:max_bytes(150000):strip_icc()/AARP_MedPlans_Logo-48b3d1f020bb4e868337921e7744fdcd.jpg)

Is Medicare better than Advantage plans?

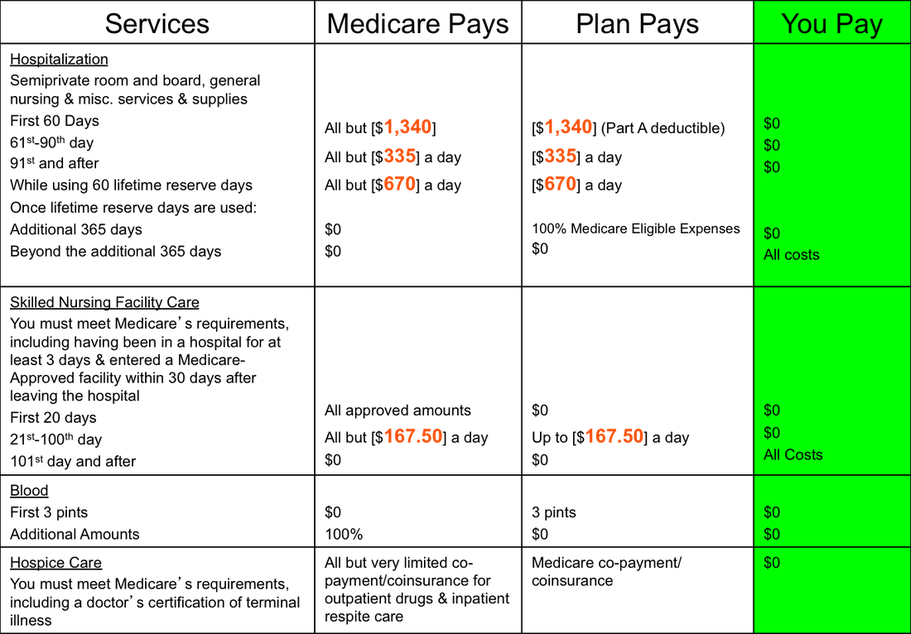

Medicare Supplement. Medicare Advantage. Monthly premiums. $50 to $250. Most people pay $0. Deductible. $0, but you pay the $198 Part B deductible with most plans.

Is it better to have Medicare Advantage or Medigap?

7 rows · Dec 27, 2021 · Medicare recipients have two options to help with additional coverage: Medicare Advantage and ...

What are the top 5 Medicare supplement plans?

Apr 09, 2021 · With a Medicare Supplement insurance plan, Medicare benefits are provided by Original Medicare while the Medigap plan covers the beneficiary’s share of the out-of-pocket costs associated with Original Medicare benefits. Both types of plans have their own specific advantages and disadvantages. It’s worth noting that you cannot enroll in both.

Why is Medicare Advantage better?

Aug 26, 2021 · Unlike Medicare Supplement, a Medicare Advantage plan does not fill in the gaps from Medicare. A Medicare Advantage plan coverage is considered an “all in one” option. This plan covers all the benefits of Part A and Part B, and may also include Part D. You may receive hearing, prescription drugs, dental, vision, and other benefits from Medicare Advantage coverage.

What is better an Advantage plan or a supplemental plan?

A Medicare Advantage plan may be a better choice if it has an out-of-pocket maximum that protects you from huge bills. Regular Medicare plus a Medigap insurance plan generally allows you more choice in where you receive your care.

What is the difference between a supplement and an Advantage plan for Medicare?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.Oct 1, 2021

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

Can I switch from Medicare Advantage to Medicare Supplement?

For example, when you get a Medicare Advantage plan as soon as you're eligible for Medicare, and you're still within the first 12 months of having it, you can switch to Medigap without underwriting. The opportunity to change is the "trial right."Jun 3, 2020

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

What is the highest rated Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Feb 16, 2022

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

How can Medicare Advantage plans have no premium?

Medicare Advantage plans are provided by private insurance companies. These companies are in business to make a profit. To offer $0 premium plans, they must make up their costs in other ways. They do this through the deductibles, copays and coinsurance.

