How to Compare Medicare Supplement Plans

| Medicare Supplement Benefits | K 2 | L 3 |

| Part A coinsurance and hospital coverage | ||

| Part B coinsurance or copayment | 50% | 75% |

| Part A hospice care coinsurance or copay ... | 50% | 75% |

| First 3 pints of blood | 50% | 75% |

Which insurance company is best for a Medicare supplement?

3 rows · Mar 24, 2022 · It covers everything the other plans cover, in addition to 100% of Medicare Part B excess ...

What is the best secondary insurance with Medicare?

Sep 13, 2019 · All Medicare Supplement plans typically cover: Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted. Some or all of your Medicare Part B coinsurance. Some or all of your Part A hospice coinsurance. Some or all of your first three pints of blood.

What is the cheapest Medicare supplement insurance?

Part B also covers durable medical equipment, home health care, and some preventive services. What Medicare health plans cover. Medicare health plans include Medicare Advantage, Medical Savings Account (MSA), Medicare Cost plans, PACE, MTM. Preventive & screening services. Part B covers many preventive services. What's not covered by Part A & Part B

How much does a Medicare supplemental insurance plan cost?

While Medicare helps cover many medical expenses, it does not pay for everything. Let’s discuss your Medicare options so you can enroll in the plan that will be right for you. Original Medicare. Original Medicare is composed of Part A and Part B. Part A (Hospital Insurance) helps cover the costs of medical care when you are formally admitted as an inpatient in a hospital, skilled …

Which Medicare supplement is most comprehensive?

Does Medicare cover 100% of Part A?

What is the difference between Medicare gap and Medicare Advantage?

What are the disadvantages of a Medicare Advantage plan?

- Restrictive plans can limit covered services and medical providers.

- May have higher copays, deductibles and other out-of-pocket costs.

- Beneficiaries required to pay the Part B deductible.

- Costs of health care are not always apparent up front.

- Type of plan availability varies by region.

Is Medicare Part A free at age 65?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Why do doctors not like Medicare Advantage plans?

Why is Medigap so expensive?

Can you be denied a Medicare supplement plan?

Does Medicare cover dental?

Who is the largest Medicare Advantage provider?

What is the highest rated Medicare Advantage plan?

| Category | Company | Rating |

|---|---|---|

| Best overall | Kaiser Permanente | 5.0 |

| Most popular | AARP/UnitedHealthcare | 4.2 |

| Largest network | Blue Cross Blue Shield | 4.1 |

| Hassle-free prescriptions | Humana | 4.0 |

How Do Medicare Supplement (Medigap) Plans Work With Medicare?

Medigap plans supplement your Original Medicare benefits, which is why these policies are also called Medicare Supplement plans. You’ll need to be...

What Types of Coverage Are Not Medicare Supplement Plans?

As a Medicare beneficiary, you may also be enrolled in other types of coverage, either through the Medicare program or other sources, such as an em...

What Benefits Do Medicare Supplement Plans Cover?

Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible vers...

What Benefits Are Not Covered by Medicare Supplement Plans?

Medigap policies generally do not cover the following health services and supplies: 1. Long-term care (care in a nursing home) 2. Routine vision or...

Additional Facts About Medicare Supplement Plans

1. You must have Medicare Part A and Part B to get a Medicare Supplement plan. 2. Every Medigap policy must be clearly identified as “Medicare Supp...

Do you have to pay Medicare premiums if you are 65?

Part A covers inpatient hospital services, as well as care in a hospice or skilled nursing facility and some home health care expenses. Most people don’ t have to pay a premium for Part A ( premium-free Part A), but if you’re 65 and you didn’t pay the Medicare tax for 10 years or more, you may have to pay a premium.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

Does Medicare have a penalty for enrolling in Medicare?

In order to encourage people to enroll in Medicare, the federal government imposes a penalty on people who enroll in Medicare after their Initial Enrollment Period has passed and if they don’t qualify for any of the Special Enrollment Periods described above.

What happens if you don't enroll in Medicare?

If you don’t enroll in Part A (inpatient hospital services) when you initially qualify, you may find yourself saddled with a 10% late enrollment penalty on your Part A premium. Says the Medicare website, “You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.”

Does Medicare Advantage cover coinsurance?

