Do you have questions about your Medicare coverage? 1-800-MEDICARE (1-800-633-4227) can help. TTY users should call 1-877-486-2048. What should I have ready when I call 1-800-MEDICARE?

How can I get answers to my Medicare questions?

Also, an agent can answer all your Medicare questions, so you feel confident in your decision. Fill out an online rate form to see your rates now. Or, call us at the number above to get answers to your Medicare questions. We can even walk you through enrolling in a policy. Enter your zip code to pull plan options available in your area.

What questions should Medicare patients ask before they're discharged?

What questions should Medicare patients ask before they're discharged from the hospital? How does a doctor's participation in Medicare affect reimbursement? Will all doctors accept my Medicare coverage? How do I replace a lost Medicare card? What steps should I take to avoid Medicare fraud?

Are you eligible for Medicare Part B?

Not everyone is eligible for Medicare part B. Eligibility depends on meeting one of the criteria’s listed below. Benefits start automatically with ALS eligibility. You will receive a sign up card before your 65th birthday or after a certain disability.

How many people use Medicare and Medicare Part B?

As the baby boomer generation continues to age, each year more people require Medicare and Medicare Part B. Even though combined Medicare services cover around 40 million people across the United States, the Medicare process sometimes confuses consumers.

Why is my Medicare Part B bill so high?

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase: Rising prices to deliver health care to Medicare enrollees and increased use of the health care system.

How can I ask Medicare a question?

Call 1-800-MEDICARE For questions about your claims or other personal Medicare information, log into (or create) your secure Medicare account, or call us at 1-800-MEDICARE (1-800-633-4227). TTY users can call 1-877-486-2048.

How much will Medicare Part B go up in 2022?

$170.10In November 2021, CMS announced that the Part B standard monthly premium increased from $148.50 in 2021 to $170.10 in 2022.

How do I appeal my Medicare premium increase?

First, you must request a reconsideration of the initial determination from the Social Security Administration. A request for reconsideration can be done orally by calling the SSA 1-800 number (800.772. 1213) as well as by writing to SSA.

Who is the best person to talk to about Medicare?

Do you have questions about your Medicare coverage? 1-800-MEDICARE (1-800-633-4227) can help. TTY users should call 1-877-486-2048.

What is the phone number to contact Medicare?

(800) 633-4227Centers for Medicare & Medicaid Services / Customer service

Will 2022 Part B premium be reduced?

About half of the larger-than-expected 2022 premium increase, set last fall, was attributed to the potential cost of covering the Alzheimer's drug Aduhelm.

Why is Medicare Part B going up so much in 2022?

The increases in the 2022 Medicare Part B premium and deductible are due to: Rising prices and utilization across the health care system that drive higher premiums year-over-year alongside anticipated increases in the intensity of care provided.

How do I get my $144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Are Medicare Part B premiums recalculated each year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

How can I reduce my Part B premium?

Everyone must pay a premium for Part B. Some Medicare Advantage plans have a built-in premium reduction. Your policy pays a portion of the Part B premium, and you pay the rest. Having a Medicare Advantage plan with this option will reduce your overall Medicare premium costs.

When is the open enrollment period for Medicare Part B?

If you do decide to delay your Medicare Part B signup, you will have to wait until the Open Enrollment Period, which runs from January 1 to March 31.

What is Medicare Part B?

Medicare Part B is one part of Original Medicare health insurance. It serves the specific purpose of helping cover costs related to doctor visits, lab work, and medical procedures for diagnostic purposes. Some of the links on this page may link to our affiliates. Learn more about our ad policies.

What is the Medicare premium for 2020?

Medicare Part B Premiums 2020. The standard monthly premium begins at a base rate of $144.60 in 2020. People in high income brackets will pay increased premiums. If you enroll late, you will also face an increased premium penalty.

How much will Medicare premiums increase in 2020?

If you are eligible to enroll in Medicare in 2020 but wait to enroll in Part B, your monthly premium may increase by 10% each year you delay. Below is a graphic of the Medicare Part B premium penalty schedule. Remember that the penalty applies for your entire lifespan, so the longer you wait to sign up, the more you will pay on a permanent basis.

How much is Medicare Part B 2020?

The annual deductible for Medicare Part B is $198 for 2020. It is essential to note that after your deductible, Medicare Part B only covers up to 80% of all Part B-related costs. You are responsible for the remaining 20%. There are no limits or caps on the 20% you owe.

