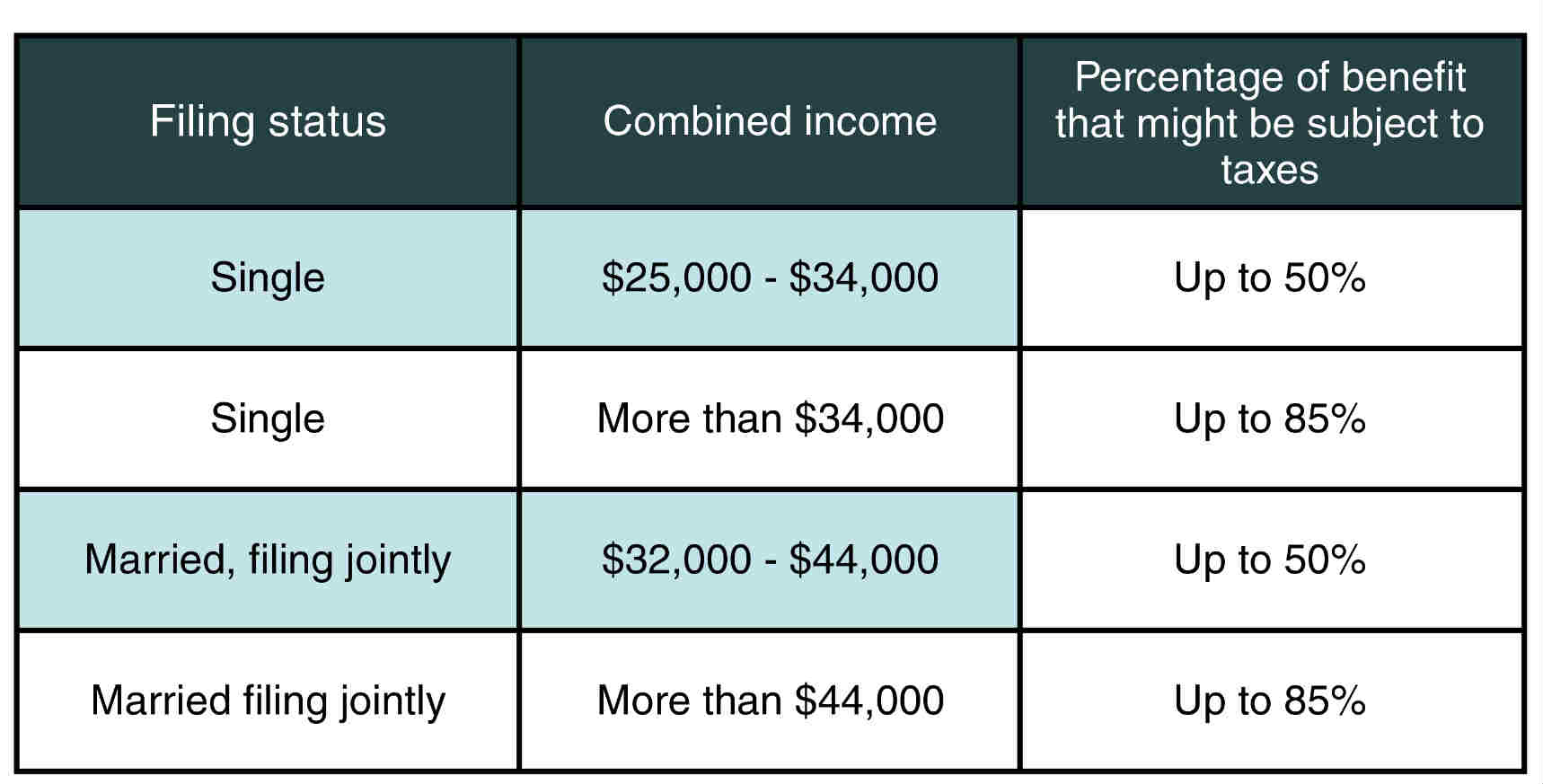

between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits. more than $34,000, up to 85 percent of your benefits may be taxable.

Does federal tax rate include SS and Medicare?

What is FICA tax? FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.Jan 13, 2022

How is Medicare tax calculated?

For both of them, the current Social Security and Medicare tax rates are 6.2% and 1.45%, respectively. So each party – employee and employer – pays 7.65% of their income, for a total FICA contribution of 15.3%. To calculate your FICA tax burden, you can multiply your gross pay by 7.65%.Jan 12, 2022

At what age do you stop paying Social Security?

The full retirement age is 66 if you were born from 1943 to 1954. The full retirement age increases gradually if you were born from 1955 to 1960 until it reaches 67. For anyone born 1960 or later, full retirement benefits are payable at age 67.Jan 1, 2022

At what age is Social Security no longer taxed?

At 65 to 67, depending on the year of your birth, you are at full retirement age and can get full Social Security retirement benefits tax-free.

At what age does Social Security stop being taxed?

Key Takeaways. Social Security benefits may or may not be taxed after 62, depending in large part on other income earned. Those only receiving Social Security benefits do not have to pay federal income taxes.

