As a retired SJCERA member, you may be eligible for the Medicare Part B Reimbursement Program if you: •Are a retired County employee or eligible beneficiary, •Were hired before August 2001, •Have a Sick Leave Bank Balance (see your SJCERA monthly earnings statement), and •Are enrolled in Medicare Part B. Eligible beneficiaries include your spouse and disabled adult children who have Medicare Part B coverage and are your (the retiree’s) tax dependents (under Section 152 of the Internal Revenue Code.) a new

What is the maximum premium for Medicare Part B?

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B. You may be reimbursed the full premium amount, or it may only …

Should I buy Medicare Part B?

Who Is Eligible For The Medicare Part B Give Back Benefit? It is pretty easy to qualify for the Medicare Give Back benefit as the eligibility criteria are straightforward. First, you must be enrolled in Original Medicare. You need to have both Medicare Part A and Medicare Part B coverage. Next, you must pay your own monthly Part B premium.

What are the requirements for Medicare Part B?

who qualifies for medicare part b premium reimbursement - Erinbethea.com. Only the member or a Qualified Surviving Spouse/Domestic Partner enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement. Only the member or a Qualified Surviving Spouse/Domestic Partner enrolled in Parts A and B is eligible for Medicare Part B premium reimbursement.

Does Medicaid pay for Medicare Part B?

Dec 17, 2021 · As a reminder, Part B reimbursement only applies to Retired Members or Qualified Survivors who are eligible for an LAFPP health subsidy and are enrolled in both Medicare Parts A and B. Any additional Part B fees or penalties charged by CMS are not eligible for reimbursement.

How do you qualify to get $144 back from Medicare?

How do I qualify for the giveback?Be a Medicare beneficiary enrolled in Part A and Part B,Be responsible for paying the Part B premium, and.Live in a service area of a plan that has chosen to participate in this program.Nov 24, 2020

How do I get reimbursed for Part B premium?

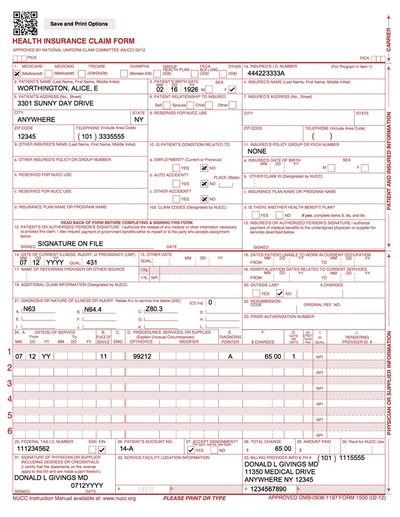

Submit Medicare Part B premium proof of payment and a completed reimbursement form for each eligible dependent to HealthEquity in one of the following ways: Scan and upload them to healthequity.com. Fax them to 1-801-999-7829. (Be sure to include a cover sheet.)

Who receives Medicare reimbursement?

Original Medicare pays for the majority (80 percent) of your Part A and Part B covered expenses if you visit a participating provider who accepts assignment. They will also accept Medigap if you have supplemental coverage. In this case, you will rarely need to file a claim for reimbursement.

Can I get Medicare Part B for free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

How does Medicare Part A reimbursement work?

Medicare reimbursement is the process by which a doctor or health facility receives funds for providing medical services to a Medicare beneficiary. However, Medicare enrollees may also need to file claims for reimbursement if they receive care from a provider that does not accept assignment.Dec 9, 2021

Can I get reimbursed from Medicare?

The Centers for Medicare & Medicaid Services (CMS) sets reimbursement rates for Medicare providers and generally pays them according to approved guidelines such as the CMS Physician Fee Schedule. There may be occasions when you need to pay for medical services at the time of service and file for reimbursement.

Can I get reimbursed for Medicare premiums?

Call 1-800-MEDICARE (1-800-633-4227) if you think you may be owed a refund on a Medicare premium. Some Medicare Advantage (Medicare Part C) plans reimburse members for the Medicare Part B premium as one of the benefits of the plan. These plans are sometimes called Medicare buy back plans.Jan 20, 2022

What Is The Medicare Part B Give Back Benefit?

The Give Back benefit is a benefit offered by some Medicare Advantage plan carriers that can help you reduce your Medicare Part B premium. You should know, however, that the Give Back benefit is not an official Medicare program. This benefit is provided as part of some Medicare Part C plans as a way to encourage participation in a specific plan.

Who Is Eligible For The Medicare Part B Give Back Benefit?

It is pretty easy to qualify for the Medicare Give Back benefit as the eligibility criteria are straightforward. First, you must be enrolled in Original Medicare. You need to have both Medicare Part A and Medicare Part B coverage. Next, you must pay your own monthly Part B premium.

Applying For A Medicare Part B Give Back Benefit

So, what is the enrollment process for the Give Back benefit? Many people are looking to save as much money as possible when it comes to their health care costs, so they want to know how to get signed up for this program. The process is quite simple, so here is how to do it.

The Bottom Line

Since most people on Medicare are receiving Social Security benefits, finding a way to reduce the cost of your health insurance is always a plus. The Medicare Give Back program can do just that by paying for a portion or even all of your Medicare Part B premium.

What is the deadline for Medicare give back benefit?

There is no deadline to qualify for the give back benefit. You must already be enrolled in Medicare Part A and Part B, and you must pay your own monthly Part B premium. You then simply need to enroll in a Medicare Advantage plan that offers this benefit.

When do you have to be on Medicare before you can get Medicare?

Individuals already receiving Social Security or RRB benefits at least 4 months before being eligible for Medicare and residing in the United States (except residents of Puerto Rico) are automatically enrolled in both premium-free Part A and Part B.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is the income related monthly adjustment amount for Medicare?

Individuals with income greater than $85,000 and married couples with income greater than $170,000 must pay a higher premium for Part B and an extra amount for Part D coverage in addition to their Part D plan premium. This additional amount is called income-related monthly adjustment amount. Less than 5 percent of people with Medicare are affected, so most people will not pay a higher premium.

What happens if you don't enroll in Part A?

If an individual did not enroll in premium Part A when first eligible, they may have to pay a higher monthly premium if they decide to enroll later. The monthly premium for Part A may increase up to 10%. The individual will have to pay the higher premium for twice the number of years the individual could have had Part A, but did not sign up.

How long does Medicare take to pay for disability?

A person who is entitled to monthly Social Security or Railroad Retirement Board (RRB) benefits on the basis of disability is automatically entitled to Part A after receiving disability benefits for 24 months.

Why does Part A end?

There are special rules for when premium-free Part A ends for people with ESRD. Premium Part A and Part B coverage can be voluntarily terminated because premium payments are required. Premium Part A and Part B coverage ends due to: Voluntary disenrollment request (coverage ends prospectively); Failure to pay premiums;