How much does Medicare Part D cost per month?

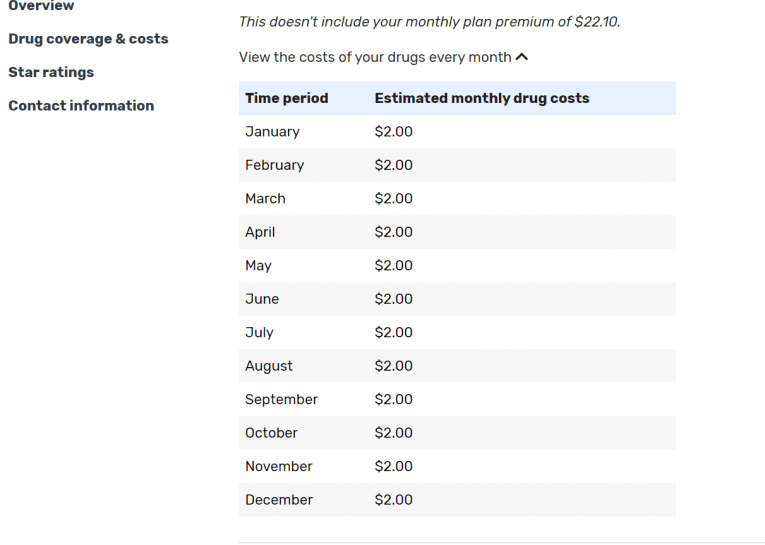

According to MyMedicareMatters.org, the national average monthly premium for a Part D plan is $33.19. However, the cost varies depending on the plan you choose and the area where you live. In addition, to really determine the best plan for you, you need to consider the cost of the drugs you take plus the deductible and premium.

What are the best Medicare Part D prescription drugs plans?

If you’re uncertain whether a Medicare prescription drugs plan is relevant to you, read our sections on 'Should I get a Medicare Part D plan?' and 'Who is Eligible for Medicare Part D?' to learn more. The best Medicare Part D providers include AARP, Humana Medicare Rx, WellCare, and Cigna-HealthSpring.

Where can I find information about Medicare Part D drug coverage?

Official Medicare site. Learn about the types of costs you’ll pay in a Medicare drug plan. Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

Which Medicare Part D plans have lowest copays?

Anthem Blue Cross (Anthem) Medicare Part D plans can offer copays as low as $0, and some plans can feature $0 deductibles. The Anthem network features over 68,000 pharmacies nationwide. Aetna offers Medicare Part D plans, including the SilverScript Choice Part D plan, which is available nationwide.

What is the best Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the best Medicare Part D plan for 2022?

The 5 Best Medicare Part D Providers for 2022Best in Ease of Use: Humana.Best in Broad Information: Blue Cross Blue Shield.Best for Simplicity: Aetna.Best in Number of Medications Covered: Cigna.Best in Education: AARP.

Is SilverScript a good Medicare Part D plan?

The SilverScript family includes several distinct plans. SilverScript was the only Medicare Part D prescription drug plan serving over half a million beneficiaries to earn a 4 out of 5 Star Rating from Medicare in 2020.

Are there any ways to avoid the Medicare Part D donut hole?

If you find yourself paying a lot for medicines, each year, check out whether you may be eligible for several prescription savings programs. People with 'Extra Help' see significant savings on their drug plans and medications at the pharmacy, and don't fall into the donut hole.

Is WellCare a good Part D plan?

Wellcare's Part D plans are relatively inexpensive, but their ratings aren't great. They have a below-average overall star rating from the Centers for Medicare & Medicaid Services, or CMS, and they're rated below average on eight out of 12 Medicare Part D quality measures.

Is GoodRx better than Medicare Part D?

GoodRx can also help you save on over-the-counter medications and vaccines. GoodRx prices are lower than your Medicare copay. In some cases — but not all — GoodRx may offer a cheaper price than what you'd pay under Medicare. You won't reach your annual deductible.

What is the difference between SilverScript choice and SilverScript Smart Rx?

The SilverScript Plus plan has no deductible and more coverage during the Part D donut hole, while the SilverScript Choice and SilverScript SmartRx plans offer lower monthly premiums.

Who bought out SilverScript?

