Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if they want help paying for their Medicare Part A and Part B coverage. Beyond that, Part F is the most comprehensive of all the MedSup plans on the market today. What does that mean?

What is covered by Medicare Part F?

... Part D is an outpatient prescription drug benefit available to people who have Medicare (Part A and/or Part B). While technically Part D is optional coverage, Medicare “encourages” you to enroll in Part D by assessing a late penalty if you don’t.

What are the benefits of Medicare Part F?

What is Plan F, Plan G, and Medigap?

- Covers the Part A hospital and Part B outpatient deductibles

- Covers your 20% Part B co-pay

- Covers Part B excess charges

- Does not have a network. You can see any doctor

- Does not require referrals

- Is guaranteed renewable

How much does Medicare Part F cost?

Since Medicare Part F is the is the most comprehensive Medigap policy, the premium can be costly. Typically, these range from $120 to $140 per month for a 65-year-old. However, the exact cost will be determined by your location, plan provider, current health condition, and age and gender.

Will I have to pay for part an of Medicare?

Medicare Part A, which covers hospitalization, is free for anyone eligible for Social Security, even if they have not claimed benefits yet. If enrolled in Part B but not yet collecting Social Security benefits, you’ll be billed quarterly by Medicare.

Can I still get Medicare Part F?

Medicare Plan F has not been discontinued, but it is only available for people who were eligible for Medicare before Jan 1, 2020. If you are currently enrolled in Plan F, your enrollment remains active unless you choose a different plan or fail to pay your premiums.

Who is eligible for Medicare Part F?

Plan F is only available if you first became eligible for Medicare before January 1, 2020 (which means your 65th birthday occurred before January 1, 2020). Or you qualified for Medicare due to a disability before January 1, 2020.

What is Medicare Part F coverage?

Plan F covers the 20% of Medicare-approved hospital expenses not covered under Part A. Plan F also covers other costs, such as: Part A hospital deductible and coinsurance. Hospital costs up to an additional 365 days after Medicare benefits are exhausted. Part A Hospice care coinsurance or copayment.

What is the average cost of Medicare Part F?

Medicare Supplement Plan F premiums may be more expensive than those for other Medicare Supplement plans. However, the reason is that this plan provides the most benefit to enrollees. The plan's average cost is around $230.00 per month. However, many factors impact the premium price.

Is Medicare Plan F still available 2022?

Previously, anyone enrolled in original Medicare could purchase Medigap Plan F. However, this plan is now being phased out. As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020. If you were already enrolled in Medigap Plan F, you can keep the plan and the benefits.

Can I switch back to plan F?

You pay for Medicare-covered costs up to the $2,490 deductible (as of 2022) before the plan begins to pay for anything. If you currently have Medicare Supplement Plan F, you can switch to high-deductible Plan F by contacting your insurance provider.

Is plan F better than plan G?

Is Medicare Plan G better than Plan F? Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F. It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

Are all Medicare Plan F the same?

Remember, all Plan F policies offer the exact same benefits. This is true no matter where you buy the plan. Different insurance companies may charge different premiums, deductibles, copayments or coinsurance for it, but they can't change its coverage.

What is the cost for Medicare Plan F in 2022?

The average premium for Medicare Supplement Insurance Plan F in 2022 is $172.75 per month, or $2,073 per year.

What is the difference between Medicare Plan C and plan F?

Plan F covers everything Plan C does, and also covers Medicare Part B excess charges. These two plans are some of the most comprehensive Medicare Supplement Insurance plans you can purchase, which makes them a very attractive option.

Does Medicare Plan F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

What does Medicare Supplement Plan F cover?

MedSup Plan F pays for 100% of the following: Medicare Part A deductible. Medicare Part B deductible. Part A coinsurance and hospital costs up to a...

What is Medicare Part F?

Medicare Part F is one of the 10 MedSup policies Americans enrolled in Original Medicare can buy if they want additional health coverage, or if the...

How does Medicare Part F compare to other MedSup plans?

The only way MedSup Plan F differs from Plan G is that Plan F pays your Medicare Part B deductible while Plan G does not. All other benefits are th...

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and...

Can I still get Plan F?

People who were eligible for Medicare prior to 2020 will continue to have the option to buy Plan F. This is regardless if you enrolled in Medicare...

What is the average cost for Medicare Plan F?

Medicare Plan F cost varies by several factors. Costs for Medicare Plan F vary by area, gender, zip code, and tobacco status. In many areas, we fin...

What is Medicare Plan F Coverage?

It covers all of your cost-sharing for Medicare Part A and B services. Medicare must approve and pay for the service before your Medicare Plan F po...

