What are the top 5 Medicare supplement plans?

Jan 26, 2019 · The California Department of Insurance (CDI) The California Department of Insurance (CDI) regulates Medicare Supplement policies underwritten by licensed insurance companies. The CDI assists consumers in resolving complaints and disputes concerning premium rates, claims handling, and many other problems with agents or companies.

Who has the best Medicare supplement plans?

Dec 23, 2021 · Who Regulates Medicare Supplement Plans? Although Medicare Supplements (Medigap) plans are sold by private insurance companies, the federal government (CMS) regulates each plan’s design in terms of coverages offered. This means that each Medicare Supplement Plan must have the same coverage across all insurance companies that offer …

Which insurance company is best for a Medicare supplement?

Jul 09, 2013 · Most of the U.S. While Medigap plans are purchased through private insurance companies, and Medigap plans are administered by private insurance companies, it is actually the Centers for Medicare and Medicaid Services (CMS) that regulates these Medicare supplemental insurance plans. The CMS determines what must be covered by these Medigap plans and …

Which Medicare supplement plan should I Choose?

Medicare Supplement insurance is a private health insurance policy purchased by a Medicare beneficiary. Federal and state law regulates Medicare Supplement policies. Only a Medicare Supplement policy, or a Medigap policy, will help fill gaps in Medicare benefits. Other kinds of insurance may help you pay out-of-pocket health care costs, but they do not qualify as true …

Are Medicare supplements regulated by state and federal government?

Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary.Dec 1, 2021

Is Medigap regulated by CMS?

