What Is the Additional Medicare Tax?

- The Additional Medicare Tax has been in effect since 2013.

- Taxpayers who make over $200,000 as individuals or $250,000 for married couples are subject to an additional 0.9 percent tax on Medicare.

- The Additional Medicare Tax goes toward funding features of the Affordable Care Act.

How to calculate additional Medicare tax properly?

- Normal medicare tax rate for individual is 1.45 % of gross wages or salary

- Normal medicare tax rate for self employed person is 2.9 % of Gross income.

- If wage or self employment income is more than the threshold amount , only then you are liable for additional medicare tax .

Who is exempt from paying Medicare tax?

Who is exempt from paying Medicare tax? The following classes of nonimmigrants and nonresident aliens are exempt from U.S. Social Security and Medicare taxes: A-visas. Employees of foreign governments, their families, and their servants are exempt on salaries paid to them in their official capacities as foreign government employees.

Do employers match additional Medicare tax?

An employer must begin withholding Additional Medicare Tax in the pay period in which the wages or railroad retirement (RRTA) compensation paid to an employee for the year exceeds $200,000. The employer then continues to withhold it each pay period until the end of the calendar year. There's no employer match for Additional Medicare Tax.

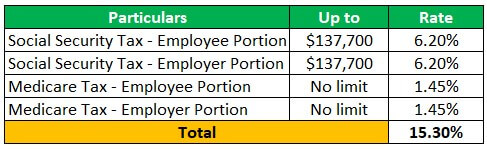

Who pays FICA taxes?

U.S. Attorney John C. Gurganus says Ehrenberg, as an owner of a business, is responsible for collecting and paying federal payroll taxes to the Internal Revenue Service (IRS). This includes Federal Insurance Contribution Act (FICA) taxes, which Ehrenberg failed to pay to the IRS from 2017 through 2020, totaling $185,681.90, Gurganus said.

Who pays additional Medicare tax 2021?

The Additional Medicare Tax applies to people who are at predetermined income levels. For the 2021 tax year, those levels are: Single tax filers: $200,000 and above. Married tax filers filing jointly: $250,000 and above.

Who pays Medicare surtax?

The Medicare tax rate is 2.9% of your income. If you work for an employer, you pay half of it, and your employer pays the other half — 1.45% of your wages each. If you are self-employed, you are responsible for the full 2.9%.

Do employers have to pay the additional Medicare tax?

Employer Responsibilities An employer must begin withholding Additional Medicare Tax in the pay period in which the wages or railroad retirement (RRTA) compensation paid to an employee for the year exceeds $200,000. The employer then continues to withhold it each pay period until the end of the calendar year.

How does the Medicare surtax work?

The additional Medicare tax rate is 0.9%. However, the additional 0.9% only applies to the income above the taxpayer's threshold limit. 9 For example, if you earn $225,000 a year, the first $200,000 is subject to Medicare tax of 1.45%, and the remaining $25,000 is subject to additional Medicare tax of 0.9%.

How to calculate Medicare taxes?

If you receive both Medicare wages and self-employment income, calculate the Additional Medicare Tax by: 1 Calculating the Additional Medicare Tax on any Medicare wages in excess of the applicable threshold for the taxpayer's filing status, without regard to whether any tax was withheld; 2 Reducing the applicable threshold for the filing status by the total amount of Medicare wages received (but not below zero); and 3 Calculating the Additional Medicare Tax on any self-employment income in excess of the reduced threshold.

What is the responsibility of an employer for Medicare?

Employer Responsibilities. An employer is responsible for withholding the Additional Medicare Tax from wages or railroad retirement (RRTA) compensation it pays to an employee in excess of $200,000 in a calendar year, without regard to filing status. An employer must begin withholding Additional Medicare Tax in the pay period in which ...

What form do you need to request an additional amount of income tax withholding?

Some taxpayers may need to request that their employer withhold an additional amount of income tax withholding on Form W-4, Employee’s Withholding Certificate, or make estimated tax payments to account for their Additional Medicare Tax liability.

Can non-resident aliens file Medicare?