What portion of Social Security is taxable in 2021?

Here's how to know. If you file a federal tax return as an "individual" and your combined income is: Between $25,000 and $34,000: You may have to pay income tax on up to 50% of your benefits. More than $34,000: Up to 85% of your benefits may be taxable.Mar 17, 2021

Are Social Security benefits taxed after age 66?

Yes. The rules for taxing benefits do not change as a person gets older. Whether or not your Social Security payments are taxed is determined by your income level — specifically, what the Internal Revenue Service calls your “provisional income.”

Why is my Social Security tax higher than federal?

Assuming you mean "for" Social Security taxes, the answer is that it is typical for lower income employees to pay more Social Security and Medicare taxes than Federal Income tax.Jun 4, 2019

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

What is the discount for generic drugs?

If you fall into the donut hole, you’ll get a discount on the cost of your prescriptions. In 2018, the discount is: 56 percent for generic medications (you pay 44 percent) 65 percent for brand name drugs (you pay 35 percent)

What is catastrophic limit?

This will effectively close the coverage gap. As it stands, the catastrophic limit prevents you from paying higher prescription drug costs forever. Once you hit the catastrophic limit ($5,000 in 2018), you’ll only be responsible for about 5 percent of the cost of your medications for the rest of your plan year.

How much is Medicare Part B?

Premiums for Medicare Part B, which primarily covers doctors' visits and other outpatient care, can also change annually. For 2017 the base premium was $134, with higher earners paying more. For 2018, the standard monthly premium for Medicare Part B enrollees will stay at $134.

How much is Social Security financed?

Social Security is financed by a 12.4 percent tax on wages up to the taxable-earnings cap, with half (6.2 percent) paid by workers and the other half paid by employers. As a result, employers also will pay more in 2018, as their 6.2 percent share is applied to additional earnings.

What is the maximum amount of Social Security earnings?

Starting Jan. 1, 2019, the maximum earnings that will be subject to the Social Security payroll tax will increase by $4,500 to $132,900—up from the $128,400 maximum for 2018, the Social Security Administration announced Oct. 11, 2018.

What is the Medicare payroll tax rate?

For employers and employees, the Medicare payroll tax rate is a matching 1.45 percent on all earnings, bringing the total Social Security and Medicare payroll withholding rate for employers and employees to 7.65 percent each—with only the Social Security portion (6.2 percent) limited to the $128,700 taxable-maximum amount.

What is the standard deduction for 2018?

The 2017 tax act also makes the following income tax adjustments for 2018: The deduction for personal exemptions, which had been $4,050 for 2017, is suspended . The standard deduction for single taxpayers and married taxpayers filing separately rises to $12,000 from $6,350.

by William Reichenstein, William Meyer

The taxation of Social Security benefits affects many lower- and middle-income households, while the income-based structure of Medicare premiums affects many higher-income households.

The Taxation of Social Security Benefits

Here is an example to demonstrate how Social Security benefits are taxed. George is single, receives $25,000 per year in Social Security benefits and will be at least 65 years old at the end of 2018.

A Primer on Income-Based Medicare Premiums

The Affordable Care Act (ACA) instituted higher Medicare premiums for retirees as their income level increases. In general, Medicare premiums for one calendar year are based on modified adjusted gross income (MAGI) levels from two calendar years earlier. For Medicare premiums, MAGI is defined as adjusted gross income plus tax-exempt interest.

The Effect of Roth IRA Conversions on Medicare Premiums

Consider John and Jan. Jan is retired and John expects to retire within the next two years. They will both be on Medicare by 2020. John’s 2018 income affects their 2020 premium levels.

Discussion

Join a select group of investors who benefit from our educational mission. Sign up to receive exclusive AAII content to achieve your financial goals. Plus, receive the bonus special report: "Profitable Retirement Planning" 100% Privacy Guaranteed.

What is the Medicare tax rate?

The employee tax rate for Medicare is 1.45% — and the employer tax rate is also 1.45%. So, the total Medicare tax rate percentage is 2.9%. Only the employee portion of Medicare taxes is withheld from your paycheck. There’s no wage-based limit for Medicare tax. All covered wages are subject to Medicare tax. If you receive wages over $200,000 ...

How much Medicare tax do you pay if you are married?

If you receive wages over $200,000 a year, your employer must withhold a .9% additional Medicare tax. This will apply to the wages over $200,000. This is on top of the 1.45% employer tax rate. If you’re married, you might not have enough Medicare taxes withheld.

What is the Social Security tax rate for 2020?

The employee tax rate for Social Security is 6.2% — and the employer tax rate for Social Security is also 6.2%. So, the total Social Security tax rate percentage is 12.4%. Only the employee portion of Social Security tax is withheld from your paycheck. The 2020 wage-base limit is $118,500.

What is the income limit for married filing separately?

This also applies to married filing separately if your income is over $125,000. If this is the case, cover the additional Medicare taxes needed by: Adjusting your withholding. Making estimated payments.