Full Answer

Where to get free Medicare advice?

- You have full Medicaid coverage.

- You get help from a Medicare savings program.

- You receive Supplemental Security Income (SSI) benefits from the Social Security Administration.

How do I pick an unbiased, helpful Medicare adviser?

What to Expect When You Meet with a Medicare Advisor

- Give you business cards to pass on to your friends and family

- Provide you with an enrollment form

- Provide you with plan materials

- Talk to you about plan options you agreed to discuss

- Tell you how to get more information on a plan

How do you check out your Medicare coverage?

- You can use the enrollment check at Medicare.gov

- You can check the status online at http://www.mymedicare.gov

- You can call Medicare at 1-800-633-4227

- Members can visit a local office to review the coverage in person

How to switch your Medicare drug plan?

- The Medicare Advantage and Medicare Part D prescription drug plan data on our site comes directly from Medicare and is subject to change.

- Medicare has neither reviewed nor endorsed the information on our site.

- We provide our Q1Medicare.com site for educational purposes and strive to present unbiased and accurate information. ...

Who can help me choose the right Medicare plan?

Get personalized help with choosing a Part D or Medicare Advantage plan from your local State Health Insurance Assistance Program (SHIP). Go to shiptacenter.org or call 800-633-4227 for local contacts.

Who is the best person to talk to about Medicare?

Do you have questions about your Medicare coverage? 1-800-MEDICARE (1-800-633-4227) can help. TTY users should call 1-877-486-2048.

What is the best way to find out about Medicare?

Visit Medicare.gov/about-us/nondiscrimination/accessibility-nondiscrimination.html, or call 1-800-MEDICARE (1-800-633-4227) for more information. TTY users can call 1-877-486-2048. Paid for by the Department of Health & Human Services.

Where can I get unbiased information about Medicare?

Call 1-800-MEDICARE For questions about your claims or other personal Medicare information, log into (or create) your secure Medicare account, or call us at 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

Why are Medicare plans so confusing?

Medicare can seem confusing because they have tried to develop a system to accomodate a variety of lifestyles and financial situations across the country. In addition, they work to give Medicare beneficiaries as many options as possible when they move or if their health or financial conditions change.

Does Medicare have local offices?

Does Medicare Have Local Offices? Medicare does not have local offices.

What is the best supplemental insurance for Medicare?

Best Medicare Supplement Insurance Companies of 2022Best Overall: Mutual of Omaha.Best User Experience: Humana.Best Set Pricing: AARP.Best Medigap Coverage Information: Aetna.Best Discounts for Multiple Policyholders: Cigna.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

When should I start preparing for Medicare?

Medicare is health insurance for people 65 or older. You're first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also called Lou Gehrig's disease).

How do I find a Medicare broker in my area?

You can find a Medicare insurance agent or broker near you by using the Centers for Medicare & Medicaid Services healthcare. gov's Find Local Help search tool. You can also find licensed agents and brokers through your state insurance department.

Is United Medicare Advisors a legitimate company?

Yes, United Medicare Advisors is a reputable company offering legitimate services and insurance products. Its licensed agents can provide free, reliable advice as you navigate the confusing world of Medicare supplement insurance so that you can choose the best plans for your needs and budget.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What information does an agent or broker need to help me enroll in Medicare?

An agent or broker can help you with the process of selecting a plan and completing the enrollment. In order to best assist you, they will need to...

Can a friend or family member help me sign up for Medicare?

You always have the right to have a trusted friend or family member present while you’re discussing your health coverage needs with Medicare, your...

How can I authorize Medicare to discuss my coverage with someone else?

If you want Medicare to be able to directly share your personal health information with someone else, there’s an authorization form that you’ll nee...

Can someone help me sign up for Medicare if I'm incapacitated?

If you’re incapacitated and unable to participate in your own plan selection process, someone else can act on your behalf as long as you’ve created...