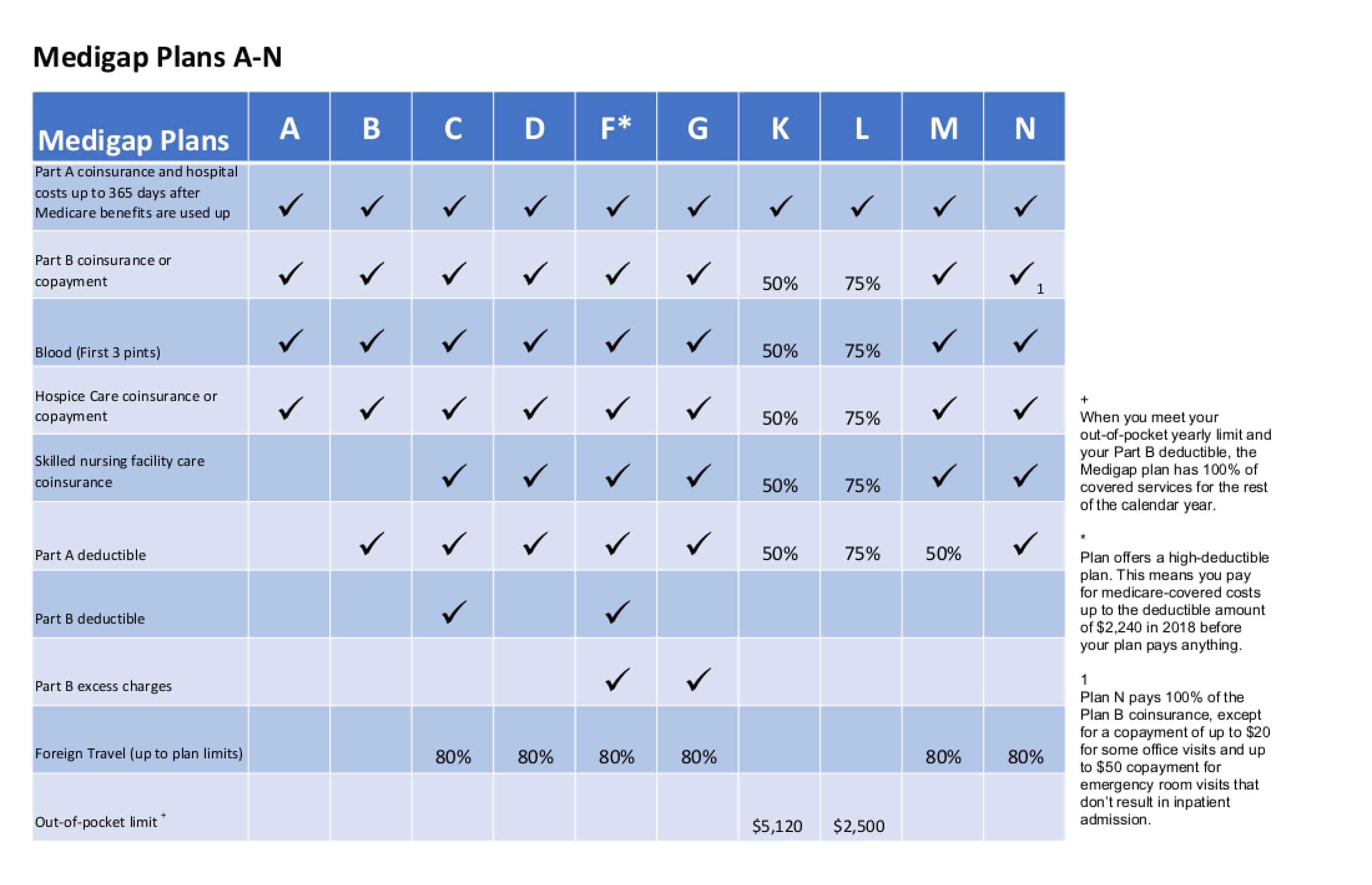

Medigap offerings have been standardized by the Centers for Medicare and Medicaid Services (CMS) into ten different plans, labeled A through N, sold and administered by private companies. Each Medigap plan offers a different combination of benefits. The coverage provided is roughly proportional to the premium paid.

Is Medigap federally regulated?

In general, Medigap insurance is state regulated, but also subject to certain federal minimum requirements and consumer protections. For example, federal law requires Medigap plans to be standardized to make it easier for consumers to compare benefits and premiums across plans.Jul 11, 2018

What states allow you to change Medicare Supplement plans without underwriting?

In some states, there are rules that allow you to change Medicare supplement plans without underwriting. This includes California, Washington, Oregon, Missouri and a couple others. Call us for details on when you can change your plan in that state to take advantage of the “no underwriting” rules.

Which two Medicare plans Cannot be enrolled together?

You generally cannot enroll in both a Medicare Advantage plan and a Medigap plan at the same time.Jun 2, 2021

Are Medigap policies guaranteed renewable?

All Medigap policies issued since 1992 are guaranteed renewable. . This means your insurance company can't drop you unless one of these happens: You stop paying your premiums.

Is there underwriting for Medigap plans?

Medigap insurance companies are generally allowed to use medical underwriting to decide whether to accept your application and how much to charge you for the Medigap policy.

What states do not offer Medicare supplement plans?

Medigap plans are standardized across most states, meaning they offer the same benefits. The exceptions are Wisconsin, Minnesota and Massachusetts.

Are Medigap policies guaranteed issue?

If you are age 65 or older, you have a guaranteed issue right within 63 days of when you lose or end certain kinds of health coverage. When you have a guaranteed issue right, companies must sell you a Medigap policy at the best available rate, regardless of your health status, and cannot deny you coverage.

Can you switch from Plan N to Plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.Jan 30, 2021

Can you switch Medigap plans without underwriting?

During your Medigap Open Enrollment Period, you can sign up for or change Medigap plans without going through medical underwriting. This means that insurance companies cannot deny you coverage or charge you more for a policy based on your health or pre-existing conditions.Nov 22, 2021

Can you switch Medicare Supplement plans anytime?

You can change your Medicare Supplement Plan anytime, just be aware that you might have to answer medical questions if your outside your Open Enrollment Period.

What is a medicaid supplement?

Medigap (Medicare Supplement Health Insurance) A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

What is the difference between Medigap and Medicare?

Generally, the only difference between Medigap policies sold by different insurance companies is the cost. You and your spouse must buy separate Medigap policies.Your Medigap policy won't cover any health care costs for your spouse. Some Medigap policies also cover other extra benefits that aren't covered by Medicare.

Do you have to pay for Medigap?

