What parts of Medicare are means tested?

The Medicare Prescription Drug, Improvement, and Modernization Act (MMA) of 2003 introduces means-testing of premiums and benefits in two ways. It will means-test the Part B premium, setting higher premiums for better-off seniors.

Are Medicare premiums means tested?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Are Social Security and Medicare means tested?

It provides a foundation of retirement protection for people at all earnings levels. It encourages private pensions and personal saving because it isn't means-tested — it doesn't reduce or deny benefits to people whose income or assets exceed a certain level.Mar 4, 2022

What is Medicare Part B premium only?

The Medicare Part B premium is a monthly fee that Medicare beneficiaries pay if they choose to enroll in it to supplement the services available to most seniors for free with Medicare Part A. Medicare Part A is hospital insurance.

Does Social Security have a means test?

In its simplest form, means-testing would look at the annual income of Social Security beneficiaries and determine, based on that income, whether they'd receive a reduced benefit check, or no benefit check at all.Aug 16, 2018

What is the meaning of means tested?

Key Takeaways. A means test determines if a person or household is eligible to receive some sort of benefit or payment. Means-tested benefits include many government assistance and state and federal welfare programs that measure a family's income against the federal poverty line.

Which of the following is a non means-tested program?

The largest non–means-tested programs are Social Security, most of Medicare, and civilian and military retirement programs.Jun 17, 2019

Why is Social Security not means-tested?

Retirees who earned comparatively higher wages receive higher benefits than those who earned lower wages, the reasoning would go, therefore the program cannot possibly be means tested.

Which benefits are means-tested benefits?

The means-tested benefits are: Pension Credit. Housing Benefit. The Council Tax Reduction Scheme.Feb 3, 2022

Is MA and Part C the same thing?

A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

What is the difference between Medicare and Medicare premium?

The plan pays the full cost of your care after you reach the limit. Definitions: Premium: The monthly fee you pay to have Medicare or your health plan. Deductible: What you must pay before Medicare or your health plan starts paying for your care.

Who qualifies for QMB?

In order to qualify for QMB benefits you must meet the following income requirements, which can also be found on the Medicare Savings Programs page:Individual monthly income limit $1,060.Married couple monthly income limit $1,430.Individual resource limit $7,730.Married couple resource limit $11,600.

When will Medicare testing brackets be indexed?

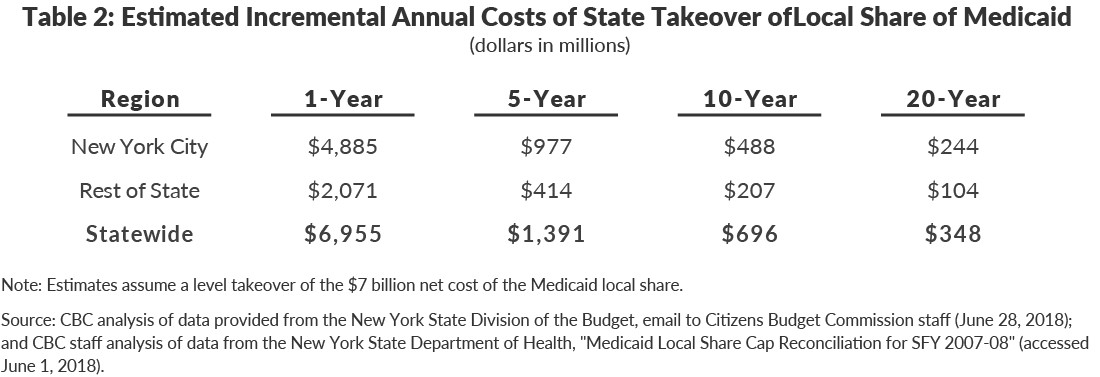

The Medicare trustees announced in September 2019 that means testing brackets will be indexed for infl ation starting in 2020, based on the CPI-U or Consumer Price Index for Urban Consumers. That’s good news for a˝ uent retirees. For 2020, means testing income brackets 1-5 will be adjusted for infl ation by 1.7%.

What is RMD in Medicare?

