Medicare Part B Eligibility Requirements Medicare Part B is a health insurance option that becomes available for people in the United States once they reach age 65. However, there are some special circumstances under which you may qualify to enroll in Medicare Part B before the age of 65.

Full Answer

What are the requirements for Medicare Part B?

Dec 08, 2021 · You need Part B in order to sign up for Medicare Advantage or a Medigap plan. Original Medicare has two parts: Part A covers inpatient hospital costs, and Part B covers outpatient medical care, preventive care, durable medical equipment and more. Medicare Part B is optional. Whether or not you need Part B depends on your individual situation.

What is the maximum premium for Medicare Part B?

Individuals who earn more than $170,000 but less than $500,000 per year will pay $544.30 in Medicare Part B premiums per month. If you earn $500,000 per year or more, your Medicare Part B premium will be $578.30 per month. These amounts reflect individual incomes only. Married couples will pay the same rates, but for different, higher thresholds.

Does Medicare Part B cost money?

Individuals who are eligible for premium-free Part A are also eligible for enroll in Part B once they are entitled to Part A. Enrollment in Part B can only happen at certain times. Individuals who must pay a premium for Part A must meet the following requirements to enroll in …

How much does Medicare Part B costs?

Jan 22, 2015 · If you continue to work when you reach age 65 your employer-sponsored medical insurance plan may require you to enroll in Medicare Part B. Here’s why. If the company you work for has 2 to 19 employees, then Medicare is the primary payer, which means that Medicare pays your medical claims first, and then your company’s health insurance plan pays its portion.

Understanding What Medicare Part B Offers

First, let’s take a look at what Medicare Part B actually covers. Medicare Part B covers medical treatments and services under two classifications:...

Medicare Part B Enrollment Options and Penalties

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed...