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

Can insurance companies sell standardized Medicare?

Insurance companies can only sell you a “standardized” Medigap policy. Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.”. It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that ...

What are Medicare Supplement Plans?

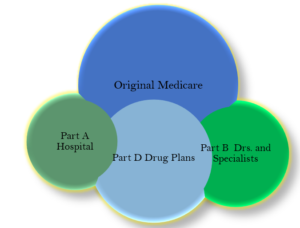

Medicare Supplement plans, also known as Medigap, are supplement insurance plans that work with Original Medicare Part A and Part B.

Who Regulates Medicare Supplement Plans?

Although Medicare Supplements (Medigap) plans are sold by private insurance companies, the federal government (CMS) regulates each plan’s design in terms of coverages offered.

How Does Medicare Supplement Plans Work?

While there are 10 Medigap plans to choose from in all but three states, each plan, although different from the next, works in the same manner. Medicare would pay its share and then the Medicare Supplement Plan would pay its share.

Which Medicare Supplement Plans Provide the Best Coverage?

Having multiple Medigap plans to choose from enables the policy shopper to select a plan that will best meet their individual needs and their individual budget. It’s also important to keep in mind that the Medigap Plan you select will have a monthly premium charge over and above your Medicare Part B premium.

What are High-Deductible Medicare Supplement Plans?

There are two high-deductible Medicare Supplement Plans available. High deductible Plan F and Plan G both have a regular version and a “high-deductible” version. Since the policyholder is agreeing to accept more out-of-pocket expenses for their annual healthcare expenses, the insurance company offers the plan at a lower monthly premium.

What is Medicare Supplement insurance?

Medicare does not pay for everything. Medicare beneficiaries also pay a portion of their medical expenses, which includes deductibles, copayments, services not covered by Medicare, and excess charges when doctors do not accept assignment.

Medicare Supplement Insurance (Medigap)

Medicare Supplement insurance is also called Medigap insurance because it covers the "gaps" in Medicare benefits, such as deductibles and copayments. Medicare Supplement insurance is a private health insurance policy purchased by a Medicare beneficiary. Federal and state law regulates Medicare Supplement policies.

Standard Medicare Supplement Coverage

To make it easier for you to compare one Medicare Supplement policy to another, Indiana allows 8 standard plans to be sold. The plans are labeled with a letter, A through N. Plans H, I, and J are no longer offered, and Plans C and F are only available to people who were eligible for Medicare before January, 2020.

Medicare SELECT Insurance Policies

Medicare SELECT policies are a type of Medicare Supplement insurance sold by a few private insurance companies. A Medicare SELECT policy is one of the 8 standardized supplement policies.

What does Medicare Supplement insurance cover?

Medicare Supplement insurance is sold in 12 standard plans. Plans C and F are only available to people who were eligible for Medicare before January 2020. View all plans types and the benefits they include. (updated 1/6/2020)

Part A Deductible

The initial amount Medicare does not pay for an inpatient hospital stay per benefit period ($1,484 in 2021).

Part B Deductible

The initial amount Medicare will not pay for covered physical or other outpatient services each calendar year ($203 in 2021). Most people will pay $148.50 (2021) each month for the Part B Premium. Due to changes that were implemented in January 2020, the Part B deductible is not covered unless you were eligible for Medicare before January 2020.

When is Medicare Supplement Plan A sold in Maryland?

Under 65 . Medicare Supplement Plan A, C, or D that is sold by any insurance company in Maryland for those eligible before January 1, 2020 Medicare Supplement Plan A or D that is sold by any insurance company in Maryland for those eligible on January 1, 2020 or later.

How long does Medicare Supplement Plan A last?

Medicare Supplement Plan A, B, D, G, K or L that’s sold by any insurance company for those eligible on January 1, 2020 or later. Time limits apply, 63 days.

What happens if you are enrolled in a Medicare Advantage plan?

An individual has a guaranteed issue period if the individual was enrolled in a Medicare Advantage plan and: •The plan’s certification is terminated. •The plan has stopped providing the plan in the area in which the individual resides. •The individual is no longer eligible due to a change in place of residence.

