The negotiated price for a drug is the price reported to CMS at the point of sale, which is used to calculate beneficiary cost-sharing and generally adjudicate the Part D benefit. Although CMS is not implementing this policy for 2020, the agency appreciates the over 4,000 comments that were received on this potential policy approach.

Full Answer

How much does Medicare Part D prescription drug coverage cost in 2021?

Learn about 2021 Medicare prescription drug plan costs and find prescription drug coverage in your area. Medicare Part D provides coverage for prescription medications. The average Part D plan premium in 2021 is $41.64 per month. 1

What are the changes to Medicare Part D plans in 2020?

As of January 1, 2020, changes to Medicare’s Part D Prescription Drug plan can impact how much Medicare recipients pay per month and how much they pay out of pocket. Significant changes may also impact the coverage gap. Part D plans are offered by private insurers as stand-alone plans or as part of a Medicare Advantage plan.

What determines the cost of a Medicare Part D plan?

Several factors can play into determining the cost of a Medicare Part D plan, such as: Each Medicare Part D plan contains a formulary, which is a list of drugs covered by the plan. Covered drugs are divided up into different tiers.

How much does Medicare pay for prescription drugs in 2020?

In 2020, the catastrophic coverage threshold is $6,350. Once you are eligible for catastrophic coverage, you will only pay 5% of Medicare’s cost for prescription medication. What Medications Are Not Covered by Part D?

How are Medicare Part D drug prices determined?

Under the lock-in approach, a Part D plan agrees to pay a PBM a set rate for a particular drug. The PBM then negotiates with pharmacies to obtain the lowest possible price for the drug, which often is lower than the amount the PBM receives from the plan.

How is Medicare Part D Premium 2020 calculated?

As specified in section 1860D-13(a)(7), the Part D income-related monthly adjustment amounts are determined by multiplying the standard base beneficiary premium, which for 2020 is $32.74, by the following ratios: (35% − 25.5%)/25.5%, (50% − 25.5%)/25.5%, (65% − 25.5%)/25.5%, (80% − 25.5%)/25.5%, or (85% − 25.5%)/25.5%.

Can Medicare Part D change the copay price in the middle of the year?

The cost of your Medicare Part D-covered drugs may change throughout the year. If you notice that prices have changed, it may be because you are in a different phase of Part D coverage.

Why do Medicare Part D premiums vary?

Another reason some prescriptions may cost more than others under Medicare Part D is that brand-name drugs typically cost more than generic drugs. And specialty drugs used to treat certain health conditions may be especially expensive.

What determines Part D premium?

If you have a higher income, you might pay more for your Medicare drug coverage. If your income is above a certain limit ($87,000 if you file individually or $174,000 if you're married and file jointly), you'll pay an extra amount in addition to your plan premium (sometimes called “Part D-IRMAA”).

Are Part D premiums based on income?

The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income. Your additional premium is a percentage of the national base beneficiary premium $33.37 in 2022. If you are expected to pay IRMAA, SSA will notify you that you have a higher Part D premium.

Who has the cheapest Part D drug plan?

Recommended for those who Although costs vary by ZIP Code, the average nationwide monthly premium for the SmartRx plan is only $7.08, making it the most affordable Medicare Part D plan this carrier offers.

How do I avoid the Medicare Part D donut hole?

If you have limited income and resources, you may want to see if you qualify to receive Medicare's Extra Help/Part D Low-Income Subsidy. People with Extra Help see significant savings on their drug plans and medications at the pharmacy, and do not fall into the donut hole.

What is the cost of Medicare Part D for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What is the cost for Medicare Part D for 2021?

The maximum annual deductible in 2021 for Medicare Part D plans is $445, up from $435 in 2020.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

Are all Part D formularies the same?

Each Medicare Part D plan has its own unique formulary, meaning that it has its own unique list of drugs the plan covers. Medicare formularies are used to help provide Medicare beneficiaries with affordable and effective medications.

When will Medicare Part D be required?

Effective January 1, 2021, CMS will require the Part D Explanation of Benefits that Part D plans send members to include drug price increases and lower cost therapeutic alternatives. This information will inform Medicare beneficiaries about possible ways to lower their out of pocket costs by considering a lower cost medication.

