Full Answer

Who is not eligible for Medicare Part D?

There are times you may be eligible for Medicare but are not allowed to enroll in a Part D plan. This occurs when you reside outside of the country or U.S. territories. When you return to the United States, you will be eligible to sign up. When you are incarcerated, you receive benefits from the prison system, not Medicare.

Who has the best Medicare Part D plan?

The estimated average monthly premium for Medicare Part D stand-alone drug plans is projected to be $43 in 2022, based on current enrollment, while average monthly premiums for the 16 national PDPs are projected to range from $7 to $99 in 2022.

What do prescribers need to know about Medicare Part D?

The Part D Prescriber PUF is based on information from CMS’s Chronic Conditions Data Warehouse, which contains Prescription Drug Event records submitted by Medicare Advantage Prescription Drug (MAPD) plans and by stand-alone Prescription Drug Plans (PDP).

What you should know about Medicare Part D?

You are eligible for a Medicare Part D plan if:

- You are 65 years of age or older.

- You have a qualifying disability for which you have been receiving Social Security Disability Insurance (SSDI) for more than 24 months.

- You have been diagnosed with End-Stage Renal Disease (permanent kidney failure requiring a kidney transplant or dialysis).

- You are entitled to Medicare Part A or Part B.

Is Medicare Part D for everyone?

Medicare Cost Plan Medicare offers prescription drug coverage for everyone with Medicare. This coverage is called “Part D.” There are 2 ways to get Medicare prescription drug coverage: 1.

When did Medicare Part D become mandatory?

January 1, 2006The benefit went into effect on January 1, 2006. A decade later nearly forty-two million people are enrolled in Part D, and the program pays for almost two billion prescriptions annually, representing nearly $90 billion in spending. Part D is the largest federal program that pays for prescription drugs.

Do I have to purchase Part D Medicare?

En español | Part D drug coverage is a voluntary benefit; you are not obliged to sign up. You may not need it anyway if you have drug coverage from elsewhere that is “creditable” — meaning Medicare considers it to be the same or better value than Part D.

Do I need Medicare Part D if I don't take any drugs?

No. Medicare Part D Drug Plans are not required coverage. Whether you take drugs or not, you do not need Medicare Part D.

Is Medicare Part D optional?

Is Medicare Part D Mandatory? It is not mandatory to enroll into a Medicare Part D Prescription Drug Plan.

What happens if I don't have Medicare Part D?

If you don't sign up for a Part D plan when you are first eligible to do so, and you decide later you want to sign up, you will be required to pay a late enrollment penalty equal to 1% of the national average premium amount for every month you didn't have coverage as good as the standard Part D benefit.

Can I add Medicare Part D anytime?

