Full Answer

What is the difference between Medicaid and private insurance?

pays first and Medicare pays second during a coordination period that lasts up to 30 months . After the coordination period ends, Medicare pays first and the group health plan pays second . If you originally got Medicare due to your age or a disability other than ESRD, and your group health plan was your primary payer, then it will continue

How is Medicare different from private insurance?

No-fault insurance or liability insurance pays first and Medicare pays second. If the no-fault or liability insurance denies your medical bill or is found not liable for payment, Medicare pays first, but only pays for Medicare-covered services. You're still responsible for your share of the bill (like. coinsurance, a. copayment or a

Which insurance pays first?

Nov 23, 2021 · Medicare pays first when it serves as your primary payer. If you have Medicare as well as another type of insurance, your coverage is provided through a coordination of benefits. In some situations, Medicare will serve as your primary payer, which means Medicare pays first. Your other insurance coverage will then serve as your secondary payer.

Can I use private insurance instead of Medicare?

When you have both Medicare and TRICARE, the question of who pays first depends on whether you’re active-duty or inactive-duty military. Active-duty: Medicare pays second; Inactive-duty: Medicare pays first; If you receive services from a federal provider, such as a military hospital, TRICARE always pays first.

Is Medicare billed first?

gov . Medicare pays first, and Medicaid pays second . If the employer has 20 or more employees, then the group health plan pays first, and Medicare pays second .

When Medicare is secondary payer?

The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the remaining costs. If your group health plan or retiree coverage is the secondary payer, you may need to enroll in Medicare Part B before they'll pay.

How do you determine which insurance is primary and which is secondary?

The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer. The secondary payer only pays if there are costs the primary insurer didn't cover.Dec 1, 2021

Does Medicare pay the same as private insurance?

Based on the reviewed studies comparing Medicare and private insurance rates for hospital and physician services, this brief finds that private insurance payments are consistently greater, averaging 199% of Medicare rates for hospital services overall, 189% of Medicare rates for inpatient hospital services, 264% of ...Apr 15, 2020

Is it better to have Medicare as primary or secondary?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

How do you determine which insurance is primary?

Primary insurance is a health insurance plan that covers a person as an employee, subscriber, or member. Primary insurance is billed first when you receive health care. For example, health insurance you receive through your employer is typically your primary insurance.Oct 8, 2019

When two insurance which one is primary?

If you have two plans, your primary insurance is your main insurance. Except for company retirees on Medicare, the health insurance you receive through your employer is typically considered your primary health insurance plan.

Can you have 2 primary insurances?

Yes, individuals can have coverage under two different health insurance plans. When two health insurance plan providers work together to pay the claims of one person, it's called coordination of benefits. The following situations are reasons employees would have dual insurance coverage: The employee is married.Feb 5, 2021

Is my mom the primary insurance holder?

Generally, the parent whose birthday occurs the earliest in the calendar year is considered to hold the primary insurance for the children. The parent, whose birthday falls later in the calendar year, is considered to hold the secondary insurance for the children.

How is Medicare paid?

Medicare is funded by the Social Security Administration. Which means it's funded by taxpayers: We all pay 1.45% of our earnings into FICA - Federal Insurance Contributions Act - which go toward Medicare. Employers pay another 1.45%, bringing the total to 2.9%.

Can you have medical and Medicare at the same time?

If you qualify for full Medi-Cal (Medi-Cal without a share of cost (SOC)), Medi-Cal will also cover your Medicare Part A and B deductibles and copayments, and pay your monthly Medicare Part B premium.

Do Medicare patients get treated differently?

Outpatient services are charged differently, with the patient typically paying 20% of the Medicare-approved amount for each service.Mar 23, 2021

What is Medicare Advantage?

A Medicare Advantage plan replaces your Original Medicare coverage. In addition to those basic benefits, Medicare Advantage plans can also offer some additional coverage for things like prescription drugs, dental, vision, hearing aids, SilverSneakers programs and more.

What is a group health plan?

The group health plan is your secondary payer after Medicare pays first for your health care costs. You have End-Stage Renal Disease (ESRD), are covered by a group health plan and have been entitled to Medicare for at least 30 months. The group health plan pays second, after Medicare. You have ESRD and COBRA insurance and have been eligible ...

Is Medicaid a dual payer?

You are “dual-eligible” ( entitled to both Medicare and Medicaid ). Medicaid becomes the secondary payer after Medicare pays first. You are age 65 or older and are covered by a group health plan because you or your spouse is still working and the employer has fewer than 20 employees.

Is Medicare a secondary payer?

Medicare serves as the secondary payer in the following situations: You are 65 or older and are covered by a group health plan because you or your spouse is still working and the employer has 20 or more employees. The group health plan is the primary payer, and Medicare pays second.

Does tricare work with Medicare?

You may use both types of insurance for your health care , but they will operate separately from each other. TRICARE does work with Medicare. Active-duty military personnel who are enrolled in Medicare may use TRICARE as a primary payer, and then Medicare pays second as a secondary payer. For inactive members of the military who are enrolled in ...

