In most states you need to be 65 years or older; however, insurance carriers in a few states offer at least one Medicare Supplement to Medicare beneficiaries under 65 years. Anyone who is at least 65 years old and enrolled in Medicare Parts A & B is eligible for Medigap.

Which insurers offer Medigap?

Cigna - Cigna is a huge company that offers Medigap coverage in most states at competitive rates. Aetna - It is fairly easy to get quotes online from this big-name insurer, and you can get prescription drug plans as well. Mutual of Omaha - This insurer has a huge household discount of 12 percent and is owned by its policyholders.

Who pays first Medicare or Medigap?

The primary insurer is the one that pays the claim first, whereas the secondary insurer pays second. With a Medigap policy, the supplement is secondary. Medicare pays claims first, and then Medigap pays. But, depending on the other policy, you have Medicare could be a secondary payer.

What are the insurance companies that offer Medigap in Texas?

Shopping tips

- Buy during open enrollment. The best time to buy a Medicare supplement policy is during your Medicare open enrollment period because companies must sell you any plan they offer without ...

- Shop around. Prices can vary. ...

- Consider other things. Price should not be your only consideration. ...

- Consider your needs. ...

Who needs Medigap insurance?

Medigap Plan M is a Medicare Supplement Insurance plan that covers some out-of-pocket expenses for Medicare members, including copays, coinsurance and deductibles. Plan M is nearly identical to ...

What makes you eligible for Medigap?

A: You are eligible for Medicare supplement (Medigap) coverage if you are already enrolled in Medicare Part A and Medicare Part B. The open enrollment window is six months long, beginning on the date your Medicare B becomes effective.

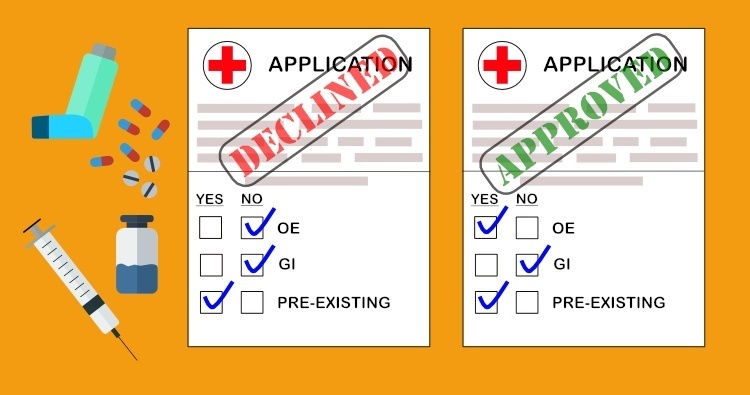

Can Medigap insurance be denied?

The answer is yes, you can be denied Medigap coverage. But you can also be guaranteed Medigap coverage if you apply during your Medigap open enrollment period.

What is the relationship between Medigap insurance and Medicare?

Medigap Plans The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

Can you have Medigap without Medicare?

Do I need to have Original Medicare to apply for Medigap? The short answer is yes. To have a Medigap policy, you must first have Medicare Part A and Part B. Your Medigap Open Enrollment Period begins on the first day of the month that you're both 65 or older and enrolled in Medicare Part B.

Do Medigap plans have a waiting period?

The six-month waiting period begins once your policy starts. These pre-existing condition waiting periods only apply to Medigap policies.

Do Medigap plans have out-of-pocket limits?

Do Medigap Plans have an Out-of-Pocket Maximum? Medigap plans don't have a maximum out-of-pocket because they don't need one. The coverage is so good you'll never spend $5,000 a year on medical bills.

What is the downside to Medigap plans?

Because Medigap plans are sold by private insurance companies, they can charge different monthly premiums. While plans are standardized in regard to coverage and benefits, they are not standardized in regards to cost. Cost can even increase over time based on inflation, your age and other factors.

Can I switch from Medicare Advantage to Medigap?

Most Medicare Advantage Plans offer prescription drug coverage. , you may want to drop your Medigap policy. Your Medigap policy can't be used to pay your Medicare Advantage Plan copayments, deductibles, and premiums.

Can you switch from Medicare Advantage to Medigap with pre existing conditions?

The Medigap insurance company may be able to make you wait up to 6 months for coverage of pre-existing conditions. The number of months you've had your current Medigap policy must be subtracted from the time you must wait before your new Medigap policy covers your pre-existing condition.

