Choosing the Best Medicare Supplement Plan for You

| Medicare Supplement Benefits | K 2 | L 3 |

| Part A coinsurance and hospital coverage | ||

| Part B coinsurance or copayment | 50% | 75% |

| Part A hospice care coinsurance or copay ... | 50% | 75% |

| First 3 pints of blood | 50% | 75% |

Full Answer

Which Medicare supplement plan is the most popular?

Medicare supplement Plan G is one of the most popular Medigap plans available today. More people will enroll in Plan G than any other Medigap plan, and for good reason. Medicare Plan G pays 100% of the gaps in Medicare Part A and B after you simply pay a small annual deductible. Keep reading to learn why Plan G might be the best option for you.

Which Medicare supplement plan should I Choose?

Some people also refer to these plans as Medigap. As with traditional Medicare, the CMS divides Medicare supplement plans by letter. People new to Medicare in 2021 can choose from plans A, B, D, G, K, L, M, and N. Not all insurers offer the same plans in all areas of the country, however.

What is the best supplemental insurance plan for Medicare?

Fort Worth, Jan. 31, 2022 (GLOBE NEWSWIRE) -- Fort Worth, Texas - Boomer Benefits, an award-winning insurance agency ... to look into getting a Medicare Supplement plan. Since Original Medicare ...

What is the best and cheapest Medicare supplement insurance?

The Medicare Supplement Plan N is best for the following people:

- People looking for complete coverage at a modest monthly rate

- Those who don’t mind paying a minor fee at the time of service

- People who are not subject to Part B excess charges

What is the highest rated Medicare Supplement company?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Plans and Coverage: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

How do I know which Medicare plan is right for me?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What is the deductible for plan G in 2022?

$2,490Effective January 1, 2022, the annual deductible amount for these three plans is $2,490. The deductible amount for the high deductible version of plans G, F and J represents the annual out-of-pocket expenses (excluding premiums) that a beneficiary must pay before these policies begin paying benefits.

Which Medicare plan offers the best coverage?

Best Medicare Advantage Providers RatingsProviderForbes Health RatingsCoverage areaBlue Cross Blue Shield5.0Offers plans in 48 statesCigna4.5Offers plans in 26 states and Washington, D.C.United Healthcare4.0Offers plans in all 50 statesAetna3.5Offers plans in 44 states1 more row•Jun 8, 2022

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

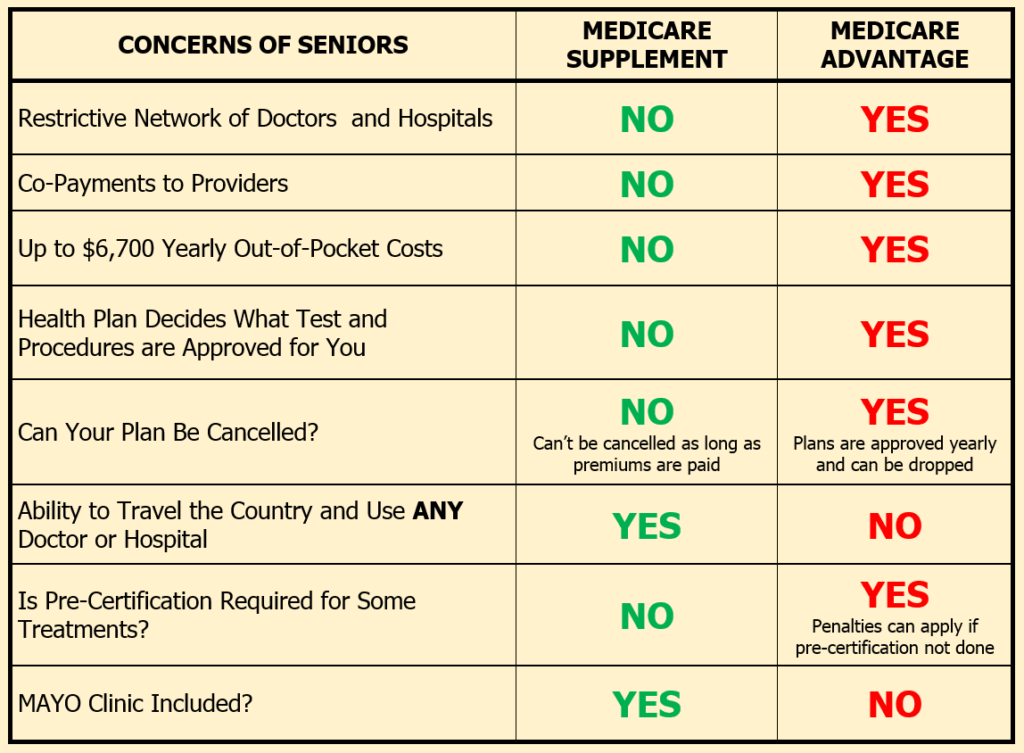

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the monthly premium for Plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

Is Medicare G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

What Plan G does not cover?

