Our recommendations for the best Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

UnitedHealth Group

UnitedHealth Group Incorporated is an American for-profit managed health care company based in Minnetonka, Minnesota. It offers health care products and insurance services. It is the largest healthcare company in the world by revenue, with 2018 revenue of $226.2 billion and 115 million cu…

Aetna

Aetna Inc. is an American managed health care company that sells traditional and consumer directed health care insurance and related services, such as medical, pharmaceutical, dental, behavioral health, long-term care, and disability plans, primarily through employer-paid insuranc…

Full Answer

Does AARP offer the best Medicare supplemental insurance?

We chose AARP as best for its set pricing for Medicare Supplement coverage because it doesn’t charge more as you grow older. This is especially helpful if you are still covered under your...

What is the best AARP Medicare supplement plan?

What Does AARP Medicare Supplement Plan G Cover?

- Plans C and F are not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020.

- Plans F and G also offer a high deductible plan which has an annual deductible of $2,370 in 2021. ...

- Plan K has an out-of-pocket yearly limit of $6,220 in 2021. ...

Is Humana a good Medicare supplement?

With Medicare supplemental plans available in all 50 states, Humana rates above-average, due to its offerings, customer experience, and financial stability. The company offers eight out of ten Medigap plans, thereby covering a large swathe of benefits, with other features, such as dental and vision, available as add-ons.

What are Medicare supplement plans does Humana offer?

Humana Medicare Supplements are available to all Connecticut beneficiaries, ages 65 and older, who are enrolled in Medicare Part B Medicare Part B is medical coverage for people with Original Medicare benefits. It covers doctor visits, preventative care, tests, durable medical equipment, and supplies.

What is the difference between AARP and Humana?

AARP makes money by licensing its name to a private insurer that offers a Medicare Advantage plan. Humana is a different private insurer that takes money from the government to provide an Advantage plan. Humana contracts with the Centers for Medicare and Medicaid Services in a program called Medicare Advantage.

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

What is the most widely accepted Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

What company has the best Medicare Advantage program?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states. Overall, Aetna Medicare ranks the best in the most (23) states.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the most comprehensive Medicare Supplement plan?

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It leaves you with 100% coverage after Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductible and the Medicare Part B 20% coinsurance.

Can you have Medicare and Humana at the same time?

People eligible for Medicare can get coverage through the federal government or through a private health insurance company like Humana. Like Medicaid, every Medicare plan is required by law to give the same basic benefits.

How do I choose a Medicare supplement plan?

Follow the steps below to purchase your Medigap plan:Enroll in Medicare Part A and Part B. ... Find which insurance companies in your state are licensed to sell Medigap plans by visiting Medicare.gov.Compare costs between companies. ... Select a Medigap plan that works best for you and purchase your policy.

What is the biggest disadvantage of Medicare Advantage?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Are there disadvantages to a Medicare Advantage plan?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

What Medicare Advantage plans do not cover?

Most Medicare Advantage Plans offer coverage for things Original Medicare doesn't cover, like fitness programs (like gym memberships or discounts) and some vision, hearing, and dental services. Plans can also choose to cover even more benefits.

What is the best Medicare Advantage plan for 2022?

The Best Medicare Advantage Plans of 2022Best User Quality: Cigna.Best User Experience: Humana.Best in Educational Content: Aetna.Best for Bonuses: AARP.Best for Simplicity and Clarity: Blue Cross Blue Shield.

What is open enrollment?

Everyone has a six month Medigap open enrollment period. This open enrollment period begins when you enroll in Medicare Part B (Part A enrollment...

Who has Guaranteed Issue?

In addition to the consumer protections provided by open enrollment, people in certain situations have Guaranteed Issue. Guaranteed Issue is the st...

What if I have Medicare but I’m not a senior?

If you are younger than 65 but you have Medicare due to disability, insurance companies in about half of all states are required to offer you at...

What does Medicare Supplement coverage exclude?

Medicare Supplement plans typically do not cover extended nursing home stays, private nurses, vision care, dental care, hearing aids, or prescripti...

Can I visit any doctor or hospital that accepts Medicare?

