Medicare claims must be filed no later than one full calendar year after the date when the services were provided. If your claim is not filed within this timeframe, you may not be granted a refund from Medicare. 2 To file a claim, fill out the Patient Request for Medical Payment form and send the completed form to your state’s Medicare contractor.

Full Answer

Should retirees receive a Medicare Part B refund?

Image source: Getty Images. The Senior Citizens League is an advocacy group for older Americans that was established back in 1992 and focuses on lobbying lawmakers and informing the public about relevant issues. Recently, the organization called for retirees to receive a refund for a portion of the Medicare Part B premiums they have paid this year.

Is Medicare Part B deducted from my social security check?

In most cases, the Medicare B premium is deducted from your Social Security check. In 2015, most retirees on Medicare will pay a monthly Part B premium of $104.90 per person.

What is the Medicare Part B give back plan?

The Medicare Part B give back plan, or premium reduction plan is a feature of Medicare Advantage. Yet, only some Medicare Advantage plans offer this benefit, and it isn’t available in all areas. Those with this plan may see a higher amount on their social security check, depending on your Part B premium payment method.

When will I receive my Medicare Part B reimbursement?

Reimbursement for the standard premium payments is generally sent out in August of the year after those Part B payments were made. Reimbursements for IRMAA payments are processed later, usually the following March.

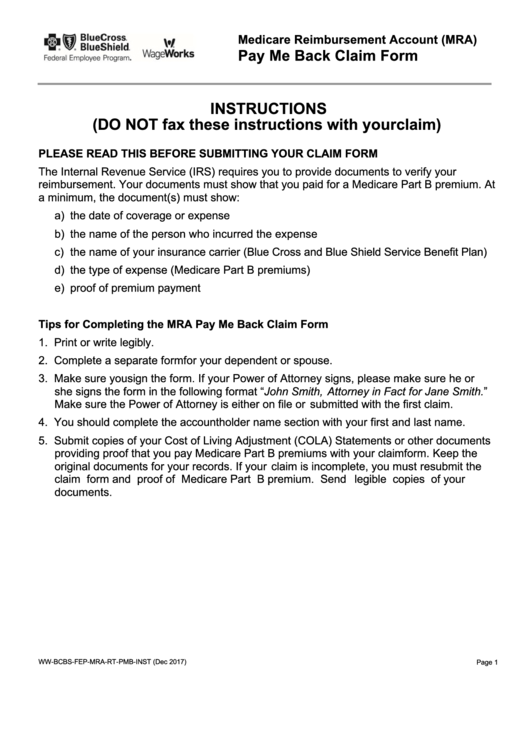

How do I get my Medicare Part B refund?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan.

Why would I get a check from Medicare Part B?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. premium deducted automatically from their Social Security benefit payment (or Railroad Retirement Board benefit payment).

Who are Medicare funds collected by?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act, if you're into deciphering acronyms - which go toward Medicare.

How does Medicare money back work?

The Part B give back benefit helps those on Medicare lower their monthly health care spending by reducing the amount of their Medicare Part B premium. When you enroll in a Medicare Advantage Plan that offers this benefit, the carrier pays either a part of or the entire premium for your outpatient coverage each month.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Are enrolled in Part A and Part B.Do not rely on government or other assistance for your Part B premium.Live in the zip code service area of a plan that offers this program.Enroll in an MA plan that provides a giveback benefit.

Is Medicare Part B reimbursement taxable?

The Medicare Part B reimbursement payments are not taxable to the retiree.

Where does my Medicare money go?

What does it pay for?Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.benefits. The health care items or services covered under a health insurance plan. ... skilled nursing facility (snf) care. ... home health care. ... hospice.

How does money get into the Medicare funds?

Q: How is Medicare funded? A: Medicare is funded with a combination of payroll taxes, general revenues allocated by Congress, and premiums that people pay while they're enrolled in Medicare. Medicare Part A is funded primarily by payroll taxes (FICA), which end up in the Hospital Insurance Trust Fund.

Does Medicare take money from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What is a Part B premium buyback?

What is a Medicare give back benefit? A Part B give back plan is simply a Medicare Advantage plan with a premium reduction benefit. These plans are sometimes called giveback plans, Medicare buyback plans, or premium reduction plans. The premium reduction benefit helps lower your monthly Part B premium.

How did Medicare Part B get reimbursed?

Reimbursement of your Medicare Part B premiums is a benefit that was won through union action. Municipal unions first won reimbursement at the bargaining table in 1966, but a succession of mayors pled poverty and paid only a portion of the premium. In 2001, the City paid just 70%, which was then $384. The return to 100% reimbursement was won through “old-fashioned politicking” by the New York City labor movement, says Irwin Yellowitz, a labor historian and former chair of the PSC Retirees Chapter.

What is Medicare Part B?

