Full Answer

How do Americans feel about cutting Social Security and Medicare?

Opposition to reducing either Social Security or Medicare benefits transcended party lines in the survey. Among all respondents age 50-plus, 85 percent strongly oppose cutting Social Security and the same percentage strongly oppose decreasing Medicare benefits to reduce the federal deficit.

Will Mitt Romney’s plan to cut Social Security and Medicare benefits work?

While enactment of Romney’s bill would not directly slash Social Security and Medicare benefits, it sets up a process that would likely result in across-the-board benefit cuts.

Does Bernie Sanders’ Medicare for all plan eliminate private sector health care?

Graham also said that Sanders’ Medicare for All program would eliminate private-sector health care, which would be extremely costly. Knewz reported that Sanders, along with 14 other senators, introduced the Medicare for All plan in May to “guarantee health care in the United States as a fundamental human right to all.”

Can the pandemic-related deficits justify cuts to Social Security?

On both counts, using the pandemic-related fiscal measures to justify cuts for Social Security, Medicare and Medicaid is wrong. The pandemic-related deficits are mainly temporary. Congress enacted the CARES Act in March 2020, which offered temporary relief mainly to families, unemployed workers and closed business.

When did the Cares Act expire?

The pandemic-related deficits are mainly temporary. Congress enacted the CARES Act in March 2020, which offered temporary relief mainly to families, unemployed workers and closed business. Most of its provisions expired in the second half of 2020. The newly elected Congress then enacted the American Rescue Plan in March 2021.

Does the Cares Act help the economy?

In contrast, the CARES Act offered much needed relief amid the worst unemployment crisis since the Great Depression, while it helped to stem the tide on declining economic growth. And experts predict that ARPA will boost economic growth to its highest rate in decades.

Is the program cutting push for a balanced budget wrong?

The program-cutting push for a balanced budget ignores two key aspects of fiscal policy. First, it matters whether fiscal interactions create temporary or permanent deficits and second, it matters whether the spending or tax cuts underlying the deficits resulted in faster growth. On both counts, using the pandemic-related fiscal measures to justify cuts for Social Security, Medicare and Medicaid is wrong.

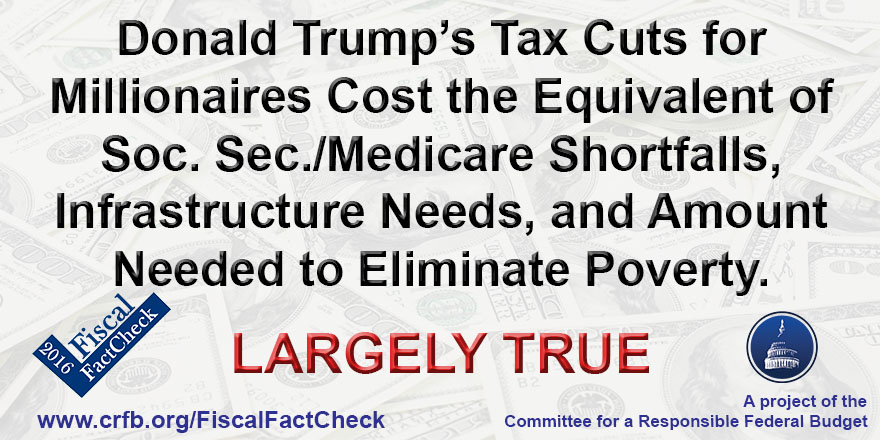

Did the Republican senators push for Medicare and Social Security?

Republican Senators Push Social Security, Medicare And Medicaid Cuts After Supporting Ineffective Tax Cuts. Opinions expressed by Forbes Contributors are their own. The economy is recovering from the depths of the pandemic in large part due to the massive relief packages that Congress passed in 2020 and 2021.

What percentage of people oppose cutting Social Security?

Opposition to reducing either Social Security or Medicare benefits transcended party lines in the survey. Among all respondents age 50-plus, 85 percent strongly oppose cutting Social Security and the same percentage strongly oppose decreasing Medicare benefits to reduce the federal deficit. The survey also found that 87 percent of Democrats, 79 percent of independents and 88 percent of Republicans strongly oppose cutting Social Security. When asked about Medicare, 87 percent of Democrats, 80 percent of independents and 86 percent of Republicans said they strongly oppose reducing that program's benefits.