What is MIA insurance?

The Maryland Insurance Administration (MIA) is the state agency that regulates insurance in Maryland. The MIA: Licenses insurers and insurance producers (agents or brokers). Examines the business practices of licensees to ensure compliance. Monitors solvency of insurers.

Does Social Security pay for Part A?

Most people with a personal or spousal work history and paid into Social Security do not pay for Part A. Covers care in a hospital, some costs of skilled nursing facilities and home health services, as well as hospice care for the terminally ill. 8. Review of Medicare: Part B.

Can you contact Medicare in Maryland?

A. The Maryland Insurance Administration cannot answer questions regarding Medicare Parts A and B, and recommends that you contact your local State Health Insurance Assistance Program (SHIP) or the Centers of Medicare and Medicaid Services (CMS) for assistance.

When did Medicare Supplement Plans start?

The history of Medicare Supplement Plans – Medigap insurance takes us back to 1980. What began as voluntary standards governing the behavior of insurers increasingly became requirements. Consumer protections were continuously strengthened, and there was a trend toward the simplification of Medicare Supplement Plans – Medigap Insurance reimbursements whenever possible. During the 1980s the federal government first provided a voluntary certification option for Medicare Supplement, or Medigap Insurance, insurers in Section 507 of the Social Security Disability Amendments of 1980 , commonly known as the “Baucus Amendment.” In order to meet the Baucus Amendment’s voluntary minimum standards, the Medicare Supplement plan was required to:

What is Medicare Select Supplement?

The Medicare SELECT Supplement plans provided a managed-care option for beneficiaries with reimbursement within a limited network. The Act to Amend the Omnibus Budget Reconciliation Act of 1990, ...

When did Medicare become standardized?

The second group of plans, labeled Plan A through Plan J, were standardized and became effective in a state when the terms of Omnibus Budget Reconciliation Act of 1990 were adopted by the state, mainly in 1992. Shopping for Medicare insurance can be overwhelming.

What is a felony in Medicare?

The Medicare and Medicaid Patient and Program Protection Act of 1987 provided that individuals who knowingly and willfully make a false statement or misrepresent a medical fact in the sale of a Medicare Supplement Plans – Medigap Insurance Insurance, policy are guilty of a felony. The Omnibus Budget Reconciliation Act of 1987 permitted ...

How many seniors will be covered by Medicare in 2021?

July 7, 2021. facebook2. twitter2. comment. Medicare is a federal program, covering more than 63 million seniors and disabled Americans throughout the country. Medicare beneficiaries in most areas have the option to get their coverage via private Medicare Advantage plans, and more than four out of ten do so.

When is Medicare Part D open enrollment?

Federal guidelines call for an annual open enrollment period (October 15 to December 7) for Medicare Advantage and Medicare Part D coverage in every state. And as of 2019, there’s also a Medicare Advantage open enrollment period (January 1 through March 31) that allows people who already have Medicare Advantage to switch to a different Advantage plan or switch to Original Medicare. But while these provisions apply nationwide, plan availability and prices are different from one state to another.

How long does Medicare coverage last?

Medigap coverage is guaranteed issue for six months, starting when you’re at least 65 and enrolled in Medicare Parts A and B.

What states require community rating for Medigap?

As of 2018, eight states (Arkansas, Connecticut, Massachusetts, Maine, Minnesota, New York, Vermont, and Washington) required carriers to use community rating.

How many Part D prescriptions will be available in 2021?

Part D prescription drug plan availability differs from state to state as well, with the number of plans for sale in 2021 varying from 25 to 35, depending on the region. The number of available premium-free (“benchmark”) prescription plans for low-income enrollees varies from five to ten, depending on the state.

How old do you have to be to enroll in Medigap?

Some states have implemented legislation that makes it easier for seniors to switch from one Medigap plan to another, and for people under age 65 to enroll in Medigap plans.

Does Alaska have Medicare Advantage?

Not surprisingly, the popularity of Medicare Advantage plans varies significantly from one state to another, with only one percent of the Medicare population enrolled in Advantage plans in A laska. (There are no individual Medicare Advantage plans available at all in Alaska.