If you have a Medicare Advantage plan, you might already have drug coverage . If you have Medicare Part A and Part B, you’re still responsible for paying premiums, deductibles, copayments, and coinsurances. Medicare Supplement Insurance can help you pay for these costs.

What are the benefits of Medicare Supplement?

All Medicare Supplement plans typically cover: 1 Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted 2 Some or all of your Medicare Part B coinsurance 3 Some or all of your Part A hospice coinsurance 4 Some or all of your first three pints of blood

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

Is Medicare Supplement Plan A the same as Medicare Part A?

Please note that Medicare Supplement Plan A is not the same as Medicare Part A. There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover medical expenses?

While Medicare helps cover many medical expenses, it does not pay for everything.

What is the original Medicare?

Original Medicare is composed of Part A and Part B. Part A (Hospital Insurance) helps cover the costs of medical care when you are formally admitted as an inpatient in a hospital, skilled nursing facility, hospice, or home health care.

What is Medicare Supplement?

Medigap, or Medicare Supplement, plans are sold by private insurance companies that are regulated by the federal government. Medigap plans are standardized and identified by letters. Each plan may vary in costs and benefits.

How long is the open enrollment period for Medicare Part B?

Each plan may vary in costs and benefits. When you are 65 years of age and are enrolled in Medicare Part B, you will have a 6-month Medigap open enrollment period. During this period of time, you have a guaranteed issue right to purchase any Medigap plan sold in your state regardless of any pre-existing conditions.

Does Medicare Part A cover prescription drugs?

Unfortunately, Original Medicare Part A and Part B do not generally cover prescription drugs prescribed by your physician. Medigap does not include prescription drug coverage, so many Medicare recipients choose to enroll in Part D prescription drug coverage.

What is Medicare Advantage?

Medicare Advantage – With or Without Prescription Drug Coverage. As an alternative to Original Medicare, Medicare recipients can choose to get their Part A and Part B benefits through a Medicare Advantage (MA) plan.

What is Medicare Supplement Insurance?

Medicare supplement insurance is also known as “Medigap” because it covers gaps in Original Medicare coverage. This supplemental insurance, offered by private companies, covers costs including deductibles, copayments and coinsurance. You pay a monthly premium for this added coverage.

Is Plan C still available for new Medicare recipients?

As of Jan. 1, 2020, Plan C is no longer available for new Medicare recipients.

Does Medicare cover Plan F?

Plan F covers everything covered by Plan C and also covers any excess charge by a doctor or hospital that Medicare does not cover. Due to the changes regarding the Part B deductible, newly eligible consumers can no longer enroll in Plan F.

What is Plan K for Medicare?

Plan K covers additional days in the hospital after Medicare benefits are exceeded and 50% of the following (up to a yearly out-of-pocket limit): Part B coinsurance, up to three pints of blood, hospice care coinsurance or copayments, coinsurance for skilled nursing facilities and the deductible for Part A.

What is Medicare Select?

Medicare SELECT is a type of Medigap policy that requires policyholders to use hospitals and doctors within its network to get coverage. The premiums are typically lower than those offered by other Medigap providers, which don’t enforce network restrictions. Medicare SELECT can provide the same Plan A through N coverage as other Medigap policies, just with added network and geographical restrictions.

Does Mutual of Omaha offer dental insurance?

Enrollees can also receive hearing aid and vision care discounts. Mutual of Omaha also offers prescription drug plans, dental insurance and dental savings plans. Mutual of Omaha Medicare Supplemental Insurance. Keep your doctors and hospitals. Keep your coverage as long as you want.

How much is the deductible for a 2021 plan F?

This version of Plan F has the same coverage as the standard Plan F, but individuals must pay a high deductible — $2,370 in 2021 — before the policy pays anything.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How to compare Medicare Supplement Plans 2021?