Required Minimum Distributions (RMDs) from tax-deferred retirement savings accounts can trigger hundreds of thousands of dollars in Medicare “means testing” surcharges during retire-ment in the form of higher premiums on Medicare Part B and Part D. Medicare means testing can threaten the retirement plans of millions of auent Americans. Smart financial planning can minimize the damage.

How much will Medicare Part B premiums increase in 2020?

That’s not a political statement. It’s math. And it’s why the Medicare trustees expectMedicare Part B premiums on average to rise 5.17% annually from 2020 to 2027.8. “ When Medicare was launched in 1966, there were 4.6 Americans in the workforce to sup- port each Medicare en- rollee.

How much does Medicare cost for a 50 year old?

Medicare premiums represent a signifi cant and growing retirement expense. A 50 year-old couple will pay a minimum of $419,914 in Medicare Part B and Part D premiums through age 90. That excludes premiums for supplemental coverage and out-of-pocket expenses.

Is Medicare testing a risk?

Medicare means testing is a largely unknown risk with potential to wreck the retirement plans of many Americans. Current Medicare means testing policy is especially punitive to Americans who have been good savers using tax-deferred accounts.

Is a 403b tax free?

The most commonly used retirement accounts, such as a traditional 401(k), 403(b), IRA, or qualifi ed annuity, are tax-deferred, not tax-free. Uncle Sam let you take a tax deduction when you made contributions, but that doesn’t mean he isn’t coming for your money eventually.

Is Medicare Part A free?

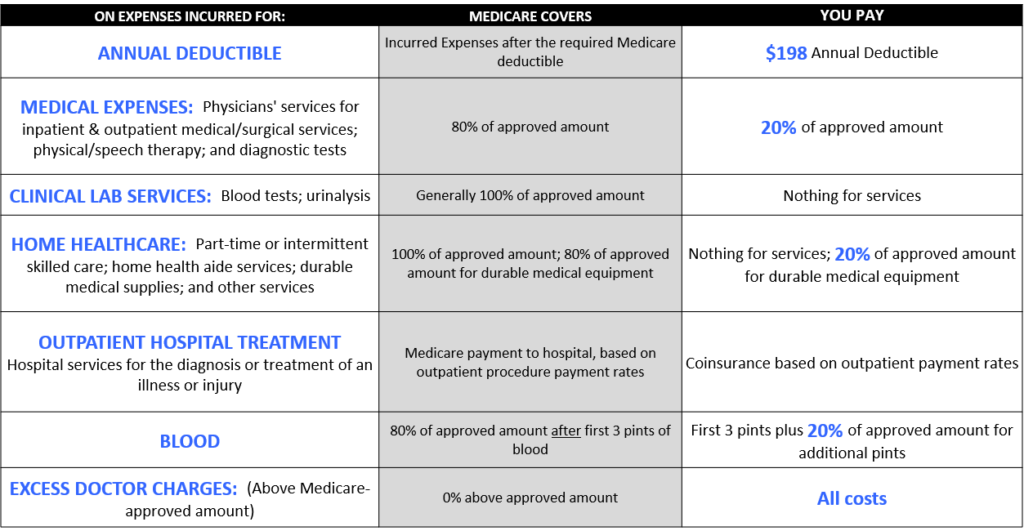

Traditional Medicare services consist of Part A (hospital care), Part B (outpatient), and Part D (drug). Many retirees mistakenly think Medicare is free because they’ve been paying into the system for their working lives. However, for most retirees, Part A is free while Part B and Part D have monthly premiums, usually deducted from Social Security checks.

What are the three parts of Medicare?

APTA guidelines/standards. Medicare. Federal government program that gives you health care coverage if you are 65 or older or have a disability, no matter what your income. Three parts: -part A (hospital insurance) -part B (optional medical insurance-outpatient)

How long is the Medicare benefit period?

First 60 days - pay onetime deductible then Medicare pays 100% $1260. 61-90 days of benefit period - copay per day $315.

What is Medicare Advantage Plan?

Most commonly known as Medicare advantage plan. Medicare coverage through a private health plan, such as an HMO or PPO. Provides all your you med A and B coverage along with extras such as vision, hearing, dental. CMS. Centers for Medicare and Medicaid services is the federal agency that oversees Medicare. Part A.