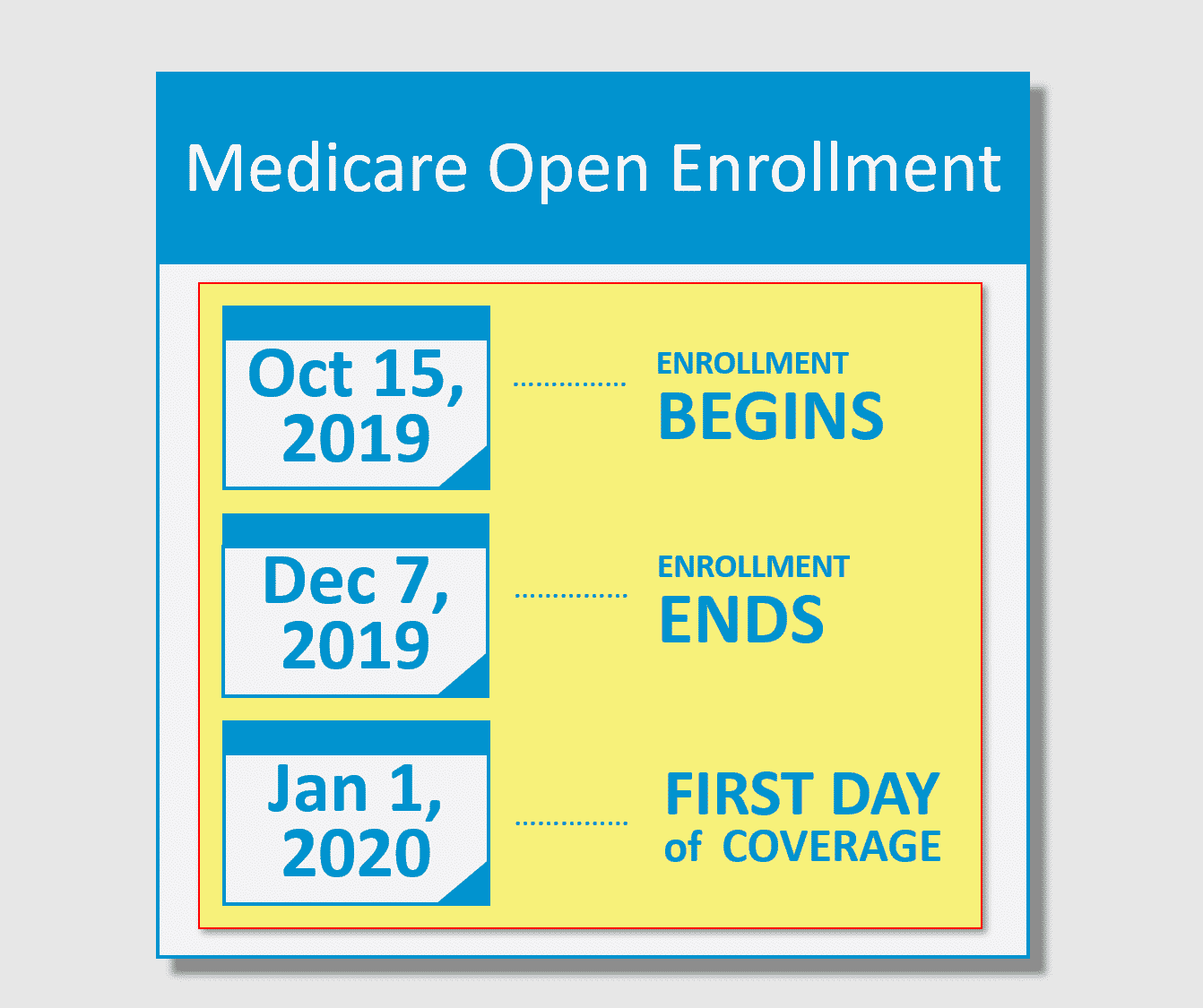

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

How do I avoid Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

What is the most popular Medicare Part D plan?

Best-rated Medicare Part D providersRankMedicare Part D providerMedicare star rating for Part D plans1Kaiser Permanente4.92UnitedHealthcare (AARP)3.93BlueCross BlueShield (Anthem)3.94Humana3.83 more rows•Mar 16, 2022

What is the cost of Part D Medicare for 2022?

$33Part D. The average monthly premium for Part coverage in 2022 will be $33, up from $31.47 this year. As with Part B premiums, higher earners pay extra (see chart below). While not everyone pays a deductible for Part D coverage — some plans don't have one — the maximum it can be is $480 in 2022 up from $445.

What does Medicare Part D do for you?

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes,” like drugs to treat cancer or HIV/AIDS. A plan's list of covered drugs is called a “formulary,” and each plan has its own formulary.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

How to get prescription drug coverage

Find out how to get Medicare drug coverage. Learn about Medicare drug plans (Part D), Medicare Advantage Plans, more. Get the right Medicare drug plan for you.

What Medicare Part D drug plans cover

Overview of what Medicare drug plans cover. Learn about formularies, tiers of coverage, name brand and generic drug coverage. Official Medicare site.

How Part D works with other insurance

Learn about how Medicare Part D (drug coverage) works with other coverage, like employer or union health coverage.

Why won't my insurance agent help me with Part D?

Part D is a Huge Time Investment for your Agent Too. Another reason many agents won’t help you with Part D is that the support needed on the back end is high . Pharmacies charge the wrong rate or the insurance company requires an exception from your doctor.

What happens when you buy Part D?

I cannot stress this enough. When you buy Part D, you are not buying it just for the meds you are using now. You are buying insurance coverage for future drug needs. Part D has a catastrophic coverage limit, and it is the best part of the coverage.

Do Part D plans come with catastrophic coverage?