There are no special rules for nonresident aliens or U.S. citizens and resident aliens living abroad for purposes of this provision. Medicare wages, railroad retirement (RRTA) compensation, and self-employment income earned by such individuals will also be subject to Additional Medicare Tax, if in excess of the applicable threshold for their filing status.

Is railroad retirement subject to Medicare?

All Medicare wages, railroad retirement (RRTA) compensation, and self-employment income subject to Medicare Tax are subject to Additional Medicare Tax, if paid in excess of the applicable threshold for the taxpayer's filing status. For more information on ...

What is Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What happens if an employee does not receive enough wages for the employer to withhold all taxes?

If the employee does not receive enough wages for the employer to withhold all the taxes that the employee owes, including Additional Medicare Tax, the employee may give the employer money to pay the rest of the taxes.

What if an employer does not deduct Medicare?

An employer that does not deduct and withhold Additional Medicare Tax as required is liable for the tax unless the tax that it failed to withhold from the employee’s wages is paid by the employee. An employer is not relieved of its liability for payment of any Additional Medicare Tax required to be withheld unless it can show that the tax has been paid by filing Forms 4669 and 4670. Even if not liable for the tax, an employer that does not meet its withholding, deposit, reporting, and payment responsibilities for Additional Medicare Tax may be subject to all applicable penalties.

How much is F liable for Medicare?

F is liable to pay Additional Medicare Tax on $50,000 of his wages ($175,000 minus the $125,000 threshold for married persons who file separate).

What is the Imputed Cost of Life Insurance?

The imputed cost of coverage in excess of $50,000 is subject to social security and Medicare taxes, and to the extent that, in combination with other wages, it exceeds $200,000, it is also subject to Additional Medicare Tax withholding. However, when group-term life insurance over $50,000 is provided to an employee (including retirees) after his or her termination, the employee share of Social Security and Medicare taxes and Additional Medicare Tax on that period of coverage is paid by the former employee with his or her tax return and is not collected by the employer. In this case, an employer should report this income as wages on Form 941, Employer’s QUARTERLY Federal Tax Return (or the employer’s applicable employment tax return), and make a current period adjustment to reflect any uncollected employee social security, Medicare, or Additional Medicare Tax on group-term life insurance. Uncollected taxes are not reported in boxes 4 and 6 of Form W-2. Unlike the uncollected portion of the regular (1.45%) Medicare tax, an employer may not report the uncollected Additional Medicare Tax in box 12 of Form W-2 with code N.

When is Medicare tax withheld?

An employer is required to begin withholding Additional Medicare Tax in the pay period in which it pays wages in excess of $200,000 to an employee.

Who is responsible for Medicare tax?

The Additional Medicare Tax is owed by higher-income employees, and employers are responsible for withholding this tax and paying it to the Internal Revenue Service (IRS). Learn how to withhold, report, and pay this employment tax.

What is the Medicare tax rate?

The Medicare tax rate is 2.9% of the employee's taxable wages, with 1.45% paid by the employee and 1.45% paid by the employer. The Additional Medicare Tax rate is 0.9% for the employee only. The employer doesn't have to pay this additional tax. 1.

What happens if an employee's withholding is miscalculated?

If an employee's withholding is miscalculated and they are owed a refund, the employee must request the refund directly from the IRS. Don't attempt to give the employee a refund or adjust the employee's withholding on a miscalculation of federal income tax or FICA tax.

When do employers have to withhold Medicare tax?

Employers must begin withholding the Additional Medicare tax Rate from an employee's pay beginning with the pay period when the individual's total pay for the year reaches $200,000 and continue withholding this tax from the employee's pay until the end of the year.

Do you have to keep records of Medicare taxes?

You must keep records of amounts of the additional Medicare tax withheld from employee pay and that you owe to the IRS as an employer. These amounts must be paid along with all other payroll tax payments.

Is fringe benefit taxable?

Some wages and fringe benefits are taxable to the employee for income tax purposes , but some wages may not be taxable to the employee for Social Security and Medicare taxes, including the Additional Medicare Tax. You must exclude the wages not subject to Social Security and Medicare taxes when you calculate the wages subject to ...

