Medicare. You can contact Medicare directly at 800-Medicare to get information on benefits, costs, and assistance programs like Medicare Savings Programs and Extra Help. SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

Full Answer

What is an irmaa in Medicare?

Medicare IRMAA: What Is It and When Does It Apply? What Is an IRMAA in Medicare? What is it? An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income.

What is the irmaa surcharge for Medicare Part B and Part D?

For high-income Medicare beneficiaries, Part B and Part D premiums include an additional charge based on your modified adjusted gross income. Medicare beneficiaries who are being assessed the IRMAA surcharge will receive notice from the Social Security Administration. | Image: fizkes / stock.adobe.com

What is the irmaa surcharge for 2021 Medicare premiums?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

How do I find my Irmaa?

If you need a replacement copy of your IRMAA letter you can obtain one from your local Social Security office, which can be located on the following website: www.socialsecurity.gov/onlineservices. This website can also be accessed to request a copy of the SSA-1099.

How do I know if I have to pay Irmaa?

SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year that you start paying IRMAA. The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income.

How is Medicare Irmaa billed?

If you have IRMAA Part D, you're billed monthly and it's included in this bill. Your Part D plan premium is different, and you must pay the plan premiums to your Medicare drug plan. If you have IRMAA for Part B, it's included in your Part B premium amount. Your IRMAA can change each year.

What is the Medicare Irmaa for 2020?

The law provides higher IRMAA levels for beneficiaries in this situation....C. IRMAA tables of Medicare Part B premium year for three previous years.IRMAA Table2020More than $326,000 but less than $750,000$462.70More than $750,000$491.60Married filing separatelyMore than $87,000 but less than $413,000$462.7012 more rows•Dec 6, 2021

How do I get a copy of my Irmaa letter?

If you need a replacement copy of your IRMAA letter you can obtain one from your local Social Security office, which can be located on the following website: http://www.socialsecurity.gov/onlineservices. This website can also be accessed to request a copy of the SSA-1099.

How do I change my Irmaa?

To request a new initial determination, submit a Medicare IRMAA Life-Changing Event form or schedule an appointment with Social Security. You will need to provide documentation of either your correct income or of the life-changing event that caused your income to decrease.

How do I find my Medicare premium amount?

Talk to someone about your premium bill For specific Medicare billing questions: Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. For questions about your Part A or Part B coverage: Call Social Security at 1-800-772-1213. TTY: 1-800-325-0778.

Is Irmaa paid directly to Medicare?

You pay your Part D IRMAA directly to Medicare, not to your plan or employer. You're required to pay the Part D IRMAA, even if your employer or a third party (like a teacher's union or a retirement system) pays for your Part D plan premiums.

Can I see my Medicare bill online?

You can use your online MyMedicare account to view your Medicare premium bills, check your payment history and set up Medicare Easy Pay for auto payments.

What is the Irmaa amount for 2021?

The IRMAA rises as adjusted gross income increases. The maximum IRMAA in 2021 will be $356.40, bringing the total monthly cost for Part B to $504.90 for those in that bracket. The top IRMAA bracket applies to married couples with adjusted gross incomes of $750,000 or more and singles with $500,000 or more of income.

What is the 2022 Medicare Irmaa?

Your 2022 IRMAA is based on your Modified Adjusted Gross Income (MAGI) from 2020. The Medicare Part B 2022 standard monthly premium is $170.10. Updated 2022 IRMAA brackets can increase Medicare Part B monthly premiums by as much as $408.20 and Medicare Part D monthly premiums by as much as $77.90.

What are the Irmaa surcharges for 2022?

How much are Part B IRMAA premiums?Table 1. Part B – 2022 IRMAAIndividualJointMonthly Premium> $114,000 – $142,000> $228,000 -$284,000$340.20> $142,000 – $170,000> $284,000 – $340,000$442.30> $170,000 – $500,000> $340,000 – $750,000$544.303 more rows

What is IRMAA?

IRMAA stands for Income Related Monthly Adjustment Amount. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years prior to determine if you owe an IRMAA in addition to your monthly premium.

Medicare Costs in 2022

The standard Part B premium amount in 2022 has increased to $170.10. Most people pay the standard Part B premium amount. If your Modified Adjusted Gross Income (MAGI) as reported on your IRS tax return from 2 years ago is above the limits listed below, you’ll pay the standard premium amount and an IRMAA.