For most Medicare Supplement plans, you can visit any doctor or hospital that accepts Original Medicare. Your Medicare Supplement coverage will kic...

Is Medigap the same as Medicare Supplement insurance?

Yes, Medigap and Medicare Supplement Insurance are exactly the same. Government websites tend to use the term Medigap and private companies more co...

How can I avoid Medicare scams?

Although searching online for Medicare Supplement will yield many results, not every search result can be trusted. Some of what you will see advert...

Under what circumstances can my policy be canceled?

If you neglect to pay your premiums on time, if you gave incorrect or misleading information on your initial application, or if your insurance comp...

What is a Medicare Supplement Plan?

A Medicare Supplement Plan, also called a Medigap plan, is a plan sold by private companies, separate from Medicare. Medicare Supplement plans pay for the costs, or “gaps,” in coverage that are not paid for by Original Medicare. These can include prescriptions, doctor visits, vision and dental care, and more.

How long do you have to switch back to Medicare Advantage?

If you’re unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance.

Is Medicare Advantage the same as Medigap?

Both Medicare Advantage and Medigap plans are supplements to Original Medicare, but they are different. Medicare Advantage is an alternative Medicare plan. Medicare Advantage has a low or $0 monthly charge and covers most prescription medicine, though the choice of doctors and networks may be limited.

Do all Medicare Supplement plans have the same benefits?

No matter which insurance company offers a particular Medicare Supplement plan, all plans with the same letter cover the same basic benefits. For instance, all Plan C policies have the same basic benefits no matter which company sells the plan.

Does Cigna cover Part B?

Warning. As of Jan. 1, 2020, Medicare Supplement plans sold to new Medicare recipients aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on Jan. 1, 2020. Medicare Supplement plans don't cover the costs ...

Does Medicare Supplement cover out of pocket costs?

As the cost of healthcare continues to increase, so do the out-of-pocket costs for services that are not covered by Original Medicare. Because it can be difficult to predict your exact health care needs and costs, Medicare Supplement plans are used to cover many of the services you may need.

Does Mutual of Omaha offer a discount?

Mutual of Omaha also offers a 7% discount if your spouse or domestic partner has applied for, or is applying for, coverage with Mutual of Omaha or an affiliate company. However, the company only offers three plans (F, G, and N).

How long does it take to sign up for Medicare Supplement?

To keep your insurance costs low, it’s crucial to sign up for a Medicare Supplement as soon as you become eligible for Medicare as a senior. The first six months that you are signed up for Medicare Part B, you are granted what’s called a “Medigap open enrollment period.” During this time, companies cannot refuse you service or charge you elevated rates due to your health. Medical underwriting is illegal during your open enrollment, and all pre-existing conditions must be covered without a waiting period.