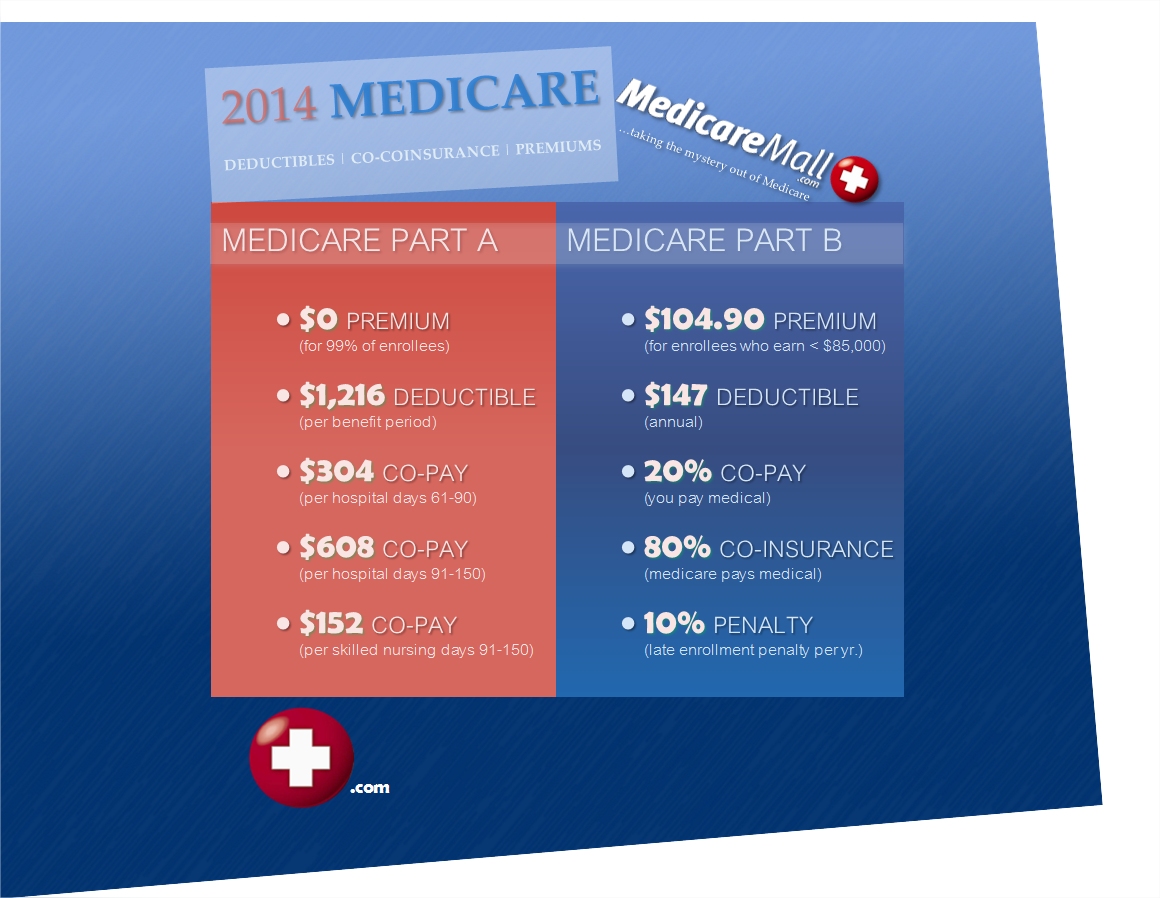

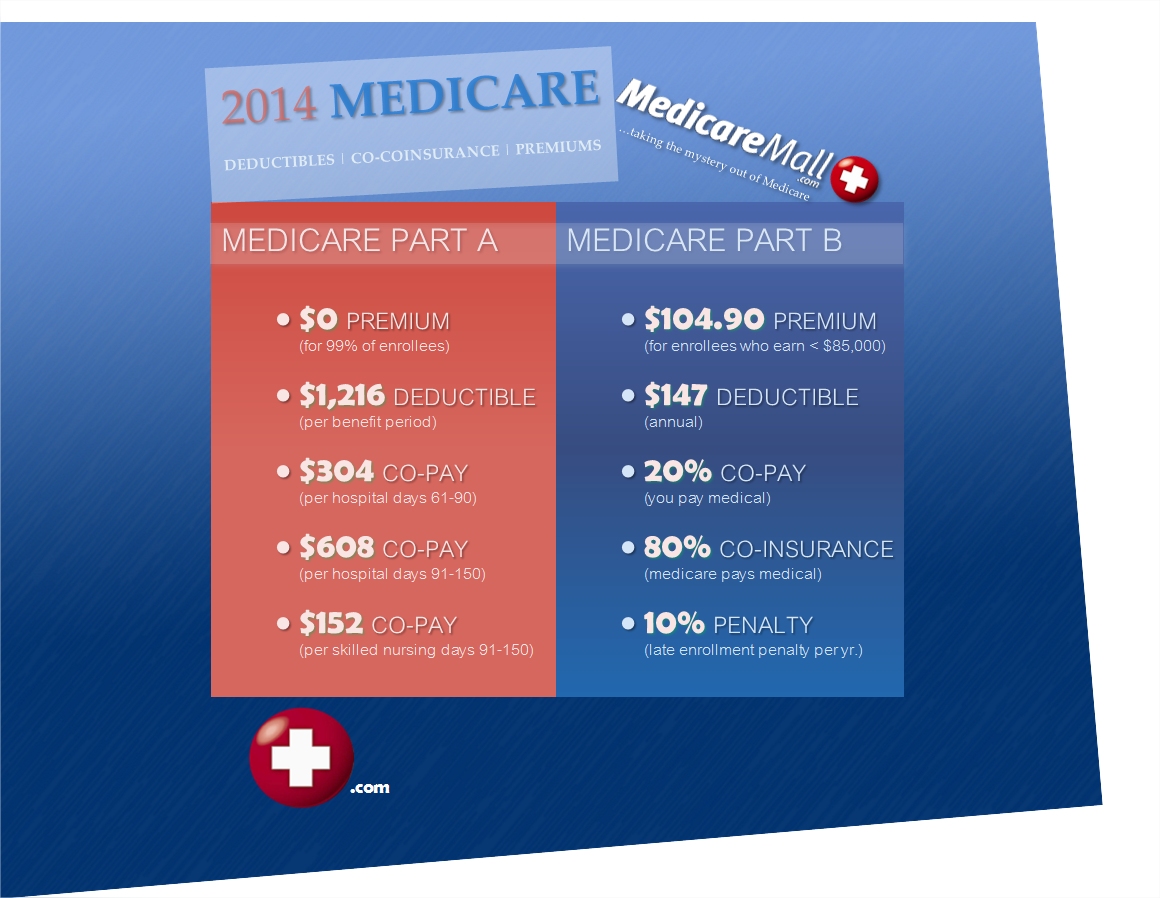

The Cost of Medicare Part B

Unlike Medicare Part A, Medicare Part B requires a premium. For the most part, the premium for Medicare Part B is $134 per month. You also pay $204...

