What Is Medicare Advantage?

Also called Medicare Part C, Medicare Advantage plans provide coverage through private insurance companies approved by Medicare. These companies pr...

What Is Medicare Supplement?

Also known as Medigap, Medicare Supplement plans are offered by private insurance companies and can take care of certain health care costs not cove...

What If I Choose Medicare Advantage?

If you decide to enroll in a Medicare Advantage plan after being in Original Medicare (Part A and Part B) for some time, you may want to cancel you...

What is Medicare Advantage?

Medicare Advantage plans negotiate contracts with networks doctors, hospitals, and other healthcare providers. The agreements they reach can help to keep their costs lower. This means that you must adhere to their networks or face substantially higher out of pocket costs.

What is a Medigap plan?

Under a Medigap plan, Medicare first pays its portion of the bill and then sends the remainder of the bills to your Medicare supplement company to pay their portion. This is done electronically through what is called the crossover system.

What are the different types of Medicare insurance?

There are two types of private plans that you can purchase that will help fill the gaps of Medicare – Medicare supplements (Medigap) or Medicare Advantage. These two plans are very different and it is imperative that you understand the differences.

How much does Medicare cover in 2021?

If you go with Medicare alone with no additional coverage, you will quickly learn that there are a lot of gaps that Medicare does not cover – a Part A deductible ($1,484 in 2021) that you must pay to the hospital to cover you for up to 60 days of hospital care.

How long does Medicare lock you in?

If you enroll in a Medicare Advantage plan, Medicare locks you into that plan until December 31st. Medicare Advantage plans and Part D prescription drug plans have only one window of opportunity each year for you to enroll. It happens from October 15 through December 7 each year. During that time, you can change plans or go from MAPD to original Medicare with a Medicare Supplement plan (or vice versa). There are Special Enrollment periods such as if you move out of your network coverage area. You have an Initial Enrollment Period three months before and three months after you first enroll in Part B of Medicare. Other than that, you cannot change plans or move back to original Medicare.

Can Medicare Advantage plans change?

Medicare Advantage plans are not guaranteed renewable which means that your deductibles and co-pays are not set in stone. Your plan coverage can change from year to year. Not only can it change, but your plan can leave your region completely or your physicians can be out of network from one year to the next.

How long does it take to get a Medigap plan?

This period starts six months before you enroll in Part B of Medicare and continues the six months after. Medicare Advantage and Part D allow a 3-month open enrollment before and after your date of first coverage under Part B. You will likely have to be underwritten to get a Medigap plan once you are out of your Open Enrollment period.

How to compare Medicare Advantage and Supplement?

Comparing Medicare Advantage Plans vs. Medicare Supplement Plans 1 Both types of plans are available from private insurance companies. 2 With most Medicare Supplement plans, you can see any doctor who accepts Medicare assignment. 3 Some Medicare Supplement plans may cover emergency medical care when you’re out of the country. 4 Medicare Advantage plans can include prescription drug coverage, while Medicare Supplement plans sold today can’t. 5 You might learn some other surprising differences.

What is Medicare Advantage?

Unlike Medicare Supplement plans, Medicare Advantage plans give you a way to get your Medicare Part A and Part B benefits through a private insurance company that contracts with Medicare. (Hospice benefits are still covered under Part A.) Medicare Advantage plans often provide coverage beyond that of Original Medicare –most of them include prescription drug benefits, and some include extra benefits such as routine dental services or membership in fitness programs.

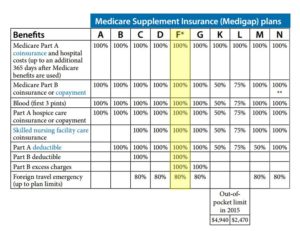

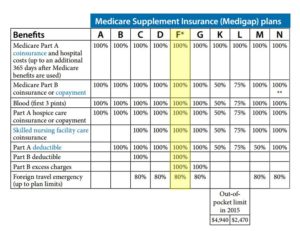

How many Medicare Supplement plans are there?

Medicare Supplement plans are standardized with lettered in many states, such as Plan A, Plan B, and so on up to Plan N. There are 10 plans available in most states (Plans E, H, I, and J are no longer sold). Wisconsin, Minnesota, and Massachusetts have their own standardized plans.

When is the best time to buy a Medicare Supplement Plan?

Perhaps the best time to buy a Medicare Supplement plan is during your Medicare Supplement Open Enrollment Period, which starts the month that you’re both 65 or more years old and enrolled in Medicare Part B.

Do you have to have Medicare Part A and Part B?

When you’re enrolled in a Medicare Advantage plan , you’re still in the Medicare program. In fact, you must have Medicare Part A and Part B in order to sign up for a Medicare Advantage plan.

Is Medicare Advantage the same as Medicare Supplement?

Medicare Advantage and Medicare Supplement insurance are not the same. But each type of insurance may have features you might like, as well as some you might not. This table lists the main differences between these types of plans. Yes (different plans may cover different portions of certain out-of-pocket costs).

Does Medicare save you money?

If you’re new to Medicare or will be eligible soon, and you have frequent doctor visits and/or hospitalizations, a Medicare Supplement plan might save you money by helping you with those costs – especially if you make sure to purchase the plan as soon as you’re eligible so your acceptance is guaranteed.

What is Medicare Advantage?

Medicare Advantage plans are a type of private Medicare insurance that offers all of the same benefits as Original Medicare. Most Medicare Advantage also offer benefits that are not covered by Original Medicare. Benefits and plan availability can vary from plan to plan.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) and Medicare Advantage plans (Medicare Part C) are two very different private Medicare options that you may consider. This guide highlights the differences between Medicare Supplement Insurance and Medicare Advantage so you can better understand these two private Medicare coverage options.