Can I switch from an Advantage plan to a supplement?

You may have chosen Medicare Advantage and later decided that you'd rather have the protections of a Medicare Supplement (Medigap) insurance plan that go along with Original Medicare. The good news is that you can switch from Medicare Advantage to Medigap, as long as you meet certain requirements.

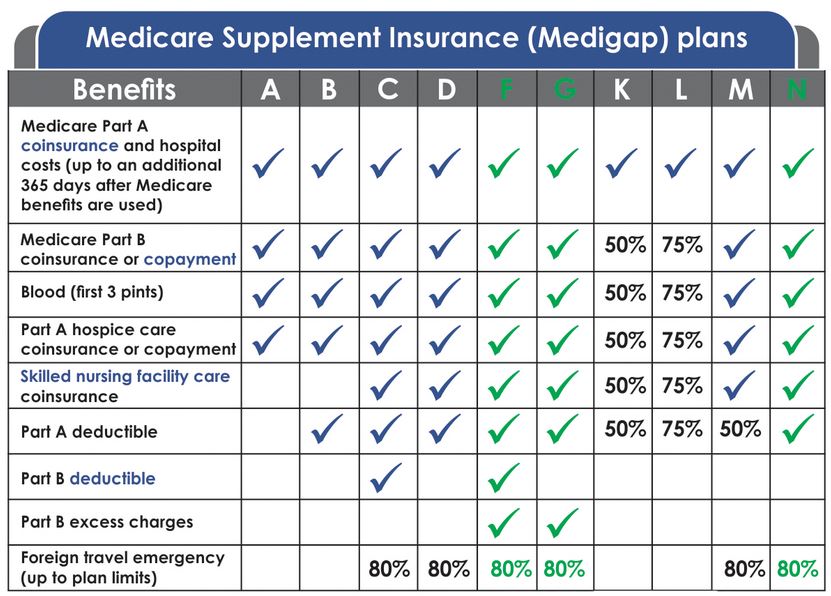

What is the most comprehensive Medicare plan?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Does getting a Medicare Advantage plan make you lose original Medicare?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

Should I switch from plan F to plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

What is Medicare Advantage?

Also known as Medicare Part C, Medicare Advantage is offered by a host of private insurance companies. Medicare Advantage plans cover everything that is covered by Original Medicare, including:

What is Medicare Supplement?

Medicare Supplement insurance, or Medigap, allows you to receive private health insurance benefits beyond those federally regulated by Medicare plans. They also provide Medicare beneficiaries with fewer out-of-pocket costs.

Medicare Supplement vs. Medicare Advantage: A Comparison

When deciding what options are best for your needs, it can help to look at the overall, big picture. Below is a side-by-side comparison to illustrating what is offered by each type of plan:

Next Steps In Deciding Which Plan To Enroll In

There are several other factors to consider when determining the best Medicare option for you. These include your financial situation, lifestyle, and the current and future condition of your health. The bottom line is that your Medicare choices are based on you as an individual.

What are the benefits of Medicare Advantage Plan?

The benefits of a Medicare Advantage plan may include the following, though may not always be the case as plan details and pricing can vary by insurance company. Potentially low monthly premiums. According to eHealth research,* the average monthly premium for a Medicare Advantage plan in 2021 for the period studied was $5.

What is Medicare Advantage?

With a Medicare Advantage plan, the beneficiary receives all of their services through the plan administered by a private insurance company contracted with Medicare rather than from the federal Medicare program. These plans must provide at least the same amount of coverage as Original Medicare, Part A and Part B, ...

How much is Medicare Supplement insurance in 2021?

According to eHealth research, the average premium of a Medicare Supplement insurance plan was $169 in 2021. Prescription drug coverage not included but can be added separately through a stand-alone Medicare Part D plan.

What is the difference between Medicare Supplement and Medigap?

With a Medicare Supplement insurance plan, Medicare benefits are provided by Original Medicare while the Medigap plan covers the beneficiary’s share of the out-of-pocket costs associated with Original Medicare benefits. Both types of plans have their own specific advantages and disadvantages.

