A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don’t pay a premium for Part A. You may also not have to pay the premium: If you haven’t reached age 65, but you’re disabled and you’ve been receiving Social Security benefits or Railroad Retirement Board disability benefits for two years.

Who doesn't have to pay a premium for Medicare Part A?

Who doesn't have to pay a premium for Medicare Part A? A: Most Medicare-eligible people do not have to pay premiums for Medicare Part A. If you are 65 and you or your spouse has paid Medicare taxes for at least 10 years, you don’t pay a premium for Part A.

What happens if you don't qualify for Medicare?

If you do not qualify on your own or your spouse's work record. You cannot enroll in a Medicare Advantage plan (such as an HMO or PPO) or buy a Medigap supplemental insurance policy unless you’re enrolled in both A and B. Most people receive statements from Social Security saying whether they're yet eligible on their work records.

Who is eligible for Medicare if you are not on social security?

You or your spouse is a government employee or retiree who has not paid into Social Security but has paid Medicare payroll taxes while working. Younger than 65? You still may be eligible You qualify for full Medicare benefits under age 65 if:

Is it possible to avoid Medicare?

While Medicare is not mandatory, it can be difficult to avoid it. If you refuse Medicare completely, you will not be allowed to receive Social Security payments.

Am I eligible for Medicare Part A?

Generally, you’re eligible for Medicare Part A if you’re 65 years old and have been a legal resident of the U.S. for at least five years. In fact,...

Am I eligible for Medicare Part B?

When you receive notification that you’re eligible for Medicare Part A, you’ll also be notified that you’re eligible for Part B coverage, which is...

How do I become eligible for Medicare Advantage?

If you’re eligible for Medicare benefits, you have to choose how to receive them – either through the government-run Original Medicare program, or...

When can I enroll in Medicare Part D?

