Tier 4 Medicare prescription drug plans typically list Rytary on Tier 4 of their formulary. Generally, the higher the tier, the more you have to pay for the medication.

Full Answer

What does Medicare Part D cover?

Apr 16, 2021 · Under Medicare Part D, prescription drug plans are available from private, Medicare-approved insurance companies, so benefits and cost-sharing structures differ from …

Do Medicare Prescription Drug plans cover rytary?

Copay Range. $4 – $362. In the Deductible stage, you may be responsible for the full cost of your drug. Copay Range. $1 – $362. After your deductible has been satisfied, you will enter the Post …

What are the best Medicare Part D prescription drugs plans?

Jul 26, 2018 · Medicare offers prescription drug coverage (Part D) to everyone with Medicare. Medicare Part D plans are offered by private companies to help cover the cost of prescription …

Where can I find information about Medicare Part D drug coverage?

Mar 11, 2021 · AARP Medicare Rx, with services provided by United Healthcare, is an excellent all-round provider of Medicare Part D plans and is the only range of plans backed by AARP. This is …

Does Medicare D cover methylphenidate?

Is tadalafil covered by Medicare Part D?

Does Medicare Part D cover immunosuppressive drugs?

Is Sildenafil covered by Medicare?

Do any Part D plans cover Cialis?

Does Medicare cover Cialis Daily?

Are immunosuppressants covered by Medicare Part B?

Are chemotherapy drugs covered by Medicare Part D plans?

How much are immunosuppressant drugs cost?

Does Medicare cover erectile dysfunction?

Does Medicare pay for Viagra 2021?

Does Medicare cover erectile dysfunction pumps?

What Is Medicare Part D Prescription Drug Coverage?

As a Medicare beneficiary, you don’t automatically get Medicare Part D prescription drug coverage. This Medicare Part D coverage is optional, but c...

What Types of Medicare Part D Prescription Drug Plans Are available?

You can get Medicare Part D prescription drug coverage in two different ways, depending on whether you’re enrolled in Original Medicare or Medicare...

Am I Eligible For A Medicare Part D Prescription Drug Plan?

You’re eligible for Medicare Part D prescription drug coverage if: 1. You have Part A and/or Part B. 2. You live in the service area of a Medicare...

When Can I Sign Up For Medicare Part D Coverage?

As mentioned, you don’t have to enroll in Medicare Part D coverage. That decision will not affect the Original Medicare coverage you have, but if y...

What’S The Medicare Part D Coverage Gap (“Donut Hole”), and How Can I Avoid It?

The coverage gap (or “donut hole”) refers to the point when you and your Medicare Part D Prescription Drug Plan or Medicare Advantage Prescription...

What Does Medicare Part D Cost?

Your actual costs for Medicare Part D prescription drug coverage vary depending on the following: 1. The prescriptions you take, and how often 2. T...

Can I Get Help With My Medicare Prescription Drug Plan Costs If My Income Is Low?

As mentioned, Medicare offers a program called the Low-Income Subsidy, or Extra Help, for eligible people with limited incomes. If you are enrolled...

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What is Medicare Part D?

Part D, which is your prescription drug coverage. Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

Does Medicare Part D cover prescription drugs?

Under Medicare Part D, prescription drug plans are available from private, Medicare-approved insurance companies, so benefits and cost-sharing structures differ from plan to plan. However, the Center for Medicare and Medicaid Services (CMS) sets minimum coverage guidelines for all Part D plans. These rules require all plans to cover medications ...

How much does Medicare Part D cost?

These plans are private plans, which means each insurance company determines costs for its plans. Generally, you will pay a combination of the following out-of-pocket costs for your Medicare Part D coverage: 1 Monthly premiums 2 Annual deductible (maximum of $445 in 2021) 3 Copayments (flat fee you pay for each prescription) 4 Coinsurance (percentage of the actual cost of the medication)

What are the different types of Medicare?

There are four parts to the Medicare program: 1 Part A, which is your hospital insurance 2 Part B, which covers outpatient services and durable medical equipment (Part A and Part B are called Original Medicare) 3 Part C, or Medicare Advantage, which offers an alternate way to get your benefits under Original Medicare 4 Part D, which is your prescription drug coverage

Why was Medicare Part D created?

Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

What is a formulary in Medicare?