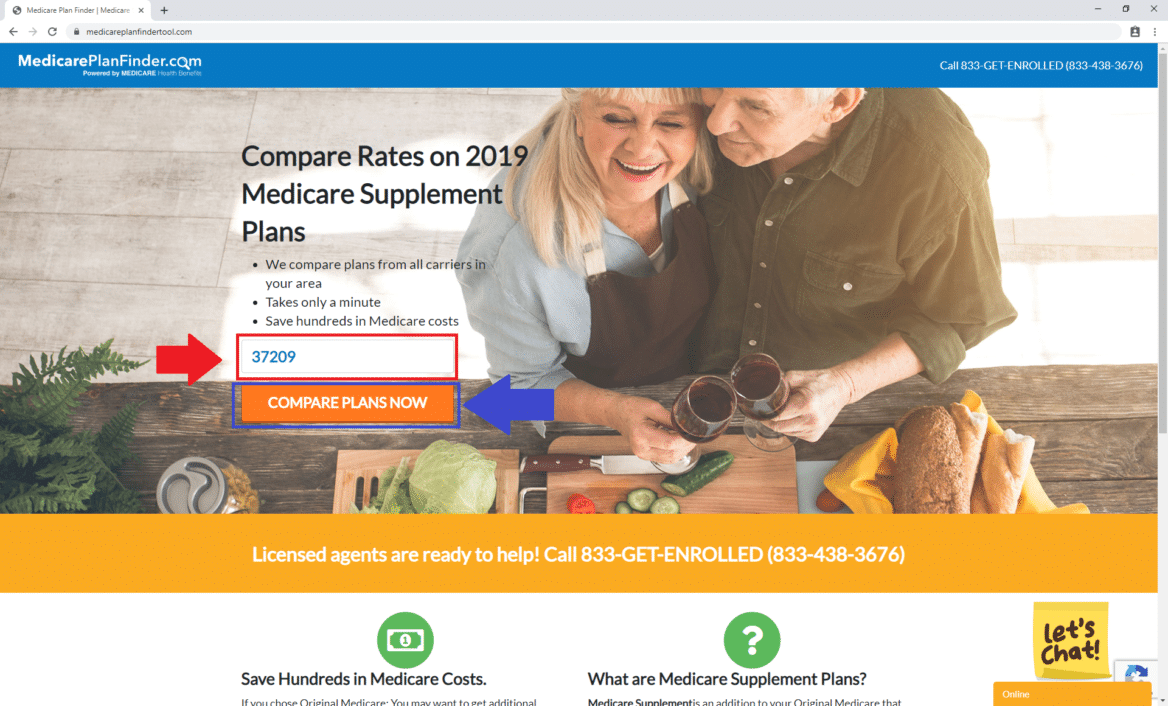

How many states does Aetna offer Medicare?

According to the online tool that allows customers to search for coverage based on their zip codes, Aetna offers supplement plans in about 30 states. The online tool can also provide pricing estimates based on the customer’s location, gender, and age.

What is the difference between Plan G and Plan F?

Plan G. With Plans F and C having been phased out, Plan G is being touted as a new favorite full coverage option. Premiums for G tend to be significantly lower than Plans F and C, but the coverage isn’t much different. Plan G only differs from Plan F in that it does not cover the Medicare Part B deductible.

Which states have standardized Medicare plans?

Wisconsin, Minnesota, and Massachusetts have different standardized plans than the rest of the states, however. Plans C and F have been phased out and are not being sold to newly eligible Medicare recipients as of January 2020.

Does Aetna offer a Medicare Supplement?

Aetna offers six of the 10 Medicare Supplement letter plans: A, B, F, High Deductible F, G, and N. Customers who want especially low monthly premiums may choose the high deductible version of Plan F. All versions of plan F are no longer offered as of January 2020, though those who purchase a Plan F before that time will be able to keep their plan.

Does Medicare Supplement cover hospital visits?

Seniors with Medicare Supplement insurance pay predictable monthly premiums so that their out of pocket costs for things like copays, deductibles, and coinsurance for hospital stays and doctor’s office visits will be either lower or completely covered, depending on the plan they choose.

Does State Farm offer discounts on Medicare Supplement?

If you bundle two or more policies with State Farm you can receive dramatic discounts on your monthly premiums through the Bundle Discount.

What is Medicare Advantage?

Medicare Advantage (MA) plans (also known as Medicare Part C) combine doctor, hospital and, in many cases, even drug coverage into one plan. Most MA plans also include coverage for routine dental, vision and hearing care, as well as other services. These plans are offered by private insurers who contract with the federal government.

How many people will choose Medicare Advantage in 2028?

Between 2008 and 2018, Medicare Advantage enrollment grew from 9.7 million, or 22% of all Medicare beneficiaries, to nearly 20.4 million, or 34% of Medicare beneficiaries. 1. By 2028, more than 41% of Medicare members are expected to choose Medicare Advantage plans. 2.

Will Medicare Advantage be available in 2028?

By 2028, more than 41% of Medicare members are expected to choose Medicare Advantage plans. 2. *Costs for Medicare Supplement plans vary by the state you live in and the plan you choose. Medicare Supplement plans can only be paired with Original Medicare.

Does Medicare cover dental?

How Original Medicare works. Original Medicare does not include coverage for prescription drugs or routine dental, vision and hearing care. If you choose Original Medicare, you can pay for those things out of pocket, or you can purchase a stand-alone prescription drug plan and a Medicare Supplement plan to beef up your coverage.

Does Medicare Part D cover prescription drugs?