You don’t want to risk paying a fortune for a critical medication. If you don’t take many prescription medications now, enroll in one of the least expensive Part D drug plans in the market. All of them come with catastrophic coverage . That way you aren’t spending too much, but you have the coverage for a rainy day.

Is an agent getting rich off Part D?

An agent would have to write thousands of them just to barely make a living. So I assure you, no agent is getting rich off Part D. Lazy agents will write your Medigap plan and throw you to wolves on Part D because it’s not worth their effort.

Is Part D a money maker?

Part D is NOT a Money Maker for your Agent. Some of you reading this are thinking – “Well of course you recommend Part D because agents get paid to sell Part D.”. Let me shed some light on this. Part D commissions for agents are so low that most agents will no longer help people with Part D.

Is Medicare Part D voluntary?

Medicare Part D, however, is a voluntary program. So even though we’ll explain why you need Part D, some people will choose to believe that “it wont’ happen to me.”. Every year, we meet dozens of Medicare beneficiaries who choose not to enroll despite the risks.

Why is Medicare Part D important?

For many, prescription medications are vital to maintaining a healthy lifestyle. The costs of medications can drain finances, Medicare Part D prescription helps those who need assistance with medications .

What happens if you don't enroll in Medicare Part D?

If you don’t enroll when you’re first eligible and don’t have creditable coverage, you could face a late enrollment penalty. Let’s take a closer look at using an example. Tip: Medicare Plan D and Part D aren’t the same things.

How long do you have to change your plan if you are no longer eligible for Part D?

If you’re no longer eligible for Extra Help for the following year, you will have a 3-month window to change plans. This period starts either the date you’re notified or when you’re no longer eligible;

Is it necessary to take prescriptions on a regular basis?

For many seniors, taking prescription drugs on a regular basis is not optional. Patients who have regular medication needs should be sure to enroll as soon as Medicare Part D eligibility begins. Unexpected or not, the cost of medications can be financially exhausting, Part D plans provide you with a much lower cost for the same quality ...

Can Medicare delay Part D?

Delaying Part D When Eligible. Medicare may add a Part D Late Enrollment Penalty to your Part D premium each month you have Part D coverage. Unless you enroll in a Part D plan when you’re first eligible during your IEP. As we grow older our chances of needing prescriptions will often increase. If you have no creditable prescription drug coverage, ...

Is Medicaid a federal or state program?

Medicaid is another Federal and State government medical health insurance program. Medicaid provides coverage for individuals and families that have low incomes or limited resources. Not all will qualify for Medicaid coverage in addition to Medicare coverage. Medicare beneficiaries with full Medicaid benefits are dually eligible.

Do I need a Medicare Advantage plan if I have supplemental insurance?

But if you have a Medicare Advantage plan that includes Part D, you can’t have a separate Part D plan.

What is Medicare Part D?

Medicare Part D is an important benefit that helps pay for prescription drugs not covered by original Medicare (parts A and B). There are private medication plans that you can add to your original Medicare coverage, or you can choose a Medicare Advantage plan (Part C) with drug coverage.

When do you have to enroll in Medicare Part D?

For most people, you first become eligible to enroll in Medicare Part D from 3 months before your 65 th birthday to 3 months after your birthday. When you find a plan to join, you’ll need to provide your unique Medicare number and the date you became eligible.

What is Medicare Supplement?

Medicare supplement (Medigap). Medigap plans help pay for some or all out-of-pocket costs like deductibles and copays. There are 10 plans available. You can compare the rates and coverage with your original Medicare coverage gap and premiums.

What are the different types of Medicare coverage?

What are the Medicare prescription drug coverage options? 1 Part D. These plans cover prescription medications for outpatient services. All plans have to offer some basic level of drug coverage based on Medicare rules. Specific plan coverage is based on the plans’ formulary, or drug list. If your doctor wants a drug covered that’s not part of that plan’s list, they’ll need to write a letter of appeal. Each nonformulary medication coverage decision is individual. 2 Part C (Advantage plans). This type of plan can take care of all your medical needs (parts A, B, and D), including dental and vision coverage. Premiums might be higher and you might have to go to network doctors and pharmacies. 3 Medicare supplement (Medigap). Medigap plans help pay for some or all out-of-pocket costs like deductibles and copays. There are 10 plans available. You can compare the rates and coverage with your original Medicare coverage gap and premiums. Choose the best option to give you maximum benefits at the lowest rates.