When is the Medicare Advantage and Part D final rule?

Medicare Advantage and Part D Drug Pricing Final Rule (CMS-4180-F) The Centers for Medicare & Medicaid Services (CMS) issued a final rule on May 16, 2019 that modernizes and improves the Medicare Advantage and Part D programs. These changes will ensure that patients have greater transparency into the cost of prescription drugs in Part D ...

What are the protected classes in Part D?

Current Part D policy requires sponsors to include on their formularies all drugs in six categories or classes: 1) antidepressants; 2) antipsychotics; 3) anticonvulsants; 4) immunosuppressants for treatment of transplant rejection; 5) antiretrovirals; and 6) antineoplastics; except in limited circumstances.

When will Medicare announce the 2020 rate announcement?

2020 Medicare Advantage and Part D Rate Announcement and Final Call Letter. Fact Sheet. On April 1, 2019 , the Centers for Medicare & Medicaid Services (CMS) released final policy and payment updates to the Medicare Advantage (MA) and Part D programs through the 2020 Rate Announcement and Call Letter. The Advance Notice was posted in two parts: Part ...

What is CMS finalizing for 2020?

Given the urgency and scope of the continuing national opioid epidemic, CMS is finalizing a number of additional policies for 2020 to help Medicare plan sponsors prevent and combat prescription opioid overuse.

Why is the CMS removing the C measure?

CMS is temporarily removing the Controlling High Blood Pressure (Part C) measure from the 2020 and 2021 Star Ratings due to a substantive measure specification change to align with the release of new hypertension treatment guidelines from the American College of Cardiology and American Heart Association .

What is the 2020 star rating?

The 2020 Star Ratings is the final year when all changes to the methodology for calculating the ratings and any changes in the measurement set will be addressed using the Call Letter. CMS is finalizing a policy to adjust the 2020 Star Ratings in the event of extreme and uncontrollable circumstances, such as major hurricane weather events. ...

When will CMS accept comments?

CMS accepted comments on all proposals through March 1, 2019. The final updates will continue to maximize competition among Medicare Advantage and Part D plans, as well as include important actions to address the nation’s opioid crisis.

Can MA health insurance be supplemental?

Traditionally, MA plans have only been allowed to offer “primarily health related” supplemental benefits and must offer these benefits uniformly to all enrollees. Beginning with the 2019 plan year, CMS determined that plans can provide certain enrollees with access to different supplemental benefits.

Does Puerto Rico have Medicare Advantage?

Puerto Rico. In Puerto Rico, a far greater proportion of Medicare beneficiaries receive benefits through Medicare Advantage than in any state or territory. The policies finalized for 2020 will continue to provide stability for the Medicare Advantage program in the Commonwealth and to Puerto Ricans enrolled in MA plans.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . If you're in a. Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, ...

Does Social Security pay Part D?

Social Security will contact you if you have to pay Part D IRMAA, based on your income . The amount you pay can change each year. If you have to pay a higher amount for your Part D premium and you disagree (for example, if your income goes down), use this form to contact Social Security [PDF, 125 KB].

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or. Medicare Cost Plan. A type of Medicare health plan available in some areas. In a Medicare Cost Plan, if you get services outside of the plan's network without a referral, your Medicare-covered services will be paid for ...

Do you have to pay Part D premium?

Most people only pay their Part D premium. If you don't sign up for Part D when you're first eligible, you may have to pay a Part D late enrollment penalty. If you have a higher income, you might pay more for your Medicare drug coverage.

Do you have to pay extra for Part B?

This doesn’t affect everyone, so most people won’t have to pay an extra amount. If you have Part B and you have a higher income, you may also have to pay an extra amount for your Part B premium, even if you don’t have drug coverage. The chart below lists the extra amount costs by income.

Do you pay extra for Medicare?

If you have questions about your Medicare drug coverage, contact your plan. The extra amount you have to pay isn’t part of your plan premium. You don’t pay the extra amount to your plan. Most people have the extra amount taken from their Social Security check.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

When will Medicare start paying for insulin?

