How much does each Medigap plan cost?

| Medicare Supplement Insurance Plan | Average monthly premium |

| A | $192.33 |

| B | $141.24 |

| C | $189.88 |

| D | $157.33 |

Full Answer

How does Medicare pay for Medigap?

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year.

What is the premium for Medigap insurance?

Jan 15, 2020 · As of 2020, the Medicare Part B premium is $144.60. This is an increase of $9.10 from the amount of $135.50 in 2019. Together with your Part B premium, you must pay a monthly premium to your private insurance provider for your Medigap policy. Prices vary from company to company and location plays a large role in the amount.

What are Medicare supplement (Medigap) plans?

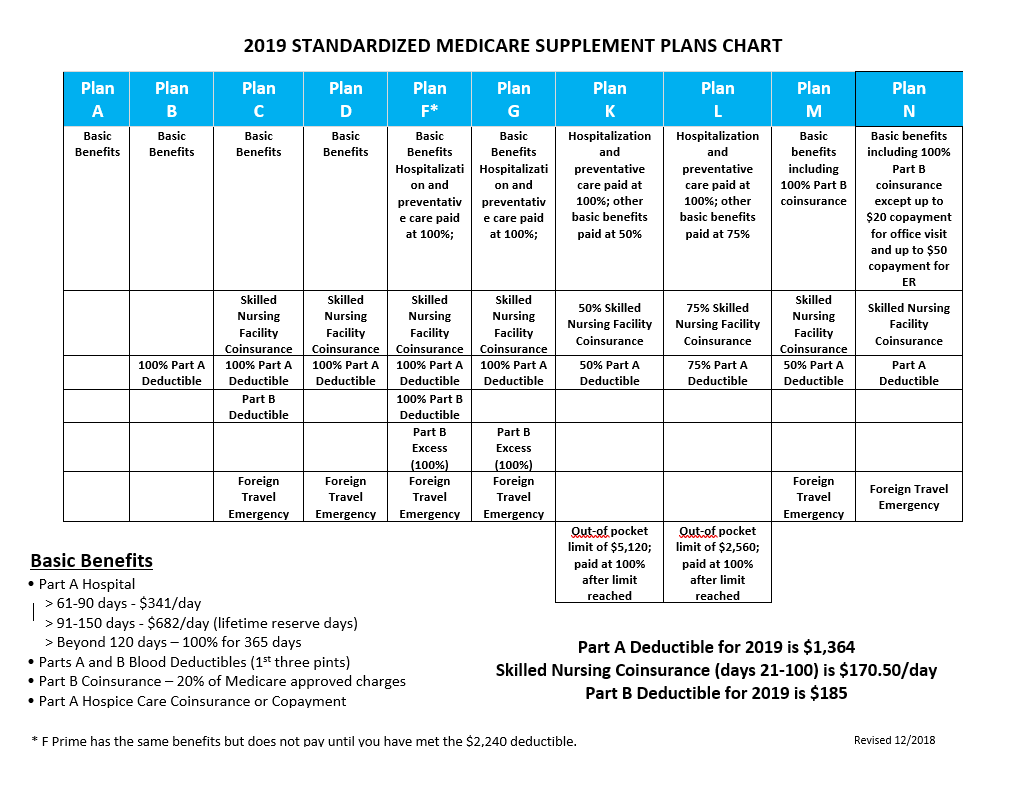

** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible, the Medigap plan pays 100% of covered services for the rest of the calendar year. *** Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in inpatient …

What is a Medicare Medigap policy?

Medicare doesn't pay any of the costs for you to get a Medigap policy. You have to pay the premiums for a Medigap policy. Medigap helps pay your Part B bills In most Medigap policies, the Medigap insurance company will get your Part B claim information directly from Medicare. Then, they pay the doctor directly.

Does Medicare pay for all of the costs?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Copayments. Coinsurance. Deductibles.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

Does Medicare Supplement Insurance cover Part B?

A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible. Because of this, Plans C and F aren’t available to people newly eligible for Medicare on or after January 1, 2020.

What is Medicare approved amount?

Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you’re responsible for the difference. for covered health care costs.

What is a Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

Does Medicare cover Medigap?

Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover. If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs.

What is the difference between Medigap and Medicare?

Generally, the only difference between Medigap policies sold by different insurance companies is the cost. You and your spouse must buy separate Medigap policies.Your Medigap policy won't cover any health care costs for your spouse. Some Medigap policies also cover other extra benefits that aren't covered by Medicare.

Do you have to pay Medicare Part B?

You will have to pay the monthly Medica re Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year.

Can insurance companies sell standardized Medicare?

Insurance companies can only sell you a “standardized” Medigap policy. Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.”. It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that ...

How much is Medicare Part B premium?

As of 2020, the Medicare Part B premium is $144.60. This is an increase of $9.10 from the amount of $135.50 in 2019.

Does Medigap cover prescription drugs?