Can a friend or family talk about my coverage with a private Medicare insurance company?

If you’re enrolled in a private Medicare plan (a Part D plan, a Medicare Advantage plan, or a Medigap plan), the insurance company will have their...

Key takeaways

An agent or broker will need information about you and your providers to help you choose a Medicare plan.

What information does an agent or broker need to help me enroll in Medicare?

An agent or broker can help you with the process of selecting a plan and completing the enrollment. In order to best assist you, they will need to know the names and dosages of any medications you take, as well as your preferred pharmacies, so that they can narrow down the options based on how your medications will be covered.

Can a friend or family member help me sign up for Medicare?

You always have the right to have a trusted friend or family member present while you’re discussing your health coverage needs with Medicare, your state’s Medicare SHIP, or with an agent or broker.

How can I authorize Medicare to discuss my coverage with someone else?

If you want Medicare to be able to directly share your personal health information with someone else, there’s an authorization form that you’ll need to complete. Once you have it on file with Medicare, you can add names to it or update it through your MyMedicare.gov account.

Can someone help me sign up for Medicare if I'm incapacitated?

If you’re incapacitated and unable to participate in your own plan selection process, someone else can act on your behalf as long as you’ve created a power of attorney (POA) and named that person as your legal representative.

Can a friend or family talk about my coverage with a private Medicare insurance company?

If you’re enrolled in a private Medicare plan (a Part D plan, a Medicare Advantage plan, or a Medigap plan ), the insurance company will have their own disclosure authorization form that you’ll need to complete so that they can discuss your coverage with a loved one.

How to use Medicare Plan Finder?

There are two ways to utilize the Medicare Plan Finder: Log in or create an account. Continue without logging in. There is also an option on the bottom of the page to compare Medigap policies in your area.

What is Medicare.gov plan Finder?

The Medicare.gov Plan Finder is a tool from the Centers for Medicare & Medicaid Services (CMS) that allows you to search for Medicare Advantage and Medicare Part D plans available where you live.

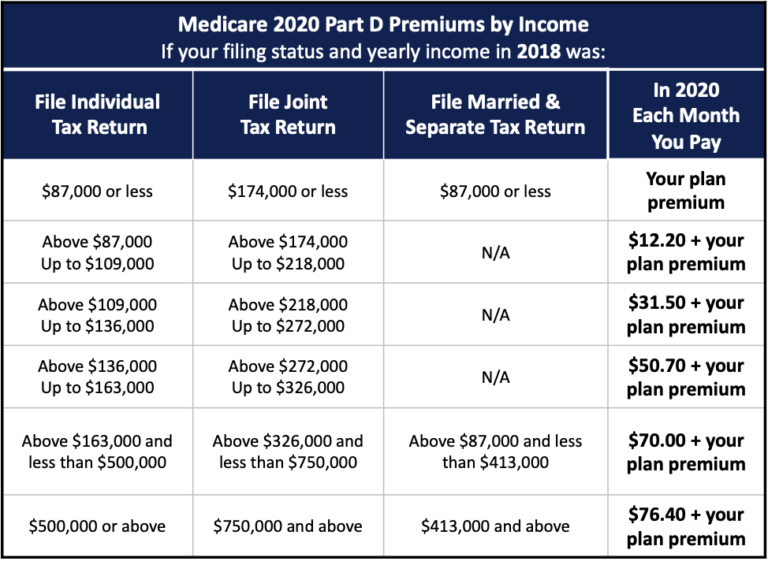

What is Medicare Part D?

A Prescription Drug Plan (Medicare Part D) provides coverage only for prescription medications. If you're looking for a Medicare Part D prescription drug plan, you can compare Part D plans in your area and enroll in a plan online in as little as 10 minutes when you visit MyRxPlans.com. 1.

What does an agent do for Medicare?

An agent can discuss your health care needs and compile a list of available Medicare plans in your area. Most importantly, an agent can help answer questions you are sure to have about costs, coverage, terms and conditions of plans and help you better understand exactly what it is you are shopping for.