Medicare Part B Financial Assistance

Because Medicare Part B requires a monthly payment (known as a premium) for its services, some people may find it difficult to pay for the monthly...

Medicare Part B Special Circumstances and Updates

Some people don’t need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special condi...

Benefits of Medicare Part B

Medicare Part B covers a variety of routine healthcare visits and treatments. If you can afford the premiums, then you may want to take advantage o...

Is Medicare Part B mandatory?

Medicare Part B is optional, but in some ways, it can feel mandatory, because there are penalties associated with delayed enrollment. As discussed later, you don’t have to enroll in Part B, particularly if you’re still working when you reach age 65.

Does Medicare Part B require a monthly payment?

Because Medicare Part B requires a monthly payment (known as a premium) for its services, some people may find it difficult to pay for the monthly costs associated with this portion of Medicare. Those with limited incomes, in particular, may wonder if there are cost assistance programs in place to help mitigate the financial burden.

What is the number to call for Medicare?

1-800-810-1437 TTY 711. If you are about to turn 65 and need information regarding the various portions of Medicare, then you’ve come to the right place. We know how overwhelming all of the information regarding Medicare can be. And we want to help you choose a plan that meets your individual needs.

Does Medicare Part B cover cancer?

In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range.

What is covered by Medicare Part B?

In addition, Part B may cover other medical procedures and treatments that fall within the necessary or preventive range. Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B.

Is mental health covered by Medicare?

Ambulance services, clinical research, mental health counseling and some prescription drugs for outpatient treatment may all be covered under Medicare Part B. As of the 2019 plan year, the Centers for Medicare and Medicaid Services has lifted coverage caps on critical services covered under Medicare Part B.

Is Medicare Part B the same as Medicare Part A?

Eligibility requirements for Medicare Part B are essentially the same as those for Medicare Part A. In this section, we’ll highlight some important distinctions for Part B for enrollment purposes. For some people, enrollment in Medicare is automatic based on certain criteria.

Do you have to pay Part A and Part B?

Also enroll in or already have Part B. To keep premium Part A, the person must continue to pay all monthly premiums and stay enrolled in Part B. This means that the person must pay both the premiums for Part B and premium Part A timely to keep this coverage. Premium Part A coverage begins prospectively, based on the enrollment period ...

What is Medicare Part A?

Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

How long does it take to get Medicare if you are 65?

For someone under age 65 who becomes entitled to Medicare based on disability, entitlement begins with the 25 th month of disability benefit entitlement.

How long do you have to be on Medicare if you are disabled?

Disabled individuals are automatically enrolled in Medicare Part A and Part B after they have received disability benefits from Social Security for 24 months. NOTE: In most cases, if someone does not enroll in Part B or premium Part A when first eligible, they will have to pay a late enrollment penalty.

What is MEC in Medicare?

Medicare and Minimum Essential Coverage (MEC) Medicare Part A counts as minimum essential coverage and satisfies the law that requires people to have health coverage. For additional information about minimum essential coverage (MEC) for people with Medicare, go to our Medicare & Marketplace page.

How long does Part A coverage last?

If the application is filed more than 6 months after turning age 65, Part A coverage will be retroactive for 6 months. NOTE: For an individual whose 65th birthday is on the first day of the month, Part A coverage begins on the first day of the month preceding their birth month.

When does Part A start?

NOTE: For an individual whose 65th birthday is on the first day of the month, Part A coverage begins on the first day of the month preceding their birth month. For example, if an individual's birthday is on December 1, Part A begins on November 1.

When does Medicare Part B start?

If you do not enroll in Medicare Part B during your initial enrollment period, you must wait for the general enrollment period (January 1- March 31 of each year) to enroll, and Part B coverage will begin the following July 1 of that year. If you wait 12 months or more, after first becoming eligible, your Part B premium will go up 10 percent ...

Do you have to take Part B if you don't want it?