Does Medicare Plan F cover prescription drugs?

All Medigap plans cover medications administered in the hospital or in a clinical setting. However, Medigap plans do not cover retail prescriptions...

Does Medigap Plan F cover dental, vision and hearing benefits?

No Medigap plan covers routine dental, vision or hearing services either. However, there are many great standalone plans that you can enroll in to...

Does Medicare Plan F cover chiropractic?

Yes, Medicare covers 80% of adjustments, and Plan F pays the other 20%. Medicare does not cover other services provided by chiropractors though, su...

What is the most popular Medicare Supplement plan?

The best Medigap plans in 2022 are still Plan F and Plan G. While Plan F has long been the most popular, Plan G is gaining steam since Plan F is no...

What are the top 10 Medicare Supplement insurance companies in 2022?

This absolutely varies by region. Since Medicare Supplement insurance plans are standardized, you don’t have to worry about benefits being differen...

Should I switch from Plan F to Plan G?

This depends on what your Plan F premium is and where you live (you may have to answer health questions). However, you get lower premiums for Plan...

What is Medicare Plan F?

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance, which means you pay nothing out of pocket throughout the year.

Why Choose Plan F?

The reason Medicare Plan F is so well-liked is that it will pay for ALL of the gaps in Original Medicare Part A and Part B, including both your hospital and outpatient deductible. It even pays the 20% that Medicare Part B does not cover.

What is the most comprehensive Medicare Supplement plan?

If you became eligible for Medicare on or after January 1, 2020, you’ll find that Plan G is the most comprehensive Medigap plan available to you. (In recent years, Plan G has been the second most popular Medicare Supplement plan, and you can read more on that below.)

What insurance carriers are in Plan G?

Our agency works with about 30 carriers in every state. These include Mutual of Omaha Medicare Supplements, Aetna Medicare Supplements and Cigna Medicare Supplements. All three of these carriers have competitive Plan G rates in 2021. You’ll easily learn which insurance carriers offer you the greatest long-term savings and benefits.

How much does Medicare cost for a 65 year old?

Costs for Medicare Plan F vary by area, gender, zip code, and tobacco status. In many areas, we find pricing around $120 – $140/month for a female turning 65, but it’s always important to get quotes for Medicare Plan F cost in your area.

Which Medicare Supplements are good value?

However, there are other Medicare Supplements that provide great value as well, such as Plan G and Plan N.

Does Medicare Supplement pay after Medicare?

A Medigap plan, or Medicare Supplement, pays after Medicare to help cover your deductibles, copays, and coinsurance that you would otherwise be responsible for. Medigap plans do not replace your Medicare Part B. You must be enrolled in both Part A and Part B first, then you are eligible to enroll in Medicare Supplement Plan F.

What is a plan F?

Plan F is a very comprehensive plan, helping cover expenses that original Medicare doesn’t. This includes your deductibles, coinsurance, and copays when receiving medical care. It even covers a portion of your medical expenses during foreign travel.

How much is the deductible for Plan F in 2021?

While monthly premiums for this option may be lower, you must pay a deductible before Plan F begins paying for benefits. For 2021, this deductible is set at $2,370.

What are the disadvantages of Medigap Plan F?

Disadvantages of Medigap Plan F. On the downside of this plan option, its large amount of coverage can be costly and have high monthly premiums. Also, if you’re newly eligible for Medicare as of January 1, 2020, or later, you will not be eligible to buy this plan, as it is being phased out for new enrollees.

Which Medicare supplement plan is the most comprehensive?

The various Medicare supplement plans each offer different benefits. Some plans offer more benefits than others. Plan F is generally considered to be the most comprehensive.

What is community rated insurance?

Community rated. Everyone who has the policy is charged the same amount regardless of how old they are.

Does Medicare Supplement cover healthcare?

Medicare supplement insurance can help pay for healthcare costs that original Medicare doesn’t cover. About 25 percent. Trusted Source. of people who have original Medicare are also enrolled in a Medicare supplement plan. Private companies sell Medicare supplement plans. There are 10 different Medicare supplement plans.

Is Medicare Supplement Plan F a part of Medicare?

You may have also heard of something called Medicare Supplement Plan F. Medicare Plan F isn’t a “part” of Medicare. It’s actually one of several Medicare supplement insurance ( Medigap) plans.

What coverage does Medicare Plan F offer?

Like other Medicare Supplement plans, Plan F covers Part A and Part B costs that you’d otherwise have to pay out of pocket. To learn what costs other parts of Medicare cover, read our Ultimate Medicare Guide.