Since 2006, CVS has sold its individual PDPs through a wholly-owned subsidiary called SilverScript Insurance Company. Similarly, Aetna has sold its individual PDPs since 2006. 7. How big is the PDP business for CVS?

Is CVS Caremark and SilverScript the same?

SilverScript is an affiliate of CVS Caremark. Your new plan through SilverScript will be the only prescription drug plan for Medicare-eligible Retirees of MPIHP.

Is the donut hole going away in 2021?

The Part D coverage gap (or "donut hole") officially closed in 2020, but that doesn't mean people won't pay anything once they pass the Initial Coverage Period spending threshold. See what your clients, the drug plans, and government will pay in each spending phase of Part D.

What will the donut hole be in 2021?

For 2021, the coverage gap begins when the total amount your plan has paid for your drugs reaches $4,130 (up from $4,020 in 2020). At that point, you're in the doughnut hole, where you'll now receive a 75% discount on both brand-name and generic drugs.

Do all Medicare Part D plans have a donut hole?

Once you and your Medicare Part D plan have spent a certain amount on covered prescription drugs during a calendar year ($4,430 in 2022), you reach the coverage gap and are considered in the “donut hole.” Not everyone will enter the “donut hole,” and people with Medicare who also have Extra Help will never enter it.

Is Medicare Part D worth it?

A prescription drug plan through Medicare Part D is worth it for most people who do not bundle their drug coverage into a Medicare Advantage plan....

What drugs are covered by Medicare Part D?

The list of covered drugs is determined by each insurance provider in what's known as a drug formulary. All companies are required to cover at leas...

How much does Medicare Part D cost?

Consumers pay an average of $33 per month for Medicare Part D plans. However, the amount you pay will vary based on the plan you choose and any inc...

How do you sign up for Medicare Part D?

You can sign up for a Medicare prescription drug plan through Medicare.gov. The online tool will guide you through the plans that are available in...

Best-rated Medicare Part D providers

Prescription drug plans, called Medicare Part D, are stand-alone policies purchased from private insurance companies. The plans give you coverage for specific drugs that are not included in your Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) coverages.

Kaiser Permanente: Best value Part D

Top-rated and affordable prescription plans, but only available in select regions.

BlueCross BlueShield (Anthem): Largest network of pharmacies

Expensive plans are well-rated, have a large pharmacy network and offer strong coverage options.

Humana: Best overall

Well-rated and affordable prescription drug plans, but Humana customers complain about slow customer service.

Cigna (Express Scripts): Best low-cost generic drugs

Well-rated and moderately priced Part D plans are available nationwide.

Centene (WellCare): Lowest monthly rates

Affordable and popular prescription drug plans, but many have high deductibles.

How to choose the best Medicare Part D plan for you

Most people will have about 30 Medicare Part D plans to choose from, and it's not always clear which is the best plan for your prescription medication needs. To help you choose your plan, ask yourself these seven questions:

How many Medicare Part D plans are there in 2021?

A total of 996 Medicare Part D prescription drug plans are available for Medicare beneficiaries in 2021. 1 And consumers in some states may have as many as 30 different plans from which to choose, offered by several different insurance companies. You can compare Medicare prescription drug plans online or by calling to speak with a licensed ...

What is the star rating system for Medicare?

The Centers for Medicare and Medicaid Services (CMS) uses a star ratings system to rate all Medicare Part D and Medicare Advantage plans. When you shop for Medicare prescription drug plans available where you live, you can use the Medicare Star Ratings as one factor you consider to help you find the right plan for you.

How much is Cigna Part D 2021?

Cigna offers three Medicare Part D plans that are available nationwide. The weighted average premium for these three plans in 2021 ranges from $24 to $50 per month. These three plans can feature copayments ranging from just $1 to $4 for Tier 1 (generic) drugs that are purchased in-network. 1.

What is Medicare Advantage?

Some Medicare Advantage plans offer additional coverage for things like dental, vision, hearing, transportation and more. When shopping for a Medicare prescription drug plan, you may want to review any Medicare Advantage plans available in your area that include prescription drug coverage.

Can you use the Star Ratings for Medicare?

When you shop for Medicare prescription drug plans available where you live, you can use the Medicare Star Ratings as one factor you consider to help you find the right plan for you. A licensed insurance agent can help you compare the Star Ratings of plans that are available where you live.