Look for specific Medicare drug plan costs, and then call the plans you're interested in to get more details. Starting January 1, 2021, if you take insulin, you may be able to get Medicare drug coverage that offers savings on your insulin.

What is Medicare drug coverage?

You'll make these payments throughout the year in a Medicare drug plan: A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list. ).

Why are my out-of-pocket drug costs less at a preferred pharmacy?

Your out-of-pocket drug costs may be less at a preferred pharmacy because it has agreed with your plan to charge less. A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance. paying your drug coverage costs.

What is formulary in insurance?

Your prescriptions and whether they’re on your plan’s list of covered drugs (. formulary. A list of prescription drugs covered by a prescription drug plan or another insurance plan offering prescription drug benefits. Also called a drug list.

When is open enrollment for insulin?

Find a plan that offers this savings on insulin in your state. You can join during Open Enrollment (October 15 – December 7, 2020). Note. If your drug costs are higher than what you paid last year, talk to your doctor.

How much is the Part D coverage gap?

The initial coverage limit (the amount of money you will spend on covered prescription drugs before reaching the Part D “donut hole” coverage gap) increased from $3,820 in 2019 to $4,020 in 2020.

How much is Medicare Part B?

The standard premium for Medicare Part B was $144.60 per month in 2020. This represented a $9.10 increase from the 2019 standard premium of $135.50 per month.

What is the IRMAA bracket for 2020?

The chart below shows the IRMAA brackets for both individual and joint filers for 2020, based on their income from 2018. 2020 Medicare IRMAA Brackets. 2020 (based on 2018 individual tax return) 2020 (based on 2018 joint tax return) $86,000 or less. $172,000 or less.

What is Medicare IRMAA 2020?

The 2020 Medicare IRMAA (Income-Related Monthly Adjusted Amount) was the additional surcharge some higher income earners pay on top of their Medicare Part B and Part D premiums.

When will IRMAA inflation increase?

For the first time in a decade, the income levels that determine IRMAA costs were indexeded according to inflation, using the consumer price index (CPI) from September 2018 to August 2019. Inflation rose 1.7% during that 12-month span. IRMAA income brackets will also increased 1.7% from 2019 to 2020.

When will Medicare plan F and C be available?

This means that Medigap Plan F and Plan C will not be available to beneficiaries who became eligible for Medicare on or after January 1, 2020. Beneficiaries who became eligible before this date may still apply for Plan F or Plan C, if either plan is available where they live.

Does Medicare have to pay a surcharge in 2020?

In 2020, a Medicare beneficiary filing a 2018 modified adjusted gross income of $85,000 would now not meet the threshold requiring them to pay a higher Part B and/or Part D premium. Other beneficiaries might still have to pay the IRMAA surcharge, but they will likely now do so at a lower rate.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

How much does Medicare Part D cost?

The average premium for Medicare Part D is around $40 a month. The premiums do vary by location and plan. Medications that fall on the higher tiers attract higher coinsurance costs and co-payments compared to those on the lower tiers.

What is Medicare Part D 2021?

Medicare Part D costs include the initial deductible, initial coverage limit, out-of-pocket threshold, and the coverage gap, also known as the donut hole.

What is the Medicare donut hole?

The coverage gap is known as the donut hole. It begins once you reach your Medicare Part D costs plan’s initial coverage limit and ends when you spend a total of $6,550. Part D enrollees will receive a 75% discount on the total cost of their brand-name drugs purchased while in the donut hole. The 75% discount paid by the brand-name drug ...

How much is the deductible for Part D in 2021?

The initial deductible for Part D is $445 in 2021. In 2022, the initial deductible will be $480.

How much discount do you get for a brand name drug?

The 75% discount paid by the brand-name drug manufacturer will apply to get out of the donut hole. For example: if you reach the donut hole and purchase a brand-name medication with a retail cost of $100, you will pay $25 for the medication, and receive $95 credit toward meeting your total out-of-pocket spending limit.

Do you have to pay a coinsurance for Medicare Part D?