Can you switch Medicare plans at different times of the year?

It helps to make sure that you are eligible for a Medicare plan prior to enrolling.

Does Medicare cover prescription drugs?

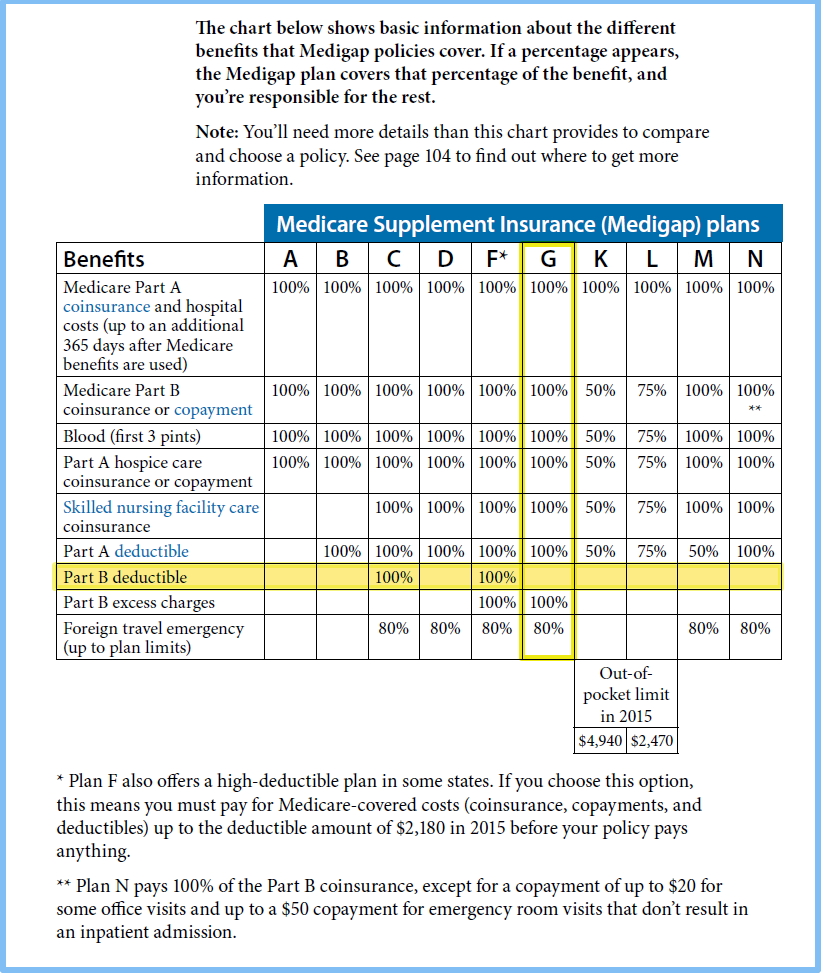

Medicare Advantage plans provide all the same coverage as Original Medicare, and most Medicare Advantage plans offer coverage for prescription drugs. Medicare Supplement Insurance, or Medigap, provides coverage for out-of-pocket costs that Medicare doesn't cover, such as deductibles, copayments and coinsurance.

What Is a Medicare Advisor?

Medicare advisors can be independent insurance sales agents representing one or multiple different Medicare plan providers (insurance companies), or they can be insurance brokers who work on behalf of a Medicare beneficiary.

How Is an Insurance Agent a Medicare Advisor?

A Medicare insurance agent can do so much more than just simply sell you a policy. A good agent will gather Medicare plans from several different carriers that sell insurance in your area, and they’ll go over the details of each one with you. The agent can help you understand the costs associated with each plan and review the benefits.

How Do Non-Profit Organizations Serve as Medicare Advisors?

Agents and brokers are both in the business of selling or negotiating insurance policies and will typically provide plenty of advice along the way.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.