Does Medigap include Part B?

Medigap policies are only available to people who already have Medicare Part A, which helps pay for hospital services, and Medicare Part B, which covers the cost for doctor services. People who have a Medicare Advantage plan cannot get a Medigap plan.

Can you have 2 Medigap policies?

En español | By law, Medigap insurers aren't allowed to sell more than one Medigap plan to the same person.

What is the difference between Medicare Advantage and Medigap?

Medigap is supplemental and helps to fill gaps by paying out-of-pocket costs associated with Original Medicare while Medicare Advantage plans stand in place of Original Medicare and generally provide additional coverage.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

How old do you have to be to get Medicare Supplement?

In most states you need to be 65 years or older; however, insurance carriers in a few states offer at least one Medicare Supplement to Medicare beneficiaries under 65 years. Anyone who is at least 65 years old and enrolled in Medicare Parts A & B is eligible for Medigap.

How old do you have to be to get medicare in 2021?

You also must be enrolled in Part A and Part B. In most states you need to be 65 years or older; however, insurance carriers in a few states offer at least one Medicare Supplement ...

What insurance does Medicare offer to people under 65?

The policy that is usually available to Medicare beneficiaries under 65 is Medigap Plan A. Insurance companies know that beneficiaries under 65, receiving Medicare are likely on disability. Those on disability are a higher risk for claims because they need more ...

How long does Medigap coverage last?

The best part, when you enroll during this period, there’s no medical underwriting. This only happens once in a beneficiary’s lifetime and lasts for 6 months. Those new to Medicare have the best opportunity when it comes to Medigap eligibility. Taking advantage of top-quality coverage at the lowest price is the opportunity every beneficiary has ...

When do seniors have to enroll in Medicare Supplement?

Many seniors will have automatic enrollment in Part A when turning 65. In some cases, beneficiaries automatically enroll in Part B. Once you’ve acquired Original Medicare, you can use your Medicare Supplement Open Enrollment Period to select a Medicare Supplement policy. The best part, when you enroll during this period, ...

Can Medicare Advantage plan beneficiaries switch to Medigap?

Medicare Advantage plan beneficiaries can switch to Medigap if they increased the copayments or premium by 15 percent or more, stopped offering the plan, ends their relationship with your provider, or reduced benefits.

What age can I enroll in Medigap?

This is a period when Medicare beneficiaries under the age of 65 can enroll in a Medigap policy without having to go through medical underwriting.

How old do you have to be to get Medicare?

For Medicare beneficiaries who are at least 65 years old, access to a Medigap policy is guaranteed during their Medigap open enrollment period. However, beneficiaries under the age of 65 do not have the same protections nationwide. Instead, those protections are regulated at the state level. Some states guarantee that applicants under 65 will have ...

How many states have Medigap coverage?

States with mandated Medigap coverage options for those under 65. According to a report by the Kaiser Family Foundation, there are 30 states that require insurers to offer at least one Medigap plan to qualifying Medicare beneficiaries under 65. 1 Certain states guarantee coverage options for those with ESRD, for those with a disability, or both.

How many Medigap plans are required for a 65 year old?

The 30 states in the chart above have a guaranteed issue requirement, which means that insurance companies must offer at least one plan to qualifying applicants under the age of 65. If applicants are under 65 and have Medicare Part A and Part B coverage, the insurance company must offer at least one Medigap plan to them in the qualifying states.

Does California require a Medigap plan?

For example, if you live in California and have Medicare coverage due to ESRD, a Medigap insurance company is not legally required to offer you a Medigap plan. The state only protects applicants under 65 with a qualifying disability.

When will Medicare change to plan F?

The rules for who can enroll in Medigap plan F have changed starting January 1, 2020. If you're newly eligible for Medicare in 2020, skip ahead to find out how this update will affect you.

What is Medicare Supplement Plan F?

Licensed Insurance Agent and Medicare Expert Writer. July 29, 2020. Medicare Plan F covers more expenses than other supplement plans, and it's one of just two plans that pay for the Part B deductible. It also covers the Part B excess charge, a benefit that’s just as rare.

Is Plan F a good Medicare supplement?

As the most popular Medicare Supplement plan, Plan F could be a logical choice for many Medica re recipients. If it seems like the right choice, call a licensed insurance agent who can help you choose the right insurance company for your needs.

Does Medicare pay for health care abroad?