What is the right Medicare plan for you?

The right plan for you depends on your budget, medication costs, and what you want to pay for premiums and deductibles. Medicare has a tool to help you compare plans in your area looking ahead to 2020. Part D. These plans cover prescription medications for outpatient services.

How long does it take for Medicare to pay late enrollment penalty?

Medicare adds on a permanent 1 percent late enrollment penalty to your premiu if you don’t enroll within 63 days of your initial eligibility period. The penalty rate is calculated based on the national premium rate for the current year multiplied by the number of months you didn’t enroll when you were eligible.

How long do you have to stay in Medicare Part D?

You’ll have to stay in the plan an entire year, so choose carefully. When using the Medicare plan finder to choose a Part D plan, enter your medications and doses, then select your pharmacy options. Of the available drug plans, you’ll see the lowest monthly premium plan displayed first.

Why was Medicare Part D created?

Because there is very little prescription drug coverage in Original Medicare, Congress created Part D as part of the Medicare Modernization Act in 2003. Medicare Part D is designed to help make medications more affordable for people enrolled in Medicare.

Why is it important to enroll in a Part D plan?

It’s important to enroll in a plan when you are first eligible if you want to avoid a late enrollment penalty with your monthly premium. If you go without creditable prescription drug coverage and you don’t enroll in Part D when you are first able, you’ll pay a penalty of 1% of the national base premium for each month you go without coverage.

What is coinsurance in Medicare?

Copayments (flat fee you pay for each prescription) Coinsurance (percentage of the actual cost of the medication ) Many Medicare Advantage plans include prescription drug coverage. If you enroll in a plan with Part D included, you typically won’t pay a separate premium for the coverage. You generally pay one monthly premium for Medicare Advantage.

What is a formulary in Medicare?

Each Medicare prescription drug plan uses a formulary, which is a list of medications covered by the plan and your costs for each. Most plans use a tiered copayment system. Prescription drugs in the lowest tiers, usually generic medications, have lower copayments.

What are the different types of Medicare?

There are four parts to the Medicare program: 1 Part A, which is your hospital insurance 2 Part B, which covers outpatient services and durable medical equipment (Part A and Part B are called Original Medicare) 3 Part C, or Medicare Advantage, which offers an alternate way to get your benefits under Original Medicare 4 Part D, which is your prescription drug coverage

How many Medicare Part D plans are there in 2021?

According to the Kaiser Family Foundation, the average Medicare beneficiary has 30 stand-alone Medicare Part D prescription drug plans to choose from in 2021. It’s important to comparison shop to find the one that’s right for you.

Does Medicare cover experimental medications?

Brand-name and specialty medications in the higher tiers cost more out-of-pocket. Medicare Part D only covers prescription drugs that are FDA approved. Experimental medications are generally not covered.

How to decide if you need Medicare Part D?

How To Decide If You Need Part D. Medicare Part D is insurance. If you need prescription drug coverage, selecting a Part D plan when you’re eligible to enroll is probably a good idea—especially if you don’t currently have what Medicare considers “creditable prescription drug coverage.”. If you don’t elect Part D coverage during your initial ...

How long do you have to be in Medicare to get Part D?

You must have either Part A or Part B to get it. When you become eligible for Medicare (usually, when you turn 65), you can elect Part D during the seven-month period that you have to enroll in Parts A and B. 2. If you don’t elect Part D coverage during your initial enrollment period, you may pay a late enrollment penalty ...

What is Medicare Part D 2021?

Luke Brown. Updated July 15, 2021. Medicare Part D is optional prescription drug coverage available to Medicare recipients for an extra cost. But deciding whether to enroll in Medicare Part D can have permanent consequences—good or bad. Learn how Medicare Part D works, when and under what circumstances you can enroll, ...

How long can you go without Medicare Part D?

You can terminate Part D coverage during the annual enrollment period, but if you go 63 or more days in a row without creditable prescription coverage, you’ll likely face a penalty if you later wish to re-enroll. To disenroll from Part D, you can: Call Medicare at 1-800-MEDICARE.

How to disenroll from Medicare?

Call Medicare at 1-800-MEDICARE. Mail or fax a letter to Medicare telling them that you want to disenroll. If available, end your plan online. Call the Part D plan directly; the issuer will probably request that you sign and return certain forms.