What are the advantages and disadvantages of Medicare Advantage?

What are the benefits and disadvantages of Medicare Advantage? 1 Potentially low monthly premiums. According to eHealth research,* the average monthly premium for a Medicare Advantage plan in 2021 for the period studied was $5. This low number is in part due to the popularity of plans that have premiums as low as $0. 2 Prescription drug coverage included with most Medicare Advantage plans, known as a Medicare Advantage Prescription Drug plan or MA-PD 3 Possible ancillary benefits, such as routine dental, routine vision, and health club membership 4 Managed care, such as supervision of doctors by the plan, possible case management, sometimes a 24-hour nurse hotline 5 Availability to all individuals entitled to Medicare Part A and enrolled in Medicare Part B who reside within the service area, without regard to age or health conditions

How long does Medicare open enrollment last?

No medical underwriting if the plan is purchased during the Medigap Open Enrollment Period, which lasts six months beginning the month a beneficiary turns 65 and is enrolled in Medicare Part B. Disadvantages include: Potentially high monthly premiums.

Does Medicare cover cost sharing?

Minimal to no cost sharing for Medicare-covered services, depending on the plan. Freedom to see any provider that accepts Original Medicare, Part A and Part B (except with some Medicare SELECT plans) Freedom to use the plan nationwide (except with some Medicare SELECT plans)

Best of the Blues: Highmark

Service area: Available in Delaware, New York, Pennsylvania and West Virginia.

How to shop for Medicare Advantage plans

The right Medicare Advantage plan for you will depend on your health history, prescription medications and where you live, among other things. Here are some strategies for selecting the best plan:

The Best Overall Medicare Advantage Provider

MoneyGeek’s top pick for the best overall Medicare Advantage option is Blue Cross Blue Shield's preferred provider organization plans.

The Best Medicare Advantage Provider for HMO Plans

Among Medicare Advantage HMOs available in at least 25 states, MoneyGeek’s pick for the best carrier overall is UnitedHealthcare based on Medicare Star Ratings and the availability of robust extra benefits.

The Best Medicare Advantage Provider for Plans Without Drug Coverage

Prescription drug coverage is optional for Medicare members and is not included in Original Medicare. Though many Medicare Advantage plans include prescription drug coverage, you can choose a Medicare Advantage plan without drug benefits.

Best Medicare Advantage Provider for Low Out-of-Pocket Cost Plans

Medicare Advantage plans can be relatively low-cost, many with zero premiums. But the trade-off can come in the form of higher out-of-pocket costs. When evaluating the price of a plan, consider all the costs, not just the premiums.

What to Know About the Best Medicare Advantage Plans

It can be hard to determine which Medicare Advantage plan is right for you. Though there are standard quality ratings, the best plan for you will depend on your specific needs.

How to Get The Best Medicare Advantage Plan for You

More than 26 million people — 42% of all Medicare beneficiaries — enrolled in a Medicare Advantage plan in 2021, more than double the number enrolled a decade ago. There are only more Medicare Advantage options for people in 2022.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

What is the name of the insurance company that offers Medicare Supplement Plans?

Blue Cross Blue Shield. BlueCross Blue Shield (known as Anthem in some states, as well as BCBS) is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don't have to worry about sorting through health insurance information that doesn't apply to you.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

How to find Medicare premiums with United Medicare Advisors?

When it comes to finding plans and premiums with United Medicare Advisors, they provide a simple online form where you enter contact information such as your name, phone number, and email address. This same information is required by almost all Medicare Supplement Plan sites.

How much is the BCBS discount?

There is also a household discount of 5% if more than one household member is enrolled in a BCBS Medicare Supplement Plan. That discount is lower than many other insurers, who typically offer anywhere from 7% to 15% off, and sometimes that applies even if no one else is currently enrolled with you.

What is the Learn About Medicare tab?

Under the Learn About Medicare tab, you can find information on Medicare Supplement, Medicare Advantage, Prescription Drug Plans, and Medicare Parts A and B. They provide access to blogs covering health care news, retirement, and health wellness.