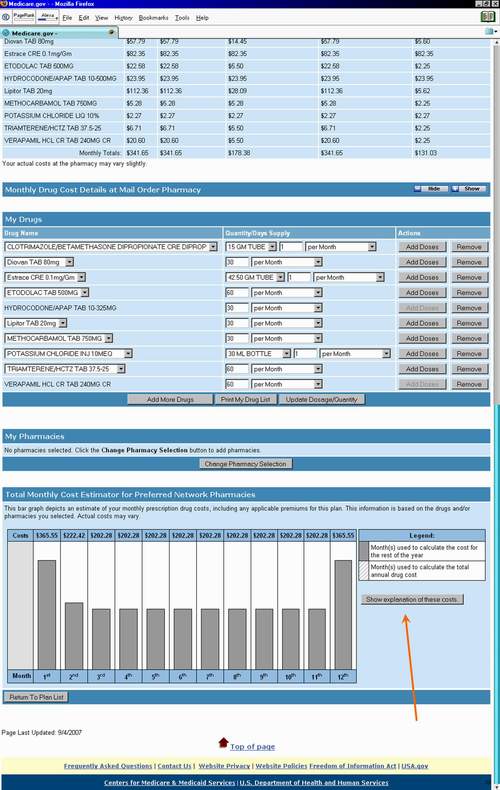

Each Medicare prescription drug plan uses a formulary, which is a list of medications covered by the plan and your costs for each. Most plans use a tiered copayment system. Prescription drugs in the lowest tiers, usually generic medications, have lower copayments.

What is coinsurance in Medicare?

Copayments (flat fee you pay for each prescription) Coinsurance (percentage of the actual cost of the medication ) Many Medicare Advantage plans include prescription drug coverage. If you enroll in a plan with Part D included, you typically won’t pay a separate premium for the coverage. You generally pay one monthly premium for Medicare Advantage.

Does Medicare cover prescription drugs?

No. In general, Medicare prescription drug plans (Part D) do not cover this drug. Be sure to contact your specific plan to verify coverage information. A limited set of drugs administered in a doctor's office or hospital outpatient setting may be covered under Medical Insurance (Part B).

How much does Medicare cover in the donut hole?

Therefore, you may pay more for your drug. Copay Range. $3 – $362. In the Post-Donut Hole (also called Catastrophic Coverage) stage, Medicare should cover most of the cost of your drug.

What is the post deductible stage?

After your deductible has been satisfied, you will enter the Post-Deductible (also called Initial Coverage) stage, where you pay your copay and your plan covers the rest of the drug cost. In the Donut Hole (also called the Coverage Gap) stage, there is a temporary limit to what Medicare will cover for your drug.

How to change Medicare plan?

You can join, switch, or drop a Medicare drug plan at these times: 1 When you are first eligible for Medicare (the 7-month period begins 3 months before the month you turn age 65, includes the month you turn age 65, and ends 3 months after the month you turn age 65). 2 If you get Medicare due to a disability, you can join during the 3 months before to 3 months after your 25th month of disability. You will have another chance to join 3 months before the month you turn age 65 to3 months after the month you turn age 65. 3 The Annual Enrollment Period, between October 15-December 7. Your coverage will begin on January 1 of the following year, as long as the plan gets your enrollment request by December 31. 4 Anytime, if you qualify for Extra Help or if you have both Medicare and Medicaid.

What is Medicare Part D?

Medicare Part D plans are offered by private companies to help cover the cost of prescription drugs. Everyone with Medicare can get this optional coverage to help lower their prescription drug costs. Medicare Part D generally covers both brand-name and generic prescription drugs at participating pharmacies.

Does Medicare cover generic drugs?

Whatever plan you choose, Medicare drug coverage will help you by covering brand-name and generic drugs at pharmacies that are convenient for you. Each Part D plan has a formulary – a list of medications the plan will cover. This list may also be referred to as a drug list, prescription drug list (PDL), or a covered medications list (CML).

What is the gap in Medicare?

The Medicare Prescription Drug Coverage Gap (the “Doughnut Hole”) Most Medicare Part D plans have a coverage gap, sometimes called the “Doughnut Hole.”. This means that after you and your drug plan have spent a certain amount of money for covered drugs, you have to pay all costs out-of-pocket for the drugs, up to a yearly limit.

What is the coverage gap for Medicare Part D?

Most Medicare Part D plans have a coverage gap, sometimes called the “Doughnut Hole.” This means that after you and your drug plan have spent a certain amount of money for covered drugs, you have to pay all costs out-of-pocket for the drugs, up to a yearly limit. Your yearly deductible, coinsurance or copayments, and what you pay while in the coverage gap all count toward this out-of-pocket limit. The limit does not include the drug plan’s premium or what you pay for drugs that are not on your plan’s formulary or prescription drug list.

Does Part D have a deductible?

Part D plans may have a monthly plan premium and a yearly deductible. These vary from plan to plan. You pay a portion of your drug costs, including a copayment or coinsurance. Costs vary depending on which drug plan you choose. Coverage options, including drug coverage, may vary from plan to plan.

When does the annual enrollment period start?

The Annual Enrollment Period, between October 15-December 7. Your coverage will begin on January 1 of the following year, as long as the plan gets your enrollment request by December 31. Anytime, if you qualify for Extra Help or if you have both Medicare and Medicaid.

What is the best Medicare Part D provider?

The best Medicare Part D providers include AARP, Humana Medicare Rx, WellCare, and Cigna-HealthSpring. If you’re eligible for Part D coverage, the three main considerations you’re likely to make are your current health, budget, and any medicine you take.

Does Medicare Part D have monthly premiums?

