What items are not covered by Medicaid?

Medicare doesn’t cover these routine items and services: Routine or annual physical checkups, with certain exceptions Physical examinations performed without a specific sign, symptom, patient complaint, or third-party requirements such as insurance companies, business establishments, or government agencies

What medications are not covered by Part D?

Dec 08, 2021 · Medicare does not typically cover most health care received outside the United States, Puerto Rico, the Northern Mariana Islands, Guam, American Samoa and the U.S. Virgin Islands. The only exceptions involve emergency care under certain circumstances.

What items are covered by Medicare?

Some of the items and services Medicare doesn't cover include: Long-Term Care (also called custodial care ) Most dental care Eye exams related to prescribing glasses Dentures Cosmetic surgery Acupuncture Hearing aids and exams for fitting them Routine foot care Find out if Medicare covers a test, item, or service you need.

What does Medicare no pay mean?

Medicare only covers three immunizations (influenza, pneumonia, and hepatitis B) as prophylactic physician services. Cosmetic procedures are never covered unless there is a medically-necessary...

Who would not be covered under Medicare?

Some of the items and services Medicare doesn't cover include:Long-Term Care. ... Most dental care.Eye exams related to prescribing glasses.Dentures.Cosmetic surgery.Acupuncture.Hearing aids and exams for fitting them.Routine foot care.

Who all is covered by Medicare?

Medicare is the federal health insurance program for:People who are 65 or older.Certain younger people with disabilities.People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Who does Medicare cover in Australia?

Support for families, children, Indigenous Australians, and people living in remote areas. We can cover some or all of the health care costs of having a baby. We cover some or all of your child's health care costs.Dec 10, 2021

What are Medicare exclusions?

Mandatory exclusions: OIG is required by law to exclude from participation in all Federal health care programs individuals and entities convicted of the following types of criminal offenses: Medicare or Medicaid fraud, as well as any other offenses related to the delivery of items or services under Medicare, Medicaid, ...

What is the difference between Medicare A and B?

Medicare Part A covers hospital expenses, skilled nursing facilities, hospice and home health care services. Medicare Part B covers outpatient medical care such as doctor visits, x-rays, bloodwork, and routine preventative care. Together, the two parts form Original Medicare.May 7, 2020

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is not covered by Medicare Australia?

Medicare does not cover: most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry or psychology services; acupuncture (unless part of a doctor's consultation); glasses and contact lenses; hearing aids and other appliances; and.

Who is not eligible for Medicare Australia?

an Australian permanent resident and lived outside Australia for 12 months or more. a temporary visa holder and you hadn't applied for permanent residency. a temporary visa holder, and you're not eligible for Medicare under a Reciprocal Health Care Agreement.Dec 10, 2021

Are CT scans covered by Medicare Australia?

Medicare also covers diagnostic imaging services such as ultrasound, CT scans, X-rays, MRI scans. Find out more about diagnostic imaging under Medicare.

What is Sam exclusion list?

An exclusion record identifies parties excluded from receiving Federal contracts, certain subcontracts, and certain types of Federal financial and non Financial assistance and benefits. Exclusions are also referred to as suspensions and debarments.

What is an exclusion list?

What are Exclusion Lists? In simplest terms, a government exclusion list is a roster of individuals and organizations that are not eligible to participate in federal or state contracts due to criminal behavior or misconduct. These lists are maintained by state or federal agencies and updated regularly.Jan 11, 2021

What is an exclusion insurance?

Exclusion — a provision of an insurance policy or bond referring to hazards, perils, circumstances, or property not covered by the policy. Exclusions are usually contained in the coverage form or causes of loss form used to construct the insurance policy.

What are the drugs covered by Medicare?

Some of the drugs Medicare Part B does cover can include: 1 Drugs used with an item of durable medical equipment such as a nebulizer 2 Certain antigens 3 Injectable osteoporosis drugs 4 Erythropoietin by injection 5 Blood clotting factors 6 Oral drugs given for End-Stage Renal Disease 7 Enteral nutrition, such as intravenous and tube feeding 8 Intravenous Immune Globulin (IVIG) that is provided at home 9 Transplant and immunosuppressive drugs

What is Medicare Part B?

Enteral nutrition, such as intravenous and tube feeding. Intravenous Immune Globulin (IVIG) that is provided at home. Transplant and immunosuppressive drugs. Medicare Part B also covers vaccinations and flu shots.

How often does Medicare cover diabetic eye exams?

Eye exams for diabetic retinopathy can be covered once a year, but only if you have diabetes. Medicare beneficiaries who want coverage for routine vision care, glasses and contact lenses may consider a Medicare Advantage plan that offers vision benefits.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

Does Medicare cover everything?

