Can I get my 1099-R form online?

Can I get a copy of my 1099-R?

Does Medicare send out 1099 forms?

What do I do if I didn't receive my 1099-R?

How do I know if I have a 1099-R?

How do I get a copy of my 1099-R form NJ?

How do I get my 1095-B form from HealthCare gov?

- Log in to your HealthCare.gov account.

- Under "Your Existing Applications," select your 2021 application — not your 2022 application.

- Select “Tax Forms” from the menu on the left.

- Download all 1095-As shown on the screen.

Is 1095 the same as 1095-B?

How do I get my 1095-B from Unitedhealthcare?

How do I get a copy of my 1099-R from Social Security?

- Using your online my Social Security account. ...

- Calling us at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, 8:00 am – 7:00 pm; or.

- Contacting your local Social Security office.

Can I get a copy of my SSA 1099?

The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income (SSI). With a personal my Social Security account, you can do much of your business with us online, on your time, like get a copy of your SSA-1099 form. Visit our website to find out more. See Comments.

How to check if I have a Social Security card?

If you receive benefits or have Medicare, your my Social Security account is also the best way to: 1 Get your benefit verification letter; 2 Check your benefit and payment information; 3 Change your address and phone number; 4 Change your direct deposit information; 5 Request a replacement Medicare card; or 6 Report your wages if you work and receive Social Security disability insurance or Supplemental Security Income (SSI) benefits.

When was the last update for Social Security?

Last Updated: February 22, 2019. Tax season is approaching, and Social Security has made replacing your annual Benefit Statement even easier. The Benefit Statement is also known as the SSA-1099 or the SSA-1042S.

What is a 1099-R?

The Form 1099-R is a tax document that TRS uses to report the payment of retirement benefits that an individual receives from TRS to the Internal Revenue Service (IRS). Who receives a Form 1099-R from TRS?

When will TRS send 1099-R?

TRS will begin sending the 1099-R forms in late January 2021. This form tells you how much TRS distributed to you during tax year 2020. From the time TRS sends this form until April 15, we receive numerous requests for duplicate copies.

How to get a copy of my 1099?

Here’s how to access your Form SSA-1099: 1 Simply login to your My Social Security Account at www.socialsecurity.gov and click on “Replacement Documents” on the far-right side of the screen (see image to the right for a reference of what this looks like). 2 This will take you to a page where you can access a copy of the form. You can then print it and/or save to your computer as a PDF.

What is a 1099 form?

The Social Security 1099 form (SSA-1099) is especially important if you’re currently receiving Social Security retirement or disability benefits. This document details the total retirement or disability benefits you received in the previous tax year, which needs to be properly reported on your income tax return.

How to check my Social Security benefits?

Here are a few other things you can do when logged in to your My Social Security account online: 1 View your Benefit Verification Letter 2 Change your address or phone number 3 Request a replacement Medicare card 4 Request a replacement Social Security card 5 Change your direct deposit information for Social Security benefits 6 Verify your Social Security benefit amount

Get a copy of your Social Security 1099 (SSA-1099) tax form online

Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

What is a Social Security Benefit Statement?

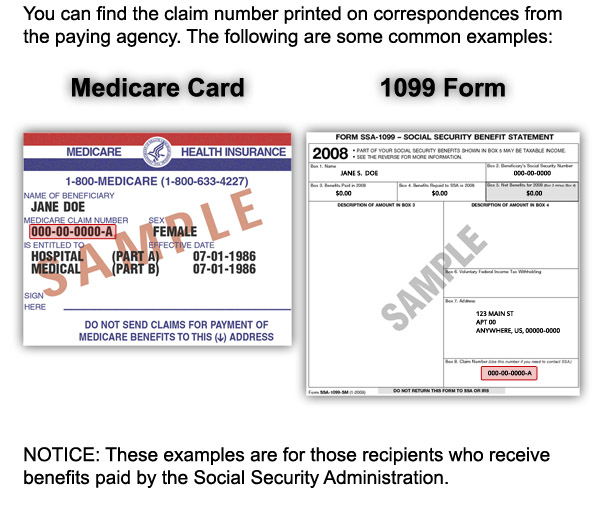

A Social Security 1099 or 1042S Benefit Statement, also called an SSA-1099 or SSA-1042S, is a tax form that shows the total amount of benefits you received from Social Security in the previous year. It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return.

Still have questions?

If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online, call our toll-free number at 1-800-772-1213 or visit your Social Security office. If you are deaf or hard of hearing, call our toll-free TTY number, 1-800-325-0778, between 8:00 a.m. and 5:30 p.m. Monday through Friday.