Medigap Plan G does not cover dental care, or other services excluded from Original Medicare coverage like cosmetic procedures or acupuncture. Some Medicare Advantage policies may cover these services. Like Medigap, Medicare Advantage is private insurance.

What is the average cost of AARP Medicare supplement insurance?

1. AARP Medigap costs in states where age doesn't affect the pricePlan nameAverage monthly cost for AARP MedigapPlan A$158Plan B$242Plan C$288Plan F$2566 more rows•Jan 24, 2022

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is the current Medicare Part B premium?

The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

Which Medicare Supplement plan is the best?

For most people, we recommend Medigap Plan G from AARP/UnitedHealthcare, which costs about $159 per month for a 65-year-old. This plan will give yo...

How much do Medicare Supplement plans usually cost?

A Medicare Supplement plan costs about $163 per month for 2022. However, the range of costs is especially wide because of the variety of plans avai...

What's the most popular Medicare Supplement plan?

Plan F and Plan G are the two most popular Medigap plans. Plan F is only available to those who qualified for Medicare before 2020, but because of...

What's the least expensive Medicare Supplement plan?

Plan K is the cheapest Medigap plan, with an average cost of $77 per month for 2022. For those who are only interested in protecting themselves aga...

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.

Which Medicare supplement is best for seniors?

Best overall Medicare supplement for new enrollees: Plan G. Due to the inability of new applicants to purchase Plan C and Plan F, Medicare supplement Plan G is the best overall plan that provides the most coverage for seniors. Plan G is very similar to Plan F in that it will cover almost everything except the Part B deductible.

Which Medicare plan has the highest premiums?

Best overall Medicare supplement pre-2020: Plan F. Plan F has the highest Medicare supplement premiums compared to C, G and N. On the other hand, it will cover all the items that you would usually need to pay for out of pocket, including deductibles and coinsurance.

What is the deductible for Medicare Supplement 2021?

For example, for the 2021 plan year, the Medicare Part A deductible is $1,484. Some Medicare supplement policies, such as Plan A, provide no coverage for this deductible.

How much is Medicare Part B deductible in 2021?

This means that you would be responsible for paying the entire Medicare Part B deductible — $203 a year for 2021 — before insurance benefits will begin to pay out. However, Plan G will have one of the highest monthly premiums among all the Medicare supplement policies: $473.

What is the best alternative to Plan G?

Best alternative to Plan G Medicare supplement: Plan N. Plan N is a good option for individuals who do not want to purchase Plan G but still want comprehensive Medicare insurance coverage at a cheaper price.

Is Medicare Supplement Plan G the same as Aetna?

This means that Medicare supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna. However, rates will change from company to company since each provider will choose a different pricing structure for their Medicare supplement plans.

Is Plan F a good plan?

Plan F is a good option if you want a comprehensive policy that will give you peace of mind about day-to-day expenses, such as paying a copay for a doctor. The monthly premium for Plan F will be $221. Unfortunately, Plan F will not be available to new Medicare enrollees who become eligible after Jan. 1, 2020.

Do I Need a Medigap Plan?

If you have a Medicare Advantage (Part C) plan, you do not need to go any further. Medigap plans do not work with Medicare Advantage plans. In fact, it is illegal for an insurance company to see you a Medigap plan if you have Part C.

Important Facts to Know about Medigap Plans

There are some things common to all Medigap plans. The most important are these:

How Does a Medigap Plan Work?

In most policies, part of the agreement you will sign allows the Medigap carrier to receive your Medicare claim after the primary carrier processes it. This is sometimes known as “piggyback” coverage.

Best Time to Purchase a Policy

When you enroll in Original Medicare Part A and B, you have an automatic six-month open enrollment period. During this window, you may purchase any Medigap policy sold in your state, no matter what your health situation is. These are known as “guaranteed issue rights.”

Basic Comparison of Plans

There are thousands of Medicare Supplemental Insurance plans available in every state. With this many choices, you might wonder where to start.

Start Your Comparison Search

Medicare’s website has a good tool to start your search. Input your zip code and whether you already have a policy and click “continue.” You can also include your health status, but that’s not necessary at this point.

A Note Regarding Pricing Methods

In the middle of this screen is a column called “Pricing Method.” This is how each insurance company sets its own premiums. This method can greatly influence the pricing of their policies. There are three rating systems:

Health Care Costs and Original Medicare

Original Medicare provides health insurance coverage for hospital stays, doctor's office visits, lab testing, medical supplies and some other services. For Medicare beneficiaries, other out-of-pocket costs can add up quickly.

Choosing the Best Medicare Supplement Plan for You

Medigap plans supplement your Original Medicare coverage with benefits that help fill in some key cost gaps. The basic benefits of each type of Medicare Supplement Insurance plan are standardized by Medicare, though the policies themselves are sold by private companies.

