The standard Medicare Part B premium increased to $170.10 per month in 2022, up from $148.50 in 2021. The premium went up even more for higher income earners who pay an income-related monthly adjustment amount (IRMAA), with the most expensive Part B premium increasing from $504.90 per month in 2021 to $578.30 per month in 2022.

Why did my Medicare Part B premium increase for 2021?

The more income you have, the higher your premium will be. 1 You'll generally see increases in your Medicare Part B premiums if your earnings rise over certain limits and the cost of living continues to increase. Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020.

How much is the monthly premium for Medicare Part A?

Monthly Premium. : Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $422 each month in 2018 ($437 in 2019). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $422 ($437 in 2019).

When did Medicare Part B and D start?

The Social Security Administration has historical Medicare Part B and D premiums from 1966 through 2012 on its website. Medicare Part B premiums started at $3 per month in 1966. Medicare Part D premiums began in 2006 with an annual deductible of $250 per year. 7 When and How to Apply for Medicare

How much did Medicare Part B cost in 1966?

You can access the table at the link above to see that Medicare Part B premiums started at $3 per month in 1966 and Medicare Part D premiums began in 2006 at $250 per year.

Why did my Medicare premium increase for 2022?

In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022. This increase was driven in part by the statutory requirement to prepare for potential expenses, such as spending trends driven by COVID-19 and uncertain pricing and utilization of Aduhelm™.

WHO raises Medicare premiums?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

When did Medicare start charging a premium?

July 30, 1965July 30, 1965: With former President Harry S. Truman at his side, President Lyndon B. Johnson signs the Medicare bill into law.

Who benefited from Medicare?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Why did Medicare increase so much?

The Centers for Medicare and Medicaid Services (CMS) announced the premium and other Medicare cost increases on November 12, 2021. The steep hike is attributed to increasing health care costs and uncertainty over Medicare's outlay for an expensive new drug that was recently approved to treat Alzheimer's disease.

Why has Medicare become more expensive in recent years?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

Why is my first Medicare premium bill so high?

If you're late signing up for Original Medicare (Medicare Parts A and B) and/or Medicare Part D, you may owe late enrollment penalties. This amount is added to your Medicare Premium Bill and may be why your first Medicare bill was higher than you expected.

Why did I get a bill for Medicare Part B?

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. premium deducted automatically from their Social Security benefit payment (or Railroad Retirement Board benefit payment).

When did we start paying for Medicare Part B?

In 1966, Medicare's coverage took effect, as Americans age 65 and older were enrolled in Part A and millions of other seniors signed up for Part B.

Can I get Medicare if I never worked?

You can still get Medicare if you never worked, but it will likely be more expensive. Unless you worked and paid Medicare taxes for 10 years — also measured as 40 quarters — you will have to pay a monthly premium for Part A. This may differ depending on your spouse or if you spent some time in the workforce.

What did the Medicare Act of 1965 do?

On July 30, 1965, President Lyndon B. Johnson signed the Medicare and Medicaid Act, also known as the Social Security Amendments of 1965, into law. It established Medicare, a health insurance program for the elderly, and Medicaid, a health insurance program for people with limited income.

When did Part D become mandatory?

Medicare Part D Prescription Drug benefit The MMA also expanded Medicare to include an optional prescription drug benefit, “Part D,” which went into effect in 2006.

What is the increase in Medicare Part B?

The 14.5% increase in Part B premiums will take monthly payments for those in the lowest income bracket from $148.50 a month this year to $170.10 in 2022. Medicare Part B covers physician services, outpatient hospital services, certain home health services, medical equipment, and certain other medical and health services not covered by Medicare Part A, including medications given in doctors' offices.

How much will Medicare premiums be in 2022?

They predicted the monthly premium for 2022 would be $158.50.

How much is Medicare Part B deductible in 2022?

Along with the premium spike, the annual deductible for Medicare Part B beneficiaries is rising to $233 in 2022, up from $203 in 2021.

What is the cost of living adjustment for Social Security in 2022?

The Centers for Medicare and Medicaid Services played down the spike, pointing out that most beneficiaries also collect Social Security benefits and will see a cost-of-living adjustment of 5.9% in their 2022 monthly payments, the agency said in a statement. That's the largest bump in 30 years.

Will Medicare increase in 2022?

And much of the 2022 increase in Social Security benefits will be eaten up by inflation, which is also rising at a rapid clip.

Is Aduhelm covered by Medicare?

Because Aduhelm is administered in physicians' offices, it should be covered under Medicare Part B, not Part D plans, which pay for medications bought at pharmacies. Traditional Medicare enrollees have to pick up 20% of the cost of most Part B medications, which would translate into about $11,500 in out-of-pocket costs for those prescribed Aduhelm.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