Is Medicare available in all locations?

Not all plans may be available in all locations. Your monthly premium may be higher if you waited to get Medicare prescription drug coverage. Copay and coinsurance amounts could be higher if you visit an out-of-network pharmacy, depending on what plan you choose.

When will Medicare Part D be updated?

Home / FAQs / Medicare Part D / Top 5 Part D Plans. Updated on June 3, 2021. Medicare prescription drug plan changes in 2021 are noteworthy. Also, by knowing what to expect, you can stay ahead of the game. Drugs can be costly, and new brand-name drugs can be the most expensive. With age, you’re more likely to require medications.

What is the best Medicare plan for 2021?

SilverScript. Humana. Cigna. Mutual of Omaha. UnitedHealthcare. The highest rating a plan can have is 5-star. Just because a policy is 5-star in your area doesn’t mean it’s the top-rated plan in the country. There is no nationwide plan that has a 5-star rating.

What are the options for United Healthcare?

The three options available with UnitedHealthcare include the Walgreens plan, Preferred, and Saver Plus plans. Those looking for a lower premium option with UHC need to look into the Walgreens policy.

What are the preferred pharmacies for Choice Plan?

For those with the Choice plan, there are fewer options. For example, the Choice plan preferred pharmacies are CVS, Walmart, and thousands of community-based independent drug stores. Then, the Plus plan includes CVS, Walmart, Publix, Kroger, Albertsons, as well as many grocery stores and retailers.

How much is Value Plan deductible?

The Value policy has no deductible on the first two tiers at preferred pharmacies. But, the Value plan has a $445 deductible on all other tiers. The Plus Plan has a deductible of $445 that applies to all tiers. However, the Plus plan has a broader range of drugs that have coverage.

Does Humana Part D have a deductible?

Humana Part D Reviews. Many generics with Humana have a $0 deductible. Further, they have a variety of plan options, something for everyone. The high deductible on brand name medications isn’t that great, and you have to go to Walmart to get the best savings.

Is Medicare Part D available in 2021?

There are many choices when it comes to Medicare prescription drug plans in 2021. And, if you're eligible for Medicare, you're eligible for Part D. You should always consult with an agent to ensure your drugs have coverage on the Part D formulary.

What is the difference between Medicare Advantage and Part D?

Medicare Advantage and Part D costs can vary on a number of important factors: provider, location, and most importantly, what medications need to be covered, but the main difference between the two will be in the cost of medication.

How much is the Choice Plan deductible?

Premiums can be a bit pricey (ranging from $22 to $50 for the Choice plan, and from $52 to $85 for the Plus plan) Choice Plan deductibles for Tier 3 prescription drugs and above can have higher deductibles, ranging from $205 to $445.

How many drugs does Cigna have?

Every company works from a "formulary," which is a list of prescriptions they cover. Cigna’s formulary includes more than 3,000 drugs, meaning there’s a much better chance that your medication is either covered or that you’ll be able to find an alternative option.

Does Medicare Part D cover Tylenol?

If a formulary doesn’t cover your prescription, it may cover a similar or generic medication (think Tylenol vs acetaminophen, or Prozac and fluoxetine). Your doctor may also be able to negotiate an exception.

Is Medicare Advantage less expensive than Medicare Part D?

A Medicare Advantage Plan is often less expensive in terms of prescription drugs since the plans are structured differently than a Part D plan. There’s also a longer list of medications that are covered with Medicare Advantage than you may find with Medicare Part D.

Does Blue Cross Blue Shield offer estimates?

Unlike many other companies, Blue Cross Blue Shield doesn’t offer specific estimates on its main website based on your ZIP code , date of birth, and other information. It does, however, lay out the basics for Medicare and Medicare Part D right there on the page.

Is Cigna a Part D plan?

Cigna won this category based on the sheer number of drugs on its formulary. Prescription medication is, after all, the whole point of a Part D Plan, so it’s important to have as many options for your medication as possible.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

What are some examples of complaints about a drug plan?

Complaints about your health or drug plan could include: Customer service: For example, you think the customer service hours for your plan should be different. Access to specialists: For example, you don't think there are enough specialists in the plan to meet your needs.

How long does it take to file a complaint with Medicare?