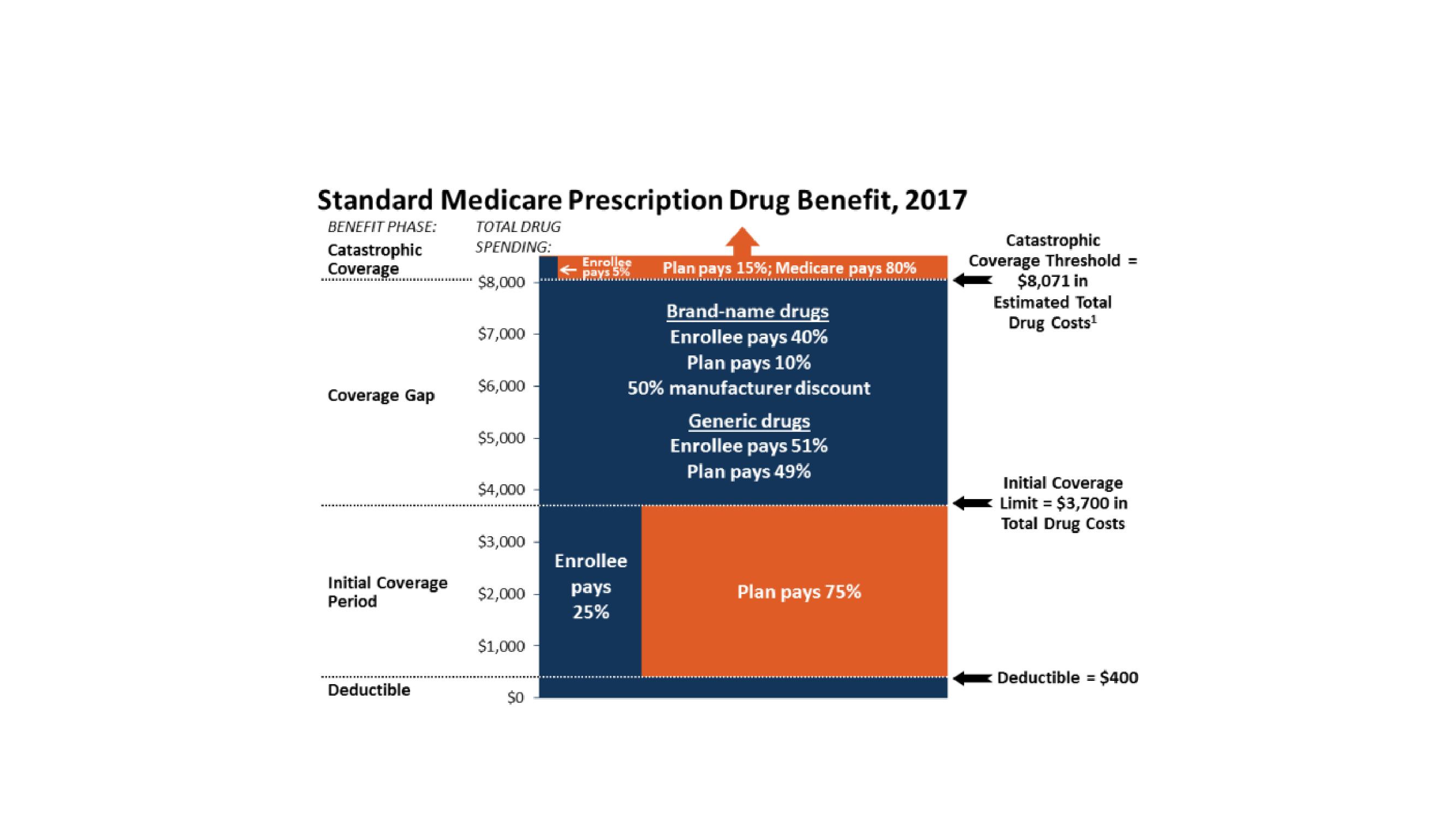

To be eligible for Medicare Part D prescription drug coverage, you must have either Medicare Part A or Part B, or both. You can sign up for Medicar...

Who's eligible for Medigap?

If you’re enrolled in both Medicare Part A and Part B, and don’t have Medicare Advantage or Medicaid benefits, then you’re eligible to apply for a...

Why use Medicare Easy Pay?

Using Medicare Easy Pay will save you time and prevent you from accidentally forgetting to pay your premiums.

What happens if you don't pay Part B?

If you don’t pay your Part B premiums on time, you could lose coverage. It won’t happen immediately, however.

How to change my Medicare Easy Pay bank account?

If you need to change your Medicare Easy Pay bank account, address, or any other information, resubmit your Medicare Easy Pay form but select the “change” option.

What is Medicare Advantage Payment?

Medicare Advantage Payment. If you have a Medicare Advantage plan, your plan is hosted by a private carrier. That means that instead of paying Medicare directly, you’ll be paying your carrier. Each carrier hosts their billing differently. You’ll likely need to either send in a check or pay online.

How to save money on Medicare?

The number one way to save money on Medicare is to enroll in either a Medicare Advantage or a Medicare Supplement plan. Medicare Advantage is a way to wrap up your hospital coverage, doctor coverage, prescription drug coverage, and extra coverage (dental, vision, hearing) into one plan with one premium.

What insurance plans treat late payments differently?

Private insurance plans (Medigap, Part D, or Medicare Advantage) may treat late payments differently. Check with your plan carrier if you have questions about the policies.

Do people pay Medicare taxes?

It’s true that most people paid Medicare taxes during their working careers, but there are still some costs involved in Medicare for most people. Those Medicare taxes that you paid all those years certainly helped fund the Medicare program, but it’s not enough.

What happens if you don't enroll in Medicare?

The General Enrollment Period (GEP) for Medicare A and B runs from January 1 to March 31 each year, for coverage effective July 1 — with an increased premium if the late enrollment penalty applies.

How old do you have to be to get Medicare?

Generally, you’re eligible for Medicare Part A if you’re 65 years old and have been a legal resident of the U.S. for at least five years. In fact, the government will automatically enroll you in Medicare Part A at no cost when you reach 65 as long as you’re already collecting Social Security or Railroad Retirement benefits.

What happens when you receive notification of Medicare Part A?

When you receive notification that you’re eligible for Medicare Part A, you’ll also be notified that you’re eligible for Part B coverage, which is optional and has a premium for all enrollees.

How much will Medicare cost in 2022?

Your premium in 2022 will be $499 a month if you’ve paid into Medicare (FICA taxes) less than 7.5 years, and $274 a month if you’ve paid Medicare taxes for at least 7.5 years but less than 10 years.

How long do you have to be in Medigap to buy it?

You have a federal right to buy a Medigap plan during the six months beginning when you’re at least 65 years old and have enrolled in Part B. This is known as your Medigap open enrollment period. After this time runs out, you will have only limited chances to purchase one down the road.

When will Medicare card arrive?

If you’re already receiving Social Security or Railroad Retirement benefits, all you need to do is check your mail for your Medicare card, which should automatically arrive in the mail about three months prior to your 65th birthday (or the 25th month of a disability, if you’re becoming eligible for Medicare due to disability rather than age). The card will arrive with the option to opt-out of Part B (see below), but opting out of Part B is only a good idea if you’re still working and have employer-sponsored coverage that provides the same or better coverage, or if your spouse is still working and you have coverage under their plan. (See our article that explains what you need to know about delaying Part B enrollment .)

When do you get Medicare for ESRD?

People with ESRD become eligible for Medicare on the fourth month of dialysis treatment, or earlier if they take part in home-dialysis training. People with ALS become eligible for Medicare the same month their disability benefits begin (and there’s no longer a five-month waiting period for disability benefits to begin after a person is diagnosed with ALS).