Medicare Part D helps cover prescription drug costs. Costs for Part D depend on things like the plan you choose and what type of prescription drugs you require. Medicare Supplement (Medigap) plans can help pay out-of-pocket costs that Medicare doesn’t, including copays, deductibles and co-insurance.*.

How much does Medicare pay monthly?

Generally, you pay a low or $0 monthly plan premium (in addition to your Part B premium). When you use services, you pay copays, coinsurance, and deductibles up to a set out-of-pocket limit. For Medicare-approved doctor and hospital services, you’ll pay a monthly plan premium in addition to your Part B premium.

What is a Medigap plan?

Medigap Plans. Doctors and hospitals. You may be required to use doctors and hospitals in the plan network. You can select your own doctors and hospitals that accept Medicare patients. Referrals. You may need referrals and may be required to use network specialists, depending on the plan.

Can I switch to a different Medicare Advantage plan?

And you generally can’t be denied coverage or charged more based on your health status . You can apply to buy a plan any time after you turn 65.

Do I have to pay a monthly premium for Medicare?

For Medicare-approved doctor and hospital services, you’ll pay a monthly plan premium in addition to your Part B premium. When you use services, you’ll have. low—or no—copays and coinsurance, depending on the plan selected. Prescription drug coverage is included with most plans.

Is non emergency care covered by Medicare?

Non-emergency care might depend on your plan’s service area. Emergency care is generally covered for travel within the United States and sometimes abroad. Enrollment. Generally, there are specific periods during the year when you can enroll in or switch to a different Medicare Advantage plan.

Does Medicare cover prescription drugs?

Prescription drug coverage is included with most plans. You can select your own doctors and hospitals that accept Medicare patients. You can see specialists without referrals. Coverage goes with you when you travel across the United States and, depending on the plan, may cover emergency care when traveling abroad.

Does Humana have Medicare?

Both UnitedHealthcare and Humana offer prescription mail delivery with some plans. There is less variety with Medicare supplement insurance (Medigap) plans. These plans have more regulation and are similar across insurance ...

Is Humana a trusted health insurance company?

Humana and UnitedHealthcare are both well-known and trusted health insurers. Both companies offer Medicare Advantage, Prescription Drug, and Medicare supplement insurance plans. UnitedHealthcare stands out for its partnership with the AARP.

Does Humana offer Medicare Advantage?

Humana offers several kinds of Medicare Advantage plans, including Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Private Fee-for-Service (PFFS), and Special Needs Plans (SNPs). Humana offers SNPs for people with eligible chronic illnesses and people who also qualify for Medicaid.

Speak with a Medicare Expert today

Medicare Supplement plans can be complicated, but UnitedHealthcare is here to help make it clear.

Learn about Medicare Supplement plans

Learn how Medicare Supplement plans work with Medicare and review plans in your area.

Get more complete coverage with Medicare Supplement and Part D

Prescription drugs can be expensive, and Medicare Parts A and B ("Original Medicare") may not provide the coverage you need. Pairing an AARP ® MedicareRx Part D Plan from UnitedHealthcare with a Medicare Supplement plan can help protect you from unexpected medical and prescription drug costs now or in the future.

The biggest benefit is peace of mind

Don't worry about finding a new doctor, shopping for a plan each year, or network changes. With a Medicare Supplement insurance plan, you also avoid the hassle of out-of-pocket costs, which puts the control right where it belongs... with you.

Providing coverage and building relationships for over 40 years

In addition to the standard benefits of Medicare Supplement plans, an AARP Medicare Supplement Insurance Plan from UnitedHealthcare has many features that stand out.

Expert advice right at your fingertips

If you have questions about the different plan options, are curious about plan benefits or just don’t know where to start, that’s OK. UnitedHealthcare is here and ready to help.

Where is Humana Medicare available?

While the selection of products will vary from one ZIP code to the next, Humana Medicare plans and UnitedHealthcare Medicare plans are available in areas of all 50 states and Washington D.C.

Does Humana sell health insurance?

However, Humana stopped selling health insurance plans for individuals and families in 2018. The only way to enroll in an individual non-Medicare Humana health insurance plan now is through an employer.