To file a complaint about your Medicare prescription drug plan: You must file it within 60 days from the date of the event that led to the complaint. You can file it with the plan over the phone or in writing. You must be notified of the decision generally no later than 30 days after the plan gets the complaint.

How long does it take to get a decision from a drug plan?

If it relates to a plan’s refusal to make a fast coverage determination or redetermination and you haven’t purchased or gotten the drug, the plan must give you a decision no later than 24 hours after it gets the complaint.

What are the most common Medicare complaints?

The Most Common Medicare Complaints. There are common Medicare complaints that many seniors express. Choosing Medicare plans can feel stressful, and it’s a big relief when you finally enroll. But it’s not always smooth sailing after that. Medicare can cost more than most people prepare for paying. Cost is a common complaint ...

Why do Medicare Advantage plans have referrals?

Advantage plans account for a large number of common Medicare complaints because out of pocket costs are different. With some Medicare Advantage plans, you must have a referral before the plan covers a visit to a specialist. If you buy a Medicare Advantage plan through us, our client care team can help you understand why your costs were not ...

Does Medicare Supplement cover Medigap?

Many people don’t understand that Medicare Supplement, or Medigap, plans to cover the same services as Medicare. If Medicare doesn’t cover a service, then Medigap won’t cover it either. Common Medicare complaints are really just misunderstandings of coverage. Having an agent that understands your needs is very important.

Does Medicare cost more than most people?

Medicare can cost more than most people prepare for paying. Cost is a common complaint among seniors, as well as coverage. There are times when people thought the coverage was enough, and that just wasn’t the case. Below we discuss some of the top Medicare complaints we see from clients.

Is Medicare complicated?

Medicare is complicated, and healthcare providers and insurance companies don’t always get things right. At MedicareFAQ, we want to help you understand Medicare and call us with any complaint, common or not. If you’re shopping for coverage, we’ll give you a free quote.

Is Medicare a ripoff?

When you consider the cost of Obamacare or employer health insurance , Medicare is not a ripoff. Most people will pay more in premiums when they’re under 65 than when they turn 65.

Does Medicare Advantage work?

But sometimes your plan doesn’t work the way you thought it would.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

What is the name of the insurance company that offers Medicare Supplement Plans?

Blue Cross Blue Shield. BlueCross Blue Shield (known as Anthem in some states, as well as BCBS) is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don't have to worry about sorting through health insurance information that doesn't apply to you.

How to find Medicare premiums with United Medicare Advisors?

When it comes to finding plans and premiums with United Medicare Advisors, they provide a simple online form where you enter contact information such as your name, phone number, and email address. This same information is required by almost all Medicare Supplement Plan sites.

How much is the BCBS discount?

There is also a household discount of 5% if more than one household member is enrolled in a BCBS Medicare Supplement Plan. That discount is lower than many other insurers, who typically offer anywhere from 7% to 15% off, and sometimes that applies even if no one else is currently enrolled with you.

What is the Learn About Medicare tab?

Under the Learn About Medicare tab, you can find information on Medicare Supplement, Medicare Advantage, Prescription Drug Plans, and Medicare Parts A and B. They provide access to blogs covering health care news, retirement, and health wellness.

How many states does United Medicare Advisors work in?

While this is fairly common in today's internet age, it's still something to note. Another fact is that United Medicare Advisors is active in 44 states, leaving out Alaska, California, Hawaii, Massachusetts, New York and Rhode Island. If you live in one of those states, you should keep reading further in our reviews.

How long do you have to file a complaint with Medicare?

The plan’s notices don’t follow Medicare rules. If you want to file a complaint, you should know the following: You must file your complaint within 60 calendar days from the date of the event that led to the complaint. You may file your complaint with the plan over the telephone or in writing. You must be notified of the decision generally no later ...

How long do you have to notify Medicare of a decision?

You must be notified of the decision generally no later than 30 days after the plan gets the complaint. If the complaint relates to a plan’s refusal to expedite a coverage determination or redetermination and you haven’t yet purchased or received the drug, the plan must notify you of its decision no later than 24 hours after it gets the complaint.

Does a health insurance plan give you a decision?

The plan doesn’t give you a decision about a coverage determination or first level appeal within the required timeframe. The plan didn’t make a timely decision on your coverage determination request tor first-level appeal and didn’t send your case to the Independent Review Entity (IRE).