Are Medicare Advantage premiums deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan; if you decide to switch to Medigap, there often are lifetime penalties.

Who pays the premiums for Medicare?

Everyone pays for Part B of Original Medicare. In 2020, the standard premium is $144.60/month for those making no more than $87,000 per year ($174,000 per year for married couples filing jointly). For 2020, the threshold for having to pay higher premiums based on income increased.

How are Medicare Advantage plans reimbursed?

Most companies will file claims for services. Since Medicare Advantage is a private plan, you never file for reimbursement from Medicare for any outstanding amount. You will file a claim with the private insurance company to reimburse you if you have been billed directly for covered expenses.

Why is Medicare Advantage being pushed so hard?

Advantage plans are heavily advertised because of how they are funded. These plans' premiums are low or nonexistent because Medicare pays the carrier whenever someone enrolls. It benefits insurance companies to encourage enrollment in Advantage plans because of the money they receive from Medicare.Feb 24, 2021

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.Dec 21, 2021

How can I avoid paying Medicare premiums?

Delaying enrollment in Medicare – when you're eligible for it – could result in a penalty that will remain in effect for the rest of your life.Sign up for Part B on time. ... Defer income to avoid a premium surcharge. ... Pay your premiums directly from your Social Security benefits. ... Get help from a Medicare Savings Program.Jan 3, 2022

Does everyone on Medicare pay the same premium?

Most people will pay the standard premium amount. If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA).