Original Medicare doesn’t pay for health care costs incurred abroad, but Plan F can cover up to 80% of those costs. When out of the country, you could pay as little as 20% for care.

Does Plan G cover Part B?

The only thing F covers that G doesn't is the Part B deductible ($198 in 2020), but Plan G’s lower premiums may make up the difference.

Is Medigap Plan F available?

Medigap Plan F will have limited availability. Beginning in 2020, Plans F and C, which cover the Part B deductible, are no longer available to people newly eligible to Medicare after January 1, 2020. If you became eligible for Medicare in 2019 or earlier, however, you can still enroll in Plan F in 2020 and beyond.

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

How to Choose the Right Medicare Supplement Plan for You

What are my health care needs now and possibly in the future? Consider your current health status as well as your family history.

Best Medicare Supplement Providers

Many health insurance companies offer various Medigap plans, but not all providers issue policies in all 50 states or boast high rankings from rating agencies like A.M. Best.

How to Sign Up for Medigap Plans

Signing up for a Medigap plan is easy. “Medicare supplements may be bought through an agent or from the carrier directly,” says Corujo. Since there’s no annual open enrollment period, you may join at any time.

When is the best time to enroll in Medigap?

That’s the six months immediately after you turn 65 and sign up for Part B, when you’re guaranteed by federal law to be accepted by any plan, regardless of health.

Why do people call Medicare Supplement Plans “Medigap”?

Some people call Medicare supplement plans “Medigap” because they “fill in the gaps” that exist in Medicare. Plan G is one of 10 major Medicare supplement plans currently offered to new Medicare enrollees. The plans are named by letter, ranging from A to N.

What is the second most comprehensive Medicare supplement plan?

The plans are named by letter, ranging from A to N. Plan G is the second-most comprehensive Medicare supplement plan available, next to Plan F. Plan G is also growing in popularity. 1.

How to contact Debra from Medicare?

Call a Licensed Agent: 833-271-5571. Debra is 64 and plans to retire next year. She will apply for Medicare Part A and Part B. Debra loves to be outside, gardening or walking her dogs. She has had a few suspicious lesions removed recently by her dermatologist, who doesn’t accept Medicare assignment.

How much does Plan G cover?

Plan G also covers 80% of emergency health care costs while in another country. However, you must pay a $250 deductible first, and the care has to occur during the first 60 days of a trip. Also, the plan sets a lifetime limit of $50,000 on this type of coverage. 5.

Does Debra have a Medigap Plan G?

After doing some research, Debra decided to purchase Medigap Plan G, as it will cover any Part B excess charges from her dermatologist and pay for emergency services abroad.

Does Plan G cover Medicare excess charges?

Part B excess charges. Unlike most Medicare Supplement plans, Plan G covers your Part B excess charges. That means you can see providers who don’t accept Medicare assignment (don’t participate in Medicare), but they can charge 15% more than standard Medicare rates. 4 Without coverage for excess charges, you pay that 15% difference.

How long after Medicare coverage ends can you start Medigap?

No later than 63 calendar days after your coverage ends. Medigap coverage can't start until your Medicare Advantage Plan coverage ends. You have Original Medicare and an employer group health plan (including retiree or COBRA coverage) or union coverage that pays after Medicare pays and that plan is ending.

How long does Medigap coverage last?

No later than 63 calendar days after your coverage ends. note: Your rights may last for an extra 12 months under certain circumstances. Your Medigap insurance company goes bankrupt and you lose your coverage, or your Medigap policy coverage otherwise ends through no fault of your own. You have the right to buy:

How long before Medicare coverage ends?

As early as 60 calendar days before the date your coverage will end. No later than 63 calendar days after your coverage ends. Call the Medicare SELECT insurer for more information about your options. Find the phone number for the Medicare SELECT company.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

How long do your rights last on Medicare?

Your rights may last for an extra 12 months under certain circumstances. You dropped a Medigap policy to join a Medicare Advantage Plan (or to switch to a Medicare SELECT policy) for the first time, you’ve been in the plan less than a year, and you want to switch back. (Trial Right) You have the right to buy:

When will Medicare plan C and F be available?

However, if you were eligible for Medicare before January 1, 2020 but not yet enrolled, you may be able to buy Plan C or Plan F.

Does Medicare cover prescriptions?

If you’re enrolled in a Medicare Advantage Plan: Most Medicare services are covered through the plan. Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. and still buy a Medigap policy if you change your mind. You have a guaranteed issue right (which means an insurance company ...