You don't have to take Part B coverage if you don't want it, and your FEHB plan can't require you to take it. There are some advantages to enrolling in Part B: You must be enrolled in Parts A and B to join a Medicare Advantage plan.

Do you need Part B before you can enroll in Medigap?

Conclusion. To recap the important points in this article, most people need Part B at some point. When you enroll will depend on what other coverage you currently have when you turn 65. Also, Part B is not a supplement. You need Part B before you can enroll in Medigap or a Medicare Advantage plan.

How long do you have to enroll in Part B if you retire?

When you retire and lose your employer coverage, you’ll be given a 8-month Special Enrollment Period to enroll in Part B without any late penalty.

How much is Part B insurance?

Most people delay Part B in this scenario. Your employer plan likely already provides good outpatient coverage. Part B costs at least $148.50/month for new enrollees in 2020.

Is there a penalty for not signing up for Medicare Part B?

If you choose not to sign up for Medicare Part B when you first become eligible, you could face a penalty that will last much longer than the penalty for Part A.

Is Medicare mandatory at 65?

While Medicare isn’t necessarily mandatory, it is automatically offered in some situations, and may take some effort to opt out of.

What is Medicare Part A?

Medicare is a public health insurance program designed for individuals age 65 and over and people with disabilities. The program covers hospitalization and other medical costs at free or reduced rates. The hospitalization portion, Medicare Part A, usually begins automatically at age 65. Other Medicare benefits require you to enroll.

What happens if you don't sign up for Medicare?

If you choose not to sign up for Medicare Part A when you become eligible, a penalty may be assessed. This penalty depends on why you chose not to sign up. If you simply chose not to sign up when you were first eligible, your monthly premium — if you have to pay one — will increase by 10 percent for twice the number of years that you went without signing up . For example, if you waited two years to sign up, you will pay the late enrollment penalty for 4 years after signing up.

Does Medicare Advantage have penalties?

Medicare Part C (Medicare Advantage) is optional and does not have penalties on its own, but penalties may be included for late enrollment in the parts of Medicare included within your Medicare Advantage plan.

How much is Part B insurance in 2021?

1 If you're on Social Security, this may be deducted from your monthly payment. 11 . The annual deductible for Part B is $198 in 2020 and rises to $203 in 2021.

What is Medicare Part A?

Medicare Part A: Hospital Insurance. Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021 ($1,408 in 2020). 1 .

How many parts are there in Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D. 1 In general, the four Medicare parts cover different services, so it's essential that you understand the options so you can pick your Medicare coverage carefully.

How much is Medicare Part A?

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021 ($1,408 in 2020). 1 .

What is the gap in Medicare?

Medicare prescription drug plans have a coverage gap—a temporary limit on what the drug plan will cover. The coverage gap is often called the "doughnut hole," and this gap kicks in after you and your plan have spent a certain amount in combined costs.

Does Part A cover hospice?

For example, Part A covers in-home hospice care but does not cover a stay in a hospice facility. 7 . Additionally, if you're hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each day's expenses.

Do you have to pay a premium for Medicare Part B?

Although most people have to pay a premium to be eligible to receive Medicare Part B benefits, there are programs that can help reduce or cover the cost depending on your circumstances. Enter your zip code above to receive private Medicare quotes for your state!

Is Medicare Part B free?

Medicare Part B is very rarely “free”, there are monthly premiums most people have to pay for their Medicare Part B coverage. There are several programs that can help to reduce the cost of your Medicare Part B premium and even cover the cost entirely.

What is a qualified Medicare beneficiary?

Qualified Medicare Beneficiary. The first program that can help reduce your costs is the Qualified Medicare Beneficiary (QMB). There are two requirements to be eligible for this program, which include the income limit and asset limit. If you meet both of these requirements and are eligible for the program, your state should pay your premiums, ...

What is QMB in Medicare?

The first program that can help reduce your costs is the Qualified Medicare Beneficiary (QMB). There are two requirements to be eligible for this program, which include the income limit and asset limit. If you meet both of these requirements and are eligible for the program, your state should pay your premiums, deductibles, ...

How much does Medicare Part B cost?

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple.

What is the asset limit for QMB?

In addition to the income limit, there is an asset limit you must meet in order to be eligible for the QMB program. The asset limit is approximately $7000 for an individual and $11,000 for a couple that is married.