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

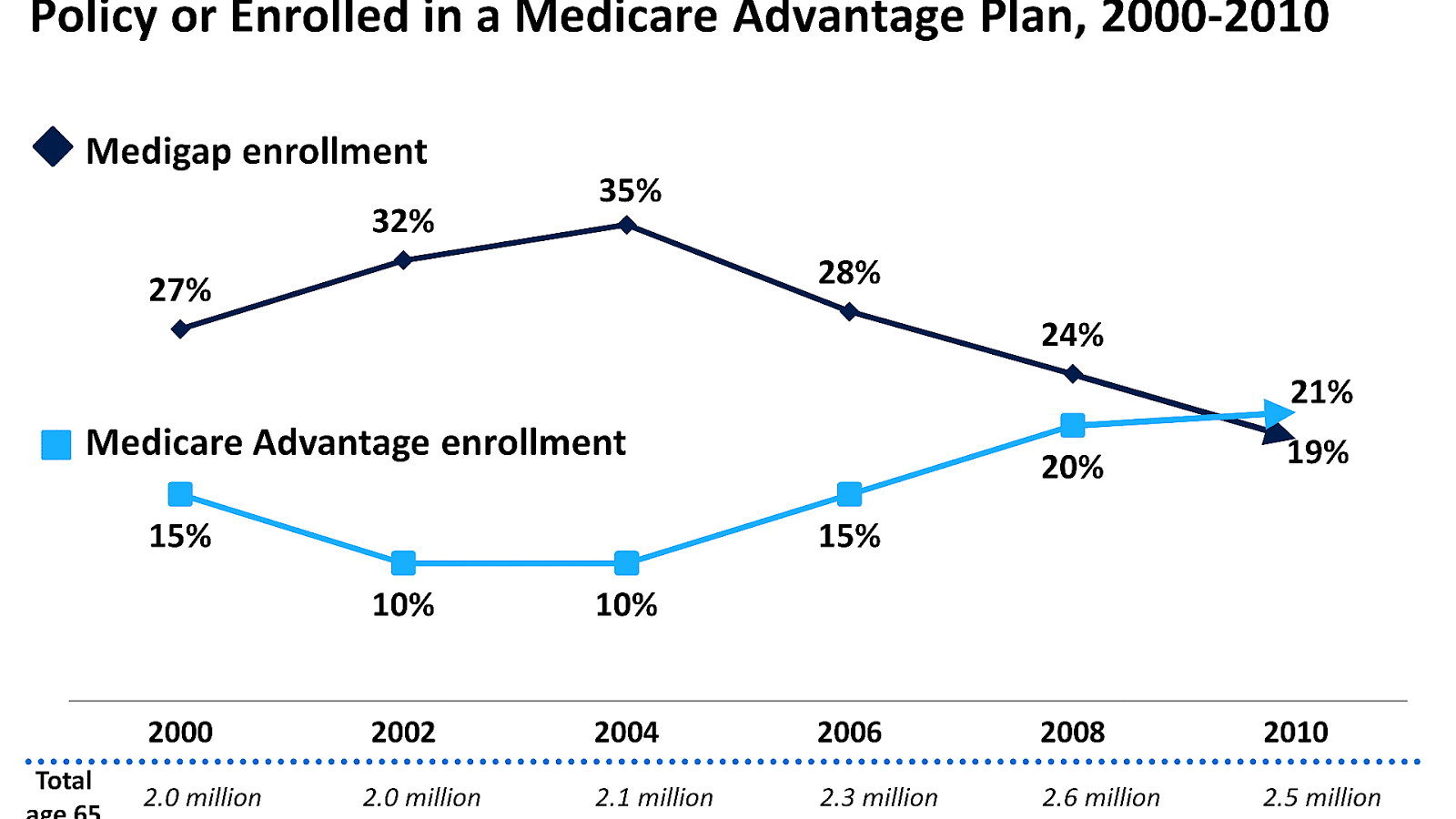

Which is better a Medigap policy or Medicare Advantage plan?

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Can you have Medicare and Medicare Advantage at the same time?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. You must use the card from your Medicare Advantage Plan to get your Medicare- covered services.

How Medicare Advantage Premiums Work

Medicare Advantage, known as Medicare Part C, includes both Medicare Parts A and B (Original Medicare) coverage. When you enroll in a Medicare Adva...

Medicare Part C Cost: How Much Is The Premium?

Medicare Advantage premiums vary depending on the type of plan and the state you live in. Monthly premiums range from $0 to the high $300s. But ove...

How Does Obamacare Affect Medicare Advantage Costs?

Obamacare (Affordable Care Act) made several changes to Medicare Advantage plans. Most of these changes had to do with the health insurance industr...

Can I Get Help Paying For Medicare Advantage?

You can get help with paying for your Medicare Part C plan through Medicare Savings Programs (MSPs) made available by the Centers for Medicare and...

How Do I Choose A Medicare Advantage Plan?

The first step in choosing a Medicare Advantage plan is to compare quotes from different insurance companies. HealthMarkets provides access to Medi...

What is Medicare Advantage?

A Medicare Advantage plan is health insurance offered by Medicare-approved private insurance companies. It’s a single plan that includes all Original Medicare (Part A and Part B) ...

Who is responsible for paying Medicare claims?

The insurance company becomes responsible for paying members’ claims. Medicare pays the insurance company a flat fee for the cost of paying claims. The insurance company uses this payment to provide members with healthcare coverage.

How is Medicare Part B billed?

Your Part B Medicare premiums are billed directly through Medicare, while your Part C premiums are billed through the private insurance company associated with your Medicare Advantage plan. Here’s how you pay Medicare and your private insurance company. Premium Payments to Medicare: If you receive Social Security, Office of Personnel Management, ...

What happens if you don't receive Medicare?

If you don’t receive these benefits, you will receive a bill called ‘Notice of Medicare Premium Payment Due’. You can then pay by mailing a check, use your bank’s online billing to make payments every month, or sign-up for Medicare’s bill pay to have the premium come out of your bank account automatically.

What is Medicare Part C premium?

The premium you may pay is used to cover the wider range of services available with Medicare Part C . The Medicare-approved private insurance companies that offer Medicare Part C coverage decide what services the plans will cover, so monthly premiums vary from plan to plan and state to state. Insurance companies are only allowed to make changes ...

What is the Medicare Advantage premium for 2020?

What Is the Premium for Medicare Advantage? In 2020, the average monthly premium for plans that include Medicare Part D prescription drug (MA-PD) benefits is $25, according to the Kaiser Family Foundation. (The average monthly premium is weighted by enrollment.)

How much is Medicare Part B 2021?

Medicare decides the Part B premium rate. The standard 2021 Part B premium is $148.50, but it can be higher depending on your income. On average, those who received Social Security benefits will pay a lesser premium rate. Usually, you pay a separate monthly premium for a Medicare Part C plan. But not all Part C plans have monthly premiums.

What is Medicare premium?

premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. . Many Medicare Advantage Plans have a $0 premium. If you enroll in a plan that does charge a premium, you pay this in addition to the Part B premium. Whether the plan pays any of your monthly.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is out of network Medicare?

out-of-network. A benefit that may be provided by your Medicare Advantage plan. Generally, this benefit gives you the choice to get plan services from outside of the plan's network of health care providers. In some cases, your out-of-pocket costs may be higher for an out-of-network benefit. .