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021. The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medicare Part B deductible. The Medicare Part B deductible is $203 per year in 2021.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Does Medicare cover glasses?

Original Medicare typically does not cover eyeglasses or corrective lenses, so you’ll be left to pay for your glasses out of pocket, unless you have a standalone vision insurance plan. If you had a Medicare Advantage plan that offers vision benefits, your eye exams and glasses may be covered by the plan.

What is the average Medicare premium for 2021?

The average monthly premium for a Medicare Advantage plan in 2021 is $33.57. 3. You’ll also still pay your Medicare Part B premium in addition to your Medicare Advantage plan premium. The average monthly premium for a Medicare Supplement Insurance plan in 2019 was $125.93. 4.

Does Medicare cover out of pocket costs?

No coverage of Original Medicare out-of-pocket costs, but MA plan out-of-pocket costs may be more affordable than what Original Medicare includes. Coverage for Medicare Part A and B deductibles, copayments and coinsurance (depending on the plan) Additional health benefits not found in Original Medicare.

What is Medicare Advantage?

Medicare Advantage plans combine the components of Original Medicare — Part A and Part B — into a single plan, while Medicare supplements help pay for costs that Medicare doesn’t cover. Seniors looking for lower costs or better coverage may want to explore their Medicare Advantage options.

What is Medicare Supplement?

Medicare Supplements. Medicare supplements are ideal for seniors who have Original Medicare and need help paying some of their out-of-pocket costs. Known as Medigap insurance, a Medicare supplement covers things like co-payments, coinsurance payments and deductibles.

Does Medicare Supplement cover Medicare Advantage?

It may also cover services that Original Medicare doesn’t cover. A Medicare supplement isn’t a replacement for Original Medicare or a Medicare Advantage plan; it simply supplements the coverage provided by Original Medicare.Medicare supplements are only available to seniors enrolled in Original Medicare. Seniors with Medicare Advantage plans may ...

Does Medicare Advantage have coinsurance?

Medicare Advantage plans may also have lower co-payments or coinsurance requirements than Original Medicare, which can reduce a senior’s out-of-pocket medical costs. Finally, many Medicare Advantage plans have annual out-of-pocket maximums, which limit a senior’s out-of-pocket expenses.

What is the difference between Medicare Supplement and Medicare Advantage?

Medicare supplement insurance fills the gaps in Original Medicare, whereas a Medicare Advantage plan completely replaces your Original Medicare coverage. With Medicare Advantage, you pay the majority of your costs when you use healthcare services through deductibles.

What is Medicare Advantage?

Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare (Medi care Part A and Medicare Part B).... and Medicare supplement insurance.

Is Medicare Advantage good for seniors?

If you are a super healthy senior, and you rarely see your doctor for anything more than your annual wellness exam, Medicare Advantage is an excellent medical insurance option.

What is Medicare Advantage Special Needs Plan?

People who qualify for a Medicare Advantage Special Needs Plan. People who are exceptionally healthy and rarely use healthcare services outside of their annual wellness visits.

Does Medicare have a provider network?

The one downside might be that Original Medicare and Medicare supplement insurance plans do not have provider networks. If you live in an area without a specialist you need that accepts Medicare, you may have to drive a distance to get the medical care you need. However, the same can be true of Medicare Part C.

What is deductible insurance?

A deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begin s to pay its share.... , coinsurance. Coinsurance is a percentage of the total you are required to pay for a medical service. ... , copayments.

Is Medicare Advantage better than Original Medicare?

Healthy people with Medicare Advantage plans often enjoy lower costs and more benefits than people in Original Medicare. People with chronic health conditions who enroll in a Medicare Advantage plan often have higher out-of-pocket costs than people in Original Medicare alone.

What is the difference between Medicare Part B and Medicare Part B?

And it does it all for one manageable cost ( Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare.

What percentage of Medicare is paid?

Medicare pays 80 percent and the patient pays the remaining 20 percent of all covered services. If the beneficiary wants additional coverage, to isolate themselves from the 20 percent gap, they simply buy a Medigap plan (supplemental Medicare coverage).

What is PFFS insurance?

With PFFS Medicare health insurance, healthcare providers bill Medicare directly for the services they provide to its beneficiaries. It’s a simple system that prevents healthcare billing nightmares. It’s easy for the patients, easy for healthcare providers, and easy for Medicare.

When was Medicare first introduced?

Garfield Kaiser invented the HMO healthcare delivery system in 1945, but it took the government a few decades to recognize its benefits.

When did Kaiser start?

When the Kaiser Permanente health plan was launched on July 21, 1945, it put in motion the most enduring health care system in history and became a model for healthcare delivery. In fact, Kaiser has had more 5-star Medicare Advantage plans than any other insurer, but they only operate in a handful of states.

Do you need a referral for Medicare Advantage?

No referrals are required to use healthcare services. Plan benefits never change. Your plan and coverage travel with you. In Why Medicare Advantage Plans are Bad: 7 Reasons, I talk about all of the many reasons that Medicare Advantage may not be a good fit for someone.

Do all doctors accept Medicare?

And, not all doctors accept Medicare-assignment, which requires them to take payment Medicare establishes for each healthcare service. Many doctors and specialists who don’t accept Medicare-assigned will see patients for an additional 15 percent fee, which is billed to the patient as Part B Excess Charges.