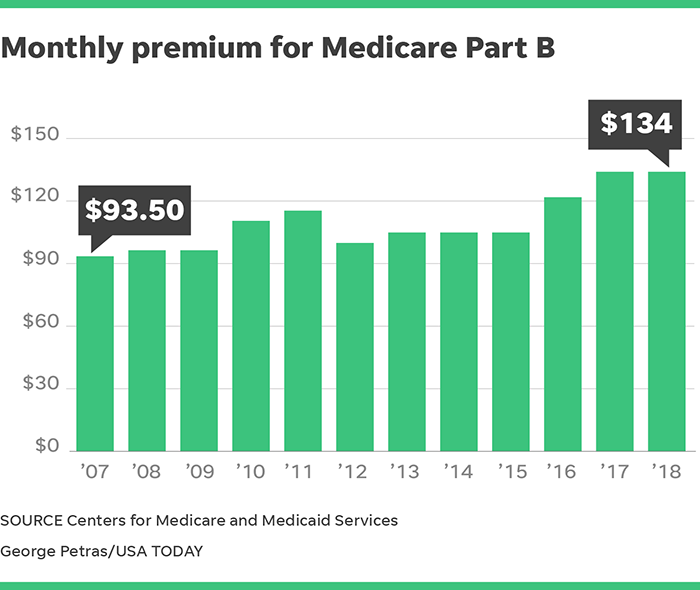

What is the Medicare premium for 2017?

The monthly premium for Medicare Part B was $134 for tax years 2017 and 2018. This rate was for single or married individuals who filed separately with MAGIs of $85,000 or less and for married taxpayers who filed jointly with MAGIs of $170,000 or less. 4 The 2017 premium rate was an increase of 10% over the 2016 rate that was not based on the Social Security Administration's cost-of-living adjustments (COLA).

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

When do you get Medicare if you don't have Social Security?

If you're not receiving Social Security, though, be sure to contact the Social Security Administration about three months prior to your 65th birthday in order to receive Medicare .

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

Does Medicare have a hold harmless?

Medicare has a "hold harmless" provision for seniors. This provision prevents Medicare from raising the premiums more than the cost of living increases. 4 While this keeps seniors from paying more than they should, you'll have to pay the increased premiums if your COLA is higher than the increase.

How to determine 2021 Social Security monthly adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

What is the number to call for Medicare prescriptions?

If we determine you must pay a higher amount for Medicare prescription drug coverage, and you don’t have this coverage, you must call the Centers for Medicare & Medicaid Services (CMS) at 1-800-MEDICARE ( 1-800-633-4227; TTY 1-877-486-2048) to make a correction.

How to determine 2021 income adjustment?

To determine your 2021 income-related monthly adjustment amounts, we use your most recent federal tax return the IRS provides to us. Generally, this information is from a tax return filed in 2020 for tax year 2019. Sometimes, the IRS only provides information from a return filed in 2019 for tax year 2018. If we use the 2018 tax year data, and you filed a return for tax year 2019 or did not need to file a tax return for tax year 2019, call us or visit any local Social Security office. We’ll update our records.

Why did my spouse receive a settlement?

You or your spouse received a settlement from an employer or former employer because of the employer’s closure, bankruptcy, or reorganization.

What does Part B cover?

Part B helps pay for your doctors’ services and outpatient care. It also covers other medical services, such as physical and occupational therapy, and some home health care. For most beneficiaries, the government pays a substantial portion — about 75 percent — of the Part B premium, and the beneficiary pays the remaining 25 percent.

What is the standard Part B premium for 2021?

The standard Part B premium for 2021 is $148.50. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

Do you pay monthly premiums for Medicare?

If you’re a higher-income beneficiary with Medicare prescription drug coverage, you’ll pay monthly premiums plus an additional amount, which is based on what you report to the IRS. Because individual plan premiums vary, the law specifies that the amount is determined using a base premium.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover prescription drugs?

Option al benefits for prescription drugs available to all people with Medicare for an additional charge. This coverage is offered by insurance companies and other private companies approved by Medicare.

How much did Medicare premiums increase between 1966 and 2017?

Over 51 years, the compounded annual increase in premium cost is roughly 7.7%, which is consistent with high medical care inflation rates.

How many people are on Medicare?

There are roughly 56 million eligible Americans that count on Medicare (or Medicare Advantage plans) to help maintain their physical and financial well-being each and every month. Of these 56 million, about five in six are aged 65 and up.

What is Medicare Part A?

Part A, also known as hospital insurance, covers in-patient hospital stays, surgeries, and long-term skilled nursing care, as an example. The great thing about Part A is that there's no premium required for a vast majority of Americans. Just as 40 lifetime work credits qualifies someone to receive Social Security benefits during retirement, 40 lifetime work credits also allows an individual to receive Medicare Part A without a premium once they reach age 65, or have other extenuating circumstances arise, such as becoming disabled.

What are the components of Medicare?

Original Medicare, which roughly 70% of eligible members are still enrolled in, is comprised of three key components: Part A, Part B, and Part D. Image source: Getty Images. Part A, also known as hospital insurance, covers in-patient hospital stays, surgeries, and long-term skilled nursing care, as an example.

Does Medicare protect you from a hold harmless?

To begin with, about 70% of all Medicare enrollees are protected by the "hold harmless" clause. For Medicare enrollees who are also receiving a Social Security benefit each month, the hold harmless clause prevents their ...

Is Medicare Part B the biggest wildcard?

Of these three Medicare components, Part B is arguably the biggest wildcard when it comes to your potential out-of-pocket expenses. This argument is only enhanced by taking a look at how Medicare Part B's monthly premium payments have evolved over the past 51 years. Data source: Centers for Medicare and ...

Is Medicare Advantage a private insurance?

Medicare Advantage plans are offered by private insurance companies, and they contain all the services you'd be able to get under Parts A, B, and D with original Medicare.