When will Medicare change to plan F?

The rules for who can enroll in Medigap plan F have changed starting January 1, 2020. If you're newly eligible for Medicare in 2020, skip ahead to find out how this update will affect you.

What is the most popular Medicare Supplement Plan?

Get Medigap Plan F . As the most popular Medicare Supplement plan, Plan F could be a logical choice for many Medicare recipients. If it seems like the right choice, call a licensed insurance agent who can help you choose the right insurance company for your needs.

What is a plan F?

Plan F is one of two Medicare Supplement plans that covers Part B excess charges (what some doctors charge above what Medicare pays for a service). Plan C is the other. Like many other Medigap policies, Plan F also covers Part B copayments and the deductible.

What is Medicare Supplement?

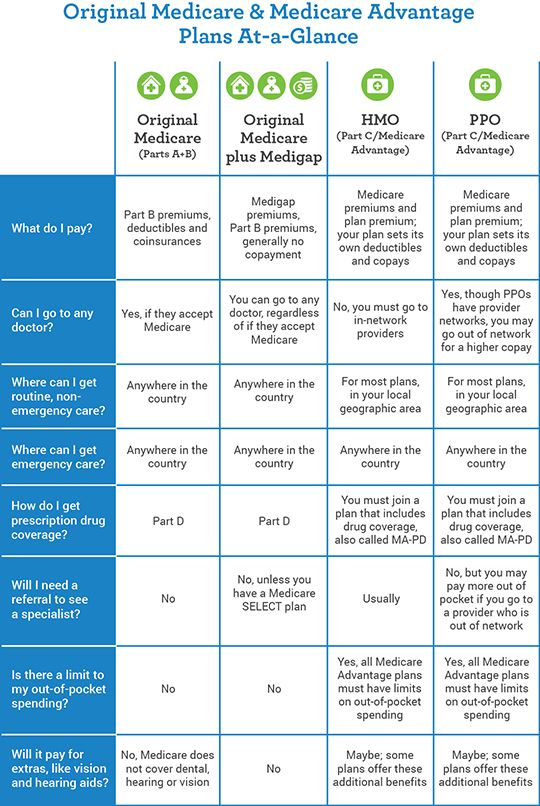

Medicare Supplement is an additional insurance policy you can buy to help cover costs that Original Medicare (Parts A and B) doesn’t. Medicare Advantage is a way to receive Part A and B, as well as additional benefits such as dental care, eye exams, and prescription drug coverage, all in one package.

How much does Plan F cost in 2020?

This plan covers everything a regular Plan F does, but in 2020, you’ll be responsible for paying the first $2,340 (up from $2,300 in 2019) of costs out of your own pocket before coverage kicks in. In return, you could pay lower premiums each month.

What is covered by Plan F?

Plan F also covers many Part A expenses, such as coinsurance for hospital stays, a skilled nursing facility, and hospice care. You’ll also have coverage for the first three pints of blood, should you ever need a transfusion. After that, Part A takes over to pay for additional blood.

What Other Medicare Supplement Plans Are Similar to Plan F?

People newly eligible for Medicare can’t sign up for Plan F, but they still have options when it comes to other Medigap plans. Here’s a look at what some experts say are the two best alternatives to Plan F.

What is Medicare Part A?

Medicare is the federal health insurance program for older U.S. adults, available starting at age 65. It consists of two main plan options: Medicare Part A covers hospitalization without a premium, and Medicare Part B covers doctor and outpatient care for a monthly premium.

Which Medicare plan provides the most benefits?

Historically, Medicare Plan F provided the most benefits of all the supplemental Medicare plans, says Price. It addresses some of the coverage gaps in Medicare parts A and B, which is why many people thought it was worth the extra premium, he notes.

What is the difference between Part G and Part N?

One of the main differences between Part G and Part N is Part N doesn’t cover the excess charges related to Part B , which occur when a doctor charges more than a Medicare-approved amount . Plan G does cover those excess charges.

Is Medicare a complicated plan?

Medicare can be a complicated subject—especially when you dive into all its variations. “A lot of people hear ‘Part A,’ ‘Part B,’ ‘Plan F’ and all these different letters flying around, and they definitely get a little confused,” says Sterling Price, a senior research analyst at ValuePenguin who specializes in health and life insurance.

Is Medicare Supplement Plan G the best option?

Medicare Supplement Plan G is generally the best option for people who are no longer eligible for Plan F, says Price. “It’s very similar to Plan F,” he notes.

Is Medicare Plan F a supplement?