What Does Medicare Part B Cover

Part B provides coverage for a mixture of outpatient medical services. This includes coverage for preventive vaccines, cancer screenings, annual lab work, and much more.

Retiree Health Plan Part B Reimbursement Options

If you’re retired and have Medicare and retiree group health plan coverag e from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Defer Income To Avoid A Premium Surcharge

The standard premium for Medicare Part B is $148.50 per month in 2021 but that assumes youre not a higher earner. Those with higher income levels are subject to higher premium costs. For 2021 heres what youre looking at:

Cdc Shingles Vaccine Recommendations

The Centers for Disease Control and Prevention recommends Shingrix vaccination for anyone 50 years and older, even if you have already had shingles, if you had another type of shingles vaccine, and if you dont know whether or not youve had chickenpox in the past.

Are Medicare Deductibles Based On Calendar Year

The concept of a benefit period is important because the Medicare Part A deductible is based on the benefit period, rather than a calendar year. Once you meet it, your plan will pay all or part of your costs for the remainder of the year, but then your deductible resets on January 1.

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

What You Need To Know About Medicare Parts A B C And D

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

What happens if you decline Medicare?

Declining. Late enrollment penalties. Takeaway. If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later. Medicare is a public health insurance program designed for individuals age 65 and over ...

What is Medicare Part A?

Medicare is a public health insurance program designed for individuals age 65 and over and people with disabilities. The program covers hospitalization and other medical costs at free or reduced rates. The hospitalization portion, Medicare Part A, usually begins automatically at age 65. Other Medicare benefits require you to enroll.

What happens if you disagree with a prescription drug plan?

If you disagree with the penalty you are assessed, you can appeal the decision but must continue to pay the penalty along with your premium. Your prescription drug plan can drop your coverage if you fail to pay the premium or penalty.

How much is the Part B penalty?

The Part B penalty is 10 percent of the standard premium for each 12-month period you were not signed up , and you will have to pay this penalty for as long as you are enrolled in Medicare.

When does Medicare Part A start?

The hospitalization portion, Medicare Part A, usually begins automatically at age 65. Other Medicare benefits require you to enroll.

Is there a penalty for not signing up for Medicare Part B?

If you choose not to sign up for Medicare Part B when you first become eligible, you could face a penalty that will last much longer than the penalty for Part A.

Does Medicare Advantage have penalties?

Medicare Part C (Medicare Advantage) is optional and does not have penalties on its own, but penalties may be included for late enrollment in the parts of Medicare included within your Medicare Advantage plan.

How old do you have to be to get Medicare?

citizen or have been a legal resident for at least five years, you can get full Medicare benefits at age 65 or older. You just have to buy into them by: Paying premiums for Part A, the hospital insurance.

How long do you have to live to qualify for Medicare?

You qualify for full Medicare benefits if: You are a U.S. citizen or a permanent legal resident who has lived in the United States for at least five years and. You are receiving Social Security or railroad retirement benefits or have worked long enough to be eligible for those benefits but are not yet collecting them.

How much will Medicare premiums be in 2021?

If you have 30 to 39 credits, you pay less — $259 a month in 2021. If you continue working until you gain 40 credits, you will no longer pay these premiums. Paying the same monthly premiums for Part B, which covers doctor visits and other outpatient services, as other enrollees pay.

Do you pay the same monthly premium for Part D?

Paying the same monthly premium for Part D prescription drug coverage as others enrolled in the drug plan you choose.

Is Medicare automatic for older people?

But qualifying for the program is not automatic. Here’s how to determine if you are eligible.

How much of Social Security do elderly people get?

Among elderly beneficiaries, 50% of married couples and 70% of unmarried recipients receive 50% or more of their retirement income from Social Security. 1 . Most American taxpayers do not qualify for an exemption, though they do exist for a small number of people.

What is Social Security enrollment?

Enrollment is connected to the Social Security numbers of workers and taxpayers within the U.S. All Social Security benefits were created as part of a social safety net designed to reduce poverty and provide care for the elderly and disabled.

Do religious orders pay taxes?

Members of religious orders who have taken a vow of poverty are exempt from paying self-employment taxes on work performed for the order and don't need to request a separate exemption. However, if the order elects to be covered under Social Security, then taxes would apply.

Can religious groups be exempt from Social Security?

Members of certain religious groups may be exempt from Social Security taxes. To become exempt, they must waive their rights to benefits, including hospital insurance benefits. They must also be a member of a religious sect that provides food, shelter, and medical care for its members, and is conscientiously opposed to receiving private death ...

Do self employed people pay Social Security taxes?

Self-employed workers who make less than $400 annually do not need to worry about paying Social Security taxes. 7

Do you pay taxes on Social Security?

The Social Security program automatically enrolls most U.S. workers, but a few groups are exempt from paying taxes into the Social Security system.