Original Medicare doesn’t cover everything. Learn about your coverage options, including Medicare Advantage plans that may cover additional services you need. Medicare provides coverage for a wide range of services and products, but it doesn’t cover everything. In this guide, we take a look at what is not covered by Original Medicare ...

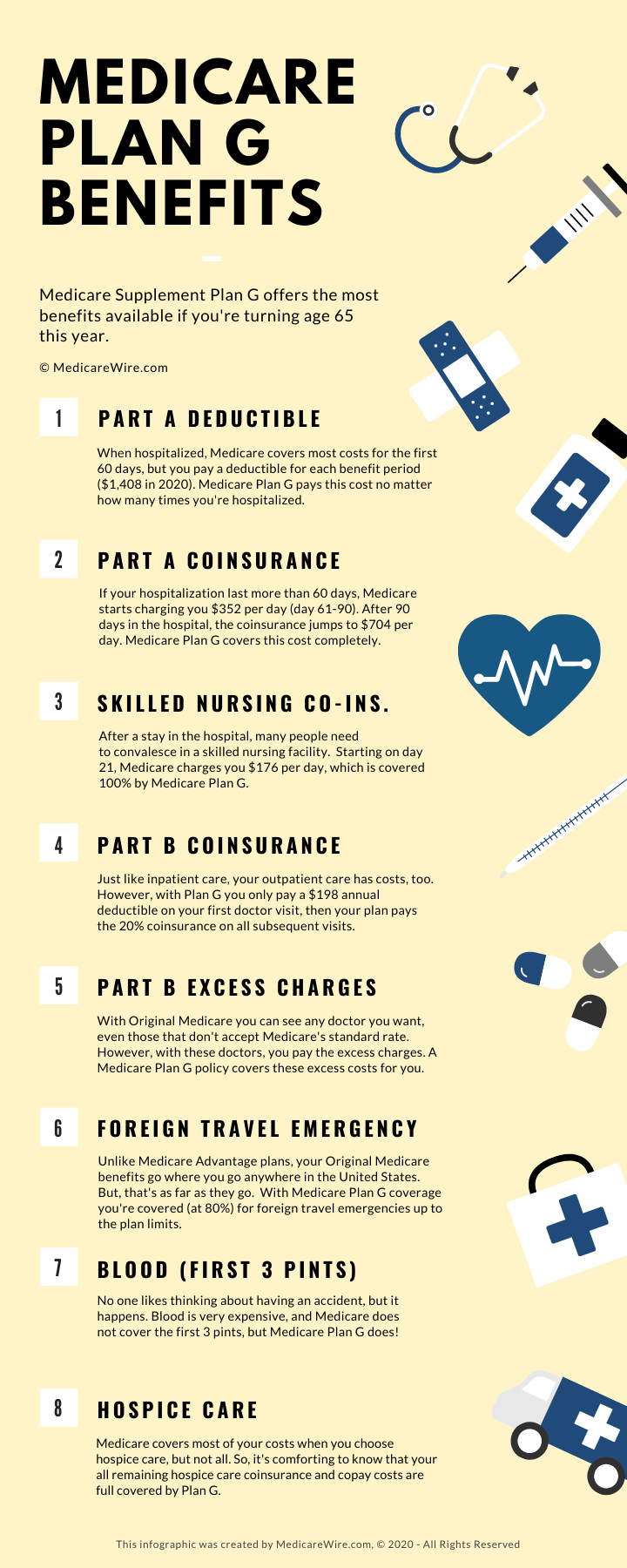

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) Medicare Supplement Insurance plans are used to cover some of the out-of-pocket expenses associated with Original Medicare, such as deductibles and copayments. Medicare Supplement Insurance plans can work alongside your Original Medicare benefits. You cannot have a Medigap plan and a Medicare Advantage plan ...

Does Medicare cover prescription drugs?

Prescription drugs. Original Medicare does not cover most prescription drugs. Only a select few prescription drugs are covered by Original Medicare, and only under limited conditions. Medicare Part B also covers vaccinations and flu shots.

What does Medicare not cover?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: 1 Long-Term Care#N#Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing. Long-term supports and services can be provided at home, in the community, in assisted living, or in nursing homes. Individuals may need long-term supports and services at any age. Medicare and most health insurance plans don’t pay for long-term care.#N#(also called#N#custodial care#N#Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom. It may also include the kind of health-related care that most people do themselves, like using eye drops. In most cases, Medicare doesn't pay for custodial care.#N#) 2 Most dental care 3 Eye exams related to prescribing glasses 4 Dentures 5 Cosmetic surgery 6 Acupuncture 7 Hearing aids and exams for fitting them 8 Routine foot care

What services does Medicare cover?