If you receive extra help paying your Part D Medicare costs. One major cost that you should consider is the monthly premium. Stand-alone Part D policies and Medicare Advantage policies have a monthly premium. Other than the monthly premiums, you may have to pay an annual deductible and a co-payment/coinsurance.

Can you still receive Medicare Part D coverage?

These are Medicare’s rules for late payments of Part D premiums: You can still receive coverage without penalties. You’re granted a grace period and warning. You receive a letter informing you to contact your plan for resolution. You must receive notification before a plan can drop you from your coverage.

How much is Medicare Part D 2021?

How much does Medicare Part D cost? As mentioned above, the average premium for Medicare Part D plans in 2021 is $41.64 per month. The table below shows the average premiums and deductibles for Medicare Part D plans in 2021 for each state. Learn more about Medicare Part D plans in your state.

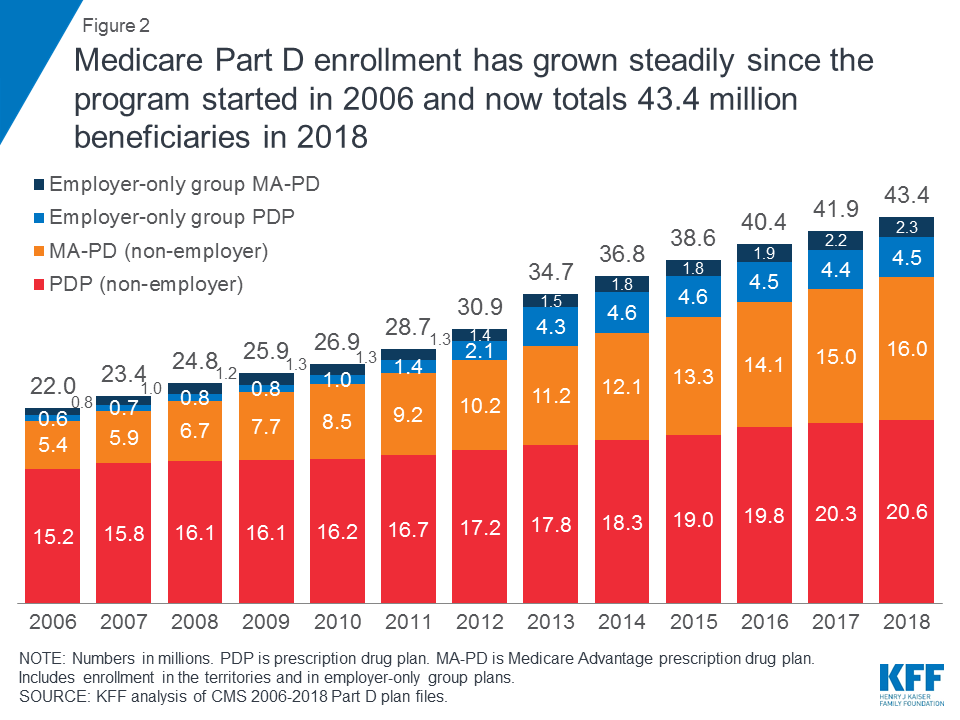

What is the average Medicare Part D premium for 2021?

The average Part D plan premium in 2021 is $41.64 per month. 1. Because Original Medicare (Part A and Part B) does not cover retail prescription drugs in most cases, millions of Medicare beneficiaries turn to Medicare Part D or Medicare Advantage prescription drug (MA-PD) plans to get help paying for their drugs.

What is the Medicare donut hole?

After 2020, Medicare Part D plans have a shrunken coverage gap, or “donut hole,” which represents a temporary limit on what the plan will cover for prescription drugs. You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021.

What is Part D premium?

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

How much will Part D cost in 2021?

You enter the Part D donut hole once you and your plan have spent a combined $4,130 on covered drugs in 2021. Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $6,550 for the year in 2021.

Who sells Medicare Part D?

Medicare Part D plans are sold by private insurance companies . These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers. Cost-sharing.

Does Medicare Advantage cover Part A?

Medicare Advantage plans (also called Medicare Part C) provide all of the same coverage as Medicare Part A and Part B, and many plans include some additional benefits that Original Medicare doesn’t cover. Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.