What happens if you don't have Part D coverage?

The late enrollment penalty permanently increases your Part D premium. 3. Prescription drug coverage that pays at least ...

What drugs are covered by Part D?

Drugs covered by each Part D plan are listed in their “formulary,” and each formulary is generally required to include drugs in six categories or protected classes: antidepressants, antipsychotics, anticonvulsants, immunosuppressants for treatment of transplant rejection, antiretrovirals, and antineoplastics.

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs , like premiums, deductibles, and coinsurance. with your prescription drug costs. If you don't join a plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

What is a copayment for Medicare?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. for each drug. If you don't join a drug plan, Medicare will enroll you in one to make sure you don't miss a day of coverage.

Do you have to have a Medicare drug plan to get tricare?

Most people with TRICARE entitled to Part A must have Part B to keep TRICARE drug benefits. If you have TRICARE, you don’t need to join a Medicare drug plan.

Can you keep a medicaid policy?

Medigap policies can no longer be sold with prescription drug coverage, but if you have drug coverage under a current Medigap policy, you can keep it. If you join a Medicare drug plan, your Medigap insurance company must remove the prescription drug coverage under your Medigap policy and adjust your premiums.

Can you join a Medicare plan without a penalty?

, you'll have a special enrollment period to join a Medicare drug plan without a penalty when COBRA ends.

Does Medicare help with housing?

, you won't lose your housing assistance. However, your housing assistance may be reduced as your prescription drug spending decreases.

Does Medicare pay for prescription drugs?

Your drug costs are covered by Medicare. You'll need to join a Medicare drug plan for Medicare to pay for your drugs. In most cases, you'll pay a small amount for your covered drugs. If you have full coverage from Medicaid and live in a nursing home, you pay nothing for covered prescription drugs.

What is Medicare Part D?

Part D is Medicare’s insurance program for prescription drugs. For most of its history, Medicare did not offer a prescription drug benefit. Congress added the coverage, which began in 2006. AARP Membership: Join or Renew for Just $16 a Year.

How much is Medicare Part D premium 2020?

The Centers for Medicare & Medicaid Services (CMS) estimates that the average monthly Part D basic premium for 2020 will be $32.74. But premiums vary widely, depending on the drugs covered and the copays. Some plans have no premiums. If you are enrolled in a Medicare Advantage plan, part of your premium may include prescription drugs.

What happens if my Medicare plan is no longer available?

If your plan is no longer available, you will receive a letter from the insurer about the termination. You will then need to pick another plan. However, Medicare officials and experts strongly suggest that you review other available Part D plans — even if you are satisfied with your current plan.

What is the Medicare call center number?

Medicare has a call center that’s open seven days a week, 24 hours a day. The toll-free number is 800-MEDICARE (800-633-4227). You may also contact SHIP. You can find contact information for SHIP in your state at Medicare.gov.

How much can I deduct from my insurance in 2020?

The federal government sets a limit on deductibles every year. For 2020, a plan can’t impose a deductible higher than $435. But deductible amounts vary widely by plan, and many plans don’t impose a deductible.

What to do if you don't qualify for extra help?

If you don’t qualify for Extra Help, you might qualify for an assistance program in your state. You can contact your State Health Insurance Assistance Program (SHIP) or state Medicaid office for more information. In addition, some drug manufacturers also offer discounts on their medications.

When do you sign up for Medicare Part A and B?

Your IEP begins three months before the month you turn 65 and lasts until three months after. For example, if you will turn 65 on June 15, your IEP is from March 1 to Sept. 30.

Pros and cons of enrolling in Part D with no active prescriptions

Medicare Part D late enrollment has a penalty that will apply for as long as you are enrolled in the program.

How much is the Part D late enrollment penalty?

The penalty is 1% of the national base average per month. If your penalty ends up being $10 and your ideal plan is $24, you will pay $34 per month for the entire time you have that plan.

What if I only take a couple of generics?

Generics with Medicare Part D may cost less than you are currently paying. For as low as 6 or 7 dollars a month, you could have lower prescription costs on generics, too.

Conclusion

No one can predict the future. Just because you don’t have any prescription costs right now does not mean that will be true next week, next month, or next year. We don’t buy insurance to only deal with what we have today — we buy it for security in the future.