Ways to Avoid IRMAA Surcharges

The primary way to avoid IRMAA surcharges involves planning, specifically income planning . If your Medicare Part B will start at age 65, and the IRMAA calculation is a two-year look back, you need to start your income planning prior to age 63.

The Takeaway

IRMAA surcharges have come as a surprise to many people because in the two years prior to Medicare eligibility, there’s a lot going on. And you don’t hear much about IRMAA surcharges until you’re hit with one, which is exactly the wrong time to learn about them.

What is the income bracket for IRMAA?

Income brackets are rounded to the nearest $1,000. IRMAA income brackets generally increased from $1,000 to $3,000 for individual tax filers, and between $2,000 and $6,000 for married couples filing jointly.

What is Medicare IRMAA 2020?

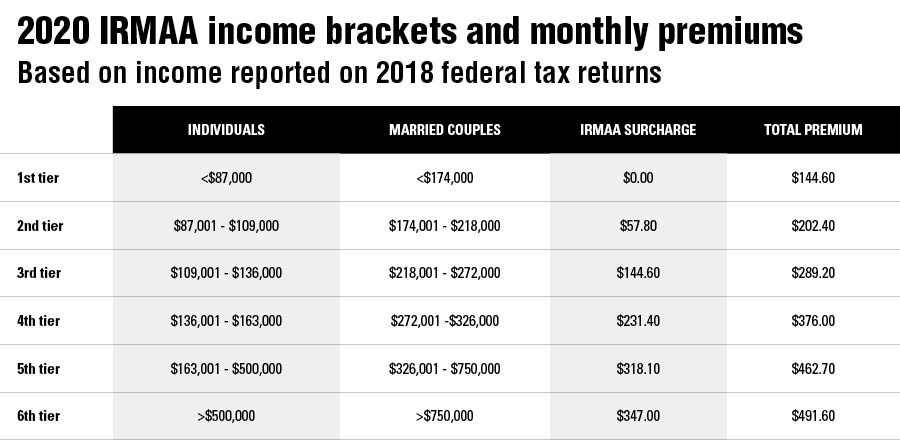

The 2020 Medicare IRMAA (Income-Related Monthly Adjusted Amount) was the additional surcharge some higher income earners pay on top of their Medicare Part B and Part D premiums.

What is the IRMAA bracket for 2020?

The chart below shows the IRMAA brackets for both individual and joint filers for 2020, based on their income from 2018. 2020 Medicare IRMAA Brackets. 2020 (based on 2018 individual tax return) 2020 (based on 2018 joint tax return) $86,000 or less. $172,000 or less.

When will IRMAA inflation increase?

For the first time in a decade, the income levels that determine IRMAA costs were indexeded according to inflation, using the consumer price index (CPI) from September 2018 to August 2019. Inflation rose 1.7% during that 12-month span. IRMAA income brackets will also increased 1.7% from 2019 to 2020.

How much is Medicare Part B?

The standard premium for Medicare Part B was $144.60 per month in 2020. This represented a $9.10 increase from the 2019 standard premium of $135.50 per month.

When will Medicare plan F and C be available?

This means that Medigap Plan F and Plan C will not be available to beneficiaries who became eligible for Medicare on or after January 1, 2020. Beneficiaries who became eligible before this date may still apply for Plan F or Plan C, if either plan is available where they live.

How much is the Part D coverage gap?

The initial coverage limit (the amount of money you will spend on covered prescription drugs before reaching the Part D “donut hole” coverage gap) increased from $3,820 in 2019 to $4,020 in 2020.

How is Medicare Part B Premium Figure?

Most people have a $0 premium for their Medicare Part A hospital insurance. But as you probably know there is a monthly premium assigned for your Medicare Part B . The standard Medicare Part B premium in 2021 is $148.50 per month. That is for individuals making less than $88,000 a year and joint earners making less than $176,000 a year.

What Is Medicare IRMAA?

Here is a web page from Medicare’s website on IRMAA. You can see here under the “What Is It Heading.” It states, You’ll get this notice if you have Medicare Part B and/or Medicare Part D and social security determines that any Income Related Monthly Adjustment Amounts (IRMAA) apply to you.