It is also important to note that Medigap policies do not include coverage for prescription drugs. You must enroll in a separate Medicare Prescription Drug Plan (Part D). Medicare Part D plans are also sold by private insurance providers that are approved by Medicare.

What is a Medicare Supplement policy?

A Medicare Supplement policy, also known as Medigap, helps pays for some coinsurance, copayments, and deductibles that are not included in your Original ...

How old do you have to be to get Medicare Supplement?

In order to be eligible to purchase any Medicare Supplement policy, you must first be 65 years of age and enrolled in Original Medicare Part A (hospital insurance) and Part B (medical insurance). You are responsible for paying your monthly Medicare Part B premium even if you have supplemental insurance that covers other out of pocket expenses. ...

How many people can you cover with Medicare Supplement?

If you are not sure where to send your Medigap premium payment, contact your insurance provider for clarification. Remember that one Medicare supplement insurance plan covers only one person. If you want coverage for your spouse as well, you must get a separate policy.

What does community rated mean?

Some companies use a community rated system which means that your age is not a factor in your cost. If you purchase a policy based on an issue-age rated system, your age is a factor. If the company uses an attained age rated system, your premium increases with age.

Does Medigap cover Medicare Supplement?

Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance.". Insurance companies can sell you only a "standardized" policy identified in most states by letters. All policies offer the same basic. benefits.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

What is Medicare claim?

claim. A request for payment that you submit to Medicare or other health insurance when you get items and services that you think are covered. information directly from Medicare. Then, they pay the doctor directly. Some Medigap insurance companies also provide this service for Part A claims.

What is a Medicare payment request?

A request for payment that you submit to Medicare or other health insurance when you get items and services that you think are covered. information directly from Medicare. Then, they pay the doctor directly. Some Medigap insurance companies also provide this service for Part A claims.

What is Medicare assignment?

assignment. An agreement by your doctor, provider, or supplier to be paid directly by Medicare, to accept the payment amount Medicare approves for the service, and not to bill you for any more than the Medicare deductible and coinsurance. " for all Medicare patients.

What is Medicare Supplement?

Medicare Supplement (also known as Medigap) insurance plans are sold by private insurers . Medicare Supplement insurance plans are designed to help pay some of the out-of-pocket costs not paid by Medicare. These costs typically include Medicare deductibles, copayments, and coinsurance.

Does Medicare Supplement pay 100%?

The Medicare Supplement comparison chart shows you exactly which benefits each plan may cover. In the Medicare Supplement comparison chart, “ Yes” means the lettered Medigap insurance plan may pay 100% of the benefit. If a percentage appears in the row, the Medigap insurance plan may pay part of the benefit ...

Why are Medigap Plans More Expensive in These States?

There are many factors that impact your Medigap rates. Eight of the ten most expensive states for Medigap plans use a community rating. The other two states have high costs of living and different special rules that can influence prices. Community rating methods tend to be higher for those age 65 and balance out through the life of the policy.

How Much is Medigap in Arkansas?

When you age into Medicare at 65, you can expect to pay $150 a month for Plan G in Arkansas. Arkansas follows community rating methods. With Arkansas being the third most unhealthy state, it would make sense to see higher costing healthcare.

How Much is Medigap in California?

It should be no surprise to see California Medigap plans on this list. With this being the third most expensive state and the cost of healthcare on the rise, it’s no wonder Cali is on the list. At 65, you can expect to pay around $155 for Plan G.

How Much is Medigap in Massachusetts?

Three states follow their own rules for Medigap, and Massachusetts is one of them. In this state, there are different plan names than traditional options. The comparable option to Plan G would be the 1A Plan, and it would cost about $160 a month. Massachusetts has a two-month window annually where Medigap plans are Guaranteed Issue.

How Much is Medigap in Florida?

The cost of Plan G for a person turning 65 in Florida would be about $170 a month. The sunshine state isn’t one of the most expensive places to live, but it’s certainly not the cheapest. Florida requires insurers to use issue-age rating methods, but the carriers can choose community rating instead if they wish.

How Much is Medigap in Washington?

Plan G in Washington would cost around $175 a month. Community ratings are the law in Washington. Further, those with pre-existing conditions will only have a 3-month waiting period instead of the usual 6 months. But, once you have Medigap in Washington, you can apply to buy or switch plans at any time.

How Much is Medigap in Vermont?

In Vermont, a 65-year-old would pay about $185 for Plan G. While Vermont was listed as the healthiest state, the cost of living is still about 15% higher than the national average. Vermont follows the community rating method that influences a higher price.

We work in all 50 states! How can we help you?

MedicareFAQ (Elite Insurance Partners) is licensed to sell products nationwide. It is beneficial for us to do this so we can ensure that in the case any of our clients move to another state that we can move with them.

Find a State

Medicare Supplement Plans in Utah help cover the expenses not covered by Original Medicare. Without Medigap coverage, you could pay enormous out-of-pocket bills for healthcare services.