Medicare Part B is the part of Medicare that covers doctors’ visits, outpatient care and other services not covered by Medicare Part A, which covers hospitalization. In most cases, the Medicare B premium is deducted from your Social Security check. In 2015, most retirees on Medicare will pay a monthly Part B premium of $104.90 per person.

When is IRMAA reimbursement sent out?

Reimbursement for the standard premium payments is generally sent out in August of the year after those Part B payments were made. Reimbursements for IRMAA payments are processed later, usually the following March. For example, reimbursement for standard Part B premium payments made in 2014 would be sent out in August 2015, while IRMAA reimbursements for that year would be sent out in March 2016.

How to contact the NYC Health Benefits Program?

For further information, contact the NYC Health Benefits Program (212-513-0470) or the University Benefits Office (646-664-3350).

Where to apply for TIAA-CREF?

The application is online at tinyurl.com/CUNY-TIAA-Part-B. Send the completed form, plus copies of your retiree health insurance card and your Medicare card (and Medicare card of your spouse or domestic partner), to the address below. Your Medicare card (s) must indicate the effective dates of enrollment in both Parts A and B. Send these documents to:

Does NYC reimburse Part B?

Reimbursement of your Part B premium is processed by the New York City Health Benefits Program, and you won’t receive reimbursement unless you have submitted notice of your eligibility. You do not need to submit an annual request to receive reimbursement for the standard monthly premium; once you are signed up you will continue to receive this basic reimbursement each year. Retirees in the Teachers’ Retirement System (TRS) with City health coverage must write to the NYC Office of Labor Relations (see below), while retirees in TIAA-CREF or other retirement vehicles in CUNY’s Optional Retirement Program (ORP) must send a form to CUNY.

How to file a claim with Medicare?

To file a claim, fill out the Patient Request for Medical Payment form and send the completed form to your state’s Medicare contractor.

How to contact Medicare if you don't accept Medicare?

Speak with a licensed insurance agent. 1-800-557-6059 | TTY 711, 24/7. If you go to a provider that does not accept Medicare assignment, you may have to pay for the service out of pocket and then file a claim to be reimbursed by Medicare.

What are the benefits of Medicare Advantage?

Still, there are several advantages to having a Medicare Advantage plan. For instance, many Medicare Advantage plans can offer benefits that aren’t covered by Original Medicare, including: 1 Prescription drug coverage 2 Dental coverage 3 Vision coverage 4 Hearing coverage 5 Health and wellness program benefits, such as membership to SilverSneakers

How to find Medicare Advantage plan?

To learn more about Medicare or to find Medicare Advantage plans in your area, speak with a licensed insurance agent by calling. 1-800-557-6059 . 1-800-557-6059 TTY Users: 711 24 hours a day, 7 days a week. 1 Medicare.gov. Lower costs with assignment.

What is Medicare assignment?

Providers that accept Medicare assignment are required by law to accept the Medicare-approved amount as full payment for covered services. Providers that don’t accept assignment can charge up to 15 percent more for covered services, which you are typically responsible for paying. 1

What should be included in a medical bill?

The bill should include: The date of service. A description of each service. The charge for each service. The place of service. Diagnosis. Name and address of the provider. A letter explaining your reason for the claim, including why you received the medical care from the provider.

Does Medicare have an out-of-pocket maximum?

Original Medicare does not have an out-of-pocket maximum.

What is the Medicare Part B Give Back Benefit?

The Part B give back benefit helps those on Medicare lower their monthly health care spending by reducing the amount of their Medicare Part B premium. When you enroll in a Medicare Advantage Plan that offers this benefit, the carrier pays either a part of or the entire premium for your outpatient coverage each month.

What is Medicare give back?

What is the Give Back Benefit in Medicare? The give-back benefit is another term for Part B premium reduction. This is when a Medicare Advantage plan reduces the amount you pay towards your Part B monthly premium.

How Much Do I Get Back With a Part B Give Back Plan?

The amount you get back varies by plan. Amounts can range from $0.10 in some counties up to the full standard premium for the year.

What is a Part B premium reduction plan?

The Part B premium reduction plan is just like it sounds. You enroll in the policy, and the carrier pays either part or the whole premium for your outpatient coverage. In the summary of benefits or evidence of coverage , you’ll see a section that says Part B premium buy-down; this is where you can see how much of a reduction you’ll get.

How much does Part B premium cost?

These plans reduce your Part B premium up to the full standard amount of $148.50 each month and add the money to your Social Security check.

How much do you get back on a Medicare plan?

The amount you get back can range from $0.10 in some counties up to $148.50. Also, the amount you get back will depend on the options in your area. Further, sometimes the same plan name will have a different premium buy-down in different counties.

How long does it take to get a Part B rebate?

It can take Social Security 1-3 months to begin your Part B premium rebate. After waiting, you can expect to see a regular increase in your checks.

Is it uncommon to receive checks like the one you received?