Is Medicare the primary payer for workers compensation?

If you are covered under workers’ compensation due to a job-related injury or illness and are entitled to Medicare benefits, the workers’ compensation insurance provider will be the primary payer. There typically is no secondary payer in such cases, but Medicare may make a payment in certain situations.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the primary payer?

Primary payer: This is the payer who pays its portion of covered services first.

What is the difference between primary and secondary payer?

Secondary payer: After the primary payer pays, the bill is sent to the secondary payer so it can pay its share.

How to use VA benefits?

To use your VA benefits, simply receive care from a VA facility. If you prefer to see a civilian doctor, use Medicare. If you favor civilian healthcare over VA, you may wish to purchase a Medigap policy. This won’t cover services received via the VA. When you see a civilian provider, Medigap becomes the secondary payer.

Is Medicare the primary payer for end stage renal disease?

Have End-Stage Renal Disease. If you have End-Stage Renal Disease (ESRD) and a group health plan, primary payer is determined by how long you’ve been eligible or entitled to Medicare. During the first 30 months of your eligibility or entitlement, Medicare is the secondary payer. After 30 months, Medicare becomes the primary payer.

Is Medicare the primary payer?

If you retire but still have group insurance through your former employer or your spouse’s employer, Medicare is the primary payer. This assumes you have both Part A and B (Original Medicare) and that your provider accepts assignment. Once it pays its share, Medicare sends the remaining bill to your secondary payer.

Who pays first for Medicare?

When it comes to Medicare, ‘Who Pays First’ is a very common dilemma these days. That’s because people are working longer than ever and often have other insurance coverage in place alongside Medicare. In most cases of other coverage, one insurance becomes the primary payer, and the other insurance becomes the secondary payer.

Can you have both Medicare and VA?

Medicare and VA Insurance. Veterans can choose to treat under Medicare or their VA benefits. If you are entitled to both Medicare and Veteran’s benefits, you can have both. When you have both VA and Medicare, Medicare is neither the primary or secondary payer.

Is Medicare primary or secondary?

Employer health plans with 20 or more employees will be primary and Medicare will be secondary. If there are less than 20 employees, then Medicare is primary and your group health plan is secondary. Again, in both of these situations, you would not need a Medigap plan because you already have a primary and secondary payer.

What are the benefits of Medicare?

Medicare provides health care for more than 59.8 million Americans, but that does not mean it necessarily covers everything they need. Consider these common items that Medicare leaves you to pay for out of pocket: 1 Acupuncture 2 Care during foreign travel with rare exceptions 3 Chiropractor services except to correct subluxation of the spine 4 Corrective eye lenses (contact lenses or eyeglasses) 5 Custodial care (bathing, dressing, toileting) 6 Dentures 7 Foot care 8 Hearing aids 9 Long-term nursing home care 10 Non-emergency transportation with rare exceptions 11 Over-the-counter medications, vitamins, and supplements 12 Prescription medications in certain categories 13 Walking canes for the blind

What happens if you don't pay Medicare?

If you do not meet the criteria for Medicare to pay first, your employer-sponsored health plan will be billed instead. What they do not pay for will then be billed to Medicare. Medicare will pay for healthcare services that it would normally cover as long as it sees them as medically necessary. Medicare will pay first.

How long can you keep your health insurance after you leave your job?

Thanks to the Consolidated Omnibus Budget Reconciliation Act (COBRA) of 1985 you can continue your employer-sponsored health plan after you leave your job. The law requires employers of 20 or more full-time employees to offer continued access to their health plan for a period of time, usually 18 months, after your job ends by way of termination or a layoff. The duration of COBRA coverage may be extended up to 36 months if certain conditions are met.

Why do people work longer?

The end result is that many people are working longer to maximize their retirement funds. Working gives them access to health care through their employers that they may choose to continue alone, continue while also signing up for Medicare, or cancel and replace with Medicare.

What is the retirement age for Social Security?

The retirement age for Social Security benefits used to be 65 years old, the same age that you become eligible for Medicare. That all changed in 1983 when Congress passed legislation to increase the retirement age based on your birthday. For people born between 1943 and 1954, the retirement age is now 66 years old. The retirement age gradually increases to a maximum of 67 years of age for those born after 1960. Retiring earlier than this designated age will result in your getting lesser payments from Social Security.

How long is the ESRD coordination period?

If you have ESRD -AND- your 30-month coordination period for ESRD has ended. If you are 65 years or older -AND- your employer has more than 20 full-time employees. If you are 65 years or older -AND- you are both self-employed and covered by another employer that has more than 20 full-time employees.

What is the retirement age for people born in 1943?

For people born between 1943 and 1954, the retirement age is now 66 years old. The retirement age gradually increases to a maximum of 67 years of age for those born after 1960. Retiring earlier than this designated age will result in your getting lesser payments from Social Security.

