Does medicaid pay if medicare denies? Since Medicare coverage is excluded, Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Why did Medicare deny my claim?

If Medicare refuses to pay for a service under Original fee-for-service Part A or Part B, the beneficiary should receive a denial notice. The medical provider is responsible for submitting a claim to Medicare for the medical service or procedure. If Medicare denies payment of the claim, it must be in writing and state the reason for the denial.

How to appeal a Medicare claim denial decision?

If the no-fault or liability insurance denies your medical bill or is found not liable for payment, Medicare pays first, but only pays for Medicare-covered services. You're still responsible for your share of the bill (like

Can someone be denied Medicare?

Your Medicare Supplement plan typically wouldn’t cover those costs. So, if Medicare Part A and/or Part B deny a claim for medical services you had or wish to have, generally a Medicare Supplement plan won’t cover it. There might be items and services that a Medicare Supplement plan may cover that Medicare doesn’t typically approve for coverage.

When do insurance companies deny claims?

Q: Medicare denied payment for services I recently had and indicated I could appeal the decision. How do I start this process? A: Denial of payment for services can occur for many reasons. Before starting the appeal process it would be wise to talk with the provider’s office to see if the problem is due […]

What happens when Medicare denies a claim?

An appeal is the action you can take if you disagree with a coverage or payment decision by Medicare or your Medicare plan. For example, you can appeal if Medicare or your plan denies: A request for a health care service, supply, item, or drug you think Medicare should cover.

Can Medicare Part A be declined?

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and won't cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so.

Will Medicare cover if primary denies?

Primary Medicare benefits may not be paid if the plan denies payment because the plan does not cover the service for primary payment when provided to Medicare beneficiaries. “A GHP's decision to pay or deny a claim because the services are or are not medically necessary is not binding on Medicare.Sep 20, 2017

Do patients pay for Medicare Part A?

Most people don't pay a monthly premium for Part A (sometimes called "premium-free Part A"). If you buy Part A, you'll pay up to $499 each month in 2022. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $499.

What happens if you decline Medicare Part B?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

What parts of Medicare are mandatory?

There are four parts to Medicare: A, B, C, and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse.

What does Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

What may be sent when a carrier rejects a claim because preauthorization was not obtained?

An appeal is sent when a carrier rejects a claim because preauthorization was not obtained.

Should I get Medicare if I have private insurance?

If you have private health insurance, you can still use Medicare services. There are times when you can claim Medicare benefits and use your private health insurance at the same time. For example, if you go to a public hospital as a private patient, you may be able to claim: from us for the costs we cover.Dec 10, 2021

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Who is eligible for Medicare Part A?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Does everyone pay the same for Medicare?

Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.

What happens if Medicare doesn't pay?

What if Medicare will not pay for something? If Medicare refuses to pay for something, they send you a “denial” letter. The denial says they will not pay. If you think they should pay, you can challenge their decision not to pay. This is called “appealing a denial.”.

How often do you get a Medicare statement?

If you have Part B Original Medicare, you should get a statement every three months. The statement is called a Medicare Summary Notice (MSN). It shows the services that were billed to Medicare. It also shows you if Medicare will pay for these services.

Can you appeal a Medicare payment?

You can appeal if: Medicare refuse s to pay for a health care service, supply or prescription that you think you should be able to get. Medica re refuses to pay the bill for health care services or supplies or a prescription drug you already got. Medicare refuses to pay the amount you must pay for a drug. Medicare stops paying for all ...

How does Medicare work with other insurance?

When there's more than one payer, "coordination of benefits" rules decide which one pays first. The "primary payer" pays what it owes on your bills first, and then sends the rest to the "secondary payer" (supplemental payer) ...

How long does it take for Medicare to pay a claim?

If the insurance company doesn't pay the claim promptly (usually within 120 days), your doctor or other provider may bill Medicare. Medicare may make a conditional payment to pay the bill, and then later recover any payments the primary payer should have made. If Medicare makes a. conditional payment.

What is the difference between primary and secondary insurance?

The insurance that pays first (primary payer) pays up to the limits of its coverage. The one that pays second (secondary payer) only pays if there are costs the primary insurer didn't cover. The secondary payer (which may be Medicare) may not pay all the uncovered costs.

When does Medicare pay for COBRA?

When you’re eligible for or entitled to Medicare due to End-Stage Renal Disease (ESRD), during a coordination period of up to 30 months, COBRA pays first. Medicare pays second, to the extent COBRA coverage overlaps the first 30 months of Medicare eligibility or entitlement based on ESRD.

What is a group health plan?

If the. group health plan. In general, a health plan offered by an employer or employee organization that provides health coverage to employees and their families.

What happens if a group health plan doesn't pay?

If the group health plan didn’t pay all of your bill, the doctor or health care provider should send the bill to Medicare for secondary payment. Medicare may pay based on what the group health plan paid, what the group health plan allowed, and what the doctor or health care provider charged on the claim.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. or a. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.

Does Medicare Supplement cover medical expenses?

Your Medicare Supplement plan typically wouldn’t cover those costs . So, if Medicare Part A and/or Part B deny a claim for medical services you had or wish to have, generally a Medicare Supplement plan won’t cover it. There might be items and services that a Medicare Supplement plan may cover that Medicare doesn’t typically approve for coverage.

Does Medicare Supplement pay for deductibles?

Medicare Supplement insurance typically helps pay for Medicare Part A and Part B coinsurance and copayments. It also may help pay Original Medicare deductibles and certain other out-of-pocket costs . Medicare Supplement insurance only works alongside Original Medicare, Part A and Part B. As the name implies, it’s a supplement – it adds ...