Similar to other commercial health insurance plans, Medicare Part D Prescription Drug Plans vary with the monthly premiums, depending on the company and the coverage and the prescriptions you need covered. Expert Advice.

Does Medicare Part D cover all medications?

Most companies offering Medicare Part D Prescription Drug Plans cover medications based on a tier program, and not all medications may be covered.

Is AARP a good Medicare plan?

AARP Medicare Rx, with services provided by United Healthcare, is an excellent all-round provider of Medicare Part D plans and is the only range of plans backed by AARP. This is the best Medicare Part D plan option for seniors as it mixes low co-pays with competitive premiums and has a network of preferred providers.

How long does Medicare Part D last?

There are three different enrollment periods for Medicare Part D, as follows: Initial enrollment period: This covers a total of seven months - three months before you turn 65, your birthday month itself, and then the three months directly after your 65th birthday. So seven months in total.

Is Medicare Part D low cost?

While prescription drugs costs under the majority of Medicare Part D plans are low, the amount you’ll pay will vary by the Part D provider. These are the most common expenses you’ll need to familiarize yourself with...

What is the Medicare Part D deductible for 2020?

In 2020, the allowable Medicare Part D deductible is $435. Depending on the provider you choose, plans may either charge the full deductible, a partial, or waive the deductible (zero deductible). You pay the network discounted price for prescription drugs until your plan equals the deductible.

Does Medicare pay for Part D?

Unlike Parts A and B, Part D drug coverage comes from private insurance companies, with Medicare paying a portion of the costs. You need to sign up as soon as you're eligible—if you don't, you may have to pay a late enrollment penalty later when you do enroll.

What is the difference between Medicare Advantage and Part D?

Medicare Advantage and Part D costs can vary on a number of important factors: provider, location, and most importantly, what medications need to be covered, but the main difference between the two will be in the cost of medication.

Is Cigna a Part D plan?

Cigna won this category based on the sheer number of drugs on its formulary. Prescription medication is, after all, the whole point of a Part D Plan, so it’s important to have as many options for your medication as possible.

Who is Stephanie Trovato?

Stephanie Trovato is a writer who specializes in researching consumer topics, and creating easy-to-understand articles to help consumers make informed decisions. Her experience in healthcare includes e-commerce, insurance advisements, mental health wellness and vitamin and supplement information.

Does Blue Cross Blue Shield offer estimates?

Unlike many other companies, Blue Cross Blue Shield doesn’t offer specific estimates on its main website based on your ZIP code , date of birth, and other information. It does, however, lay out the basics for Medicare and Medicare Part D right there on the page.

How many drugs does Cigna have?

Every company works from a "formulary," which is a list of prescriptions they cover. Cigna’s formulary includes more than 3,000 drugs, meaning there’s a much better chance that your medication is either covered or that you’ll be able to find an alternative option.

When was AARP founded?

AARP was founded in 1958, and was a trailblazer for the insurance of older people, especially since Medicare itself didn’t even exist until 1965. As such, AARP’s focus is 100% on patient understanding and comfort, and all of the information is written with you in mind.

Does Medicare Part D cover prescription drugs?

If you’re already taking prescription drugs, it’s important to see if the Medicare Part D plan you want covers your medication. In some cases, more than one or even all of the plans available in your area will cover your prescription drug . If you’re using the eHealth plan finder tool, just click “Add Rx Drugs” and type in your prescription.

What is the deductible for Medicare Part D?

A Medicare Part D deductible is an amount you have to pay out of pocket before the plan begins to pay. The federal maximum for the deductible is $405 in 2018.

Does Medicare have a stand alone plan?

Every Medicare beneficiary has access to at least one stand-alone Medicare Part D Prescription Drug Plan in 2018, according to the Centers for Medicare and Medicaid Services (CMS). This means that you, like most other Medicare beneficiaries, will have dozens of options to choose from when you’re looking for Medicare Part D Prescription Drug ...

What is the maximum deductible for Medicare?

A Medicare Part D deductible is an amount you have to pay out of pocket before the plan begins to pay. The federal maximum for the deductible is $405 in 2018. Some plans may set lower deductibles, such as Medicare Part D Plan Juliet in our example.

What is the out of pocket limit for Medicare Part D?

Some plans may set lower deductibles, such as Medicare Part D Plan Juliet in our example. All Medicare Part D plans have an out of pocket limit, which is $5,000 in 2018.

What is Medicare Part D cost sharing?

Compare Medicare Part D Plans Standard Retail Cost Sharing. Cost-sharing is what you pay every time you fill a prescription. Medicare Part D plans typically arrange medications into tiers, with lower-cost medications on the bottom of tiers and higher-cost medications on the higher tiers.

What is cost sharing in Medicare?

Cost-sharing is what you pay every time you fill a prescription. Medicare Part D plans typically arrange medications into tiers, with lower-cost medications on the bottom of tiers and higher-cost medications on the higher tiers. Here’s what Medicare Part D Plan Penelope and Medicare Part D Plan Juliet charge for prescriptions you fill: