Medicare and a private health plan – Typically, Medicare is considered primary if the worker is 65 or older and his or her employer has less than 20 employees. A private insurer is primary if the employer has 20 or more employees. The primary insurance payer is the insurance company responsible for paying the claim first.

Full Answer

How is Medicare different from private insurance?

Dec 29, 2021 · Medicare and a private health plan Typically, Medicare is considered primary if the worker is 65 or older and his or her employer has less than 20 employees. A private insurer is primary if the employer has 20 or more employees.

Does Medicare cost less than private insurance?

Nov 25, 2020 · If you are a retiree with continuing health benefits, Medicare will always be primary. Your private health plan becomes a secondary plan. Another category that some fall into is the FEHBP. This is the Federal Employees Health Benefits Program. If you are covered by this program, you are not required to join Medicare Part B when you retire.

Is Medicare better to have as primary insurance?

Jul 22, 2014 · If your employer has less than 20 employees then Medicare is the primary payer (pays first) and the group health insurance pays in a secondary capacity. If your employer has more than 20+ employees then the group health insurance plan pays first and Medicare pays in a secondary capacity.

Is Medicare always your primary insurance?

May 06, 2021 · Medicare is government-funded health insurance that may help you save on your monthly medical costs but does not have a limit on how much you might pay out of pocket each year. Private health...

How do you determine which insurance is primary?

Primary insurance is a health insurance plan that covers a person as an employee, subscriber, or member. Primary insurance is billed first when you receive health care. For example, health insurance you receive through your employer is typically your primary insurance.Oct 8, 2019

Is Medicare always considered primary?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

Is Medicare the primary or secondary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Which insurance is primary when you have two?

If you have two plans, your primary insurance is your main insurance. Except for company retirees on Medicare, the health insurance you receive through your employer is typically considered your primary health insurance plan.

Does Medicare become primary at 65?

Medicare is primary when your employer has less than 20 employees. Medicare will pay first and then your group insurance will pay second. If this is your situation, it's important to enroll in both parts of Original Medicare when you are first eligible for coverage at age 65.Mar 1, 2020

Does Medicare cover copays from primary insurance?

Medicare will normally act as a primary payer and cover most of your costs once you're enrolled in benefits. Your other health insurance plan will then act as a secondary payer and cover any remaining costs, such as coinsurance or copayments.

What type of insurance is Medicare?

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

What is Medicare Part?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. coverage if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A." Most people get premium-free Part A.

What is Medicare Secondary Payer?

Medicare Secondary Payer (MSP) is the term generally used when the Medicare program does not have primary payment responsibility - that is, when another entity has the responsibility for paying before Medicare.Dec 1, 2021

What primary insurance means?

Primary insurance is health insurance that pays first on a claim for medical and hospital care. In most cases, Medicare is your primary insurer. See also: Secondary Insurance.

Can you have Medicaid and private insurance at the same time 2020?

If You're Eligible for Both Medicaid and Private Insurance Besides collaborating with other payers on a third-party basis, Medicaid may also arrange for private insurance plans and other entities to pay health care providers for services covered by Medicaid.Oct 3, 2021

Can you have two health insurances at the same time?

Yes, you can have two health insurance plans. Having two health insurance plans is perfectly legal, and many people have multiple health insurance policies under certain circumstances.Jan 21, 2022

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

How many employees does a spouse have to have to be on Medicare?

Your spouse’s employer must have 20 or more employees, unless the employer has less than 20 employees, but is part of a multi-employer plan or multiple employer plan. If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is the phone number for Medicare?

It may include the rules about who pays first. You can also call the Benefits Coordination & Recovery Center (BCRC) at 1-855-798-2627 (TTY: 1-855-797-2627).

What is private insurance?

Private insurance is offered by health insurance companies. You can access private insurance through individual or group plans. Many employers offer health coverage as part of their benefit. When health insurance is offered through an employer, the employer will generally pay a portion or all of the premium.

What are the different types of healthcare insurance?

If you purchase individual insurance, you can also access the federal Healthcare Marketplace. There are four tiers of coverage within the Healthcare Marketplace: 1 Bronze Plans: Cover 60% of healthcare costs. 2 Silver Plans: Cover 70% of costs. 3 Gold Plans: Cover 80% of costs. 4 Platinum Plans: latcosts.

What is Medicare Supplemental Insurance?

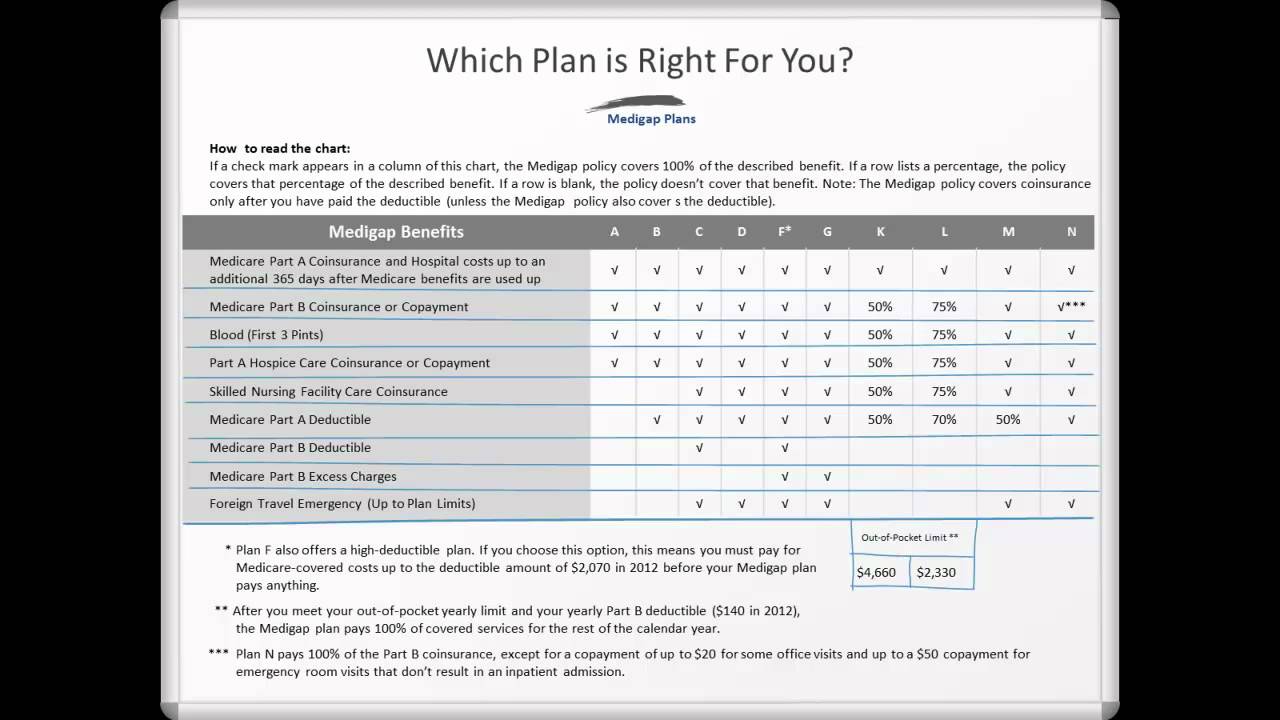

Medigap: These are Medicare supplement policies offered by private insurance companies to cover gaps in coverage and out-of-pocket costs. Medicare Supplemental insurance is not part of Original Medicare, but isregulated by Medicare. Medicare Parts A and B do not have a max on out-of-pocket costs. This is something to consider as you evaluate ...

How much is Medicare deductible for 2021?

Medicare has a sizable deductible anytime you are admitted into the hospital. In 2021, the deductible is $1,484. This tends to increase each year. Hospital stays can be expensive over time. For days 1-60, there is $0 coinsurance. You will pay the deductible. For days 61-90, there is a $371 co-insurance per day.

What happens if you apply for Medicare at any time?

If you apply at any time outside the window, there may be a lapse in coverage and penalties. If you are concerned about potential gaps in coverage between Medicare and private plans, Medicare has established options: Medicare Supplement plans and Medicare Advantage plans.

How much is Part B insurance in 2021?

You can defer signing up for Part B if you are still working and have insurance through your job or spouse’s health plan. The monthly Part B premium in 2021 is $148.50, but can be higher if your income is over $87,000. You are also subject to an annual deductible, which is $203 for 2021.

What is Plan A?

Plan A is the most basic plan. All other plans build off this coverage. Plan A covers Part A Medicare co-insurance, including an extra 365 days of hospital costs.Part B 20% co-insurance is covered, along with three pints of blood and Part A hospice care.

What is private insurance?

Private insurance plans are responsible for covering at least your preventative healthcare visits. If you need additional coverage under your plan, you must choose one that offers all-in-one coverage or add on additional insurance plans.

How many tiers of private insurance are there?

There are four tiers of private insurance plans within the insurance exchange markets. These tiers differ based on the percentage of services you are responsible for paying. Bronze plans cover 60 percent of your healthcare costs. Bronze plans have the highest deductible of all the plans but the lowest monthly premium.

What is deductible insurance?

Deductible. A deductible is the amount that you must pay out of pocket before your insurance company begins paying its share. Generally, as your deductible goes down, your premium goes up. Plans with lower deductibles tend to pay out much faster than plans with high deductibles.

What is the difference between silver and gold?

Silver plans cover 70 percent of your healthcare costs. Silver plans generally have a lower deductible than bronze plans but with a moderate monthly premium. Gold plans cover 80 percent of your healthcare costs. Gold plans have a much lower deductible than bronze or silver plans but with a high monthly premium.

How much does Medicare Advantage cost in 2021?

The most a Medicare Advantage plan can charge in out-of-pocket costs is $7,550 in 2021.

What is Medicare Advantage?

Medicare Advantage plans are a popular option for Medicare beneficiaries because they offer all-in-one Medicare coverage. This includes original Medicare, and most plans also cover prescription drugs, dental, vision, hearing, and other health perks.

Which has the lowest deductible?

Platinum plans cover 90 percent of your healthcare costs. Platinum plans have the lowest deductible, so your insurance often pays out very quickly, but they have the highest monthly premium.

How to learn more about Medicare?

How to Learn More About Your Medicare Options. Primary insurance isn't too hard to understand; it's just knowing which insurance pays the claim first. Medical billing personnel can always help you figure it out if you're having trouble. While it's not hard to understand primary insurance, Medicare is its own beast.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is a small employer?

Those with small employer health insurance will have Medicare as the primary insurer. A small employer means less than 20 employees in the company. When you have small employer coverage, Medicare will pay first, and the plan pays second. If your employer is small, you must have both Part A and Part B. Having small employer insurance without ...

Is Medicare a primary or secondary insurance?

Mostly, Medicare is primary. The primary insurer is the one that pays the claim first, whereas the secondary insurer pays second. With a Medigap policy, the supplement is secondary. Medicare pays claims first, and then Medigap pays. But, depending on the other policy, you have Medicare could be a secondary payer.

Does Medicare pay your claims?

Since the Advantage company pays the claims, that plan is primary. Please note that Medicare WON’T pay your claims when you have an Advantage plan. Medicare doesn’t become secondary to an Advantage plan. So, you’ll rely on the Advantage plan for claim approvals.

Can you use Medicare at a VA hospital?

Medicare and Veterans benefits don’t work together; both are primary. When you go to a VA hospital, Veteran benefits are primary. Then, if you go to a civilian doctor or hospital, Medicare is primary. But, you CAN’T use Veterans benefits at a civilian doctor. Also, you can’t use Medicare benefits at the VA.

Is Medicare primary insurance in 2021?

Updated on July 13, 2021. Many beneficiaries wonder if Medicare is primary insurance. But, the answer depends on several factors. While there are times when Medicare becomes secondary insurance, for the most part, it’s primary. Let’s go into further detail about what “primary” means, and when it applies.

How can you have private insurance and Medicare at the same time?

You can buy a private health insurance policy and enroll in Medicare with a few caveats. There are usually three types of situations where you can use a private health insurance policy while taking advantage of Medicare:

How does Medicare work with private insurance?

In other words, what is private insurance like for a Medicare recipient?

Should you use private health insurance while on Medicare?

Can you have affordable private insurance and Medicare if you sign up for Medicare later? You can, as you do not have to sign up for Medicare if you have private insurance and are working past 65.