How much of your medical bills does Medicare pay?

As you’ve seen with Medicare, you are still responsible for around 20 % of your medical bills. Because of this, many people buy additional coverage to pay those out-of-pocket costs that Medicare does not pick up.

How long does it take to get Medicare?

There is a seven-month window during which you can apply for Medicare. The period begins three months before your 65th birthday, and ends three months later. If you apply at any time outside the window, there may be a lapse in coverage and penalties.

What are the different types of Medicare?

There are multiple parts to Medicare: 1 Part A: This is hospital insurance and includes emergency room visits and inpatient care in addition to home healthcare, skilled nursing facility care and hospice care. 2 Part B: This is medical insurance for your doctor and specialist. It includes preventive healthcare, diagnostics and treatment for ongoing conditions. 3 Part C: Medicare Advantage. This is an optional portion of Medicare that is offered by private insurance companies and includes Part A and Part B. Part A and Part B are often referred to as Original Medicare. 4 Part D: Prescription drug coverage. This is an add-on to Original Medicare 5 Medigap: These are Medicare supplement policies offered by private insurance companies to cover gaps in coverage and out-of-pocket costs. Medicare Supplemental insurance is not part of Original Medicare, but isregulated by Medicare.

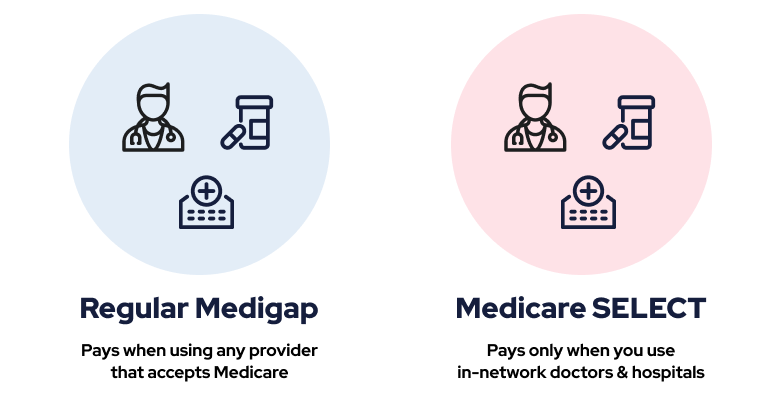

What is Medicare Supplemental Insurance?

Medigap: These are Medicare supplement policies offered by private insurance companies to cover gaps in coverage and out-of-pocket costs. Medicare Supplemental insurance is not part of Original Medicare, but isregulated by Medicare. Medicare Parts A and B do not have a max on out-of-pocket costs. This is something to consider as you evaluate ...

How much is Medicare deductible for 2021?

Medicare has a sizable deductible anytime you are admitted into the hospital. In 2021, the deductible is $1,484. This tends to increase each year. Hospital stays can be expensive over time. For days 1-60, there is $0 coinsurance. You will pay the deductible. For days 61-90, there is a $371 co-insurance per day.

What is Plan A?

Plan A is the most basic plan. All other plans build off this coverage. Plan A covers Part A Medicare co-insurance, including an extra 365 days of hospital costs.Part B 20% co-insurance is covered, along with three pints of blood and Part A hospice care.

What is Medicare Advantage Plan?

In a nutshell, Medicare Advantage bundles Original Medicare with Part D prescription drug coverage. Vision and dental coverage is also included.

What percentage of Americans have private health insurance?

Others include Medicaid and Veteran’s Affairs benefits. According to a 2020 report from the U.S. Census Bureau, 68 percent of Americans have some form of private health insurance. Only 34.1 percent have public health insurance, including 18.1 percent who are enrolled in Medicare. In certain cases, you can use private health insurance ...

What age do you have to be to get Medicare?

are age 65 or older. have a qualifying disability. receive a diagnosis of ESRD or ALS. How Medicare works with your group plan’s coverage depends on your particular situation, such as: If you’re age 65 or older. In companies with 20 or more employees, your group health plan pays first.

Is Medicare covered by HMO?

If this is the case with your group health plan and it pays first, you may not be covered by Medicare if you choose to use an out-of- network provider.

What is the number to contact for Cobra?

United States Department of Labor. If your employment has ended, you can contact the Department of Labor to learn more about COBRA coverage at 866-487-2365.

Does tricare pay for Medicare?

TRICARE pays first for any services that are covered by Medicare. TRICARE will also cover Medicare deductibles and coinsurance costs, as well as any services covered by TRICARE but not Medicare. If you’re not on active duty. Medicare pays first. TRICARE can pay second if you have TRICARE for Life coverage.

What is health insurance?

Health insurance covers much of the cost of the various medical expenses you’ll have during your life. Generally speaking, there are two basic types of health insurance: Private. These health insurance plans are offered by private companies.

Is Medicare the primary or secondary payer?

In some cases, Medicare may be the primary payer — in others, it may be the secondary payer.