Does Medicare Supplement Insurance cover copayments?

Summary: With most of its benefits, Medicare Supplement insurance depends on Medicare’s approval in order to help pay Medicare copayments and coinsurance. If Medicare doesn’t cover it, in most cases, neither will Medicare Supplement insurance.

What does it mean if Medicare denied my claim?

Though Medicare is designed to give seniors and certain disabled individuals the most unobstructed access to healthcare possible, there are some rare circumstances that may unfortunately lead to a Medicare claim denial.

Why did Medicare deny my claim?

Medicare may deny your claim based on a few different factors. The exact reasoning behind your denied Medicare claim will be explained to you in the context of your denial letter. Learn more about the four main types of denial letters right here.

What can I do if Medicare denies a claim?

If you feel that Medicare has made in error in denying your coverage, you are welcome to appeal the decision. Some scenarios in which an appeal may be justified include denied claims for services, prescription drugs, lab tests, or procedures that you do believe were medically necessary.

What are the key things to remember when considering a Medicare denied claim appeal?

If you decide to appeal, be sure to ask your doctor, health care provider, or medical supplier for any relevant information that may help your case. In addition, take the time to review your coverage plan and your denial letter thoroughly.

What is an ABN in Medicare?

reimbursed by Medicare and may be billed to the patient. An ABN must: (1) be in writing; (2) be obtained prior to the beneficiary receiving the. service; (3) clearly identify the particular service; (4) state that the provider believes.

What is an ABN form?

An Advance Beneficiary Notice (ABN), sometimes called a patient waiver form, is used to. document that the patient is aware that Medicare may not pay for a test or procedure and. has agreed to pay the provider in the event payment is denied. Each ABN must be specific.

Can Medicare deny payment?

However, when a Medicare carrier is. likely to deny payment because of medical necessity policy (either as stated in their written. Medical Review Policy or upon examination of individual claims) the patient must be. informed and consent to pay for the service before it is performed. Otherwise, the patient.

Does Medicare cover cholesterol screening?

Medicare patients may be billed for services that are clearly not covered. For example,#N#routine physicals or screening tests such as total cholesterol are not covered when there is#N#no indication that the test is medically necessary. However, when a Medicare carrier is#N#likely to deny payment because of medical necessity policy (either as stated in their written#N#Medical Review Policy or upon examination of individual claims) the patient must be#N#informed and consent to pay for the service before it is performed. Otherwise, the patient#N#has no obligation to pay for the test.

Why is Medicare denied?

Medicare’s reasons for denial can include: Medicare does not deem the service medically necessary. A person has a Medicare Advantage plan, and they used a healthcare provider outside of the plan network. The Medicare Part D prescription drug plan’s formulary does not include the medication. The beneficiary has reached the maximum number ...

What happens if Medicare does not pay for a service?

Summary. If Medicare does not agree to pay for a service or item that a person has received, they will issue a Medicare denial letter. There are many different reasons for coverage to be denied. Medicare provides coverage for many medical services to those aged 65 and over. Younger adults may also be eligible for Medicare if they have specific ...

How to appeal Medicare?

Typically, an individual must provide the following information: 1 name, address, and Medicare number 2 details of the items or services, including dates and reason for the appeal 3 a statement from the service provider 4 any other helpful information

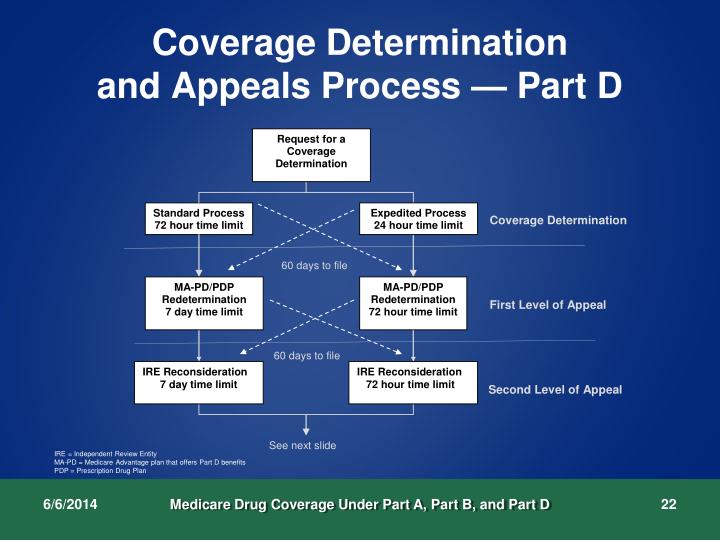

How long does it take to appeal a Medicare denial?

If an individual has original Medicare, they have 120 days to appeal the decision starting from when they receive the initial Medicare denial letter. If Part D denies coverage, an individual has 60 days to file an appeal. For those with a Medicare Advantage plan, their insurance provider allows 60 days to appeal.

What is a non-coverage notice?

Notice of Medicare Non-Coverage (NOMNC) A Notice of Medicare Non-Coverage (NOMNC) informs an individual that Medicare is not continuing to cover care from a comprehensive outpatient rehabilitation facility (CORF), a home health agency (HHA), or skilled nursing facility (SNF). Medicare must notify someone at least two calendar days before ...

How long does it take for Medicare to redetermine a claim?

Medicare should issue a Medicare Redetermination Notice, which details their decision within 60 calendar days after receiving the appeal.

What is SNF-ABN?

A Skilled Nursing Facility Advanced Beneficiary Notice (SNF-ABN) lets a beneficiary know in advance that Medicare will not pay for a specific service or item at a skilled nursing facility (SNF). In this case, Medicare may decide that the service is not medically necessary.