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). .

What is a medicaid?

Whether you have. Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. and if the plan charges for it. The plan's yearly limit on your out-of-pocket costs for all medical services. Whether you have.

What is a copayment?

A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug. An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).

What is Medicare Advantage?

Medicare Advantage (Medicare Part C) is an alternative way to get your benefits under Original Medicare (Part A and Part B). By law, Medicare Advantage plans must cover everything that is covered under Original Medicare, except for hospice care, which is still covered by Original Medicare Part A.

What does the trust fund pay for?

The money in this trust fund pays for Part A expenses such as inpatient hospital care, skilled nursing facility care, and hospice.

Does Medicare Advantage charge a monthly premium?

In addition to the Part B premium, which you must continue to pay when you enroll in Medicare Advantage, some Medicare Advantage plans also charge a separate monthly premium.

Does Medicare Advantage have a lower cost?

In return, however, Medicare Advantage plans tend to have lower out-of-pocket costs than Original Medicare, and unlike Original Medicare, Medicare Advantage plans also have annual limits on what you have to pay out-of-pocket before the plan covers all your costs.

Can I enroll in a zero premium Medicare Advantage plan?

You may be able to enroll in a zero-premium Medicare Advantage plan (although, remember, you still have to pay your regular Part B premium) and you may have other costs, such as copayments and coinsurance.

What are Medicare Advantage Plans?

Medicare Advantage plans may provide extra (“supplemental”) benefits that are not available in traditional Medicare. The cost of these benefits may be covered using rebate dollars (which may include bonus payments) paid by CMS to private plans. In recent years, the rebate portion of federal payments to Medicare Advantage plans has risen rapidly, totaling $140 per enrollee per month in 2021, a 14% increase over 2020. Plans can also charge additional premiums for such benefits. Beginning in 2019, Medicare Advantage plans have been able to offer additional supplemental benefits that were not offered in previous years. These supplemental benefits must still be considered “primarily health related” but CMS expanded this definition, so more items and services are available as supplemental benefits.

What percentage of Medicare Advantage enrollees are in HMOs?

Nearly two-thirds (60%) of Medicare Advantage enrollees are in HMOs, 35% are in local PPOs, and 4% are in regional PPOs in 2021.

How much is the deductible for Medicare in 2021?

In contrast, under traditional Medicare, when beneficiaries require an inpatient hospital stay, there is a deductible of $1,484 in 2021 (for one spell of illness) with no copayments until day 60 of an inpatient stay (assuming no supplemental coverage that covers some or all of the deductible).

How much has Medicare premium declined?

Premiums paid by Medicare Advantage enrollees have declined slowly since 2015. Average Medicare Advantage Prescription Drug (MA-PD) premiums declined by $4 per month between 2020 and 2021, much of which was due to the relatively sharp decline in premiums for local PPOs, which fell by $7 per month. Since 2016, enrollment in local PPOs has increased ...

How much does Medicare pay in 2021?

In 2021, 89% of individual Medicare Advantage plans offer prescription drug coverage (MA-PDs), and most Medicare Advantage enrollees (90%) are in plans that include this prescription drug coverage. Nearly two-thirds of beneficiaries in individual Medicare Advantage plans with prescription drug coverage (65%) pay no premium for their plan, other than the Medicare Part B premium ($148.50 in 2021). However, 15% of beneficiaries in individual MA-PDs (2.6 million enrollees) pay at least $50 per month, including 5% who pay $100 or more per month, in addition to the monthly Part B premium. The MA-PD premium includes both the cost of Medicare-covered Part A and Part B benefits and Part D prescription drug coverage. Among the one-third of all enrollees in an individual MA-PD who pay a premium for their plan (6.0 million enrollees), the average premium is $60 per month. Altogether, including those who do not pay a premium, the average individual MA-PD enrollee pays $21 per month in 2021.

What is the out-of-pocket limit for Medicare Advantage?

In 2021, the out-of-pocket limit may not exceed $7,550 for in-network services and $11,300 for in-network and out-of-network services combined. These out-of-pocket limits apply to Part A ...

How much is the out of network limit for HMO?

For enrollees in HMOs, the average out-of-pocket (in-network) limit is $4,566. Enrollees in HMOs are generally responsible for 100% of costs incurred for out-of-network care. However, HMO point of service (POS) plans allow out-of-network care for certain services, though it typically costs more than in-network coverage.