How many members of the Trust Act would be needed to support a bill?

Under the Time to Rescue United States’ Trusts Act — or TRUST Act, for short — all it would take for legislation cutting these programs to be fast-tracked in Congress would be for seven members of one of these rescue committees to support a proposed bill. Under the act, lawmakers would be unable to make any changes to a TRUST Act bill once it went to the U.S. House of Representatives or the Senate.

How much will Social Security cut in 2035?

At your full retirement age, you will receive $2,000/month in benefits. For our example we will say that benefits will be cut by 25% in 2035 as projected in the 2020 Social Security Trustees report.

How to ease anxiety about Social Security?

One way to ease your anxiety about Social Security is to see exactly how a cut to benefits would affect your specific situation. This calculator can show you the impact. Simply enter your year of birth, benefit amount at your full retirement age, percentage of your benefit cut, and year that the benefit cut occurs to calculate your claiming strategy.

Will Social Security run out of money?

If you’re nervous about the future of the Social Security program, you’re not alone. In a survey from Nationwide, 71% of adults of all generations said they are more worried now that Social Security will run out of funding. It’s no wonder, the 2020 Social Security Trustees report indicated that funds are likely to run out by 2035. At that point reserves will be depleted and 79% of scheduled benefits will be paid out with income from taxes. This doesn’t even consider the potential impact of the pandemic.

Will Social Security cuts be necessary?

All these solutions would help solve the Social Security funding issue, and benefit cuts wouldn’t be necessary . Many Americans rely on Social Security for income in retirement. I wouldn’t be surprised to see any or all the changes outlined above implemented in the next few years. The most important thing to remember is that it’s never a good idea to make financial decisions out of fear. Use this calculator to get an idea of the impact that Social Security benefit cuts would have on the total value you receive with Social Security and start a conversation with your financial advisor about how to prepare for the days ahead–no matter what they bring.

When will Social Security be depleted?

If Congress takes no action, the Social Security trust fund will become depleted in 2035 (though the program still would be able to pay about 80% of promised benefits); Medicare’s will run dry in 2026 (it covers the Part A hospital fund; the other parts of Medicare are funded by premiums), but the program still would be able to pay 90% of benefits. ...

How much does a person get from Social Security?

The average Social Security benefit today is $1,543 per month or about $18,500 a year, just a few thousand dollars above the federal poverty line. Nearly half of seniors rely on their Social Security benefits for all or most of their income. Research indicates that tomorrow’s seniors will rely on their earned benefits for financial survival even more than today’s retirees do.

What is the most alarming thing about the Trust Act?

What’s most alarming about the TRUST Act is that it does not instruct the “rescue committees” to take into account the adequacy of seniors’ earned benefits, as if they are simply figures on a ledger.

What is Mitt Romney's trust act?

Sen. Mitt Romney’s TRUST Act, which was just reintroduced after going nowhere in the previous Congress, is setting off alarm bells for seniors’ advocates. And rightly so. The Time to Rescue United States Trusts Act would create “ rescue committees ” in Congress to propose legislation to “shore up” various trust funds, ...

Do seniors rely on Social Security?

Nearly half of seniors rely on their Social Security benefits for all or most of their income. Research indicates that tomorrow’s seniors will rely on their earned benefits for financial survival even more than today’s retirees do. On the Medicare side, the TRUST Act’s boosters say that cost reductions would be on the table, ...

Does the Trust Act affect Medicare?

On the Medicare side, the TRUST Act’s boosters say that cost reductions would be on the table, especially reforms to address the overall cost of health care. We support cost containment measures on the condition that they do not affect the quality of care, provider choice, or increase beneficiaries’ out-of-pocket spending.

Can seniors trust the Trust Act?

Seniors simply cannot trust the TRUST Act with the all-important financial and health security that Social Security and Medicare provide. Max Richtman is president and CEO of the National Committee to Preserve Social Security and Medicare.