Do you have to exclude wages from Medicare?

You must exclude the wages not subject to Social Security and Medicare taxes when you calculate the wages subject to the Additional Medicare Tax as you work on payroll. IRS Publication 15-B Employer's Tax Guide to Fringe Benefits has a list of wages that are exempt from Social Security and Medicare taxes.

How much Medicare tax do you pay?

An employee will pay 1.45% standard Medicare tax, plus the 0.9% additional Medicare tax, for a total of 2.35% of their income.

What is Medicare tax?

The standard Medicare tax applies to all earned income, with no minimum income limit.

What is the threshold for Medicare 2020?

The 2020 tax year thresholds are as follows: Status. Tax threshold. single , head of household, or a qualifying widow (er) $200,000. married tax filers, filing jointly.

How much is Medicare for married couples?

The limit is $250,000 for married couples. This article explains the Medicare standard tax and the Medicare additional tax. It also looks at who pays the additional tax, how the IRS calculates it, and how the government uses the money.

Which Act expanded Medicare Part B preventive services?

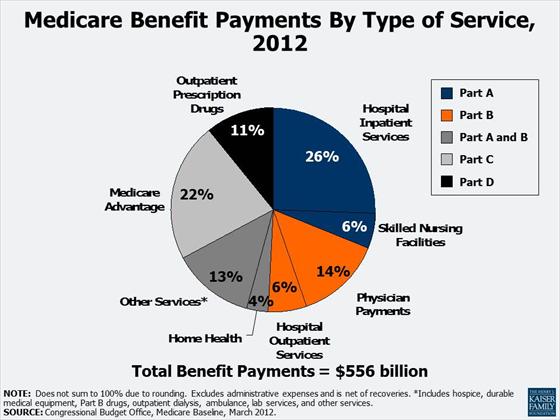

The Affordable Care Act also expanded Medicare Part B preventive services to include:

How much do employers contribute to payroll taxes?

Employers contribute 1.45% for each employee, based on the employee’s monthly earnings. An employer must also deduct payroll taxes of 1.45% from their employees’ monthly earnings.

Does Medicare tax help with prescriptions?

The additional Medicare tax helps also helps lower the cost of Medicare Advantage plans and prescription medications.

What is the extra tax on Medicare?

Under the Affordable Care Act, taxpayers who earn above a set income level (depending on filing status) pay 0.9% more into Medicare on top of the regular contribution. This extra tax is called the Additional Medicare Tax.

Why don't people pay for Medicare?

Most people don’t pay for Medicare Part A (hospital insurance) because its funded by taxpayer contributions to the Social Security Administration. Employees pay 1.45% of their earnings, employers pay another 1.45%, and self-employed individuals pay the full 2.9% on their own.

How much does my spouse pay in Medicare?

Your spouse earns $10,000. Since your joint earned income ($235,000) isn’t more than $250,000, you won’t owe Additional Medicare Tax. However, your employer will still withhold the tax from your paycheck on wages over $200,000.

What is the threshold for Medicare tax?

What is the Income Threshold for Additional Medicare Tax? If you are a high earner, you are subject to the 0.9% additional Medica re tax on earned income in excess of the threshold amount . The threshold amounts are based on your filing status: Single, head of household, or qualifying widow (er) — $200,000.

When does Medicare start withholding?

Your filing status isn’t important for this. Withholding starts when your wages and other compensation are more than $200,000 for the year.

Does Medicare tax withheld from paycheck?

Any tax withheld from your paycheck that you’re not liable for will be applied against your taxes on your income tax return. If you earn $200,000 or less, your employer will not withhold any of the additional Medicare tax. This could happen even if you’re liable for the tax.

What is additional Medicare tax?

The requirement is based on the amount of Medicare wages and net self-employment income a taxpayer earns that exceeds a threshold based on filing status.

How to calculate Medicare tax?

Step 1: Calculate the Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2: Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

What line is Medicare adjustment on 8959?