How long does it take to get a Medicare card?

You can also call the Social Security office and sign up over the phone or visit ssa.gov to apply. After signing up, it can take two to three weeks for your Medicare card to arrive in the mail.

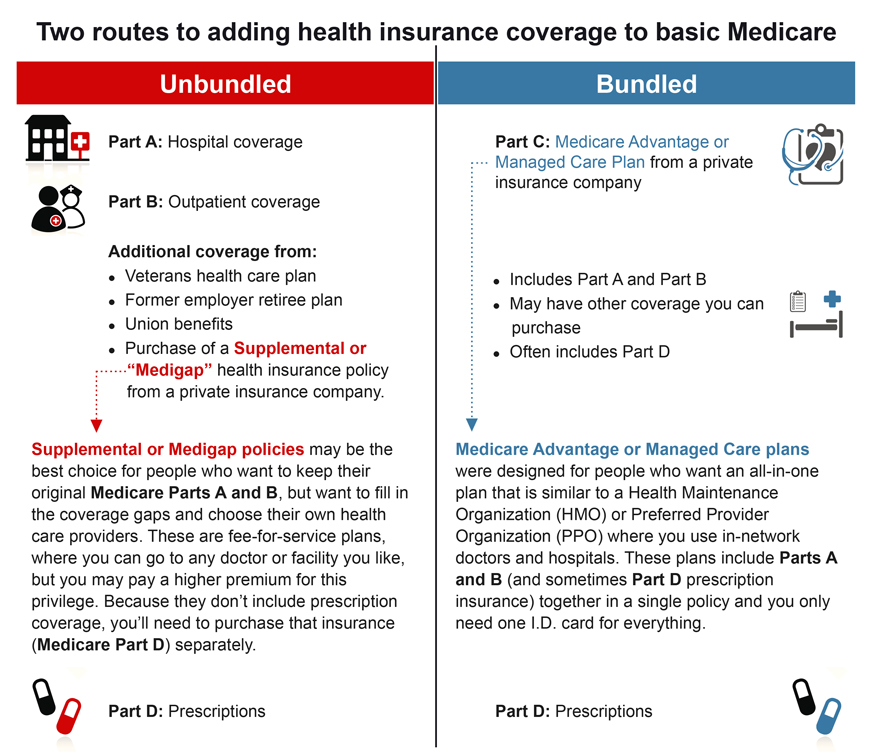

Is Medicare Part B optional?

Medicare Part B is entirely optional, but highly recommended, for those whose primary health coverage comes through Medicare. If you want to obtain Medigap coverage, or you decide on a Medicare Advantage Part C plan, you also need to sign up for Medicare Part B.

How long before Part B is effective?

You can pre-enroll in Medigap up to 6 months before the Part B effective date with some companies. But, many companies only allow you to pre-enroll 3 months before Part B effective date. The Open Enrollment Period for Medigap lasts for 6 months and begins the day your Part B is effective.

What happens if you don't pay Medicare?

But, if you don’t pay the premium on a Medicare Advantage or Medigap plan, they can drop you. Also, if you don’t pay your Part D premium, the drug plan can drop you. Usually, they give multiple notices before the plan terminates your policy.

What is Medicare Part C?

Medicare Part C is a Medicare Advantage plan. These plans sometimes have a $0 per month premiums, and many of them include Part D drug coverage. However, there are some pitfalls to Medicare Advantage plans that you need to know before signing up.

What is a medicaid supplement?

A Medigap plan is a supplemental option for Medicare. Medigap plans are also Medicare Supplement plans; these policies fill the gaps in Medicare. So, when Medicare would otherwise charge you 20% or a deductible, the Medicare Supplement could instead pick up the bill.

How many classes of drugs does Medicare cover?

There are many drugs covered under Medicare. Plus, every plan must cover the six protected classes. If you have medications that need coverage, use the Medicare plan finder tool to identify the policy that will cover your medications.

Does Medicare pay less if you have a low income?

The cost of Medicare depends on many things. Those with a low income will likely pay less than the standard amount and may qualify for Medicare and Medicaid. Those with a higher income will likely pay more for Part B; this is called the Part B Income Related Monthly Adjustment Amount.

Is Medicare mandatory?

Of course, Medicare isn’t mandatory, so you can choose whichever option makes the most sense for your situation. You can also always consult your benefits administrator at the office where you work to identify your options.