What Aspects of Medicare are Affected by IRMAA?

Medicare is an essential public service for the elderly here in America, which helps cover medical expenses in various terms. Some people will be more affected by these changes than others due to their specific needs when it comes down to coverage.

How Much is Medicare Part B Premium 2021?

The cost for Medicare Part B premium in 2021 is $148.50 per month, and an additional IRMAA surcharge may apply depending on your income. This surcharge amount varies based on how you filed taxes two years ago (IRS tax return information).

How much will IRMAA Charge Me for Medicare Part D?

It can be a little challenging to figure out the monthly premium for Medicare Part D plans. The company offering the policy will determine its price, and since there’s no standard, it could range from one program to another. But that’s not all! You also have to add surcharges into your calculations depending on how you filed taxes two years ago.

Important YouTube Channel Details

I appreciate you looking through my article. If it is interesting to you, please subscribe to my YouTube channel.

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

What is IRMAA Part D?

For Part D, the IRMAA amounts are added to the regular premium for the enrollee’s plan (Part D plans have varying prices, so the full amount, after the IRMAA surcharge, will depend on the plan).

What is the Medicare surcharge for 2021?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

Can I appeal an IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44.

Does Medicare distribution increase adjusted gross income?

The amount distributed is added to your taxable income, so exercise caution when you’re receiving distributions from qualified funds. This additional income will increase your Modified Adjusted Gross Income, and may subject you to higher Medicare Part B and Medicare Part D premiums.

How many income brackets are there for IRMAA?

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay.

What is the income used to determine IRMAA?

The income used to determine IRMAA is your AGI plus muni bond interest from two years ago. Your 2020 income determines your IRMAA in 2022. Your 2021 income determines your IRMAA in 2023. The untaxed Social Security benefits aren’t included in the income for determining IRMAA. As if it’s not complicated enough for not moving the needle much, ...

How long does it take to pay Medicare premiums if income is higher than 2 years ago?

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

What percentage of Medicare premiums do Medicare beneficiaries pay?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

How much does Medicare cover?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with ...

How much does Medicare premium jump?

If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

When will IRMAA income brackets be adjusted for inflation?

The IRMAA income brackets (except the very last one) started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and the projected brackets for 2022 coverage. Before the government publishes the official numbers, I’m able to make projections based on the inflation numbers to date.

What is IRMAA in Medicare?

What is IRMAA? IRMAA is an extra charge added to your monthly premiums for Medicare Part B (medical insurance) and Medicare Part D (prescription drug coverage). The income surcharge doesn’t apply to Medicare Part A (hospital insurance) or Medicare Part C, also known as Medicare Advantage. IRMAA charges are based on your income.

What to do if you have a higher income on Medicare?

If you’re a Medicare beneficiary with a higher-than-average income, the Social Security Administration ( SSA) could tack an extra charge onto the Medicare premiums you pay each month.

How long ago was IRMAA based on taxes?

Your IRMAA is based on tax returns from 2 years ago. If your circumstances have changed over those 2 years, you can file a form to let Medicare know about the reduction in your income.

How much Medicare premiums will I pay in 2021?

In 2021, most people pay for $148.50 per month for Medicare Part B. If your income is higher than those amounts, your premium rises as your income increases.

Does IRMAA count as income?

This way, it won’t count as income when IRMAA is calculated. It’s a good idea to work with a CPA or financial adviser to make sure you’re following IRS guidelines for making the donation. For example, you can have the check made out directly to the organization to ensure the IRS doesn’t count it as part of your income.

Does Medicare increase your monthly premiums?

Medicare increases monthly premiums for Part B and Part D coverage if your income is higher than certain limits. To avoid these surcharges, you’ll need to reduce your modified adjusted gross income. Talk with a CPA or financial adviser to determine which income-lowering strategy is best for your situation. If you’re a Medicare beneficiary ...

Is a Medicare savings account tax exempt?

Contributions to a Medicare savings account (MSA) are tax-exempt. If you contribute to an MSA, the withdrawals are tax-free as long as you’re spending the money on qualifying healthcare expenses. These accounts can lower your taxable income while giving you a way to pay for some of your out-of-pocket medical expenses.