An adjustment can be made on Form 8959 beginning at line 10, if you're calculating the AMT on both self-employment income and wages. This adjustment functions to ensure that the Additional Medicare Tax is calculated only once on wages and only once on self-employment income when they're combined and exceed the threshold amount.

How much does Barney and Betty owe in Medicare?

Barney earned $75,000 in Medicare wages, and Betty earned $200,000 in Medicare wages, so their combined total wages are $275,000. Barney and Betty will owe the Additional Medicare Tax on the amount by which their combined wages exceed $250,000, the threshold amount for married couples filing jointly.

What is the Medicare tax threshold?

The Additional Medicare Tax applies when a taxpayer's wages from all jobs exceed the threshold amount, and employers are required to withhold Additional Medicare Tax on Medicare wages in excess of $200,000 that they pay to an employee. The same threshold applies to everyone regardless of filing status.

How much Medicare does Albert owe?

His excess amount is $25,000, or $225,000 less $200,000. Albert's Additional Medicare Tax is therefore $225, or 0.9% of $25,000.

What is the Medicare tax rate for railroad retirement?

The Additional Medicare Tax also applies to Railroad Retirement Tax Act compensation for employees and employee representatives. The 0.9% rate is the same, and the threshold amounts are the same as for wage earners and for those with self-employment income as well.

What is the 0.9 percent Medicare tax?

Employers are responsible for withholding and reporting the 0.9 percent Additional Medicare Tax, which became effective in 2013. If an employer fails to withhold the correct amount from wages it pays to an employee, the employer may be liable for the amount not withheld and subject to applicable penalties. In general, employees and their employers ...

What form do you report Medicare tax withheld?

If the employer overwithholds, the employer should report the amount of withheld Additional Medicare Tax on the employee’s Form W-2 so that the employee may retain credit to be applied against the taxes shown on the employee’s individual tax return.

What happens if an employer overwithholds a tax return?

If the employer overwithholds, the employer should repay or reimburse the amount to the employee prior to the end of the year and make an interest-free adjustment on the appropriate corrected form (e.g., Form 941-X).

When do employers have to start withholding Medicare?

Employers are required to begin withholding Additional Medicare Tax in the pay period in which the employer pays wages in excess of $200,000 to an employee.

Do you have to withhold Medicare taxes?

Note that the withholding obligation exists even if an employee is not ultimately liable for the Additional Medicare Tax (e.g., if an employee’s wages together with those of his or her spouse do not exceed the $250,000 for married taxpayers filing jointly). On the other hand, an employer is not required to withhold the Additional Medicare Tax so long as the employee’s wages do not exceed $200,000, even if the employer has reason to believe the employee will be liable for the Additional Medicare Tax (e.g., if an employee and his or her spouse each earn $150,000).

Should employers check with payroll service providers?

Employers should check with their payroll service providers to make sure they are complying with their Additional Medicare Tax obligations as soon as possible. Employers should work with their payroll service providers to correct any errors prior to the last payroll period of the year to avoid any potential liability or penalties, as well as to make it easier for employees when they file their individual tax return.

Will wages increase with inflation?

Pay raises in the U.S. are returning to pre-pandemic levels but rising prices mean higher salaries aren't likely to keep pace with inflation .

Why is Medicare tax added?

As you might have guessed, the additional Medicare tax is designed so wealthier Americans help to pay for the cost of insurance and medical care for lower-income citizens. But if you're looking to learn more about the additional Medicare tax and what it might mean for you, check out the IRS site for lots of details.

When did the Affordable Care Act pass?

When the Affordable Care Act passed in 2010, people made a lot of fuss about the tax repercussions. Many Americans were surprised to see that some of those taxes weren't even showing up on returns until years later, after the act made its way through the Supreme Court to final approval.

Do single people pay Medicare?

That's not to say that some single people don't have to pay it. But it means that it depends on the total earnings of your household, and not your individual responsibility. And the good news for most folks is that it's a tax on higher income people. You're not responsible for the additional Medicare tax unless you (or you and your spouse) make over a certain amount of money.