Meanwhile, Medicare Plan F is an example of Medicare Supplement Insurance (Medigap). As its name suggests, Medigap helps fill the gaps that Medicare doesn’t cover. About 25% of people enrolled in Medicare parts A and B are also enrolled in a Medigap policy, research suggests [1].

How much does Medicare Part F cost?

The cost of Medicare Plan F depends on a few factors, including your age.

What does Medicare Plan F cover?

In addition to the deductibles and copayments, Medicare Plan F also covers things like hospice care coinsurance, skilled nursing facility coinsurance, up to three pints of blood, and foreign travel emergency care.

What does Medicare Supplement Insurance Plan F cover?

Medicare Supplement Plan F covers costs that Medicare doesn’t cover , says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What is Medigap insurance?

Medigap is supplemental insurance that helps Original Medicare beneficiaries pay out-of-pocket costs.

What is the best alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers, except for the Medicare Part B deductible. Plan G doesn’t cover the Part B deductible, which was a selling point with Plan F. The cost of Plan F and Plan G is very similar, so that’s a good alternative to Plan F.

When is the best time to buy Medicare Supplement?

Although Plan F has been eliminated for new enrollees, Decker explains that the best time to purchase any Medicare supplement is during the initial enrollment period when you first become eligible for Medicare. That begins three months before your 65th birthday and ends three months after. Otherwise, pre-existing health conditions could prohibit you from purchasing a plan later during the annual open enrollment period.

What is Medicare Supplement Plan F?

Medicare Supplement Plan F is not only the most comprehensive plan for lowering out-of-pocket costs, it is also the most popular.

Which states do not offer Medicare Supplement Plan F?

Massachusetts, Minnesota, and Wisconsin have state-specific policies and do not offer Medicare Supplement Plan F.

How much did Medicare pay out of pocket in 2016?

On average, Medicare beneficiaries paid $5,460 out of pocket on healthcare expenses in 2016, but people without supplemental insurance paid even more ($7,473). 1 This is where Medicare Supplement Plan F and other Medigap plans can be beneficial. These plans pay down the expenses left behind by Part A and Part B, including deductibles, copays, ...

What states have high deductible plan F?

High-Deductible Plan F is available in 14 states: Alaska, Delaware, Illinois, Maryland, Michigan, Montana, New Mexico, New York, North Dakota, Oklahoma, Pennsylvania, South Carolina, Texas, and West Virginia. Because a number of independent companies work under the BCBS name, there is no go-to contact number to call to enroll in Medicare Supplement ...

How to enroll in Humana Plan F?

To enroll in Humana Plan F, call Monday through Friday or request a telephone appointment using a simple online form on its website. You will need to include your start dates for Medicare Parts A and Part B and your desired start date for Medicare Supplement coverage. Humana requires a formal application for cost estimates and does not provide any rates over the phone. Its pricing, like many other Medicare Supplement companies, is based on attained age. This means you will pay more for your plan as you age. To round out your Medicare coverage, you can also sign up for dental and/or vision coverage not otherwise covered by Original Medicare and consider enrollment in one of its Medicare Part D prescription drug plans, many of which are rated 4-stars and above.

When did Humana start selling health insurance?

Founded in 1961, Humana started out as a nursing home company and began selling health insurance in the 1980s. It offers Plan F in all 47 states where traditional Medicare Supplement Plans are available. High-Deductible Plan F is available in all of those states except Georgia and Kentucky.

When did Medicare reauthorization start?

Congress passed the Medicare Access and CHIP Reauthorization Act (MACRA) in 2015. 8 One part of the law aimed to reduce access to Medicare Supplement Plans that covered the Part B deductible. Those plans, Plan C and Plan F, are no longer available to new beneficiaries, but you can still sign up for them if you were eligible for Medicare and born before January 1, 2020.

What are the extra benefits that Medicare doesn't cover?

Plans may offer some extra benefits that Original Medicare doesn’t cover — like vision, hearing, and dental services.

What is Medicare Advantage?

Medicare Advantage is a Medicare-approved plan from a private company that offers an alternative to Original Medicare for your health and drug coverage. These “bundled” plans include Part A, Part B, and usually Part D.

What is Medicare Supplemental Insurance?

Medicare Supplemental Insurance (Medigap): Extra insurance you can buy from a private company that helps pay your share of costs in Original Medicare. Policies are standardized, and in most states named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

Is Medicare a federal or state program?

Medicaid is a joint federal and state program that provides health coverage for some people with limited income and resources. Medicaid offers benefits, like nursing home care, personal care services, and assistance paying for Medicare premiums and other costs.