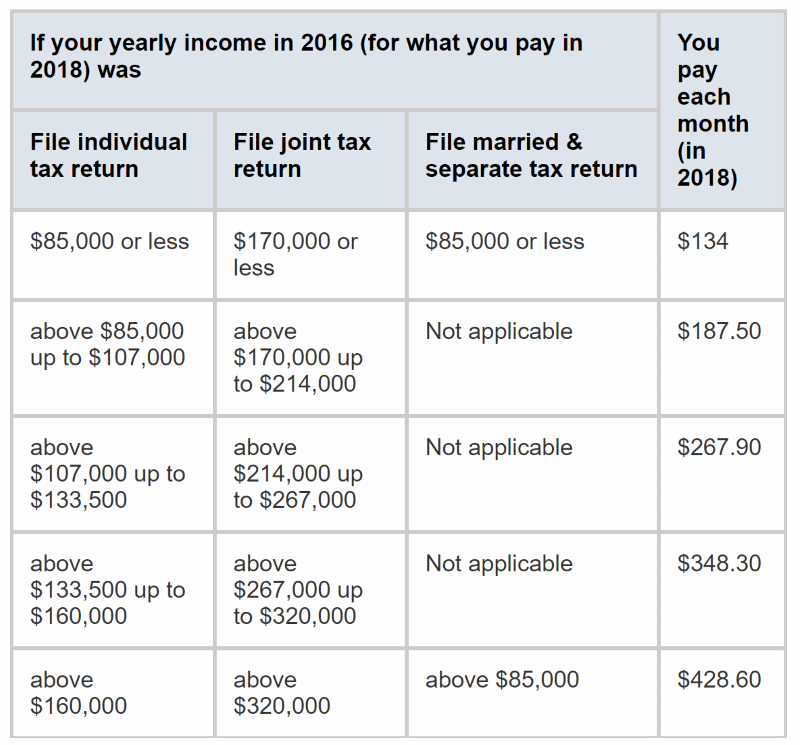

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the maximum out of pocket for Medicare 2021?

The Plan K out-of-pocket maximum is $6,220 in 2021. The 2021 Plan L out-of-pocket spending limit is $3,110.

What are the costs of Medicare?

These costs can include: 1 Your Medicare deductibles 2 Your coinsurance 3 Hospital costs after you run out of Medicare-covered days 4 Skilled nursing facility costs after you run out of Medicare-covered days

What is coinsurance in Medicare?

Your coinsurance. Hospital costs after you run out of Medicare-covered days. Skilled nursing facility costs after you run out of Medicare-covered days. Here's how it works: You pay a monthly premium for your Medicare supplement plan. These plans are also called Medigap.

What is Medicare Advantage?

Medicare Advantage plans help with your Medicare costs, too. They also offer additional health coverage that Medicare supplement plans don't. The table below breaks down the differences between Medicare supplement plans and Medicare Advantage plans. It might be a good place to start if you're wondering which type of plan is right for you.

Does Medicare cover Part D?

Some plans won't cover care you get outside their network. Medicare supplement plans don't include Part D prescription drug coverage. So if you're thinking about buying one of these plans, you'll want to make sure you buy a separate Part D plan.

Is Medicare Supplement a good plan?

A Medicare supplement plan might be a good choice for you if you already have prescription coverage through an employer or military benefits. You can read more about how supplement and Medigap plans work in our help section.

Does Mutual of Omaha offer Medicare Supplement?

Mutual of O maha Medicare Supplement Insurance plans come with an Additional Benefit Rider that may include services such as discounts on fitness programs, hearing care and vision care. Mutual of Omaha offers several types of Medigap plans. Depending on where you live, you may be able to apply for Mutual of Omaha Medicare Supplement Insurance ...

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

Is Plan F available for 2020?

80 %. * Plan F and Plan C are not available to Medicare beneficiaries who became eligible for Medicare on or after January 1, 2020. If you became eligible for Medicare before 2020, ... you may still be able to enroll in Plan F or Plan C as long as they are available in your area.

What is a BCBS?

Blue Cross Blue Shield (BCBS) is among the leading health insurance carriers in the U.S., and BCBS companies were the very first to work in conjunction with Medicare. There are now 36 different locally operated BCBS companies administering coverage in all 50 states.

Does Aetna offer Medigap?

Aetna offers a diverse portfolio of insurance products that includes Medigap plans. Over 1 million people trust Aetna for their Medicare Supplement Insurance. 3. Aetna offers several different types of Medigap plans. Plan availability may vary based on your location.

What is Medico insurance?

Medico Insurance Company. Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

Is Wellcare a Fortune company?

In 2020, WellCare was named one of Fortune Magazine’s “Most Admired Companies,” and the company boasts a number of community-based programs designed to help members navigate their local social support network and connect to community resources. 4