Getting the Most From Medicare Supplement Insurance

If you buy a plan during your Medigap open enrollment period, insurers cannot deny you a policy or charge more for your Medigap plan based on your health or pre-existing conditions. If you don't purchase a Medicare Supplement Insurance plan during your open enrollment period, you could potentially be denied coverage or pay higher monthly premiums.

Medicare Advantage Plans Replace Original Medicare Benefits

Another health plan option is Medicare Advantage plans. It is important to note that Medicare Advantage and Medicare Supplement Insurance are different. Medicare Advantage plans are an alternative to Original Medicare, while Medigap plans work alongside your Original Medicare benefits to help cover out-of-pocket costs.

Get Help Buying the Right Medigap Plan for You

The right Medicare Supplement Insurance plan is the one that best matches your health care cost requirements and your budget. A licensed agent can answer your questions and help you determine which plan is right for you.

Compare Medigap plans in your area

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareSupplement.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

What is Supplemental Insurance?

The cost of supplemental insurance is in addition to the premium you pay Medicare for Part B. Prescription drug coverage is also available through a separate stand-alone Prescription Drug Plan. Plan Comparison. The plans are labeled as A, B, C, D, F, G, K, L, M and N. Compare plans to find the coverage and costs that fit into your budget ...

Is there an optional Medicare plan?

However, be assured there are optional plans designed to supplement the Original Medicare program.

Is Medicare Supplement Insurance a private insurance?

Additionally, it is mandated that they be identified as Medicare Supplement Insurance. This insurance is also known as Medigap.

How to choose a Medicare Supplement Plan?

Choosing a Medicare Supplement plan involves balancing monthly premiums versus long term financial risk. Plans with more comprehensive coverage generally have higher monthly premiums, while plans with lower monthly costs usually offer less coverage. Keep in mind that’s not always the case, because very popular plans with more benefits may have lower monthly premiums, since they have more enrollees to help spread the costs. When researching rates it’s best to get premium costs for all policies offered, to ensure you’re not missing out on a rate that works better for your budget and coverage needs.#N#To begin narrowing your options decide which coverage variables are important to you. All the plans cover Part A coinsurance and inpatient hospitalization costs. But some don’t or only cover a portion of coinsurance and copayments for Part B services, Part A deductibles and foreign travel emergency care. Each plan is known by a letter such as “Plan A” or “Plan G.” To protect you, the plans are regulated and standardized by the federal government. This means that no matter which insurance company you choose to buy your plan from, you’ll receive the same basic benefits, though some companies may offer additional benefits and pricing will vary. Comparing the plan benefits side-by-side is the best way to get an idea of what plan choice might be best for you.

How to find out if you have Medicare Supplement?

You can find these companies by searching online, visiting the Medicare plan finding tool, talking to an insurance agent, contacting your state’s health insurance assistance program or speaking to friends and family who already have Medicare Supplement plans. Once you’ve compiled a list of prospective companies, doing some leg work will really pay off, as companies offer the same plans at very different rates. Make sure you know if you’re in your open enrollment period or have a guaranteed issue right before starting your calls. It’s also a good idea to ask each agent if the company they represent offers discounts or additional benefits. The most common option is the “household” discount, which lowers the rates of people living together with similar policies. You can also ask about their history of rate increases, which can give you an idea of what to expect going forward.

When is the best time to buy Medicare Supplement?

The best time to shop for your plan is during your “open enrollment period” which is the six-month period that starts when you turn 65 and are enrolled in Medicare Part B. During that time period you can buy any Medicare Supplement plan in your state and can’t be denied coverage based on preexisting health conditions. In most states, if you miss the open enrollment period, you may be subject to underwriting procedures and denied or offered more expensive coverage based on your preexisting conditions.

What costs are not covered by original Medicare?

By itself, original Medicare (Parts A and B) generally pays about 80% of the cost for doctors, hospitals, and medical procedures. The patient is responsible for paying the rest, and there is no limit on out-of-pocket expenses.

What does the standard Medigap coverage provide?

In general, Medigap covers your coinsurance bill once you’ve paid the Medicare deductible. Some plans (B, D, G, and N) pay your Part A deductible as well. (Plans C and F also pay the Part A deductible but aren’t available to new enrollees.)

When is the best time to buy a Medigap policy?

In most cases, the best time to buy a Medigap policy is during your open-enrollment period. This period may start either in the month you turn 65 and enroll in Medicare Part B, or when your employer-provided group healthcare coverage ends and you enroll in Part B.

How do I identify which Medigap plan I need?

When picking a Medigap plan, think about both your current and future healthcare needs. It’s important to choose carefully, because there’s no guarantee you’ll be able to switch plans later .

How do I shop for a Medigap policy?

There are a few ways to find out what policies are available in your area.

The bottom line

Medigap plans help cover costs related to Medicare Parts A and B that you'd otherwise pay yourself. The best time to choose a Medigap plan is generally when you first sign up for Medicare, when you won't have to go through medical underwriting.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.