Dentures. Cosmetic surgery. Acupuncture. Hearing aids and exams for fitting them. Routine foot care. Find out if Medicare covers a test, item, or service you need. If you need services Medicare doesn't cover, you'll have to pay for them yourself unless you have other insurance or a Medicare health plan that covers them.

Does Medicare cover everything?

Medicare doesn't cover everything. Some of the items and services Medicare doesn't cover include: Long-Term Care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Does Medicare pay for long term care?

Medicare and most health insurance plans don’t pay for long-term care. (also called. custodial care. Non-skilled personal care, like help with activities of daily living like bathing, dressing, eating, getting in or out of a bed or chair, moving around, and using the bathroom.

What is Medicare Part A?

This type of Medicare is managed by the federal government. It has two components: Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). Most Medicare beneficiaries have both Part A and Part B.

When do seniors get Medicare?

Seniors become eligible for Medicare when they turn 65. Seniors who already receive Social Security benefits will receive Medicare automatically, but all other seniors need to sign up. When seniors sign up for Medicare coverage, there are two options to choose from: Original Medicare and Medicare Advantage.

Can seniors with Medicare have a medicaid policy?

Seniors who have Original Medicare may choose to purchase a Medigap policy, also known as Medicare Supplement Insurance. Sold by private companies, these policies may help seniors pay for services that Original Medicare doesn’t cover, such as Medicare copayments, coinsurance or deductibles and foreign travel emergency care.

What is long term care insurance?

Long-term care insurance policies are sold by insurance companies, and they may help seniors pay for care that isn’t covered by Original Medicare or Medicare Advantage. Depending on the individual policy, this may include care provided in assisted living facilities, nursing homes, adult day care centers or other long-term care settings.

What is a special needs plan?

Special Needs Plans are designed for people with specific chronic illnesses, such as diabetes, cancer or chronic heart failure . These plans may provide additional benefits, such as extra days in the hospital, to accommodate these illnesses. Like HMOs, plan members are usually required to stay in-network.

Do HMOs require referrals?

For specialist care, most HMOs require a referral from a primary care doctor.

Can seniors see out of network providers?

Like HMOs, PPOs provide a network of medical providers and facilities. Seniors are allowed to see out-of-network providers, but they can usually save money by using the plan’s preferred providers. Referrals aren’t required for specialist care, but the costs for services from in-network specialists will usually be lower.

What are non covered services?

Medicare Non-covered Services. There are two main categories of services which a physician may not be paid by Medicare: Services not deemed medically reasonable and necessary. Non-covered services. In some instances, Medicare rules allow a physician to bill the patient for services in these categories. Understanding these rules and how ...

Does Medicare require an ABN?

Medicare requires an ABN be signed by the patient prior to beginning the procedure before you can bill the patient for a service Medicare denies as investigational or not medically necessary. Otherwise, Medicare assumes the patient did not know and prohibits the patient from being liable for the service.

What is an ABN for Medicare?

If a Medicare patient wishes to receive services that may not be considered medically reasonable and necessary, or you feel Medicare may deny the service for another reason, you should obtain the patient’s signature on an Advance Beneficiary Notice (ABN).

What is a GX modifier?

The -GX modifier indicates you provided the notice to the beneficiary that the service was voluntary and likely not a covered service.

How old do you have to be to get Medicare?

If you are age 65 or older, you are generally eligible to receive Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) if you are a United States citizen or a permanent legal resident who has lived in the U.S. for at least five years in a row.

When do you get Medicare Part A and Part B?

If you meet Medicare eligibility requirements and you have received Social Security benefits for at least four months prior to turning age 65, you will typically get Medicare Part A and Part B automatically the first day of the month you turn age 65.

Is Medicare available to everyone?

Medicare coverage is not available to everyone. To receive benefits under this federal insurance program, you have to meet Medicare eligibility requirements. Find affordable Medicare plans in your area. Find Plans. Find Medicare plans in your area. Find Plans.

The Basics of Medicare

What Medicare Doesn’T Cover

- There are many healthcare services that Medicare doesn’t pay for. For seniors who’ve signed up for Original Medicare, these coverage gaps include dental, hearing and vision care. Seniors are responsible for the costs of most dental care, including cleanings, fillings and dentures. While Medicare Part B covers diagnostic hearing exams, it doesn’t pa...

Are There Other Options?

- Many healthcare services aren’t covered by Original Medicare or Medicare Advantage Plans. Fortunately, there are many other ways that seniors may pay for some of these services.

FAQs

- How much do Medicare beneficiaries pay for services that aren’t covered by Medicare? In 2019, the most current year of data available, seniors with Original Medicare spent an average of $5,460 on services that weren’t covered by Medicare. Long-term care facilities, at an average of $1,014, are responsible for nearly one-third of these costs. For seniors with Medicare Advantage, out-of-…