A. Checks like the one you received are not uncommon.

Do retired teachers get Medicare?

For example, he said, if you are a retired teacher and otherwise meet the years of service and hire date eligibility requirements, you would receive an amount equal to the standard Medicare Part B monthly premium in your pension check each month.

What happens if Medicare overpayment exceeds regulation?

Medicare overpayment exceeds regulation and statute properly payable amounts. When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments.

Where do we refer overpayments to?

We refer the overpayment debt to the Treasury or to a Treasury-designated Debt Collection Center (DCC). Both work through the

What is SSA 1893(f)(2)(A)?

SSA Section 1893(f)(2)(A) outlines Medicare overpayment recoupment limitations. When CMS and MACs get a valid first- or second-level overpayment appeal , subject to certain limitations , we can’t recoup the overpayment until there’s an appeal decision. This affects recoupment timeframes. Get more information about which overpayments we subject to recoupment limitation at

What is reasonable diligence in Medicare?

Through reasonable diligence, you or a staff member identify receipt of an overpayment and quantify the amount. According to SSA Section 1128J(d), you must report and return a self-identified overpayment to Medicare within:

How long does it take to get an ITR letter?

If you fail to pay in full, you get an ITR letter 60–90 days after the initial demand letter. The ITR letter advises you to refund the overpayment or establish an ERS. If you don’t comply, your MAC refers the debt for collection.

Can Medicare overpayments be recouped?

outlines Medicare overpayment recoupment limitations. When CMS and MACs get a valid first- or second-level overpayment appeal, subject to certain limitations, we can’t recoup the overpayment until there’s an appeal decision. This affects recoupment timeframes. Get more information about which overpayments we subject to recoupment limitation at

What is voluntary refund?

A voluntary refund is when an overpayment has been self-identified. A check is required to be submitted along with the appropriate form. The check will be applied to the identified overpayments. If there are excess funds, they will be applied per CMS Medicare Learning Network (MLN) Matters (MM)3274.

What are the two types of voluntary refunds?

There are two types of voluntary refunds Medicare Secondary Payer (MSP) and Non MSP.

What Is The Medicare Part B Give Back Benefit?

The Give Back benefit is a benefit offered by some Medicare Advantage plan carriers that can help you reduce your Medicare Part B premium. You should know, however, that the Give Back benefit is not an official Medicare program. This benefit is provided as part of some Medicare Part C plans as a way to encourage participation in a specific plan. You might also hear the Give Back plan called the Part B premium reduction. Here is how it works.

What is the deadline for Medicare give back benefit?

There is no deadline to qualify for the give back benefit. You must already be enrolled in Medicare Part A and Part B, and you must pay your own monthly Part B premium. You then simply need to enroll in a Medicare Advantage plan that offers this benefit. Remember that a Medicare Advantage plan combines Part A, Part B, and prescription drug coverage into a single plan. Some of these plans provide additional benefits like vision and dental coverage. Plus, many of them offer the Medicare Give Back benefit, which helps cover some or all of your monthly Part B premium. Generally, you must enroll in a Medicare Advantage plan during specific enrollment periods. If you miss your initial enrollment period, then you can enroll during the open enrollment period from January 1 through March 31 each year.

What is a group code for Medicare?

Group Codes assign financial responsibility for the unpaid portion of the claim balance e.g., CO (Contractual Obligation) assigns responsibility to the provider and PR (Patient Responsibility) assigns responsibility to the patient. Medicare beneficiaries may be billed only when Group Code PR is used with an adjustment. CARCs provide an overall explanation for the financial adjustment, and may be supplemented with the addition of more specific explanation using RARCs. Medicare beneficiaries are sent Medicare Summary Notice that indicates how much financial responsibility the beneficiary has.

What chapters are Medicare claims processing manual?

See the Medicare Claims Processing Manual, (Pub.100-04), Chapters 22 and 24 for further remittance advice information.

What is an ERA in Medicare?

After Medicare processes a claim, either an ERA or an SPR is sent with final claim adjudication and payment information. One ERA or SPR usually includes adjudication decisions about multiple claims. Itemized information is reported within that ERA or SPR for each claim and/or line to enable the provider to associate the adjudication decisions with those claims/lines as submitted by the provider. The ERA or SPR reports the reason for each adjustment, and the value of each adjustment. Adjustments can happen at line, claim or provider level. In case of ERA the adjustment reasons are reported through standard codes. For any line or claim level adjustment, 3 sets of codes may be used:

Does Medicare provide free software to read ERA?

Medicare provides free software to read the ERA and print an equivalent of an SPR using the software. Institutional and professional providers can get PC Print and Medicare Easy Print (MREP) respectively from their contractors. These software products enable providers to view and print remittance advice when they're needed, thus eliminating the need to request or await mail delivery of SPRs. The MREP software also enables providers to view, print, and export special reports to Excel and other application programs they may have.